Subscribe

Sign up for timely perspectives delivered to your inbox.

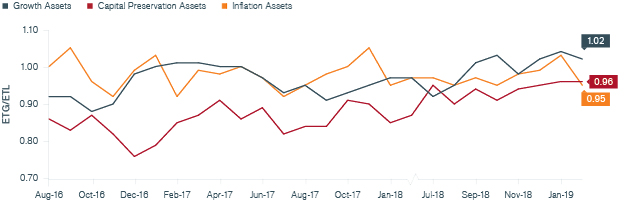

The “Fed Put” is back in play thanks to Federal Reserve (Fed) Chairman Jerome Powell’s newfound dovishness, which contributed to equities enjoying their best January in more than three decades. After this remarkable run, the options market has revised its view on the attractiveness of equities, as measured by the expected tail gains to tail losses. While equities are still viewed favorably, the February tail-based Sharpe ratio of gains to losses is lower than at the start of January, to just above average levels. As mentioned previously, the key threat to today’s rally in risk assets is inflation, which Chairman Powell again emphasized is the pivotal trigger for any potential policy tightening. At present, the options market continues to see little risk of an inflationary shock, which supports its benign outlook for risk assets.

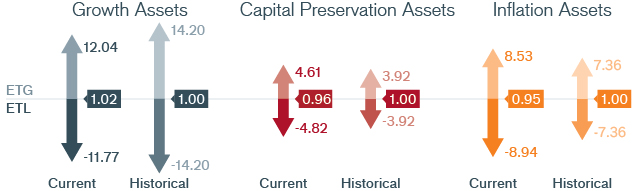

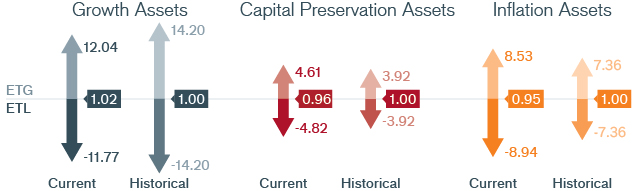

The historical Tail-Based Sharpe Ratios are normalized to 1.00 to allow for easier comparison across the three macroeconomic asset categories.

The historical Tail-Based Sharpe Ratios are normalized to 1.00 to allow for easier comparison across the three macroeconomic asset categories.

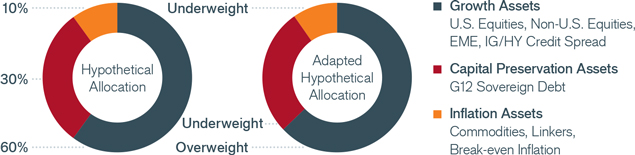

Our Adaptive Multi-Asset Solutions Team arrives at its monthly outlook using options market prices to infer expected tail gains (ETG) and expected tail losses (ETL) for each asset class. The ratio of these two (ETG/ETL) provides signals about the risk-adjusted attractiveness of each asset class. We view this ratio as a “Tail-Based Sharpe Ratio.” These tables summarize the current Tail-Based Sharpe Ratio of three broad asset classes.

The trigger for recession has always been an elevated cost of money. When one lends money over a longer time horizon, an opportunity cost is incurred and this cost, in aggregate, should equal the GDP of the country. As a rule of thumb (in a simple world), the cost of money is “fair” when the real rate on longer maturity bonds roughly equals real GDP. And with the “doves” back in the driver’s seat at the Fed, the price of money over longer horizons is once again cheap, with the real yield on the 10-year bond near 80 basis points (bps, 100 bps = 1%), while most expect long-term U.S. GDP to be noticeably higher, likely between 150 and 200 bps. However, the price of money over shorter time horizons is fair rather than cheap – with the overnight rate sitting near the inflation rate. Thus, we do not expect a repeat of the voracious 2017 bull market in risk assets, where the price of money was cheap over long and short horizons. When you lend money overnight you do not suffer much, if any, opportunity cost and, hence, one shouldn’t expect to earn more than inflation when lending money overnight to a “default free” party.

There are myriad apparent contradictory macroeconomic data, from strong labor markets to weaker service and manufacturing surveys, to strong earnings with 61% of the S&P 500® Index companies beating their revenue estimates, which is slightly higher than the longer average of 60%, yet below the 72% recorded over the last four quarters.

With such contradictions, equity rallies can come to an abrupt end or continue their sharp trajectory upward. Hence, it is imperative to focus on risk management and proactively monitor for signs of an awakening bear or a persistent bull. We presently do not hear alarm bells, but remain keenly focused to any incipient uptick in bear market risk.

In addition to our outlook on broad asset classes, Janus Henderson’s Adaptive Multi-Asset Solutions Team relies on the options market to provide insights into specific equity, fixed income, currency and commodity markets. The following developments have recently caught our attention:

Data was not calculated for all months.

*We define ETG and ETL as the 1-in-10 expected best and worst two-month return for an asset class.