Subscribe

Sign up for timely perspectives delivered to your inbox.

The Janus Henderson Portfolio Construction and Strategy (PCS) Team explores the implications of this year’s volatility and puts forward actionable ideas to capture the resulting opportunities.

Investors entered 2023 anticipating potentially calmer markets after last year’s historic inflation, rise in interest rates, and rerating of stocks on the expectation that a higher cost of capital would eventually weigh on economic growth and earnings. As the market continued to assess these fluid developments, another source of volatility emerged in the form of turmoil within the banking sector that potentially threatened financial stability in several major economies.

While regulators’ decisive actions have likely stemmed the risk of contagion spreading, enough economic assumptions were undone – and nerves frayed – to beg the question of whether markets have now entered an even more challenging environment.

We believe they have. Our view is that we are likely to see elevated risk for some time, however we’re very much “late cycle” with central banks coming toward the end of their period of rate hikes. This late-cycle stage creates opportunity for active security selectors who can benefit from the rise in idiosyncratic risk.

For example, March’s volatility proved indiscriminate. This created opportunities for active managers to gain exposure to attractive companies at discounted valuations while avoiding those potentially facing structural challenges.

This means that, while many of the trends that we expected to play out over the course of 2023 remain intact, we think investors should take steps to identify what has changed and use this information to calibrate their tactical allocations to account for and to take advantage of these volatile times.

At the beginning of the year, we stated that, as the global economy faced a mid-cycle adjustment, equity investors should prioritise quality, which we defined as companies with sound balance sheets that are capable of generating cash flows throughout the cycle. That message is truer than ever. As consumers’ access to credit weighs on revenue growth and higher input costs squeeze margins, 2023 earnings may drift toward the lower end of the predicted range, compressing valuation multiples further.

In our view, however, this is not an environment in which to avoid risk altogether. Rather, we believe investors with the appropriate risk tolerance should embrace volatility with the aim of identifying quality companies with attractive valuations. Given the powerful secular themes transforming the global economy, many companies have the potential to deliver solid earnings growth over the next several quarters.

The breadth of risks contributing to current economic uncertainty only heightens our concern about how those risks may impact stocks, especially given what we consider to be an uncomfortable level of market concentration. Strategies tightly tracking tech-laden benchmarks worked well during the 2020 market recovery. Yet, as evidenced by the past 12 months’ returns, this concentration has come back to bite index-based strategies.

But higher rates and market volatility have also created opportunities within tech. Overinvestment and higher discount rates have changed the investment landscape within the sector, and we expect to see a greater dispersion in returns over the near- to mid-term based on companies’ ability to execute in a slowing economy.

A similar dynamic is at play geographically. With many global indices tilted toward the US, benchmark-tracking investors could be exposed to sticky inflation as tighter credit conditions emerge. Opportunities for attractive returns exist in the US, but we believe investors should be afforded the opportunity to determine for themselves whether they want the level of exposure embedded in major benchmarks.

With headwinds apparent, exposure to the defensive healthcare sector merits consideration. Within this sector, biotechnology, in our view, holds particular promise given attractive valuations and its exposure to innovation. Also, as markets are forward-looking, investors might consider profitable small- and mid-cap companies as they tend to outperform early in a recovery.

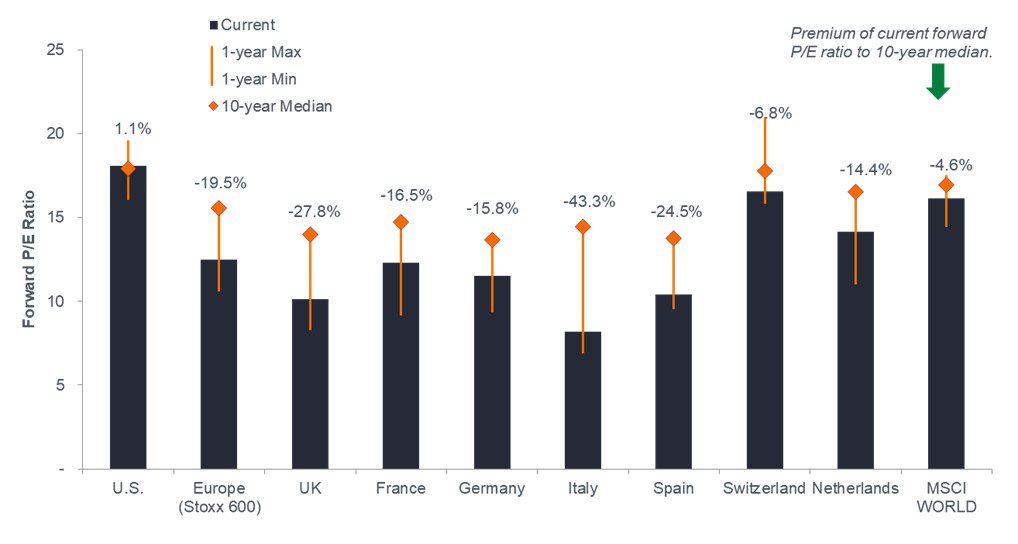

While P/E ratios have drifted back toward average levels in the US, many European countries trade and significant discounts.

Source: Bloomberg, as of 30 March 2023.

While focusing on quality during the downturn, investors should also be thinking ahead and consider attractively priced cyclical exposure to markets that are most likely to lead the way out of recession.

We believe investors could use Europe’s economic headwinds to their advantage as the year progresses. However, there are risks that remain, particularly around the impact of geopolitics on energy and food costs. Still, if things continue their current trajectory, the cyclical nature of European stocks means that they have historically been well positioned to outperform as the economy moves toward recovery. With inflation projected to moderate and growth to accelerate in 2024, early-cycle European cyclicals could rerate higher at a time when valuations of other developed-market stocks continue to compress. Enhancing the opportunity presented by European equities is their historically lower valuations and higher dividend yields relative to other major markets.

Last year’s rise in rates – as unwelcome as it was – means that, once again, a bond allocation can potentially offer attractive income generation, the potential for capital appreciation, and the accompanying benefit of diversification against historically riskier asset classes. This is why we expect to see meaningful allocations to fixed income as investors seek defensive strategies for a potential downturn.

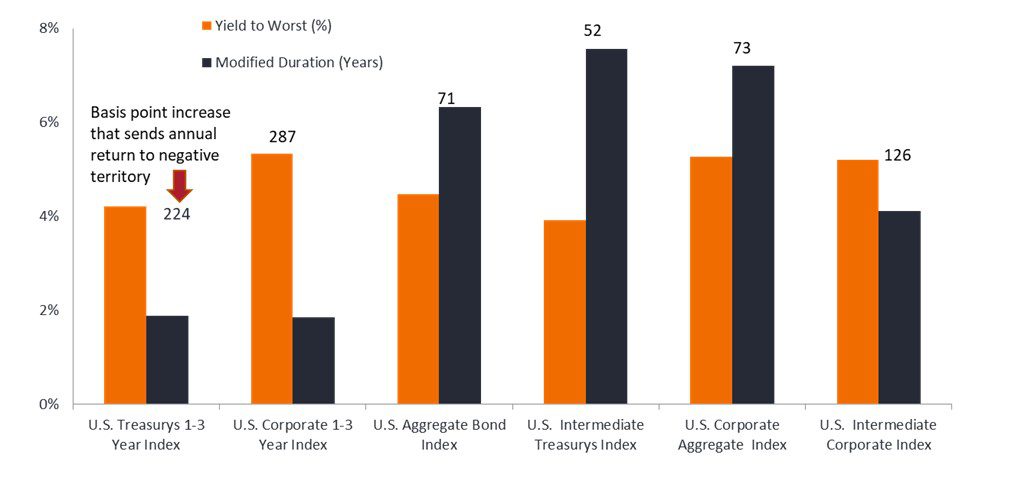

We believe current conditions may warrant bond allocations in shorter-duration, investment-grade issuance. Policy uncertainty means that elevated exposure to duration risk should be avoided. After last year’s repricing, shorter-dated bonds are now offering returns in the mid-single-digit range – something unimaginable for much of the past decade. Similarly, the risk-reward profiles have turned more favourable since early 2022.

Lastly, more resilient investment-grade business models may potentially weather a downturn better than more cyclically exposed high-yield issuers. While we believe this convergence of forces has elevated the stature of bonds within a broader allocation, investors should be mindful that inflation has been both unpredictable and difficult to contain. Consequently, investors should remain vigilant of developments that could again see either inflation or policy reaction impacting the outlook for bonds.

Shorter-duration bonds have significantly higher yield cushions than those with longer-dated maturities.

Source: Janus Henderson, as of 30 March 2023.

Source: Janus Henderson, as of 30 March 2023.

Uncertainty breeds volatility, and we believe volatility calls for strategies that seek to minimise market undulations and maximise cross-asset diversification.

Tactics aimed at lowering the downside risk of a broad allocation were conceived for environments like this. Last year’s drawdowns in both equities and bonds illustrated what occurs when diversification fails. While consensus has coalesced around impending recession in several major economies, the depth and duration of a downturn are less certain. And while some segments of equities and bonds have the potential to perform well in volatile periods, we believe the current environment lends itself especially well to exposure to alternative strategies – particularly liquid alternative strategies.

However, the range of liquid alternative strategies is immense. We recently highlighted how extreme the spread of returns was for liquid alternatives in 2022.

Therefore, in the current unsettled environment, we see strong value in multi-strategy alternatives that combine different investment strategies and that can dynamically adjust the allocation to these strategies based upon the market environment.

As we began this discussion with equities, it’s fitting that we return to this asset class in closing. As evidenced by March’s sell-off in US regional banks – including several well-run businesses – elevated volatility can lead to price dislocations that opportunistic managers can capitalise on.

As the global economy resets to a higher-inflation, higher-rate regime – and one fraught with geopolitical risk and a trend toward deglobalisation – we believe dislocations will emerge in other sectors.

Consequently, nimble investors – including those willing to deviate from their benchmark – may be able to generate considerable excess returns by separating the real risks from the noise.

Alpha compares risk-adjusted performance relative to an index. Positive alpha means outperformance on a risk-adjusted basis

Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Barclays Capital Intermediate U.S. Treasury Index includes all publicly issued, US Treasury securities that have a remaining maturity of greater than or equal to 1 year and less than 10 years, are rated investment grade, and have $250 million or more of outstanding face value.

Bloomberg Barclays U.S. Intermediate Corporate Bond Index measures the investment grade, fixed-rate, taxable corporate bond market.

Bloomberg 1-3 Year U.S. Government/Credit Index measures Treasuries, government-related issues and corporates with maturity between 1-3 years.

Bloomberg U.S. 1-3 Year Treasury Bond Index measures the performance of the US government bond market and includes public obligations of the US Treasury with a maturity between 1 and up to (but not including) 3 years.

Bloomberg U.S. Corporate Aggregate Bond Index measures US investment grade, fixed-rate corporate bonds.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Dividend Yield is the weighted average dividend yield of the securities in the portfolio (including cash). The number is not intended to demonstrate income earned or distributions made by the portfolio.

Idiosyncratic risks are factors that are specific to a particular company and have little or no correlation with market risk.

Price-to-Earnings (P/E) Ratio measures share price compared to earnings per share for a stock or stocks in a portfolio.

Yield cushion, defined as a security’s yield divided by duration, is a common approach that looks at bond yields as a cushion protecting bond investors from the potential negative effects of duration risk. The yield cushion potentially helps mitigate losses from falling bond prices if yields were to rise.

Yield to worst (YTW) is the lowest yield a bond can achieve provided the issuer does not default and accounts for any applicable call feature (ie, the issuer can call the bond back at a date specified in advance). At a portfolio level, this statistic represents the weighted average YTW for all the underlying issues.

IMPORTANT INFORMATION

Note: The referenced indices in Exhibit 1 are as follows: The S&P 500 Index for US, the STOXX Europe 600 Index for Europe, the FTSE 100 Index for UK, the CAC 40 Index for France, the German Stock Index for Germany, the FTSE MIB Index for Italy, the IBEX 35 Index for Spain, the Swiss Market Index for Switzerland, the AEX Index for the Netherlands, and the MSCI World Index.

Actively managed portfolios may fail to produce the intended results. No investment strategy can ensure a profit or eliminate the risk of loss.

Alternative investments include, but are not limited to, commodities, real estate, currencies, hedging strategies, futures, structured products, and other securities intended to be less correlated to the market. They are typically subject to increased risk and are not suitable for all investors.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Foreign securities are subject to additional risks including currency fluctuations, political and economic uncertainty, increased volatility, lower liquidity and differing financial and information reporting standards, all of which are magnified in emerging markets.

Health care industries are subject to government regulation and reimbursement rates, as well as government approval of products and services, which could have a significant effect on price and availability, and can be significantly affected by rapid obsolescence and patent expirations.

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market as a whole.