Subscribe

Sign up for timely perspectives delivered to your inbox.

Recession worries may be casting a shadow over Europe, but there are signs that it could fare better than expected, a positive for investment grade credit. Portfolio manager Tim Winstone considers how best to navigate the market.

While other central banks are signalling that rates are set to peak, the European Central Bank (ECB) has been signalling a “higher for longer” interest rate environment – understandable given that it started its hiking cycle later than its peers. Unlike the UK and US central banks, the ECB has also erred on the side of caution in the magnitude of rate hikes, reflecting its accommodative stance and focus on maintaining financial integrity (in ECB-speak, avoiding market ‘fragmentation’) across the eurozone as well as market stability. Lower energy prices are feeding through to headline inflation, which in the eurozone slowed more than expected in January. This means a lower terminal rate – the eventual interest rate settled on by central banks – is being priced in Europe relative to other major developed markets, like the US. This is also due to the lower structural growth potential in Europe compared to peers. Cooling a less hot economy is an easier feat after all.

The eurozone has so far dodged recession, with some positive economic growth coming through in the fourth quarter of 2022. Milder-than-expected weather meant gas stockpiles were not depleted as badly as feared, while fiscal support has cushioned the impact of high energy prices, which have abated somewhat. Despite this, and a more benign default environment expected for Europe compared to the US, spreads in Europe are pricing in more recession risk – in other words offering more compensation for recession risk compared to other credit markets.

Source: Bloomberg, JP Morgan. Uses data from last six months and compares to historical drawdowns. As at 6 February 2023, spreads shown in basis points.

Note: Index tickers used: SPX, SX5E, LUACTRUU, I02002EU, LF98TRUU, I02501EU, USGGT05Y, GEIL5Y.

While Euro investment grade (IG) spreads have retraced from their 2022 wides, levels are still wide compared to 3-year, 5- year and 10-year averages1. We argue that pockets of spread volatility could emerge this year as economic data, for example, challenges the market narrative, such as we saw with January’s US payrolls report. Such widening could create better entry points for investors to add credit risk.

With the repricing of rates, Euro IG yields have dramatically improved to levels seen not seen in over a decade. In the summer of 2021, just over 40% of the Euro IG market had a negative yield, with about 6% of the universe offering more than 1%. Today’s market is dramatically different, with the entire universe yielding more than 1% (Figure 2) and the lowest yield out of approximately 3,500 issues at 2.3% (compared to -0.58% in summer 2021). The persistence of a low interest rate environment could mean that investors have forgotten the benefit of a carry buffer. Given there could be further volatility to come, such a yield cushion provides a helpful shield against further spread volatility.

Source: Bloomberg, ICE BofA Euro Corporate Index, 13 January 2023.

Primary markets have been buoyant thus far in 2023 and this supply has been met with strong demand. In January, we saw €108 billion of Euro IG issuance – close to the record levels seen in the same month in 2009 (€110 billion). Similarly, January’s wave of government bond supply has been easily absorbed2, but there is more to come with quantitative tightening – or balance sheet reduction – reaching an expected €88 billion in 2023 (Figure 3).

Source: UBS, National DMOs, ECB, Haver, Bloomberg, UBS estimates; QT estimates as at 3 January 2023.

Notes: Assume 50% reinvestment rate from March to December 2023. 2023 is a forecast. There is no guarantee that past trends will continue, or forecasts will be realised.

The departure of the central bank buyer also affects credit, with a slowing of the reinvestment of maturing securities under the ECB’s corporate sector purchase programme (CSPP) – the purchase of senior non-financial credit – due to begin in March 2023. This has fuelled concerns over supply indigestion, but these programmes have been well telegraphed and demand has been strong. Another concern on potential demand headwinds has been around the recalibration of Targeted Longer-Term Refinancing Operations (TLTRO) programmes. The scheme encouraged banks to lend by offering access to cheap funding, allowing them to effectively borrow at a rate of as low as -1%. However, we believe that banks can and more than likely will refinance this debt via senior and covered bond issuance.

Senior bank issuance has had a bumper start to 2023, while the expiry of the discount on TLRO could encourage more. Such volumes could impact prices, but this could be front-loaded and supply could therefore taper off over the rest of the year. This is where valuation and compensation also come into play. We have seen spread tightening post issuance and new issue concessions – where a lender is compensated for taking on a primary issue – have been increasing, but they aren’t massive. This suggests that companies are not having to significantly pay up to raise capital, reflecting healthy demand that we believe will continue as investors favour high quality debt through any downturn.

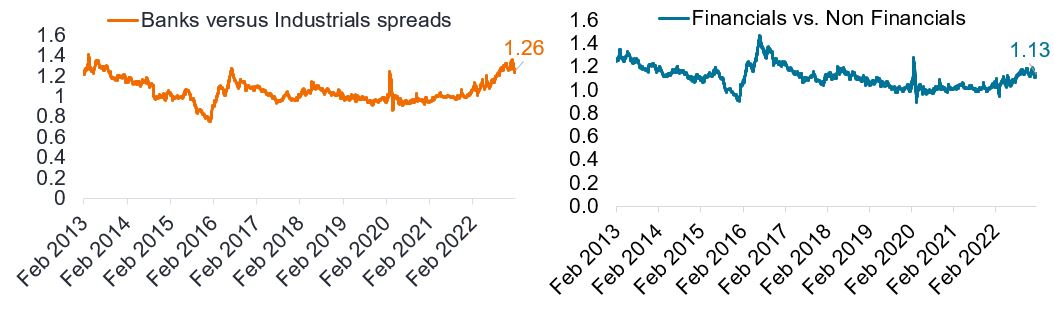

Senior banks look extremely compelling from a valuation perspective, as seen when comparing non-financials to financials and banks with other cyclicals such as industrials. The ratio of banks spreads versus industrials spreads are at extreme levels, around those seen during the Brexit-related sell-off in July 2016 (1.28x) and COVID sell-off (1.25x) in March 2020 (Figure 4). Banks price weakness is not related to fundamental concerns, but reflect more supply dynamics (as discussed), sentiment around banks being a macro (economic) proxy, weakness in bank equity and liquidity – bank paper can be more easily offloaded when reducing portfolio risk. However, we believe that banks are fundamentally well-positioned even if we enter recession in Europe.

Source: Bloomberg, as at 31 January 2023. Government option-adjusted spreads for the ICE BofA Euro Financial Index versus the ICE BofA Euro Non-Financials Index and Bloomberg Barclays Euro Aggregate Corporate Banking (Class 3) Index versus the Bloomberg Barclays Euro Aggregate Industrials (Class 2) Index.

Banks are positively geared to rate hikes and their balance sheets in Europe have been substantially strengthened and improved since previous crises. European banks thus seem well-capitalised and provisioned – signalling ample liquidity buffers – and better regulated. While still being cyclical, this means, in our view, they may be more able to withstand a recession than seen in the past. Much of the non-financial market has been trading too tight in our view. We therefore see a strong opportunity in banks, particularly given Europe’s receding recession risk, as well a potential growth tailwind from China reopening – with Europe one of the key exporters to China.

Further dispersion could be seen in 2023 with the premium for ECB eligible debt (non-financial senior debt) disappearing as the ECB steps back. However, we believe this is not going to lead to a dramatic repricing of non-financial debt as investors are under-allocated to credit and not actively selling risk, but more gradual widening from stretched valuations.

Another driver of dispersion could be earnings weakness broadening out across sectors and companies. We have only seen a spattering of profit warnings so far and we expect this to become more prevalent. Given many IG companies are large, global businesses, they may be better positioned to weather the storm in Europe and benefit from the different cycles that prevail globally as economies finish their hiking cycles at different times.

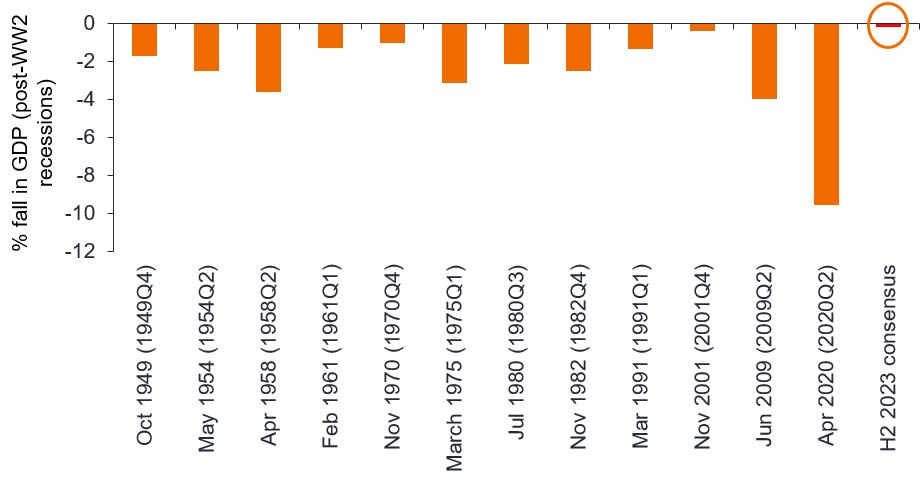

Many of the potential headwinds facing Europe and by proxy its credit market are known risks, such as buoyant supply in IG. The energy crisis is also a known quantum and it would need to evolve in a materially worse way than expected to impact risk markets. Similarly, this global downturn is arguably the most anticipated recession ever, but consensus is also expecting the mildest recession in history.

Source: BEA, Haver Analytics, Deutsche Bank, as at 31 December 2022. Shows percentage of GDP lost from peak to trough in post-WW2 recessions.

Note: There is no guarantee that past trends will continue, or forecasts will be realised.

Nevertheless, economic outcomes remain uncertain. Whether the elusive – but eagerly anticipated – soft landing materialises is up for debate. We believe a more prudent approach would be to capitalise on issuer dispersion, but also focus on careful security selection to capture idiosyncratic stories at attractive valuations. While removal of the quantitative easing backstop has been a collective prerogative of central banks, the focus on financial stability in the eurozone means that the transmission protection instrument (TPI)3 remains a fallback for the ECB. Europe could also then potentially diverge from other economies and so being vigilant to signs of a narrative shift from central banks is also key.

Dispersion: This refers to the range of possible returns on an investment. It can also be used to measure the risk inherent in a particular security or investment portfolio.

Volatility: The rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. It is used as a measure of the riskiness of an investment

Credit spread: The difference in the yield of corporate bonds over equivalent government bonds.

Consumer price index (CPI): A measure that examines the price change of a basket of consumer goods and services over time. It is used to estimate ‘inflation’. Headline CPI or inflation is a calculation of total inflation in an economy, and includes items such as food and energy, in which prices tend to be more prone to change (volatile). Core CPI or inflation is a measure of long-run inflation and excludes transitory/volatile items such as food and energy.

Quantitative easing: An unconventional monetary policy used by central banks to stimulate the economy by boosting the amount of overall money in the banking system. The opposite is quantitative tightening.

Investment-grade bond: A bond typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments. The higher quality of these bonds is reflected in their higher credit ratings when compared with bonds thought to have a higher risk of default, such as high-yield bonds.

High yield: A bond that has a lower credit rating than an investment grade bond. Sometimes known as a sub-investment grade bond. These bonds carry a higher risk of the issuer defaulting on their payments, so they are typically issued with a higher coupon to compensate for the additional risk.

Corporate Sector Purchase programme (CSPP): The ECB’s purchase scheme of corporate sector bonds, where investment grade euro-denominated bonds issued by non-bank corporations established in the euro area are deemed eligible assets.

Targeted Long-term Refinancing Operations (TLTRO): The targeted longer-term refinancing operations (TLTROs) are Eurosystem operations that provide financing to credit institutions. By offering banks long-term funding at attractive conditions, they preserve favourable borrowing conditions for banks and stimulate bank lending to the real economy.

Credit: A marketplace for investment in corporate bonds and associated derivatives.

Primary market: This part of the capital market where new securities are issued and become available for trading.

Monetary policy: Central bank policies aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money. Monetary stimulus refers to a central bank increasing the supply of money and lowering borrowing costs. Monetary tightening refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money.

Fiscal policy: Government policy relating to setting tax rates and spending levels. It is separate from monetary policy, which is typically set by a central bank. Fiscal austerity refers to raising taxes and/or cutting spending in an attempt to reduce government debt. Fiscal expansion (or ‘stimulus’) refers to an increase in government spending and/or a reduction in taxes.

Cyclical stocks: Companies that sell discretionary consumer items, such as cars, or industries highly sensitive to changes in the economy, such as miners. The prices of equities and bonds issued by cyclical companies tend to be strongly affected by ups and downs in the overall economy, when compared to non-cyclical companies.

Fragmentation: From a monetary policy transmission perspective, fragmentation can be viewed as the lack of full tradability of central bank reserves across borders which cannot be explained by technical or fundamental factors.

Carry: A typical definition is the benefit or cost of holding an asset. For a bond investor this includes the interest paid on the bond together with the cost of financing the investment and potential gains or losses from currency changes. Note that the meaning of ‘carry’ is dependent on the context used.

Liquidity: The ability to buy or sell a particular security or asset in the market. Assets that can be easily traded in the market (without causing a major price move) are referred to as ‘liquid’.

Premium: When the market price of a security is thought to be more than its underlying value, it is said to be ‘trading at a premium’. Eg. within investment trusts, this is the amount by which the price per share of an investment trust is higher than the value of its underlying net asset value. Premium is the opposite of discount (security price trading lower than the underlying value).

1 Source: Bloomberg, ICE BofA Euro Corporate Index, 6 February 2023.

2 Source: BNP Paribas, 6 February 2023.

3 The TPI is intended to support the effective transmission of monetary policy and ensure that the monetary policy stance is transmitted smoothly across all euro area countries. The Eurosystem could purchase securities from individual countries in order to combat deteriorations in financing conditions not warranted by country-specific fundamentals.