Subscribe

Sign up for timely perspectives delivered to your inbox.

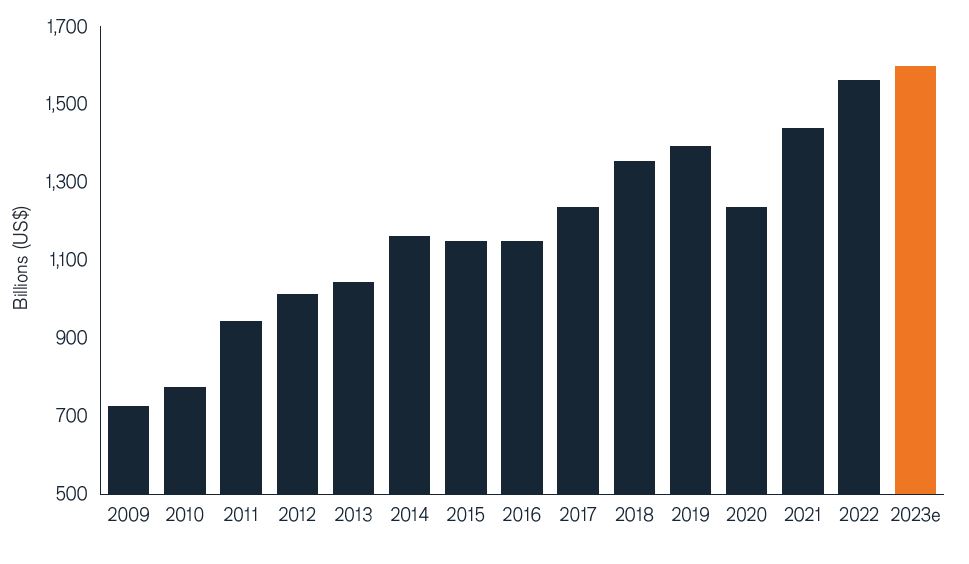

According to the latest release of the Janus Henderson Global Dividend Index, global dividends reached a high of $1.6 trillion in 2022. Head of Global Equity Income Ben Lofthouse and Client Portfolio Manager Jane Shoemake discuss the key drivers and why further dividend growth is possible in 2023.

Despite rampant inflation, interest-rate hikes, war and asset price declines in 2022, global dividends continued to grow, with 88% of companies either increasing or holding them steady. This highlights the importance of dividends to both companies and shareholders.

Global dividend payouts have returned to their historical growth trend, after many companies rebased their dividends to more sustainable levels during the pandemic. Driven by strong profitability, global dividends grew strongly in 2022, recording headline growth of 8.4% to reach a record total of $1.6 trillion, as reported by the most recent release of the Janus Henderson Global Dividend Index. In fact, underlying dividend growth was even stronger at 13.9%, after adjusting for dollar strength against most currencies, as well as lower special dividends and other technical factors.

Strong global dividend growth saw twelve countries achieving record payouts in US dollar terms. These included the US, Canada, Brazil, China, India and Taiwan, while other countries that posted record highs in local currencies included France, Germany, Japan and Australia.

Source: Janus Henderson Investors as of 31 December 2022. Nothing in this document should be construed as advice. Past performance does not predict future returns. International investing involves certain risks and increased volatility. These risks include currency fluctuations, economic or financial instability, lack of timely or reliable financial information or unfavourable political or legal developments. The value of an investment and the income from it can fall as well as rise and you may not get back the amount initially invested.

Despite some clear sector winners, growth was nevertheless broadly based – globally 88% of companies raised dividends or held them steady.

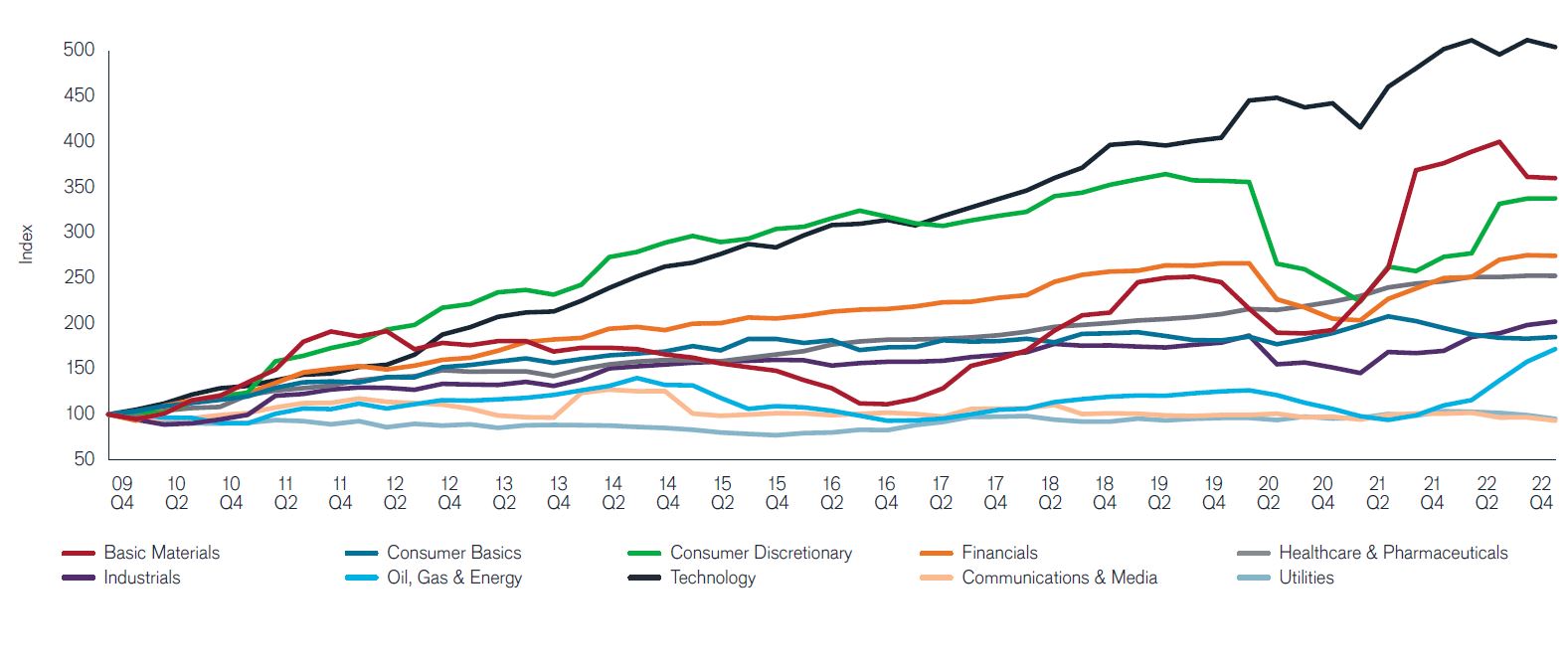

As expected, soaring energy prices led oil & gas producers to raise payouts by two thirds in a mixture of regular distributions and one-off special dividends. The higher payouts were broad based, with the sector contributing almost one quarter of 2022’s increase in global dividends.

Banks and other financials benefited from the rising interest rate environment, contributing another quarter of the year’s dividend growth. US, UK and European financial stocks were particularly strong, building on the robust dividend recovery from the pandemic that the sector recorded in 2021.

Source: Janus Henderson Investors as of 31 December 2022. Nothing in this document should be construed as advice. Past performance does not predict future returns. International investing involves certain risks and increased volatility. These risks include currency fluctuations, economic or financial instability, lack of timely or reliable financial information or unfavourable political or legal developments. The value of an investment and the income from it can fall as well as rise and you may not get back the amount initially invested.

Other key contributors to dividend growth included transport companies, which benefited from rising freight costs, while soaring demand and higher prices for cars and luxury goods were important drivers in Europe. Lower commodity prices, by contrast, meant mining payouts fell from their record 2021 highs, falling by around a tenth on a headline basis.

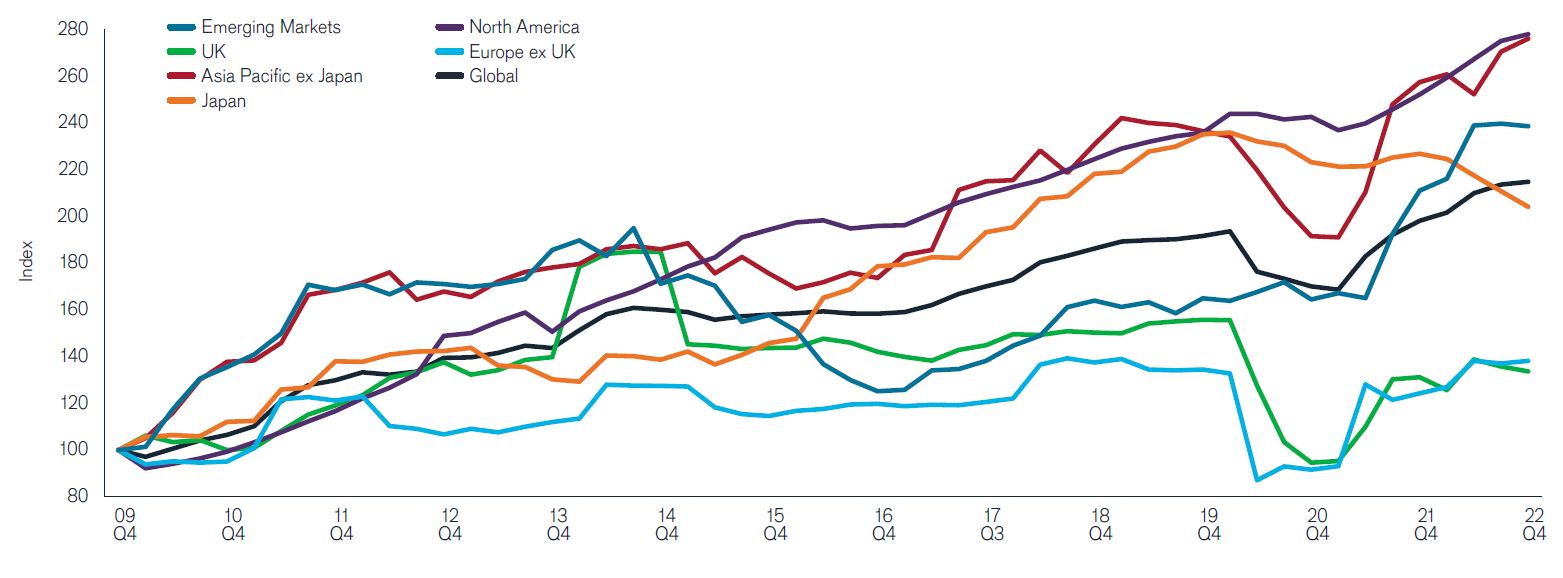

By region, emerging markets (EM), Europe ex UK and North America recorded the strongest headline dividend growth over the year. EM saw payouts soar by a fifth, almost double their 2016 level. Europe ex UK dividends shrugged off weaker exchange rates. The region’s consumer discretionary sector, particularly autos and luxury goods, enjoyed extremely strong demand and higher prices, with dividend increases reflecting increased profitability. Most UK companies also raised dividends or held them steady, with a resurgence in banking dividends and a rise in payouts from oil companies.

US dividends hit a new record of $574.2bn, with 94% of US companies raising dividends or holding them steady. Over in Asia Pacific ex Japan, Taiwan, Hong Kong, Singapore and South Korea all saw double-digit increases while Australia was held back by lower payouts from the miners. In Japan, headline growth was impacted by the weaker yen, but on an underlying basis dividends rose by 16%.

Dividends are unlikely to repeat the sharp increases witnessed in 2022 given oil prices have moderated and mining payouts are likely to fall further. Among financials, banks may benefit from wider margins, thanks to higher interest rates, but there will be a need for prudent planning for rising levels of bad loans as economic growth slows.

Inflation, the extent of further rate hikes, and geopolitical risks all cloud the horizon. The drag from exchange rate factors should be smaller, however, and could begin to reverse in the second half of 2023 based on current trends, but one-off special dividends are more likely to reduce than increase further. Crucially, investors who are seeking income should be reminded that dividends vary much less over the economic cycle than profits as companies seek to smooth the impact on the income paid to their shareholders.

Source: Janus Henderson Investors as of 31 December 2022. Nothing in this document should be construed as advice. Past performance does not predict future returns. International investing involves certain risks and increased volatility. These risks include currency fluctuations, economic or financial instability, lack of timely or reliable financial information or unfavourable political or legal developments. The value of an investment and the income from it can fall as well as rise and you may not get back the amount initially invested. There is no guarantee that past trends will continue, or forecasts will be realised.

As a result, while we expect dividend growth to slow from the exceptionally high levels witnessed in 2021 and 2022, there is still potential for dividends to edge higher in 2023. Janus Henderson forecasts total dividends of $1.6 trillion for 2023, up 2.3% on a headline basis, equivalent to an underlying increase of 3.4%.

About Janus Henderson Global Dividend Index (JHGDI):

Launched at the end of 2009, JHGDI is a quarterly, long-term study into global dividend trends, analysing dividends paid by the 1,200 largest firms by market capitalisation. It is a measure of progress that global firms are making in paying their investors an income on their capital.

Special dividends: typically, one-off payouts made by companies to shareholders that are declared to be separate from their regular dividend cycle. Headline dividends: total of all dividends received. Headline growth: change in total gross dividends. Underlying dividend growth: headline dividend growth adjusted for special dividends, change in currency, timing effects and index changes. Underlying dividends: headline dividends adjusted for special dividends, change in currency, timing effects and index changes.

IMPORTANT INFORMATION

Emerging market investments have historically been subject to significant gains and/or losses. As such, returns may be subject to volatility.

Financials industries can be significantly affected by extensive government regulation, subject to relatively rapid change due to increasingly blurred distinctions between service segments, and significantly affected by availability and cost of capital funds, changes in interest rates, the rate of corporate and consumer debt defaults, and price competition.

Consumer discretionary industries can be significantly affected by the performance of the overall economy, interest rates, competition, consumer confidence and spending, and changes in demographics and consumer tastes.