Subscribe

Sign up for timely perspectives delivered to your inbox.

Jenna and I have a lot of sympathy for arguments that deflationary elements are affecting the global economy and hence supporting ‘lower for longer’ interest rates. The economic textbooks would suggest that following US$16 trillion dollars of quantitative easing (QE), both economic growth and inflation should be very strong, but it is not. We both have an economics degree but have found it woeful in explaining why bond yields keep falling. There are many reasons why the global recovery has been so miserable: banks, corporates, governments and consumers all simultaneously deleveraging their balance sheets, creating excess savings; the secular stagnation thesis; demographics; lack of growth of global trade; and the end of the commodity super cycle.

Alongside this we would highlight the extraordinary effects that technology is having on increased utilisation of existing capacity, particularly through the sharing economy. This is bringing prices down in many industries, contributing to the deflationary forces gripping the world.

Readers of my age will remember the TV programme Noel Edmond’s Swap Shop on a Saturday morning – where children would turn up in the studio, at outside broadcasts, or phone in wanting to swap one toy for another. Children would duly exchange toys and everybody would go home with a “new” toy. Most of us have shared rides on the school run or to the children’s cricket match, hired morning suits from Moss Bros to avoid buying a rarely used item or swapped excess foreign exchange with a colleague to cut out the middle man. I remember an Australian school teacher who even swapped his job and house for a year with one of our UK-based teachers.

Technology enables scale to come into these swaps, bringing numerous asset owners and hirers together with amazing efficiency and ease. All our team are now frequent users of Uber – it costs about 60% to 70% of the cost of a black cab. On a recent marketing trip to Newcastle the black cab driver told me Uber would never break into his patch! I am not so sure. Uber is a great example of how anyone with access to a car, satnav, and public carriage licence can become a self-employed cabbie thanks to the enabling of modern technology. It is amazingly deflationary and provides a service for a fairly low-end skill – driving. Uber is commoditising the taxi industry and driving prices lower. Satnav is making “The Knowledge” redundant. A black cab from the City to London City Airport costs around £22. My recent Uber journey was under £17! The barriers to entry are low and the drivers have virtually no wage power, unlike the restrictive closed shop of the black cabs. These are massive structural shifts in the way the taxi industry operates and are deflationary – the so-called “gig economy”.

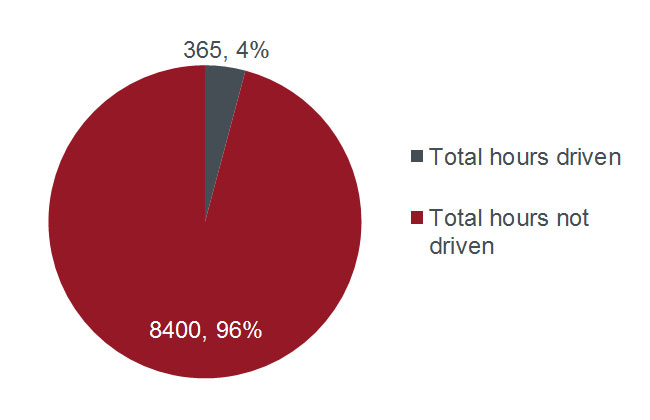

Sticking to cars, I resisted buying a second car for many years – my family used to use City Car Club – whereby you could hire a car locally by the hour by booking online. Family constraints meant it was not effective. Now our second car sits on the drive depreciating away while awaiting the weekend sports fixtures. Morgan Stanley research suggests the average car is used just 4% of the time – that is an extraordinary waste of an asset!

Aggregate hours worldwide that cars are driven

Source: Morgan Stanley Research, figures in billions, 4 September 2014

Their research piece* suggests that Uber’s founder Travis Kalanick’s motto could be: “We will make taxis so cheap that only rich people will own cars.”

This is a clever twist on Thomas Edison’s quote when demonstrating his incandescent light bulb: “We will make electricity so cheap that only the rich will burn candles.” I should be renting my car out through the week to the Uber driver and yes there is an app for that! Car sharing (Lyft.com) could massively increase car utilisation from low levels but this could similarly decrease the need for new cars – another potentially vast deflationary force. It could also shake up the cosy oligopoly in the car hire industry.

Turning to another high fixed cost industry, hotels, where Airbnb is the dominant challenger to this industry. Bank of America Merrill Lynch (BAML) estimate Airbnb could account for 1.2% of US hotel room supply and could rise to 3.6% to 4.3% by 2020. Airbnb is estimated to be growing by 40%-50% per annum. In Austin, Texas, research by BAML has found each 10% rise in Airbnb rooms listed has caused a 0.35% decline in room revenue. Airbnb has a 17%, 12%, and 10% share of hotel room supply in New York, Paris, and London respectively. Airbnb could have huge ramifications for the hotel industry. By using existing resources more efficiently prices will be lower to the benefits of consumers.

We have plenty of capacity in the world. In fact, most industries have too much capacity, such as airlines, autos, shipping and steel. This is not helped by deficient demand and lack of growth in the world. Disruptive innovation, which uses existing capacity more efficiently, can only be deflationary.

So, next time I am off on holiday the house will be up for rent on Airbnb.com, the car will be lent to easycarclub.com, the travel money will come from weswap.com and the pet dog will be lent out on borrowmydoggy.com. Not sure about the kids – I guess that’s what grandparents are for. Oh, and yes, I will be using Uber to get to the airport!

* Rent a car meets Tech; head on collision; Morgan Stanley; Adam Jonas, 4 September 2014