Subscribe

Sign up for timely perspectives delivered to your inbox.

Jenna Barnard, Co-Head of Strategic Fixed Income, explains how an uneven geographical divide in technology is melding with a world of divergent growth and interest rate outlooks.

iStock[/caption]

iStock[/caption]

As bond investors looking for opportunities to invest across developed economies, for a number of years our primary perspective has been one of divergence. Global growth has appeared increasingly polarised, such that the ability of other central banks to follow the US Federal Reserve in its rate hiking cycle has been severely constrained in many economies.

This in turn has created some of the largest interest rate differences between countries for decades, presenting opportunities for bond investors and highlighting the underlying structural fragility of the global economy. Europe’s struggles with a deleveraging economy are well known but smaller, more dynamic economies have also faced their own constraints. For some, such as Australia, it is an overheating housing market and subdued consumer that was the problem; for others, such as the UK, it has been idiosyncratic issues (the overhang of Brexit).

However, over the last year, as bond managers we have also focused on the wider issue of technological disruption, initially at a stock level but increasingly at a macroeconomic level as well. Indeed, it is notable that we have heard traditional economists from a variety of countries belabour the lack of exposure to this growth industry and the consequence for long-term economic prospects.

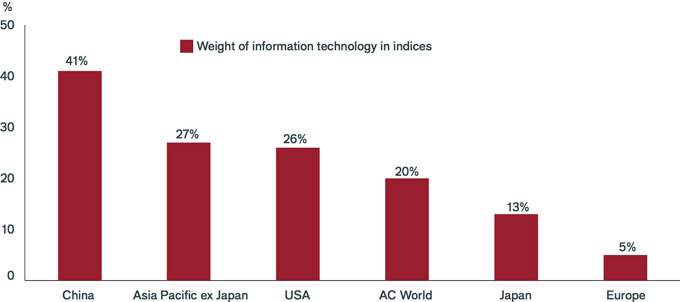

Figure 1: geographical divide in technology’s dominance

[caption id=”attachment_68068″ align=”alignnone” width=”680″] Source: MSCI, FactSet, Goldman Sachs Investment Research, June 2018 Note: AC World = MSCI All Countries World Index (ACWI)[/caption]

Source: MSCI, FactSet, Goldman Sachs Investment Research, June 2018 Note: AC World = MSCI All Countries World Index (ACWI)[/caption]

Technology dominates economies, industries and stock markets but not equally, and not everywhere. There is a clear geographical divide where technology companies dominate in the US and China, but form a smaller part of other, particularly developed, markets. A cursory glance at the top 50 entries in a Wikipedia ranking of unicorn start-ups reveals that 28 are Chinese, 15 are American, and none are from Europe. The chart in figure 1 is a good illustration of this, looking at the weight of information technology in various equity indices.

In smaller economies like Canada, Australia, and the UK, the weightings of technology are even lower than that of Europe in figure 1. The technology sector comprises 4.1% of the Canadian Toronto Stock Exchange Composite Index, 2.4% of the Australian ASX 200 Index, and 1.3% of the FTSE 100 Index in the UK. The stock markets of these three economies look increasingly anachronistic with their composition so heavily dominated by ‘legacy’ sectors of finance and commodity companies. In the case of Canada and Australia, this is particularly pertinent, as we have written on a number of occasions about their post-2008 crisis experience of encouraging housing market and consumer indebtedness booms.

We have positioned our strategic bond funds to reflect the correction that is unfolding as a result. The lack of technology exposure as reflected in their indices serves to highlight how reliant these economies have been on relatively unsustainable sources of growth.

The modern world, and with it society, has evolved through a constant state of disruption. However, in the last year or so, we have seen an extraordinary amount of disruption on a more micro level in businesses and industries that we always thought of as very dull but relatively safe areas to which to lend money. Today’s disruptive forces weighing down on companies are often difficult to predict, as advances in technology have allowed new business models to disrupt traditional marketplaces and put existing companies out of business — at record speeds.

Managing disruption at the company level is not an easy task as potential disruptive forces are hard to see. It requires a new mindset and a re-evaluation of the business model.

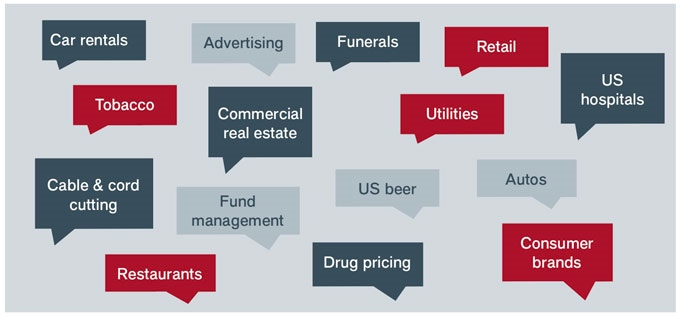

Figure 2 shows a range of businesses that have fundamentally changed in the last 12-18 months. While disruptions in businesses such as retail and cable TV are very well known, the surprises are funeral businesses, the beer industry in the US, tobacco and advertising. We have termed these ‘pursued businesses’; often stable businesses with good cash flows and profit margins, now hunted by new entrants or shifting economics within these industries.

Figure 2: pursued businesses

[caption id=”attachment_68079″ align=”alignnone” width=”680″] Source: Janus Henderson Investors, June 2018[/caption]

Source: Janus Henderson Investors, June 2018[/caption]

Disruption can cause dislocation and upheaval for many businesses and from an investment perspective have a significant impact on portfolios.

In our view, long term structural forces set the ‘climate’ for investing in bonds, while cyclical ups and downs are more akin to the ‘weather’; and yet, tend to generate a disproportionate amount of attention.

The long-term impact of debt super cycles has been a particularly important lens in our understanding of economies such as Japan and the eurozone, while much has also been written on the impact of ageing populations in the developed world.

There is no doubt that technology is becoming an increasingly important factor in the bond investing climate on every level. The geographically polarised nature of the global technology titans and the ecosystems in which they thrive has added a new dimension to a world of already divergent growth and interest rate outlooks.