Subscribe

Sign up for timely perspectives delivered to your inbox.

How do you build a long-term investment strategy in a world where technology and politics keep changing the rules? Portfolio manager Stephen Payne reflects on some of the characteristics he values when looking for companies that can thrive during periods of potentially significant disruption.

Disruption is inevitable and an essential catalyst for progress. The most pertinent question facing us in the UK, as we look ahead at the impact of geopolitical and technological upheaval in financial markets, is how to harness this disruption to generate long-term sustainable returns for investors, particularly as we move towards a new relationship with Europe and the rest of the world.

How do you build a long-term investment strategy in a world where technology and politics keep changing the rules? Portfolio manager Stephen Payne reflects on some of the characteristics he values when looking for companies that can thrive during periods of potentially significant disruption.

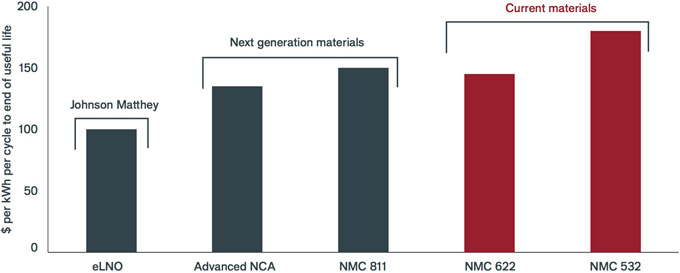

Johnson Matthey, for example, is a world-class specialty chemicals firm, harnessing cutting-edge science and technology to deliver profitable solutions to clients, with a focus on cleaner air, improved healthcare and more efficient use of natural resources. It leads the market in the development of durable and increasingly efficient catalytic converters, an area that should benefit from tightening regulatory oversight. Demand for high-performing battery systems also continues to rise, and Johnson Matthey looks poised to benefit from the development of its eLNO (enhanced lithium nickel oxide) technology for electric vehicles (see chart).

Similarly, Victrex has proactively invested in the development of polymer products for use across a range of industries, including healthcare. PEEK – a reinforced thermoplastic composite – is a demonstrably good alternative to metals in aviation and the auto industry, areas where lighter, stronger and more durable alternatives can help to cut costs and satisfy stringent safety and environmental regulations.

Source: Johnson Matthey annual results 2017/2018.

Chart to scale, with eLNO indexed to 100. Note: Cost in US dollars per kilowatt hour (kWh) per cycle to end of useful life (80% retention of charge). Third-party testing by Qinetiq. Electrochemical data from Qinetiq benchmark testing, cost data from Johnson Matthey. NCA = nick/cobalt/aluminium. NMC = nickel/manganese/cobalt.

Elsewhere, I like those companies that are helping to meet the future needs of the country, in terms of infrastructure, renewables and waste management. Costain’s recent projects include building an ‘electricity superhighway’ beneath the streets of London, to ensure that the city’s growing demands for power can be met in the coming years, and developing road infrastructure in the Midlands to provide a test environment for the use of autonomous vehicles. Another example is John Laing, a global infrastructure development firm, which in the UK manages a range of infrastructure projects, such as the second Severn River Bridge joining England and Wales.

Janus Henderson Cautious Managed Fund