August 2018

Tail Risk Report: Attractiveness Continues to Be Elusive …

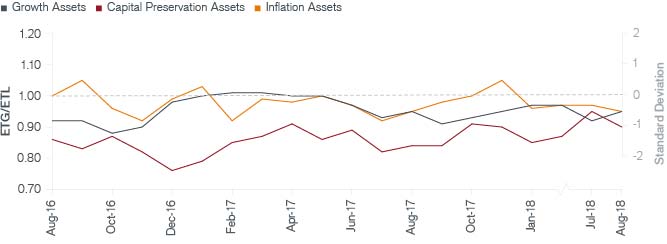

Attractiveness has yet to come out of the woods. Similar to last month, the options market sees the three broad asset classes – growth, capital preservation and inflation – all unattractive. Each one of these is showing a level of expected upside to downside below the average level of 1.0. The attractiveness of capital preservation assets – mainly global duration – is particularly low.

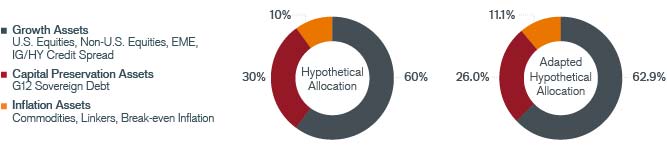

IMPACT OF TAIL RISK SIGNALS ON HYPOTHETICAL ASSET ALLOCATION

Using proprietary technology, Janus Henderson’s Adaptive Multi-Asset Solutions team derives tail risk signals from options market prices on three broad asset classes. Given our current estimates of tail risks, we illustrate how those signals would impact a 60/30/10 allocation.

CURRENT TAIL-BASED SHARPE RATIOS (ETG*/ETL*)

Beginning in August 2016, the “Tail-Based Sharpe Ratios” have been normalized to 1.00 to allow for easier comparison across the three macroeconomic asset categories. *We define ETG and ETL as the 1-in-10 expected best and worst two-month return for an asset class.

Our Adaptive Multi-Asset Solutions team arrives at its monthly outlook using options market prices to infer expected tail gains (ETG) and expected tail losses (ETL) for each asset class. The ratio of these two (ETG/ETL) provides signals about the risk-adjusted attractiveness of each asset class. We view this ratio as a “Tail-Based Sharpe Ratio.” These tables summarize the current Tail-Based Sharpe Ratio of three broad asset classes.

Following last month’s theme, the market is not offering many diversification opportunities. As investors, we must be aware that traditional forms of diversification may be weak going forward. It is important to understand what risks may arise in our portfolios if diversification or correlation benefits between different asset classes disappear.

Inflation is one risk that could cause a correlated move between growth and capital preservation assets. As global household income continues to rise and unemployment stays low, consumer spending will likely continue to pick up. And an increase in prices should follow, all of which will keep central banks on course to increase rates, in particular the real rates, which as we have remarked before represents a headwind for all assets.

In addition to our outlook on broad asset classes, Janus Henderson’s Adaptive Multi-Asset Solutions team relies on the options market to provide insights into specific equity, fixed income and commodity markets. The following caught our attention:

- Growth: On a relative basis, U.S. and emerging market equities continue to look the most attractive globally. While Chinese stocks have been hardest hit from President Trump’s threats of tariff and trade wars, we are witnessing a favorable expected upside to downside tradeoff to Chinese equities. If the risk of trade war subsides, Chinese equities are likely to benefit the most as they were hurt the most when this risk escalated.

- Fixed Income: U.S. and Australian sovereign bonds offer the most attractive place to source duration relative to other developed sovereign markets.

- Currency: Our option based signals point to the continued strength of the U.S. dollar.

HISTORICAL MONTHLY TAIL-BASED SHARPE RATIOS

(Expected Tail Gain* / Expected Tail Loss*)

Data was not calculated for all months.