Subscribe

Sign up for timely perspectives delivered to your inbox.

Portfolio Manager Tal Lomnitzer highlights the exciting investment opportunities within the resources sector arising from the need for sustainable construction.

Multiple structural shifts are underway across the built environment as it undergoes rapid transformation to reduce its carbon intensity. From planning, construction, usage and decommissioning, there are enormous opportunities when it comes to delivering the next generation of green buildings and infrastructure.

Urban centres are significant carbon emitters, with more than 60% of total global emissions stemming from the built environment and just over a third of this is attributed to buildings.1

Currently, around half the resources extracted globally are used for housing, construction, and infrastructure and the continuing trend of urbanisation means that 230 billion square metres of new buildings will need to be constructed over the coming 40 years.

With global commitments to achieving a net zero emissions future, finding a way to cater to the world’s growing urban population, while ensuring emissions reductions are achieved, means industrial innovation and new practices will need investment.

There are opportunities to reduce carbon emissions and intensity at every stage of the building and construction life cycle, and significant investment is already underway.

Lowering the carbon footprint of construction through better building materials processing, optimising design, using recyclable components and improving energy usage are just some pathways to mitigating emissions.

In a return to bygone days, city buildings are once again being constructed from timber, which is both a renewable resource and a store of carbon, replacing materials like concrete and steel, which are far more emissions-intensive, as well as finite resources.

Meanwhile, there is a wave of tech innovation driving efficiencies, shrinking buildings’ carbon footprints. Artificial intelligence-driven controls, Internet of Things (IoT) and sensor technology are helping optimise energy usage – putting a stop to heating, cooling and lighting vacant office spaces, while also making use of on-site renewable energy generation.

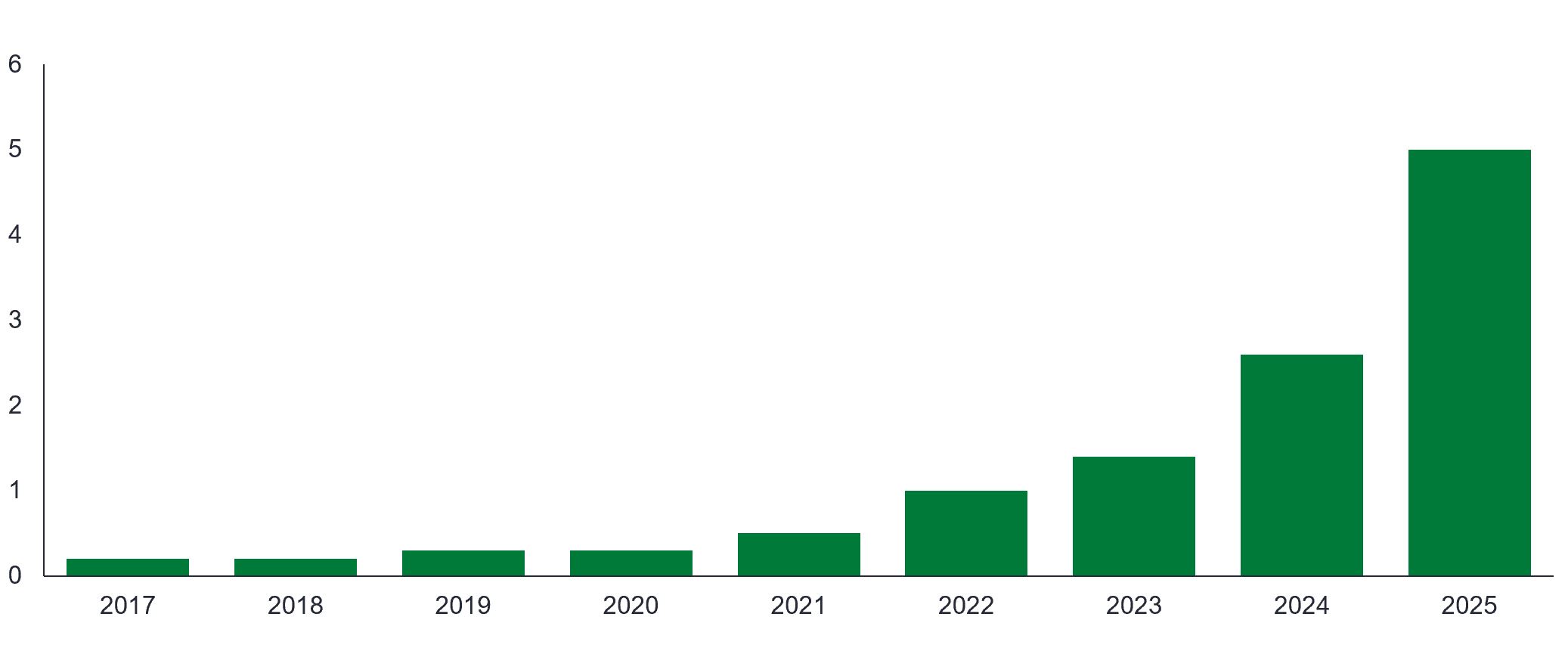

In 2021, over US$500 billion was raised for green bond issuances, with 30% of these funds going towards buildings2. Yet this is just a fraction of the investment opportunity, with global investments in green buildings accounting for less than 9% of the US$5 trillion spent on building construction and renovation in 2017.

Source: Climate Bonds Initiative, 2022. 2022-2025 are estimates. Forecasts cannot be guaranteed.

Research suggests that the green building materials market could achieve a compound annual growth rate of 10.16% in 2030.3 Meanwhile, new sustainable buildings are set to represent a US$24.7 trillion investment opportunity in emerging markets alone.4

The momentum behind sustainable construction, including green buildings and infrastructure, provides investors including those in the natural resources sector with the opportunity to participate in a long-term global shift as an increasingly urbanised world moves to achieve net zero emissions.

1 United Nations.org; Climate Change/Climate Solutions/Cities and Pollution: Generating Power.

2 Climate Bonds Initiative, 31 January 2022.

3 Green Building Materials Market Report 2023.

4 International Finance Corporation, World Bank Group: Green Buildings Report, 2019.

Green bonds: a means of raising funds by companies and governments via the debt capital markets for projects that deliver environmental benefits and solutions.

Net zero: refers to the balance between the amount of greenhouse gas produced and the amount removed from the atmosphere. Net zero is reached when the amount of greenhouse gas added is no more than the amount taken away.

IMPORTANT INFORMATION

Commodities (such as oil, metals and agricultural products) and commodity-linked securities are subject to greater volatility and risk and may not be appropriate for all investors. Commodities are speculative and may be affected by factors including market movements, economic and political developments, supply and demand disruptions, weather, disease and embargoes.

Natural resources industries can be significantly affected by changes in natural resource supply and demand, energy and commodity prices, political and economic developments, environmental incidents, energy conservation and exploration projects.

Sustainable or Environmental, Social and Governance (ESG) investing considers factors beyond traditional financial analysis. This may limit available investments and cause performance and exposures to differ from, and potentially be more concentrated in certain areas than the broader market.