Subscribe

Sign up for timely perspectives delivered to your inbox.

Portfolio Manager Ben Lofthouse shares why he remains cautiously optimistic on the prospects for global dividends in the weaker economic environment.

Rate hikes to combat higher inflation following a period of ultra-low interest rates may tempt investors to squirrel their money away in an interest-bearing savings account. But that would mean missing out on two important advantages of dividend-paying equities: dividend and capital growth potential over time.

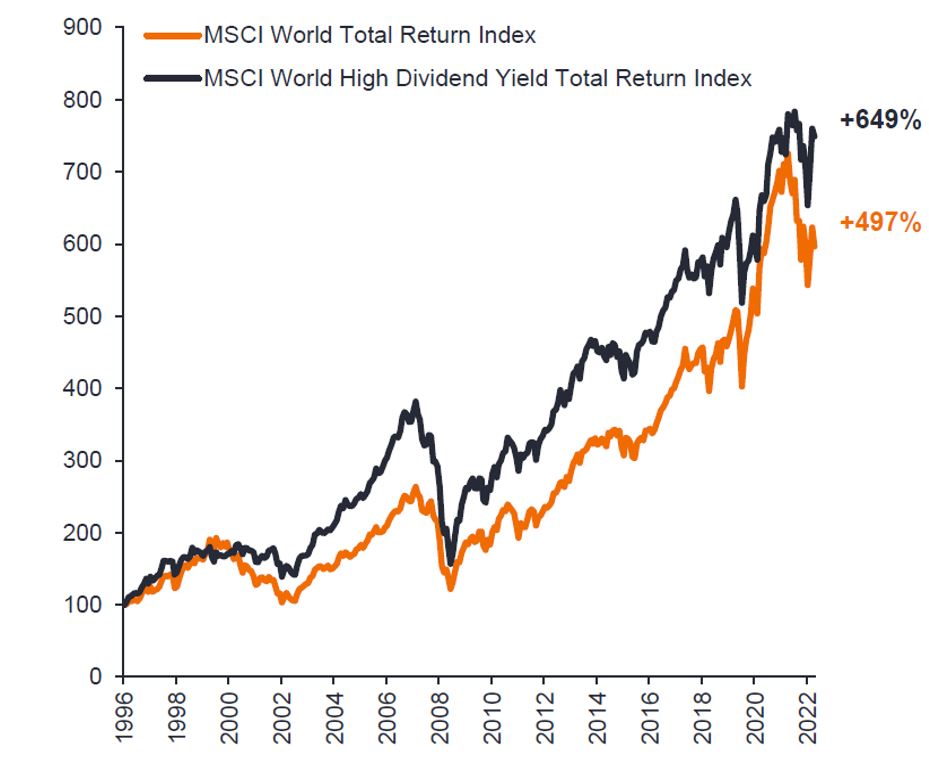

Regular income from equities can help soften the blow of the higher cost of living and mortgage rate rises. During past periods of higher inflation and rising interest rates, equity valuations often begin to stagnate or even decline in terms of price-to-earnings (PE) ratios. In these times, dividends have formed an important part of returns as investors are “paid to wait” for markets to pick up. The combination of reinvested dividend income and capital growth has led to long-term outperformance of higher dividend-paying companies (figure 1).

Source: Refinitiv Datastream, Janus Henderson Investors, as at 31 December 2022. Indices rebased to 100 at 30 September 1996. Past performance does not predict future returns.

In 2022, a strong positive was the strength of dividend growth as companies that rebased their dividends because of COVID-19 increased them again, leading us to consistently upgrade our dividend expectations. As of 3Q22, 90% of global companies raised dividends or held them steady1. Looking ahead, dividends generally look well covered by profits (dividend cover), which should provide support for payouts even as the global economy slows.

Additionally, valuations of dividend stocks currently remain low versus general equities, but we are now seeing some signs of a rotation away from the growth style of investing towards value investing.

We think an equity portfolio is capable of delivering consistent income if it invests in businesses that offer an attractive dividend yield with opportunities for dividend growth, while also ensuring cash flows remain sustainable with good dividend coverage (number of times a company can pay the current year’s dividend from the current year’s earnings). Companies that pay dividends make a commitment to shareholders to do so consistently, and therefore must grow earnings so they can generate the cash flow needed to pay out dividends. This means these businesses tend to be of higher quality.

In our view, the only way to consistently be able to offer a high and sustainable level of equity income is through investing globally. Having the flexibility to invest in companies from different regions allows a portfolio manager to not only take advantage of different macro environments, but also capitalise on the seasonality of dividends. For example, European and Asian companies tend to pay dividends annually or semiannually, rather than quarterly for US-listed companies. Furthermore, investing globally provides the potential for risk reduction through global diversification. Although the US is home to the largest stock markets by market size, over the last 20 years the highest dividend-yielding region has been outside the US.2

Equity markets have already priced in rising rates, meaning equity prices have revalued to a large extent. However, the true impact of higher rates on households and economies is yet to be known. This leaves us cautious on consumer-focused companies, and those that are more dependent on debt to finance their operations, like real estate, which may face higher debt costs – and businesses that are non-cash generative. Meanwhile, growth prospects for the tech sector appear to be weakening given current cost-cutting exercises, including layoffs.

More positively, utilities companies have continued to pay dividends. Within financial services, insurers and banks can benefit from higher interest rate margins and invest in higher-yielding assets. Areas like the energy market and the resources market are still seeing high prices, which typically leads to stronger cash flows. In consumer staples, businesses that we believe are more likely to be resilient typically possess pricing and brand power, as well as economies of scale.

Inflationary pressures, tightening monetary policy, and slowing global economic growth alongside ongoing geopolitical uncertainty continue to weigh on investor sentiment, leading us to be cautiously optimistic. China’s sudden economic reopening has brought a lot of positivity back to the markets, which should benefit emerging markets and industrials, while falling natural gas prices in Europe are helping reduce market risk in investors’ minds. We have also seen more optimism in the US on the inflation front.

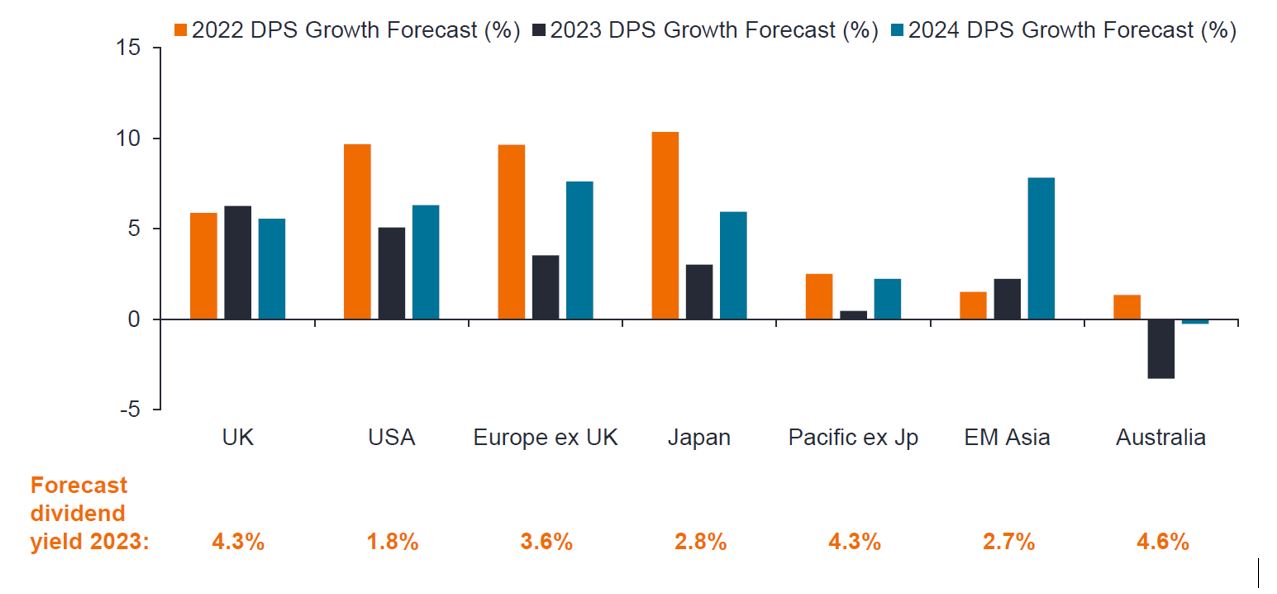

Generally, dividend cover remains high on a comparative historical basis and dividend growth looks positive (see figure 2), while the broadness of dividend growth suggests that it could continue into 2023. More excitingly, the significant weakness in equity prices last year is offering us some opportunities across regions and sectors to invest in well-managed, resilient businesses at cheaper valuations.

Dividend growth expected in most major regions in 2023

Source: Citi, Janus Henderson Investors Analysis, as of 31 December 2022. Note: DPS (dividend per share) growth forecasts. Past performance does not predict future returns.

1 Janus Henderson Global Dividend Index 3Q22. The Index is a quarterly, long-term study into global dividend trends, analysing dividends paid by the 1,200 largest firms by market capitalisation. It is a measure of progress that global firms are making in paying their investors an income on their capital.

2 Refintiv Datastream, based on dividend yield comparisons between the US, UK, Europe ex UK, Asia ex Japan and Australia from January 1999 to December 2022. Dividend yield is the weighted average dividend yield of securities within the representative indices.

Dividend cover: the ratio of a company’s income to its dividend payment. The measure provides an indication of the sustainability of a company’s dividends.

Price-to-earnings ratio (PE): a ratio used to value a company’s shares, compared to other stocks, or a benchmark index, calculated by dividing the current share price by earnings per share.

Value/growth style: value investors look for companies that they believe are undervalued by the market, and therefore expect their share price to increase, while growth investors search for companies with earnings that are expected to grow at an above-average rate compared to the rest of the market, and therefore anticipate the share prices will increase in value.