Subscribe

Sign up for timely perspectives delivered to your inbox.

Disruption is a constant process and any successful investment strategy must take this into account. Andrew Gillan, Head of Asia ex-Japan Equities at Janus Henderson Investors, discusses the opportunities that disruption can offer in the Asia region.

Disruption is a continuous process and one that knows no geographical or sectoral bounds. Asia has long been at the heart of this transformational change but what is different today is the sheer pace of disruption and the scale and depth at which its effects are felt. Technological advances, policy and regulatory changes, and a growing consumer population keen to adopt the latest technologies are all pushing Asia to the forefront of disruption.

Technology is often the first theme that springs to mind when we think of disruption. Asia is a hub for this development, with information technology companies accounting for 26% of the MSCI Asia Pacific ex-Japan Index as at 31 August 2018.

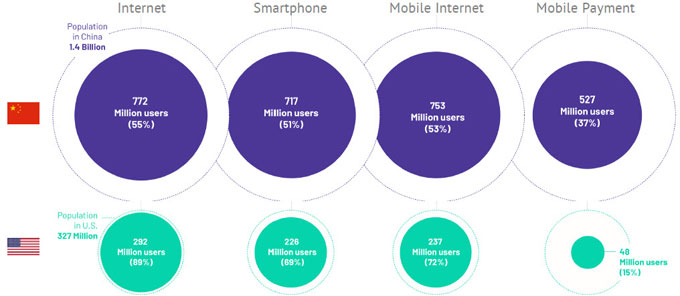

Technological advancements are empowering new companies to challenge incumbent companies and industries at a faster rate than ever before. The rapidly growing take-up of online and mobile services is a key component of this. In China, more than half the population is using the internet, smartphones and mobile internet services. The Chinese consumer has also been quick to take advantage of advances in digital payments. With 37% using mobile payment systems – compared to only 15% in the US – the country is well on its way to becoming a cashless society.

Source: EPFR Global, Citi Research, as at 12 April 2018

Converging with this shift in consumer preference is the burgeoning trend of the cloud, which has levelled the playing field by allowing companies to access its consumer base anytime, anywhere, and at very low costs. It is impossible to ignore China’s web giant Tencent as an example of this. The company now has more than one billion monthly active users a month across its social, messaging and gaming ecosystem and demonstrates the benefits that are gained from seamlessly connecting with consumers.

It is easy to focus on successful challengers when looking at disruption at company or sector level. It is worthwhile highlighting, however, that some of the best investments in the region so far this century have been from incumbents that have successfully maintained, or increased, their competitive advantage.

Taiwan’s TSMC, the world’s leading semiconductor foundry, is a case in point. As an enabler of disruption and technology evolution, the company has developed a mutually beneficial relationship with its clients; sharing the rewards of its technological advances and delivering attractive and consistent returns to shareholders. To achieve this, the company has had to move quickly to embrace and adapt to changes in the devices that are utilising its technology.

Within the more emerging markets in the region, incumbents in the financial services sector have been very successful investments. Private sector banks in India, and the larger banks in Indonesia, are benefiting from the earlier stage of economic development in these countries. There will no doubt be more competition ahead for these banks but they can remain on their upward trajectory if they continue to tap into an underpenetrated consumer base, with its underlying demand for mortgages and other financial products. While these demographic tailwinds may boost their revenues, however, it will be important for these companies to maintain their prudency and risk management.

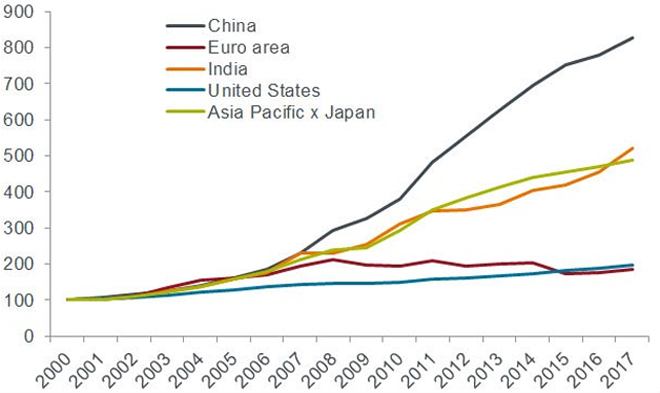

The main platform for technological advancement is undoubtedly Asia’s strong macroeconomic advantage over some of the older developed economies. The region’s consumption and demographics profile provides fantastic opportunities to companies operating in the region. Asia’s GDP as a whole is growing at a significantly faster rate than global GDP and is very much expected to sustain this in the decades to come. It also has a growing middle class that is hungry to consume, with growth in household expenditure rising exponentially over the past decade (see chart below).

Cumulative growth in household consumption expenditure (Index 2000 = 100)

Despite these drivers, Asia remains underappreciated by investors and, we believe, underrepresented in global indices. For these reasons, we believe Asia has the potential to disrupt traditional ways of allocating capital, becoming a more established asset class in its own right; with investors increasingly making a dedicated investment in the region instead of gaining exposure via global emerging markets, for example. Volatility has historically been – and most probably will remain – higher than within developed markets but the level of returns has rewarded the long-term investor.

An important step towards increasing Asia’s importance in global investor allocations was made this year when the China ‘A’ share market* was included in major indices. It is also true, however, that the sheer amount of equity issuance has also supported China’s rise in major indices, rather than sustained outperformance relative to the rest of the region.

Other policy and regulatory developments also play their part in disruption in the region. The recent US-China tensions around the escalation in trade tariffs, for example, highlight how government policies or major events can also lead to disruption both in terms of stock market sentiment and company fundamentals.

Traditional thinking that Asian companies compete on low labour costs is outdated. Product innovation and successful customer-centric business models in the region are offering exciting investment opportunities. While there have been negative headlines in recent months surrounding intellectual property theft, when it comes to truly innovating and providing the best solutions for their global clients, many Asian companies have been leading the pack.

*China A-shares are stocks listed on the Shenzhen and Shanghai stock markets