Subscribe

Sign up for timely perspectives delivered to your inbox.

Can a strong corporate backdrop help U.S. equities to deliver a positive return in 2019? Portfolio Managers Marc Pinto and Jeremiah Buckley look at the prospects for domestic U.S. equities, following a turbulent 2018, and some of the themes that they believe could create value over time. They also consider some of the key issues facing fixed income markets.

What was broadly a strong year for U.S. equities in 2018 was latterly undermined by mixed macro signals, political uncertainty and concerns about a potentially aggressive stance from the U.S. Federal Reserve in its handling of interest rates. Sometimes this can be used as an excuse to take profits in the short term, but it has left many investors feeling a little more cautious at the start of 2019.

In our view, a healthy economy and improving consumer and business confidence should support U.S. equity market strength in 2019, although there are risks. Consumers continue to spend, with a focus on travel, leisure and other experiential activities. Consumer activity represents a significant portion of the U.S. economy, so as the consumer goes, so goes the economy.

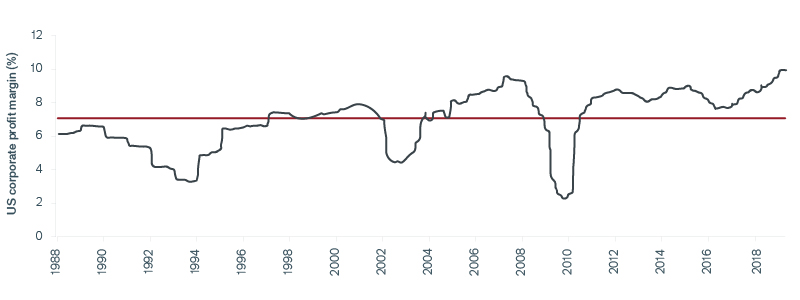

We think the corporate backdrop remains pretty good, as well. We have seen strong improvements in productivity, in terms of businesses’ efficiency, reflected in higher margins (Exhibit 1) and increasing cash flow. We expect the general level of optimism among CEOs to fuel continued business investment and merger and acquisition activity. Overall, this looks like a good framework for U.S. equities, although we are mindful of the various downside risks, such as the potential impact of U.S. Federal Reserve monetary policy or the rising tension in global trade.

We favor companies with more of a U.S. footprint and are seeking to mitigate exposure to companies that may be impacted by trade rhetoric and slowing global growth. We continue to focus on companies that exhibit consistent free cash flow, and on those making business investments that should drive value over time.

Thematically, we are looking to capitalize on robust global travel trends and the desire for experiential moments. The trend toward greater interconnectivity (and the Internet of Things) could also generate opportunity, particularly for semiconductor and semiconductor equipment manufacturers.

Digital disruption is an important theme in markets right now, as well. We have some exposure to what we call the “disruptors,” those companies using technology to improve efficiency and improve margins. Traditional industrials and transportation stocks should continue to benefit as they implement technological enhancements to create growth and generate efficiencies. We see opportunity in the payment space, whether that is credit cards or nontraditional forms of payment – i.e., not cash or check. Growth in this area is, in our view, significantly higher than the overall economy.

However, disruptive forces also pose risk. Health care and financial services are big sectors that look ripe for disruption, and companies’ ability to combat cyberattacks is of growing concern. We are extremely careful when it comes to retail, as it has been a difficult place to invest, as a whole. But even in this area, there are companies that have found a good balance between e-commerce and traditional retail sales, improving the shopping experience to make it easy for customers. Good retailers do more than just launch a website; they integrate their existing physical stores with their e-commerce platform.

The turn in the credit cycle is not a point in time; it happens in stages, and 2018 affirmed our view that the cycle is advancing. We may be in uncharted territory in terms of the length of this particular cycle, but the typical cracks are showing: high debt levels, tighter financial conditions and diminishing liquidity. We want to stress, however, that we do not expect an imminent acceleration toward the cycle’s end. While a deceleration in growth around the globe has given us reason to pause and must be monitored, U.S. economic growth is slowing but remains constructive. Given the economic backdrop and decent corporate fundamentals, we believe that a positive return environment is feasible for corporate credit in 2019. We are, however, closely monitoring U.S. economic data, particularly inflation figures, as well as rhetoric from the U.S. Federal Reserve.

What do you see as the best strategy to optimize the returns from a balanced portfolio?

Our mixed asset strategy gives us the flexibility to balance our exposure between equities and fixed income to reflect opportunities and risks that we see in each area. As we look ahead to what investors need, whether that is retirement, setting money aside for their children’s education, or paying for health care expenses, we believe that equities are going to provide better growth potential. But we continue to use the fixed income portion of the portfolio in an attempt to play a little more defensively when we believe that equity markets are facing increased risks.

Source: Thomson Reuters Datastream/Fathom Consulting, 1/1/88 to 1/1/19. Red line represents 30-year average of net profit margins in U.S. companies.

We are always mindful of the risks and the fourth quarter of 2018 emphasized the importance of this for equity investors. Looking ahead, heightening trade disputes could have a significant impact on U.S. large-cap equities, consumer and business confidence. Onerous tariffs would be inflationary for the U.S., and rising import costs could cut into profit margins, curbing U.S. exporters’ ability to compete in global markets. But if the government allows free markets to function normally, or potentially gets some concessions from the trade dispute with China, that could be great. The U.S. Federal Reserve itself is also a risk and we are monitoring its trajectory in the event the central bank moves more aggressively than warranted and stalls the U.S. economy.

Given the potential impact of these uncertainties, our balanced strategy is positioned more defensively at the start of 2019 than it was in 2018. Prudent position sizing and the discipline to take profits in more economically sensitive names will be an important part of our approach. We are monitoring our portfolio exposures, particularly in the industrials sector, for companies subject to trade risk. Should conditions deteriorate, we would look to further reduce our presence in more economically sensitive sectors, while increasing consideration for more defensively viewed companies with strong fundamentals.