Subscribe

Sign up for timely perspectives delivered to your inbox.

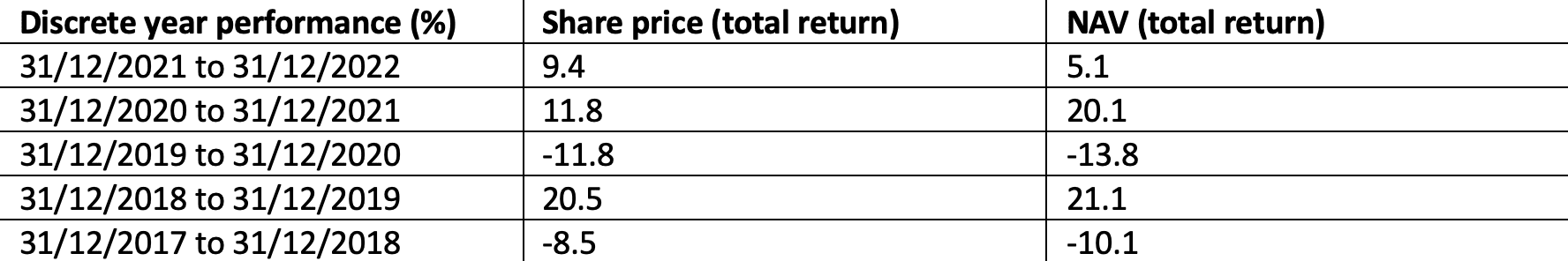

With its strong defensive growth qualities and attractive income, the UK stock market remains a vital component of a diversified portfolio. The City of London Investment Trust levers these qualities to help bring stability to returns in uncertain times.

With the ramifications of Brexit back in the headlines and a revolving door seemingly in need of installation at 10 Downing Street, confidence in the UK economy has dipped dramatically in the last few years. And, not surprisingly, this combination of volatile politics and pessimism around growth has dampened sentiment towards UK stocks and dragged down their returns against the rest of the world. But could it be that the doom and gloom is overdone, and that the UK market is, in fact, fairly well set to ride out the uncertainty that lies ahead?

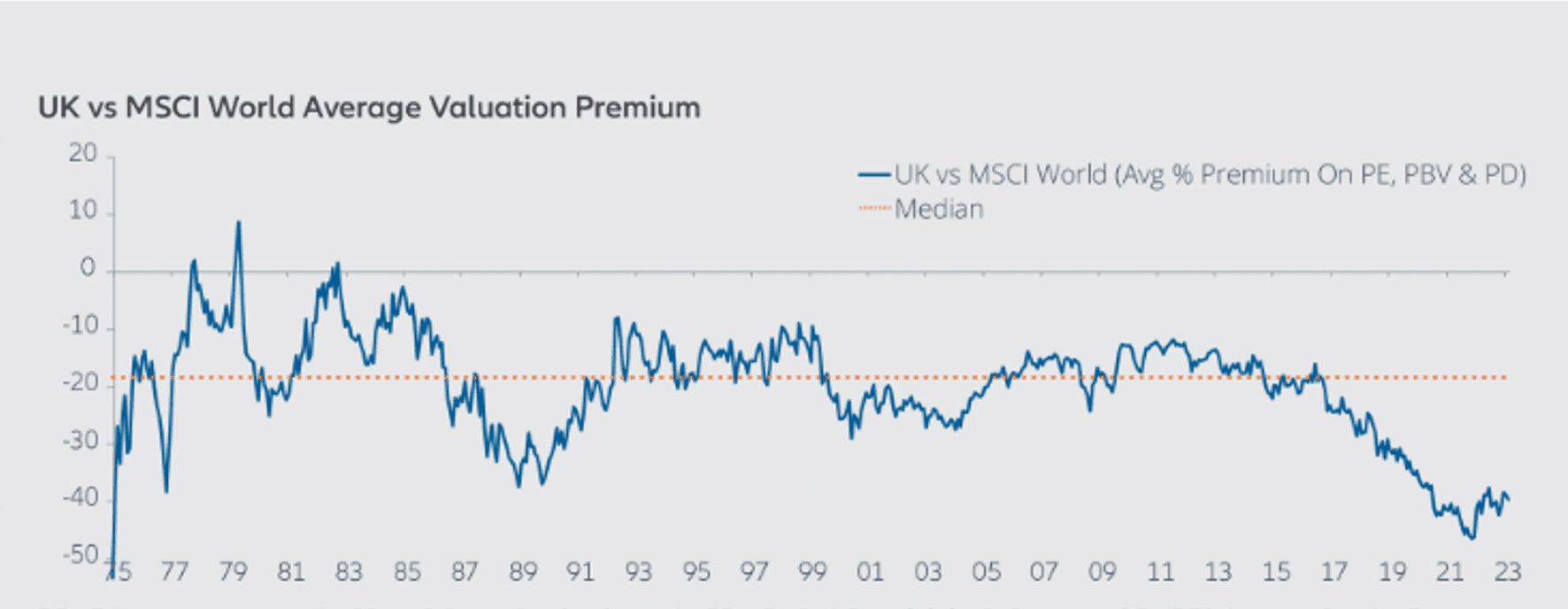

Despite their solid performance last year, UK shares remain relatively cheap and are attractively priced when compared to other leading players: the US, Europe, and Japan. In fact, as can be seen in the chart belowi, UK stocks are still trading at a 40% discount relative to their peers, partly reflecting its small technology sector. We believe this creates a ripe opportunity for investors to pick up cheap bargains whilst getting exposure to the many world-class businesses that reside in the UK.

Source: MSCI, IBES, Morgan Stanley Research as at 03/02/2023

Source: MSCI, IBES, Morgan Stanley Research as at 03/02/2023

Note: PE = price to earnings ratio. PBV = Price to book value ratio. PD = Probability of default

As the global economy navigates recessionary headwinds and increasingly fraught geopolitics, having exposure to large companies which have solid balance sheets and are cash generative should insulate investors from volatility. One of the most important steps to building attractive long-term returns is finding value – the price you pay for a stock matters, and investing at price levels similar to today has historically proven to be a good approach.

There are sound structural reasons for retaining exposure to UK shares, even during times of flux. First, it remains a hub for dependable cashflows. The UK is home to many long-established, world-leading ‘value’ companies with solid business models that post stable and reliable earnings year in, year out. This is key both when growth concerns are to the fore and when inflation is high and interest rates are rising. Moreover, these qualities are key in helping the UK retain its status as a leading destination for overseas investment. The many billions of assets that flood into the country annually not only underpin the economy but also help support share prices via the acquisition of UK companies.

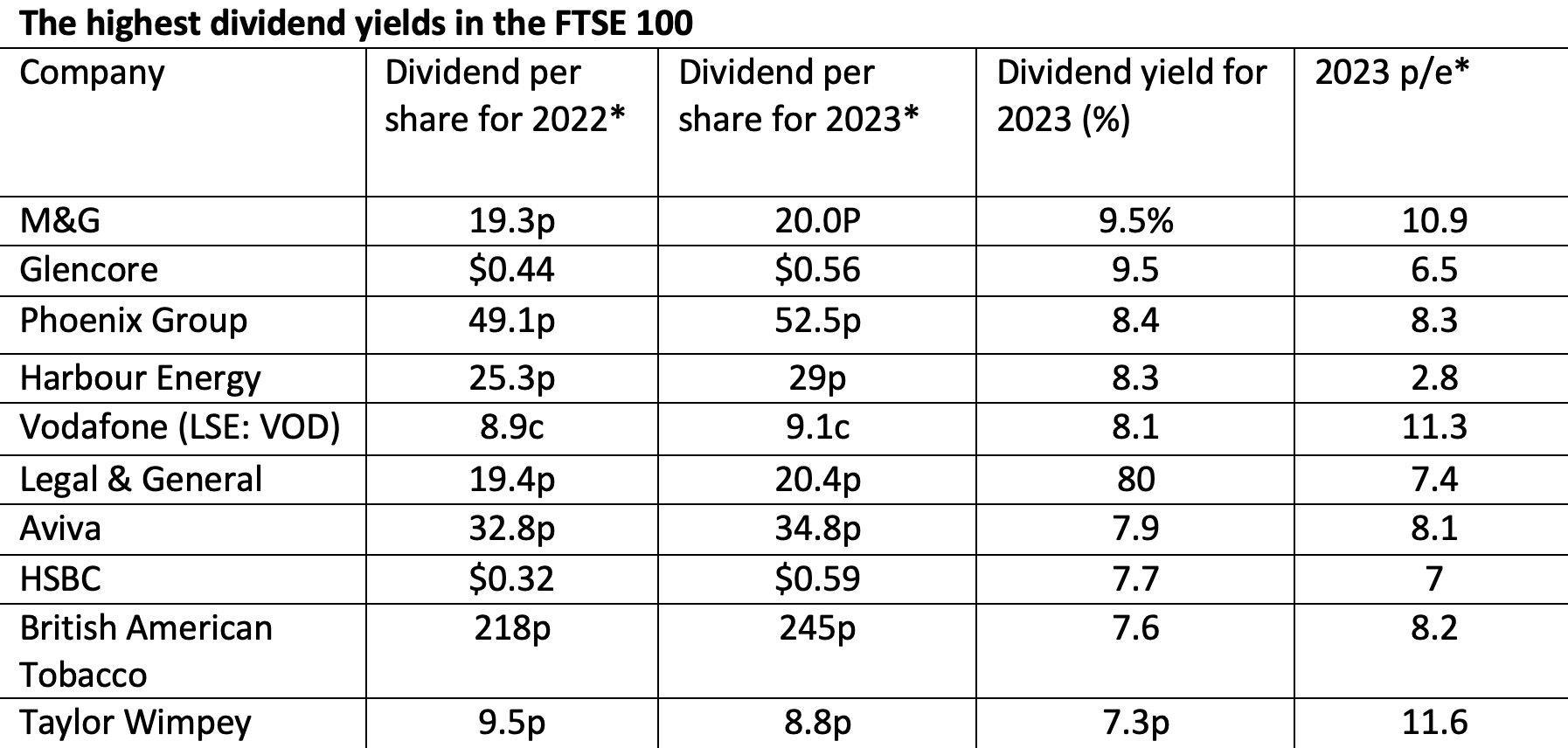

Second, the UK stock market has a history of paying investors highly competitive and growing dividends. And despite the volatility we have experienced over the last few years, the UK has remained one of the top dividend-paying regions and UK companies are forecast to pay the highest dividends in 2023: 4.1%.ii In addition, though many of the country’s leading companies may be listed in the UK, they generate the bulk of their revenues from overseas, meaning they are less impacted by domestic uncertainty or volatility. This provides an important layer of diversification to their cashflows, thereby protecting their ability to pay dividends.

Third, the profile of the UK market has unique ‘defensive’ advantages that argue for it as a shrewd tactical play. A notable advantage is the market’s large representation in sectors such as health care and consumer staples – two steady, though unspectacular areas of the economy where earnings traditionally hold up well as recession bites. Financials also represent a significant portion of the UK market, and the higher interest rate environment should benefit their profit margins. And it is not just traditional banks that stand to benefit; insurance companies have been a reliable and resilient source of income, with Aviva Group, Phoenix Group and Legal & General forecast to be among the top dividend payers for 2023.

Source: Refinitiv broker estimates as 23/02/23

Past performance does not predict future returns

Given the numerous macro-economic unknowns in play, investors should be looking to provide ballast to their portfolio. With that in mind, The City of London Investment Trust (CTY) may be a compelling proposition in that it is a conservative fund but with an impressive record. It has outperformed its benchmark over the long term, and nothing argues more strongly for its dependability than its position at the top of the AIC’s Dividend Heroes list. It has raised its dividend for 56 consecutive years, the longest run of any investment trust.

A key benefit of CTY is that it levers the global profile of many of the UK’s largest companies. With its concentration in UK ‘large-caps’, it not only avoids the turbulence associated with smaller companies but also gives meaningful exposure to international streams of revenue. As around 70% of earnings of companies in the blue-chip FTSE 100 Index come from overseas, investors benefit from an added layer of diversification. So with CTY you ‘invest local’ but ‘get global’.

CTY also serves as a perfect complement for those investors with global or more risky exposure but want ‘ballast’ in their portfolio that can deliver a consistent and stable income as well as capital growth. The portfolio allocation is a testament to this, with key positions in defensive areas such as health care and consumer staples. However, the largest overweight is to financials, which currently represent a quarter of the portfolio. Holdings within the sector are diverse, with life insurance groups, financial services and 3i all included. High street banks also feature, which in particular have benefited from rising interest rates. So in terms of how it fits within an overall strategy, CTY can play a key anchor role.

With so many uncertainties hanging over the markets currently, investors should think long and hard before taking on undue risk. With its strong defensive credentials, CTY may be the ideal vehicle for those who want to get exposure to the unique growth and income benefits of the UK market but without having to accept excessive volatility. And with UK shares trading more cheaply than their main competitors and the economy showing tentative but tangible signs of recovery, the home market is primed for upside surprises.

ii Source: The UK companies paying the highest dividends in 2023 | Trustnet

Balance sheet – A financial statement that summarises a company’s assets, liabilities and shareholders’ equity at a particular point in time. Each segment gives investors an idea as to what the company owns and owes, as well as the amount invested by shareholders. It is called a balance sheet because of the accounting equation: assets = liabilities + shareholders’ equity.

Cashflow – The term cash flow refers to the net amount of cash and cash equivalents being transferred in and out of a company. Cash received represents inflows, while money spent represents outflows.

Price-to-book (P/B) – ratio Many investors use the price-to-book ratio (P/B ratio) to compare a firm’s market capitalization to its book value and locate undervalued companies. This ratio is calculated by dividing the company’s current stock price per share by its book value per share (BVPS).

Price-to-earnings (P/E) – ratio A popular ratio used to value a company’s shares, compared to other stocks, or a benchmark index. It is calculated by dividing the current share price by its earnings per share.

Volatility – The rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. Higher volatility means the higher the risk of the investment.