Subscribe

Sign up for timely perspectives delivered to your inbox.

Portfolio Manager Jonathan Coleman discusses several factors he feels are aligning in favor of smaller companies.

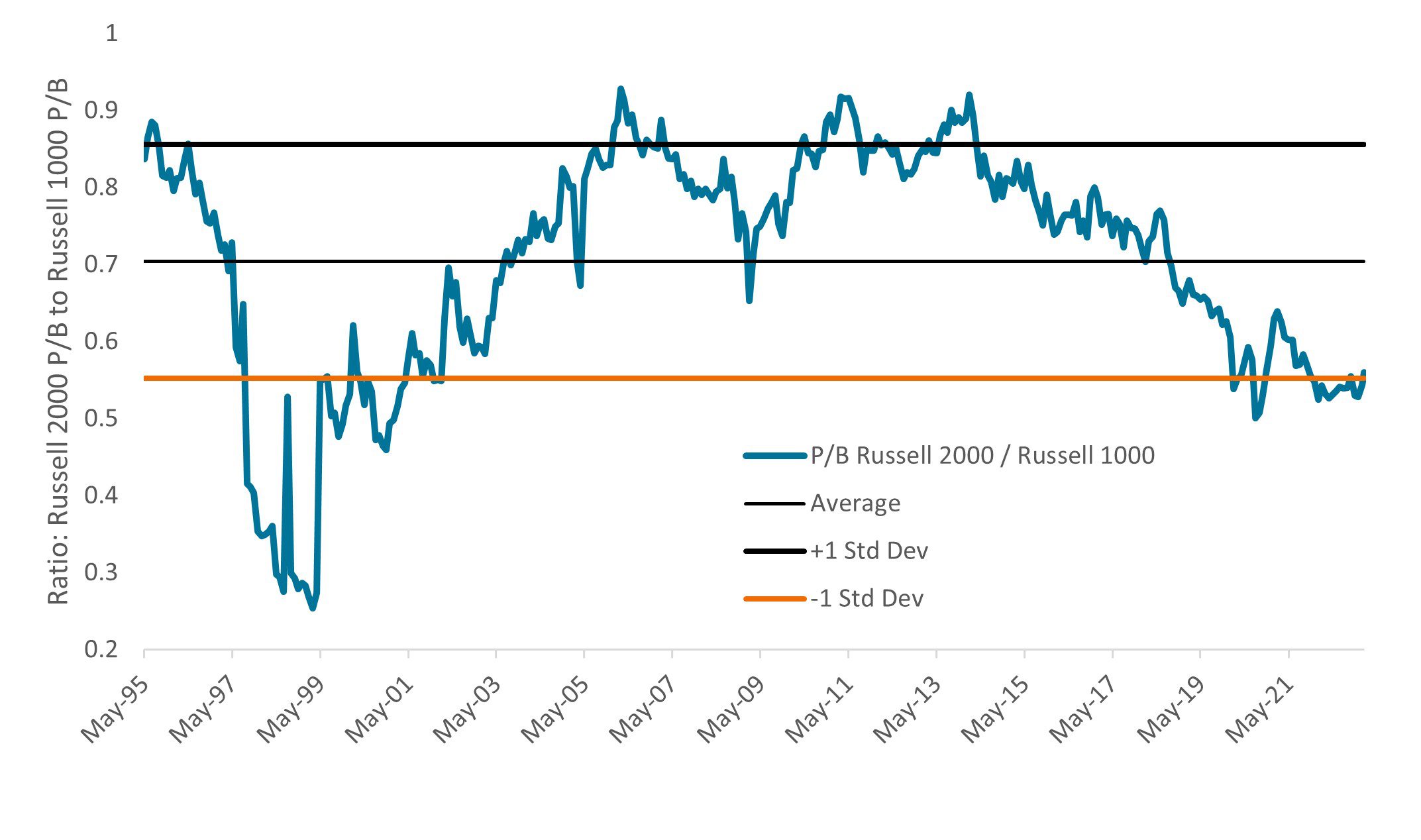

Historically, small caps have traded at a slight premium to large caps on average. While smaller companies typically carry higher risk, investors expect to earn a higher return (a risk premium) for taking on that risk. For quite some time now, small caps have actually traded at a significant discount to large caps based on relative valuations (Figure 1). And while the risk premium/discount changes over time, the last time we saw valuation imbalances at these levels was more than 20 years ago during the dot-com bubble, right before an extended period of small-cap outperformance.

Source: Bloomberg, as of February 16, 2023.

Source: Bloomberg, as of February 16, 2023.

Note: Past performance is no guarantee of future results.

After the tech bubble collapsed, small caps outpaced large caps from the market peak in March 2000 through the summer of 2018.1 Since then, large caps – driven mainly by a handful of mega-cap technology stocks – have enjoyed an impressive run of outperformance. That leadership, however, appears to be shifting once again. Mean reversion is a powerful force in the market, and we expect to eventually return to more normal valuations and a small-cap risk premium.

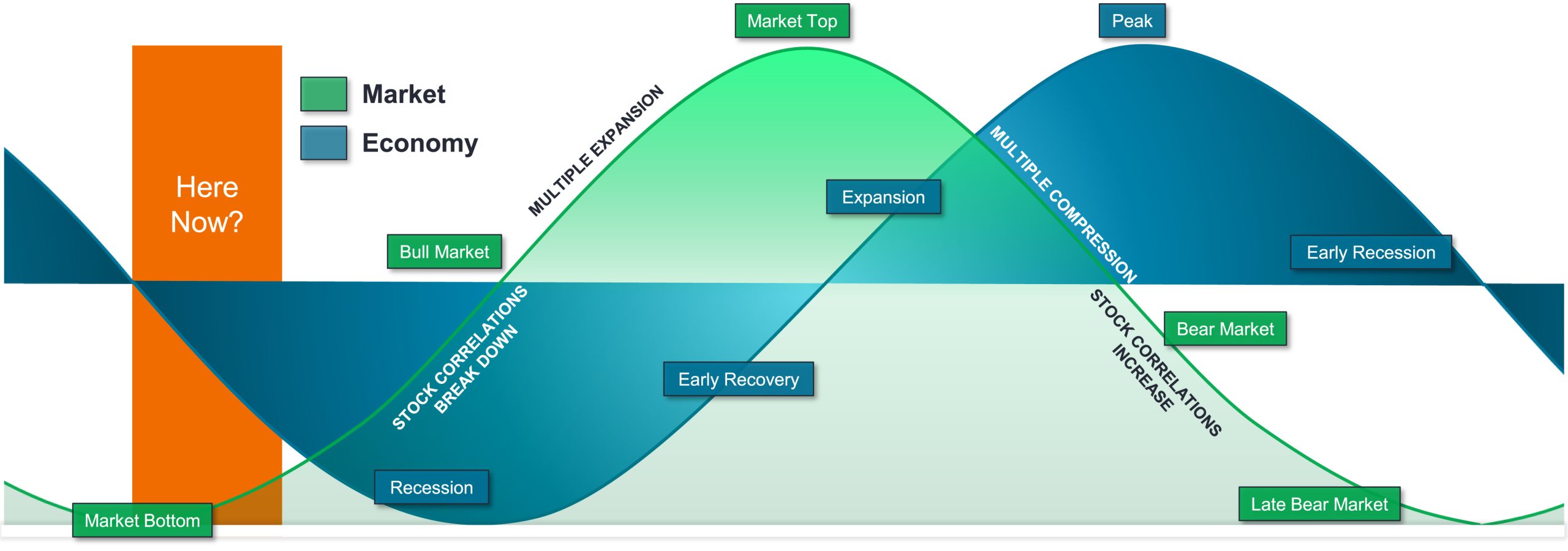

It appears we are in the latter stages of the economic cycle as the potential for recession has increased. While some economic data remains resilient, the Federal Reserve (Fed) has been aggressive, and it can take time for tighter policy to fully work its way through the economy.

As we saw last year, small caps tend to be more volatile and economically sensitive than large caps, typically selling off more in anticipation of a downturn. However, as we wrote then, small-cap performance during recessions has often been resilient, with the potential for substantial growth as the economy recovers.

Source: Janus Henderson Investors.

Note: Past performance is no guarantee of future results.

Re-shoring and deglobalization − long-term forces we think have been solidified by COVID and ongoing geopolitical upheaval – should also benefit smaller-cap companies. Globalization and larger companies’ longer, more efficient supply chains have historically been a headwind for small caps. But as businesses look to make their supply chains more resilient, small caps do not have to spend the money and time to shorten supply chains. Small caps also tend to be more U.S.-centric and stand to profit from increased domestic capital spending. The recently adopted Inflation Reduction Act (IRA), which will provide green energy subsidies, and the Creating Helpful Incentives to Produce Semiconductors and Science (CHIPS) Act, which will fund semiconductor fabrication, have already earmarked significant government spending in support of these trends. Tighter monetary policy − which has bolstered the U.S. dollar − is also relatively positive for small-cap companies with more domestic exposure.

While these dynamics are generally supportive of small caps as an asset class, we think it is essential to consider quality individual companies when investing in the space. In another nod to changing leadership, we have recently seen more reasonably valued and profitable companies returning to prominence in the small- and mid-cap growth markets after significant periods of leadership from non-earning, highly valued, and more speculative businesses.

While it is impossible to forecast the future path of markets, overall, several factors have aligned that we believe signal the potential for small caps to lead in coming years. The current environment may provide investors with an opportunity to evaluate their small-cap exposure and consider an active, quality-growth approach in the space. Our experience has taught us that positioning ahead of potentially long runs of asset class outperformance can be a powerful force.

IMPORTANT INFORMATION

Smaller capitalization securities may be less stable and more susceptible to adverse developments, and may be more volatile and less liquid than larger capitalization securities.

1Source: Bloomberg. As measured by the Russell 1000® (large cap) and Russell 2000® (small cap) indices.

Premium/Discount indicates whether a security is currently trading above (at a premium to) or below (at a discount to) its net asset value.

Price-to-Book (P/B) Ratio measures share price compared to book value per share for a stock or stocks in a portfolio.

Russell 1000® Index reflects the performance of U.S. large-cap equities.

Russell 2000® Index reflects the performance of U.S. small-cap equities.

Quantitative Tightening (QT) is a government monetary policy occasionally used to decrease the money supply by either selling government securities or letting them mature and removing them from its cash balances.

Standard Deviation measures historical volatility. Higher standard deviation implies greater volatility.