Subscribe

Sign up for timely perspectives delivered to your inbox.

Portfolio Managers John Lloyd and John Kerschner, and Securitized Products Analyst Jason Brooks, discuss the impact of recent bank failures and tighter lending conditions on commercial real estate and CMBS.

The abrupt collapse of Silicon Valley Bank (SVB) in March, followed by the failures of Signature Bank and Credit Suisse, rattled markets. The banking sector touches virtually all elements of the economy, and at one point, everyone – depositors, investors, regulators, and the Federal Reserve (Fed) – was spooked by what had happened, and by what could happen, if more banks failed.

Thankfully, the Fed recognized the dire consequences of a loss of faith in the banking system and responded swiftly to restore confidence therein, preventing more systemic issues and calming market fears.

Now that the market appears somewhat more comfortable with the backstop and safeguards the Fed has in place for banks, investors have begun to ask, “What’s the next shoe to drop?” Firmly in their crosshairs is the commercial real estate (CRE) sector and associated securities, such as commercial mortgage-backed securities (CMBS).

There has been much buzz about this topic in the media recently, and we aim to unpack both the challenges and opportunities within CRE and CMBS.

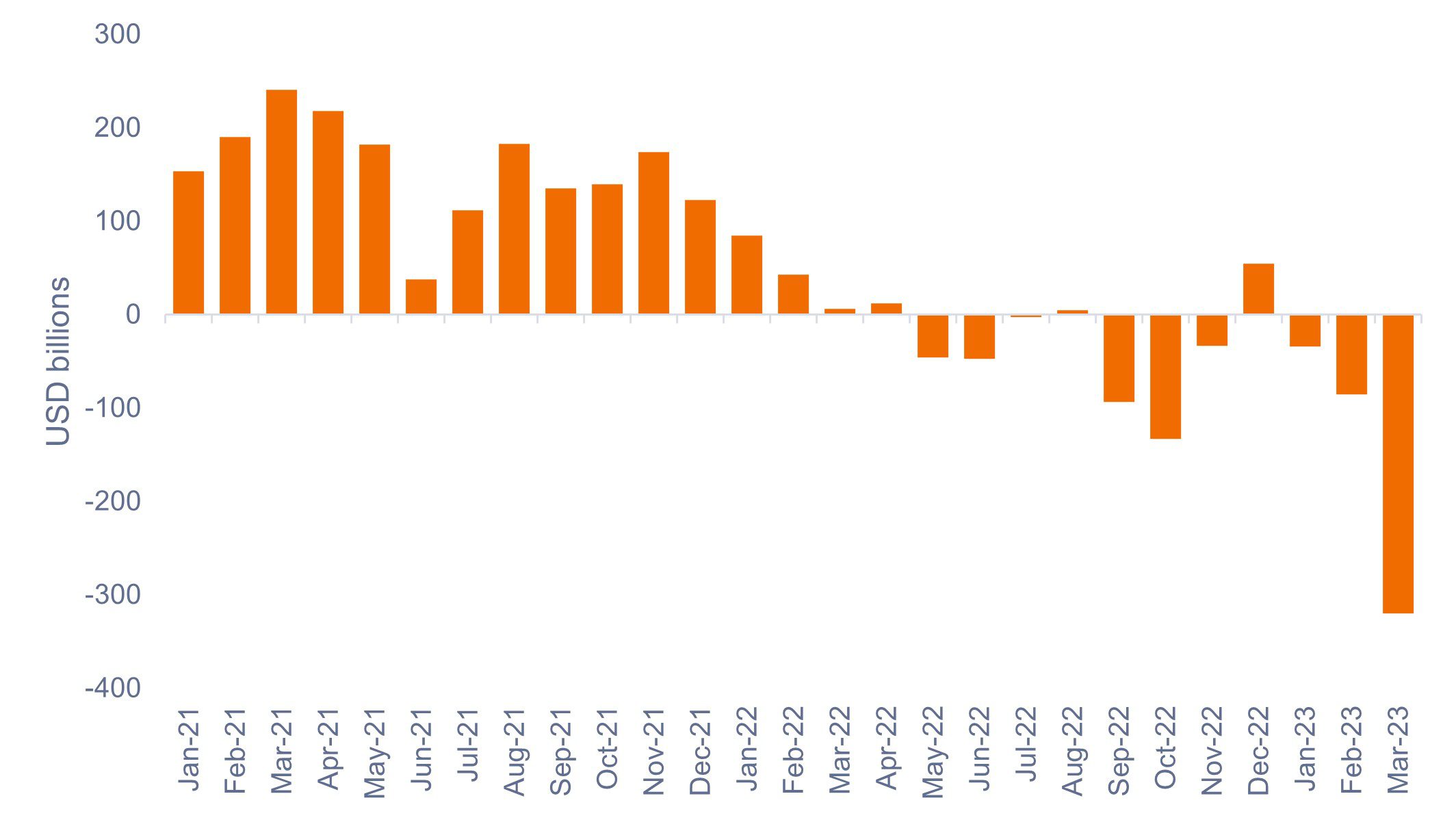

The inverted yield curve and high interest rates have become problematic for U.S. banks for several reasons. Front and center among them: Since the Fed began raising rates in 2022, funds have been flowing out of domestic bank deposits into higher-earning bonds and money market funds at an ever-increasing pace, as shown in Figure 1.

Source: Bloomberg, as of March 31, 2023.

Source: Bloomberg, as of March 31, 2023.

The first-order effect of persistent deposit outflows impacts banks directly: Their interest margins get squeezed as they must pay higher rates to attract and retain deposits, they might be forced to sell long-term securities (in many cases at a loss) to meet withdrawal requests and, importantly, their capacity to make new loans diminishes by a factor for each dollar of shrinkage in their deposit base.

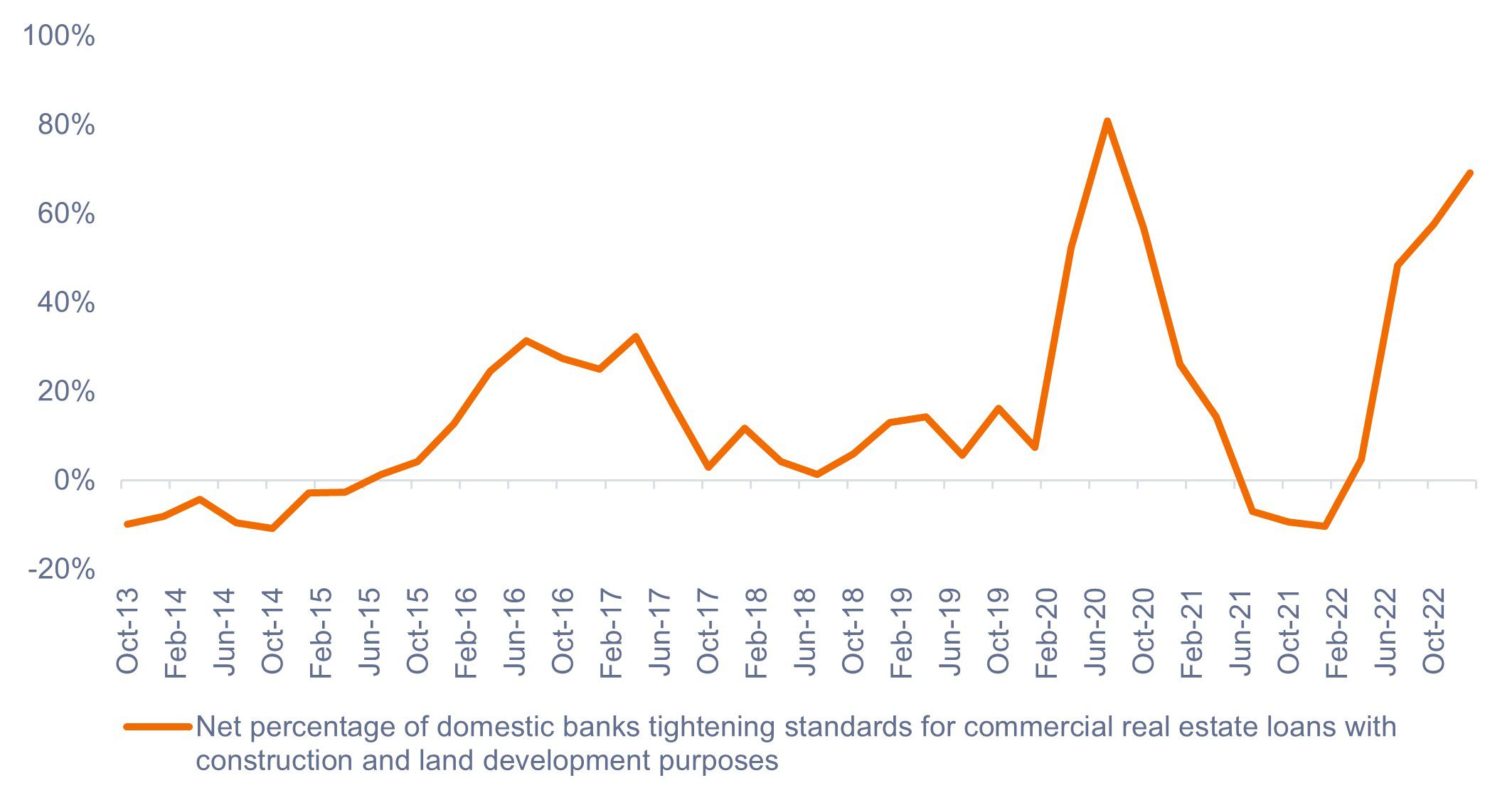

The second-order effect is seen in the impact of a challenging operating environment for banks on other sectors in the economy. These challenges are ultimately limiting the banking sector’s capacity to make new loans, while also driving up rates on the loans they make as their funding costs rise. As shown in Figure 2, there has been a sharp tightening in lending standards as banks aim to be more conservative in protecting their balance sheets. In a nutshell, securing financing is becoming more difficult and costly.

Source: Federal Reserve Board, Senior Loan Officer Opinion Survey on Bank Lending Practices, as of April 14, 2023.

Source: Federal Reserve Board, Senior Loan Officer Opinion Survey on Bank Lending Practices, as of April 14, 2023.

As the reality of higher rates sets in and begins to impact the economy in various ways, we believe there are three key reasons why CRE and CMBS have come into the spotlight for investors.

1. CRE is a high-leverage business. Real estate deals rely to a large degree on debt financing, with loan-to-value ratios (LTV) anywhere from 45% to 75%. As existing loans begin to mature and are refinanced, significantly higher interest costs will adversely impact issuer profitability and make it harder to meet interest coverage ratios and other loan covenants.

2. CRE is exposed to refinancing risk. Many CRE loans are interest-only (IO) loans, and therefore do not amortize. As such, issuers rely heavily on the assumption that they’ll be able to refinance existing loans upon maturity. Because almost 40% of CRE deals are financed through domestic banks and thrifts, a reduction in their capacity to lend brings into question the assumption of refinancing.

Borrowers that are not able to refinance, or fully refinance, may need to seek alternative forms of financing or liquidate assets; otherwise, default becomes a possibility. Additionally, loan terms on CRE run from two to 10 years, so borrowers are not able to lock in low rates for 15 or 30 years like residential mortgage holders. This means the impact of higher rates will be felt sooner, with an estimated $1.5 trillion in CRE loans set to mature within the next three years.

3. A double squeeze due to revenue pressure. The profitability of CRE deals is sensitive to revenue, which is a function of occupancy and rents. Some sectors – specifically, office and some retail – are facing declining revenues due to lower occupancy rates and falling rents. As some issuers face the dual pressures of diminishing revenue and rising interest expense, default becomes a real possibility. Also, they are less likely to get refinanced if a building is half empty and rents are declining.

While zero interest rates in the preceding decades promoted a culture of everyone being a winner, today’s high interest rates are setting the stage for bifurcation in financial markets and the emergence of clear winners and losers. CRE looks to be a proving ground for this broader trend: We are seeing incredible pressure and risk in certain sectors, geographies, and issuers, while others are thriving and maintaining positive future prospects.

It can be easy to hold an overly simplistic view of CRE and CMBS right now. We’ve witnessed this in the form of indiscriminate selling as investors have offloaded their CRE and CMBS holdings based on fear of what’s taking place in the market. But, in our view, situations are seldom simplistic; rather, they tend to be complex and nuanced.

No person has captured this principle better than Charles Dickens, in the opening line of his 1859 novel, A Tale of Two Cities:

It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us…

Inherent in Dickens’ masterful quote is the duality and complexity that pervades everyday life. The world of investing in financial markets is no different. Instead of thinking in absolutes, we believe investors would do well to see the complexity and juxtaposition in situations as they seek to make better investing decisions.

If we adopt a mindset where it’s either the best of times or the worst of times, we risk missing something that only becomes clear in hindsight. To quote another masterful author from a different era, F. Scott Fitzgerald once said, “The test of a first-rate intelligence is the ability to hold two opposing ideas in mind at the same time and still retain the ability to function.”

With that in mind, let’s review the two key areas where we’re seeing this contrast play out in the CMBS market:

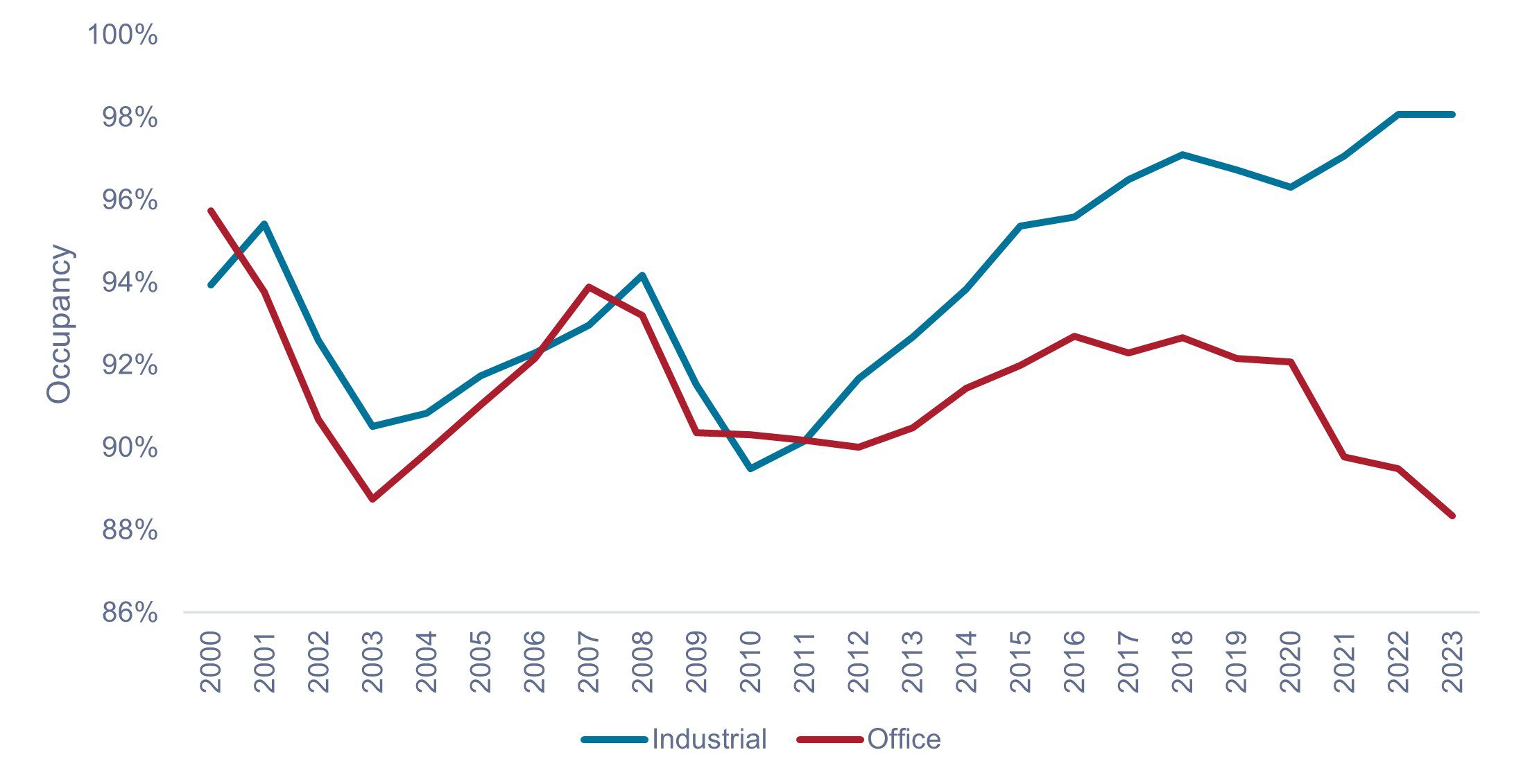

1. Occupancy rates are being driven by structural shifts

Occupancy rates have begun to diverge between sectors and geographies, and even between individual projects and properties. These have been driven by long-term structural changes in the economy. For example, the migration to online retail has boosted the need for industrial warehouses while hurting traditional shopping malls and other retail outlets.

Compare that trend with the plight of the office sector, which was dealt a hammer blow by the COVID pandemic and the remote work revolution. With more workers electing to work remotely and moving out of larger, more expensive cities, traditional office has struggled, and the trend is likely to continue for several years.

Source: Green Street, as of April 14, 2023.

Source: Green Street, as of April 14, 2023.

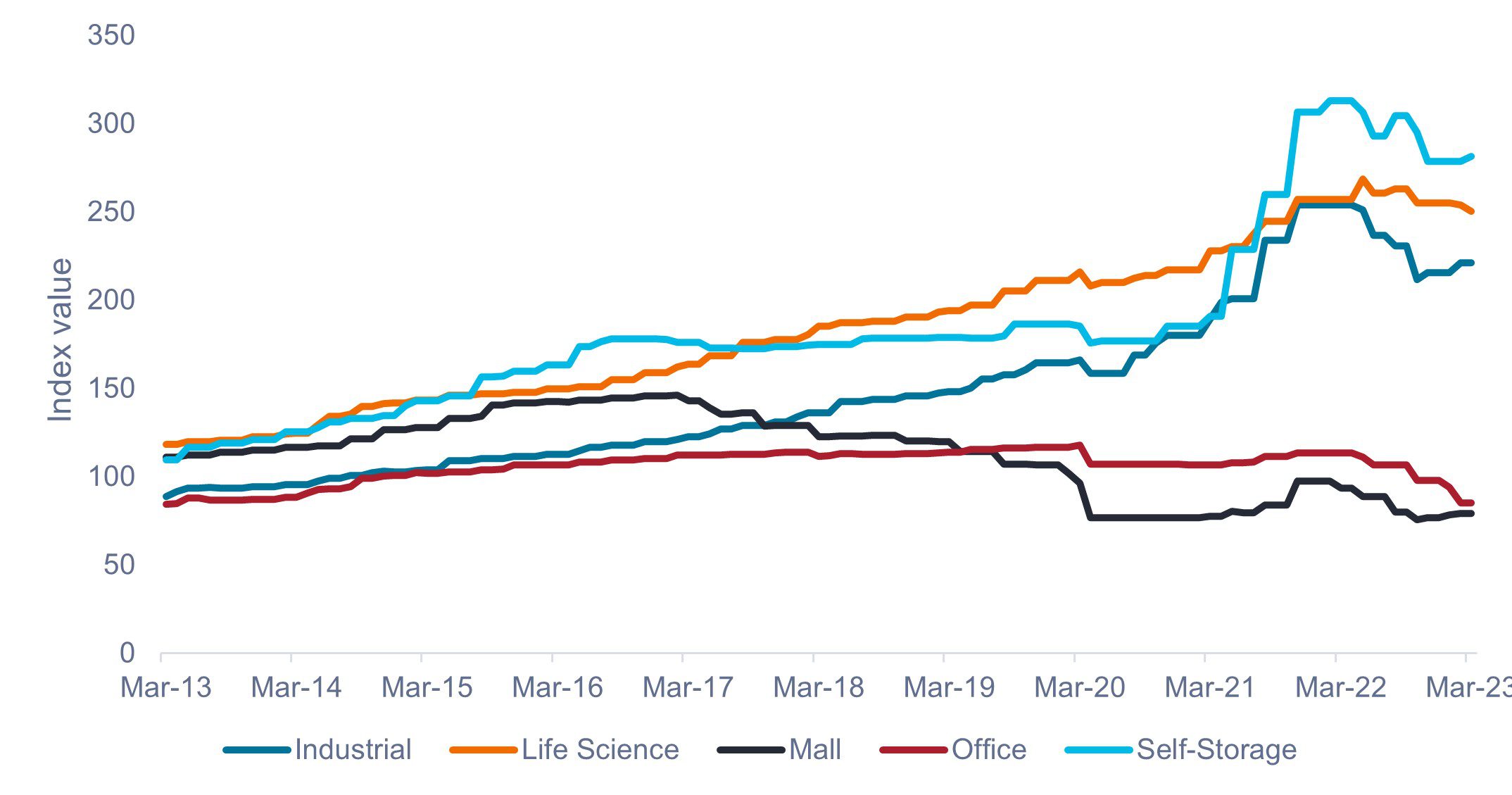

2. What you buy and what you pay matters greatly

While property prices have come off their COVID peaks, in sectors such as industrial, self-storage, and life-sciences, we’ve witnessed a normalization from sky-high valuations. Other sectors, such as malls and offices, have continued their downward trend with little prospect for a turnaround as structural shifts continue to unfold, as shown in Figure 4. Therefore, we continue to see more value in seasoned CMBS (those issued before 2022) because they were entered into at more reasonable property valuations and should be less affected by prices coming off their highs. In contrast, issues originated in mid-to-late 2022 might face refinancing challenges due to relatively lower property values when they’re seeking refinancing.

Source: Green Street, as of April 14, 2023.

Source: Green Street, as of April 14, 2023.

To summon Dickens once more, in our view, it is both the best of times and the worst of times for CRE and CMBS. While the challenges facing the industry are real, they are not uniform across sectors, geographies, or properties. Some sectors continue to thrive, with excellent prospects, and are, in our view, sheltered from much of the dislocation and challenges faced by other sectors.

The high interest-rate environment has set the stage for the winners to win. Naturally, where there are winners, there will be losers. Indiscriminate fear-based selling following the failure of SVB is, in our view, providing opportunities to acquire robust, high-performing CMBS at attractive prices.

In closing, if banks are going to be more selective in who they lend money to, shouldn’t investors follow suit? We believe they should. As such, we think attractive risk-adjusted returns are available to active investment managers who follow a proven, research-driven approach and can be discerning about the assets they purchase and the prices they pay.

A yield curve plots the yields (interest rate) of bonds with equal credit quality but differing maturity dates. Typically bonds with longer maturities have higher yields.

An inverted yield curve occurs when short-term yields are higher than long-term yields.

IMPORTANT INFORMATION

Real estate securities, including Real Estate Investment Trusts (REITs), are sensitive to changes in real estate values and rental income, property taxes, interest rates, tax and regulatory requirements, supply and demand, and the management skill and creditworthiness of the company. Additionally REITs could fail to qualify for certain tax-benefits or registration exemptions which could produce adverse economic consequences.

Securitized products, such as mortgage- and asset-backed securities, are more sensitive to interest rate changes, have extension and prepayment risk, and are subject to more credit, valuation and liquidity risk than other fixed-income securities.