Subscribe

Sign up for timely perspectives delivered to your inbox.

Recently back from the US West Coast on separate research trips, Global Technology portfolio managers Alison Porter and Graeme Clark met with portfolio companies and prospective investable businesses. Here, they discuss the key takeaways from these trips.

In terms of the macroeconomic outlook, almost all of the companies we met were very positive on the demand backdrop for tech. US tax reform has clearly provided US-based customers with additional capital to invest in their IT infrastructures while the global demand environment for IT also appears constructive.

Demand seems to be strong both to refresh and improve legacy infrastructures where historical underspending is leading to performance degradation. More importantly, demand is also based around modernising IT infrastructures in order to provide more flexibility as companies focus on being able to respond to the digital transformations in their respective industries. These factors are very supportive of our investment theme in next generation infrastructure, which includes the shift to ‘cloud infrastructure’ – large industrial scale computing and storage that enables cheap, fast compute power and access to machine learning.

This modernisation seems to be happening across on-premise, the public cloud (third party provider) or a hybrid of both. Indications suggest that customers are looking to modernise their infrastructures in the most efficient manner, which often means on-premise first, with a view to moving to a hybrid-cloud infrastructure and eventually to the public cloud. Companies need to modernise their IT infrastructures to enable them to innovate, react, launch new products and services in a timely manner to meet the changing needs of the modern business and consumer. Spending by existing and new customers using the large public cloud platforms Microsoft Azure and Amazon Web Services (AWS) appears to be strong and is spurring ongoing high levels of capital spending on capacity additions and geographic expansion by these ‘hyperscalers’.

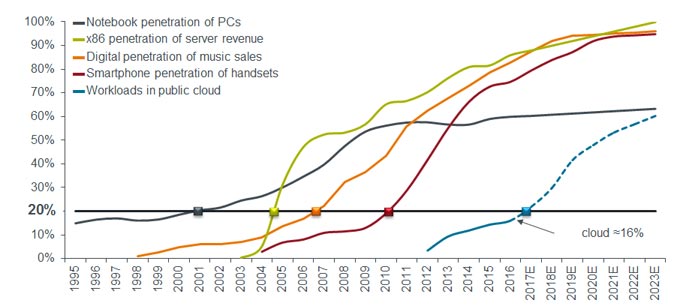

The following S-curve chart illustrates the fact that technology adoption tends to start gradually, then it accelerates, and finally flattens off.In the US, cloud adoption is approaching an inflection point: as it reaches 20% penetration adoption normally accelerates. The logic is that when one in five are adopters then there tends to be a peer network effect.

US cloud: approaching key 20% penetration level

[caption id=”attachment_72296″ align=”alignnone” width=”680″] Source:Morgan Stanley research: Public cloud: what’s it worth? 15 March 2017. E= estimated data 2017-2023. Estimates may vary and are not guaranteed.[/caption]

Source:Morgan Stanley research: Public cloud: what’s it worth? 15 March 2017. E= estimated data 2017-2023. Estimates may vary and are not guaranteed.[/caption]

Looking specifically at the software companies visited, it is clear that the next generation of software platforms are winning. These include public cloud providers like AWS or Microsoft’s Azure or application platforms such as ServiceNow, Salesforce or Adobe. All of these companies continue to gain share and are investing in order to grow their product offering and secure their position as key platforms.

Meetings with a range of smaller, disruptive software providers served as a reminder that scaling mid-sized software companies remains a real challenge. The task of taking a single product company and developing a suite of products around it, while driving revenues to $1bn+ should not be underestimated; this remains the key challenge for a number of up and coming vendors. Gaining platform status is the ‘Holy Grail’, but something that is only achieved by a select few with significant barriers to entry.

Our meeting with the Chief Financial Officer of Apple confirmed the team’s view that the company is transitioning to more of broad platform than just one that’s focuses on a single product such as the iPhone.While the replacement cycle for new iPhones appears to be elongating, Apple is continuing to invest in Apple Pay, media content, Apple Music and the app store in order to better monetise the 1.3 billion installed base of accounts on the Apple iOS platform. In April a plan for better optimising its capital structure and $163bn of net cash is set to be revealed to investors.

Another common theme was the developing opportunity around artificial intelligence (AI) and machine learning. While these themes remain in the early stages of development, most companies are able to showcase early offerings in this space and demonstrate the benefits for customers. While we remain cognisant of navigating the hype cycle in this next wave of technology development, we believe AI is a key enabler for technology to take share from a wider range of industries in the future.

US corporate tax reform and overseas profit repatriation present opportunities for tech companies, but could also provide a boost to other sectors and may lead to a short-term impact on relative earnings growth for tech compared to these sectors.

Overall, these trips reinforced our positive view on the outlook for technology. In the meantime, we continue to have a focus on valuation and ‘navigating the hype cycle’ to identify and understand where a new technology sits in the hype phase and avoiding these areas, both key elements of our investment process.

The above stock examples are for illustrative purposes only and are not indicative of the historical or future performance of the strategy or the chances of success of any particular strategy. Janus Henderson Investors, one of its affiliated advisors, or its employees, may have a position in the securities mentioned. References made to sectors and stocks do not constitute or form part of any offer or solicitation to issue, sell, subscribe, or purchase them.