Subscribe

Sign up for timely perspectives delivered to your inbox.

Portfolio Manager Andy Acker explains why the healthcare sector could offer an attractive combination of defense and growth in today’s market.

Healthcare might be best known for its resiliency during market drawdowns, thanks to steady demand for medical care. That certainly was the case in 2022, when the MSCI World Health Care IndexSM returned ‑5.4% compared to the -17.7% decline for the MSCI World IndexSM.1 But the sector is also increasingly experiencing rapid growth, offering another potential source of diversified returns for investors.

Advances in genomic sequencing and other biomedical tools over the past two decades have unlocked new methods for targeting and treating disease. Many of these methods – from antibody drug conjugates and gene therapies to remote glucose monitors – have the potential to dramatically improve the standard of care for patients and, in some cases, address rare diseases once thought untreatable. Consider spinal muscular atrophy (SMA), an inherited disorder that typically manifests in young children and causes the breakdown of muscle strength and movement. For decades, treatments could only manage symptoms, with an average life expectancy of under two years for infants with severe cases. But starting in 2016, regulators approved the first disease-modifying therapy for SMA, followed by a gene therapy in 2019. Both help replace the missing protein that causes SMA, leading to dramatic improvements in motor function and survival rates for patients.

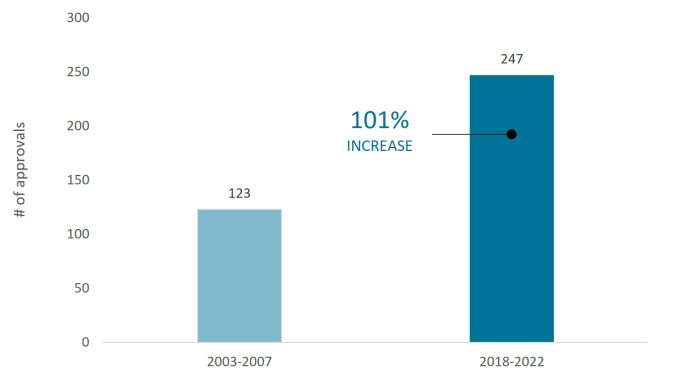

To encourage this type of research, regulators have created pathways that accelerate the review process for medicines targeting high unmet medical needs. The result has been a dramatic jump in new drug approvals. From 2018 to 2022, the Food and Drug Administration (FDA) greenlighted nearly 250 novel drugs, up 100% from 15 years ago (Figure 1). Similarly, over the same five-year period, the European Medicines Agency (EMA) approved more than 200 therapies.2

Source: Food and Drug Administration, as of 31 December 2022.

Just as new therapies are emerging, demand for medical care is exploding. Rising household wealth and the expansion of public and private insurance coverage are two drivers. In China, for example, 95% of the population is now covered by the country’s basic insurance program, thanks to government reforms over the past decade.3 Reimbursement for pharmaceuticals in China is also expanding: Since 2017, the government has made annual updates to the National Reimbursement Drug List, with more than 100 therapies added in 2022.4

Aging populations are another significant factor. By 2050, roughly 16% of the world’s population will be over age 65, a cohort that typically spends around 3x more on healthcare than those who are younger.5 In many high-income regions, the “graying” of the population is even more acute. In Japan, 28% of the population was 65 years or older in 2020; that percentage is expected to grow to 38% by 2060.6 In Europe, seniors are forecast to make up 28.5% of the continent’s population by 2050.7 While technology and other tools can help to control costs, the trajectory for medical spending is undoubtedly higher. In Europe, for example, aggregate outlays for healthcare rose 24% from 2012 to 2020.8

This combination of innovation and rising demand has helped to lift revenues for the sector. Sales of blockbuster biotech drugs exceeded $400 billion in 2021, 70x what they were roughly two decades ago. (A blockbuster drug is defined as having annual sales of $1 billion or more.) COVID-19 products – a market that didn’t exist three years ago – contributed $75 billion to total revenue for the year (Figure 2).

COVID is not the only new market to have developed in healthcare recently. In the U.S., Medicare Advantage – a private-sector alternative to Medicare, the public insurance program for the elderly – is one of the fastest-growing segments of insurance, with enrollment expected to rise from 48% of all Medicare participants in 2022 to 61% over the next decade.9 Companies developing value-based systems and tech-enabled tools are also emerging. Last year, European healthtech companies raised nearly €5 billion in venture capital, only slightly behind the record hit in 2021 (€5.2 billion) – an impressive feat given the stalling of capital markets in 2022.10

Drug research is also expanding beyond cancer (which for years has made up the bulk of R&D spending in biopharma) to other large disease categories. Last year in clinical trials, an obesity treatment delivered weight loss of up to 22.5%, a level previously achieved only through surgery. If approved, the drug could have a sizable total end market: An estimated 770 million adults globally were overweight or obese in 2020, a number that could exceed one billion by 2030.11

In Alzheimer’s, a new drug, Leqembi, has offered clear proof that it can slow the rate of cognitive decline in the early stages of the disease. (The drug was approved by the FDA in January 2023 and is under review by the EMA.) Leqembi is part of a new class of medicines being developed that target the pathophysiology of Alzheimer’s, giving hope to the roughly 55 million people worldwide suffering from dementia.12 It was one of dozens of clinical successes in 2022, setting the stage for a potential surge of drug launches in 2023: In total, 75 compounds are up for FDA review over the coming year.13

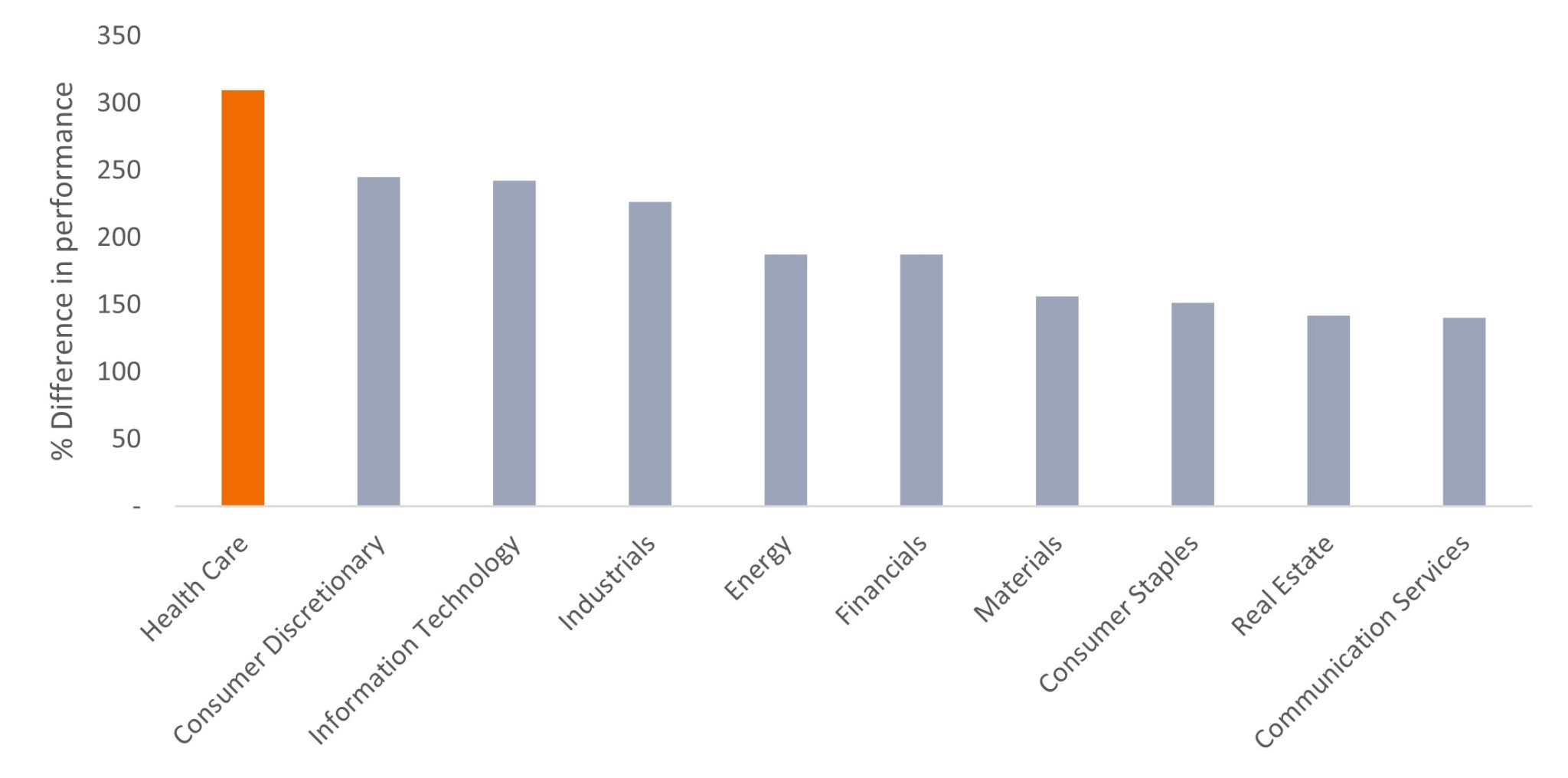

These growth drivers are not without their risks. Research shows that 90% of compounds that enter human clinical trials never make it to market.14 Of those that do, we’ve found investors over- or underestimate a product’s commercial potential 90% of the time. Such odds can result in sharp equity moves. In fact, over the past decade, the disparity between top- and bottom-performing stocks in healthcare was the largest of any sector (Figure 3).

Source: Janus Henderson Analytics, as of 31 December 2022.

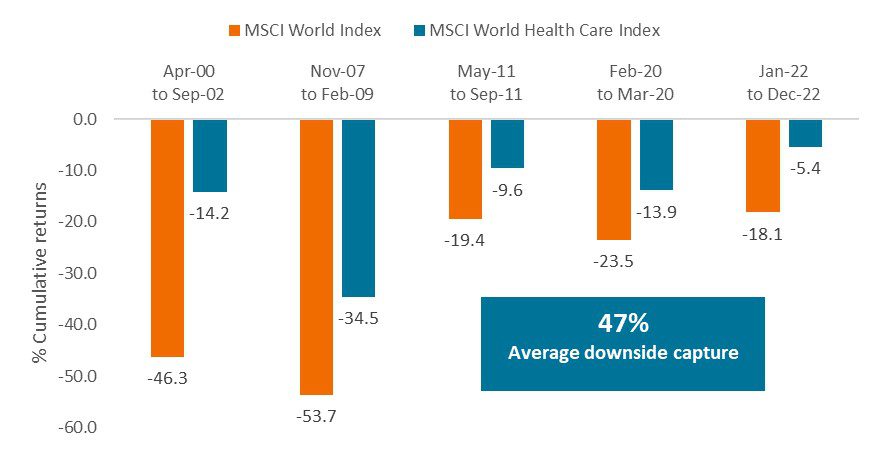

Even so, in 2022, as rising interest rates buffeted markets, the healthcare sector outperformed broad equity indices. This was not an anomaly. Since 2000, healthcare has, on average, captured just 47% of market drawdowns of 15% or more (Figure 4). Large-cap health insurance and pharmaceutical firms are largely to thank, as these companies tend to have steady demand and pricing power regardless of the economic backdrop.

Source: Janus Henderson, FactSet. As of 31 December 2022.

Note: Chart reflects market declines of 15% or greater in the MSCI World Index since 2000.

Index performance does not reflect the expenses of managing a portfolio as an index is unmanaged and not available for direct investment. Past performance is no guarantee of future results. Investing involves risk, including the possible loss of principal and fluctuation of value.

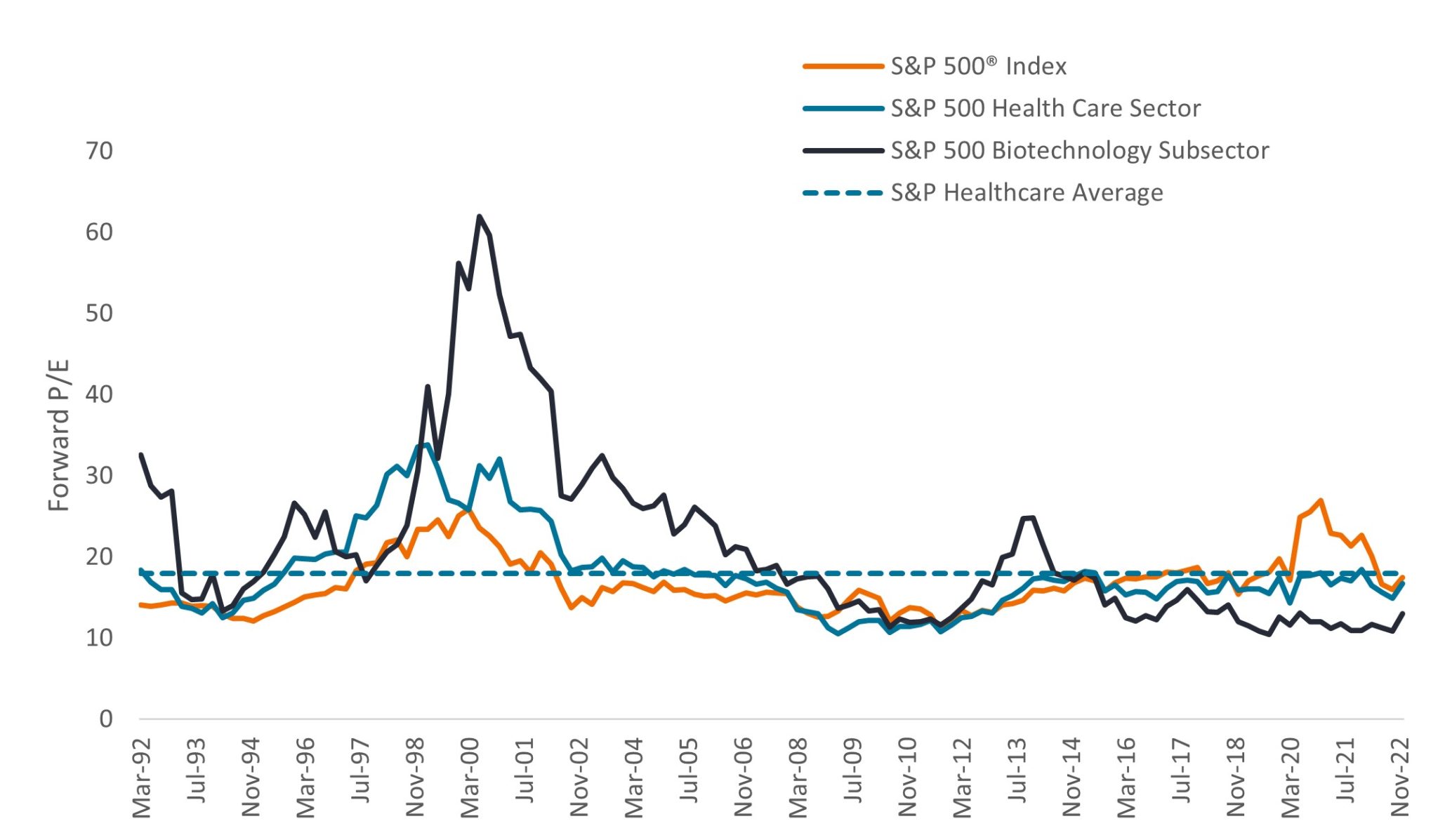

At the same time, investors have shown an increased willingness in recent months to reward innovation, with some stocks experiencing significant gains (100% or more15) on positive news. Attractive valuations are helping make such returns possible. The healthcare sector’s forward price-to-earnings (P/E) ratio sits below its long-term average (Figure 5) while hundreds of biotech companies trade for less than the value of cash on their balance sheets.16 Low valuations have also captured the interest of large-cap biopharma companies, with several mergers and acquisitions announced last year at premiums of more than 100%. With some biopharma companies facing significant patent cliffs this decade, we believe more deals could follow in 2023.

Source: Bloomberg. Data from 31 March 1992 to 31 December 2022. P/Es based on forward, estimated 12-month earnings. Price-to-Earnings (P/E) Ratio measures share price compared to earnings per share for a stock or stocks in a portfolio.

The healthcare sector is not without its challenges. Labor shortages, regulation, and waning COVID-related sales could weigh on some stocks. But in our view, the sector’s long-term outlook more than makes up for any near-term headwinds, and the opportunity to generate uncorrelated returns – while at the same time delivering benefits for patients – is only growing stronger.

1 Janus Henderson Investors, as of 31 December 2022.

2 European Medicines Agency, as of 31 December 2022. Total is for new active substances.

3 World Health Organization, February 2023.

4 National Healthcare Security Administration, 18 January 2023.

5 Population: United Nations, December 2019. Healthcare spending: JAMA Network, “Comparison of Health Care Spending by Age in 8 High-Income Countries,” 6 August 2020. Data reflect 2015 figures for Australia, Canada, Germany, Japan, the Netherlands, Switzerland, the UK and the U.S.

6 World Health Organization, “How will population ageing affect health expenditure trends in Japan and what are the implications if people age in good health?” 2020.

7 McKinsey & Company, “European insurance and the future of senior protection and well-being,” 11 November 2021.

8 Eurostat, November 2022.

9 Kaiser Family Foundation, “Medicare Advantage in 2022: Enrollment Update and Key Trends,” 25 August 2022.

10 PitchBook, “Startup Radar: Europe’s healthtech startups to watch,” 8 February 2023.

11 World Obesity Federation, February 2023.

12 World Health Organization, 20 September 2022.

13 Food and Drug Administration, 31 December 2022.

14 American Society for Clinical Pharmacology & Therapeutics, “Probability of Success in Drug Development,” van der Graaf, Piet H., 19 April 2022.

15 Bloomberg, 13 September 2022. Akero Therapeutics’ shares rose 136.76% during market hours on Sep 13 after the company announced positive top-line data from its phase IIB HARMONY study. Bloomberg, 24 October 2022 to 28 October 2022. Vaxcyte’s shares more than doubled during the trading week after the company announced positive topline data from a phase 1/2 study for its pneumonia vaccine candidate.

16 Rapport Biotech Insight & Opinion, “Semper Maior: Time to Reboot Biotech,” January 2023.

IMPORTANT INFORMATION

Health care industries are subject to government regulation and reimbursement rates, as well as government approval of products and services, which could have a significant effect on price and availability, and can be significantly affected by rapid obsolescence and patent expirations.

Initial Public Offerings (IPOs) are highly speculative investments and may be subject to lower liquidity and greater volatility. Special risks associated with IPOs include limited operating history, unseasoned trading, high turnover and non-repeatable performance.