Subscribe

Sign up for timely perspectives delivered to your inbox.

Portfolio Manager Jason England explains why the market may be setting itself up for a reckoning should the Federal Reserve (Fed) maintain a rate trajectory far higher than what many investors predict.

The latest skirmish in the ongoing tug-of-war between financial markets and the Federal Reserve (Fed) occurred on February 1, with the latter party reaffirming its hawkish stance. This largely followed the plot established in late 2022, when a rally in bonds and riskier assets that was premised on the Fed ultimately relenting was only briefly interrupted by the Fed’s hawkish December statement. Should the market again either ignore or misinterpret the Fed’s resolve, we believe investors may be setting themselves up for what could be an inevitable – and potentially painful – reckoning.

This meeting’s 25 basis-point (bps) rate increase was already baked into asset prices. What the market may have a hard time digesting is the continued inclusion in the Fed’s statement of the phrase “ongoing rate increases will be appropriate.” Open to interpretation is how long the fed funds rate will remain at its cycle peak once we get there.

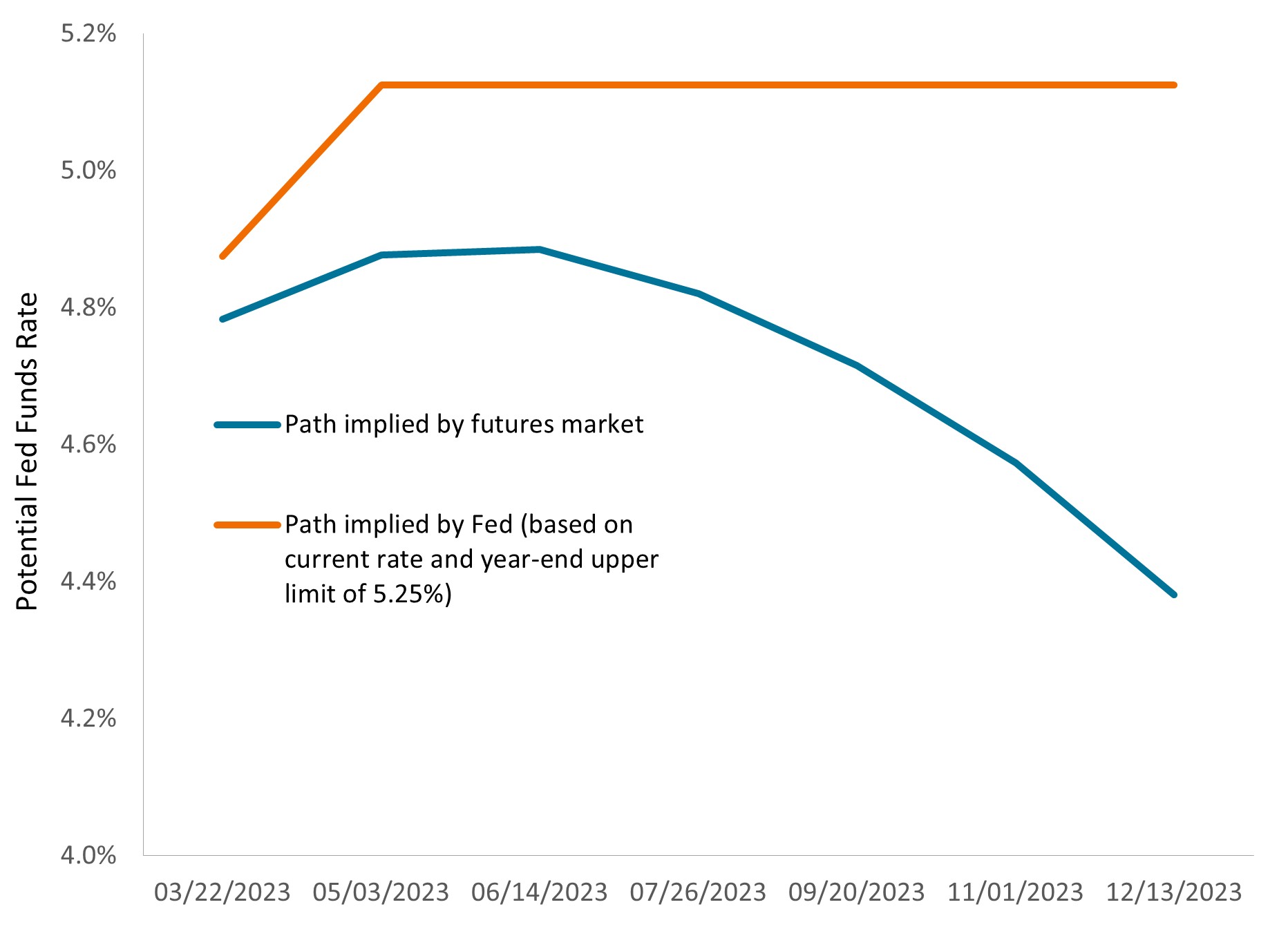

At its December meeting, the Fed’s own Dots survey indicated that the upper limit of the overnight rate’s range would finish 2023 at 5.25%. That represents potentially two more 25 bps increases. Both the Fed and the market presume that any more hikes will come sooner rather than later. The futures market, however, expects the fed funds rate to peak at roughly 5.00% in July before falling to 4.50% by year’s end. That’s quite a discrepancy and, in our view, sets up a fairly precarious game of chicken.

A divergence of views

The gap between where the Fed expects rates to go over the remainder of 2023 and what the market expects has only widened as investors grow more optimistic and central bankers dig in on hawkishness.

Source: Bloomberg, as of 1 February 2023.

Source: Bloomberg, as of 1 February 2023.

The divergence in expectations in the future trajectory of monetary policy has its roots in nearly diametrically opposed objectives between the Fed and markets. Chairman Jerome Powell and company seek to achieve three intertwined imperatives: Continue to make progress in guiding year-over-year core inflation down from 4.4% toward its 2.0% target, reestablish the credibility that it frittered away by coming to the rescue every time market volatility spiked and, lastly, avoid the Arthur Burns path of blinking before inflation is tamed and thus causing the expectation for ever-increasing prices to be imbedded throughout the economy. The market, on the other hand, wants a cheap cost of capital so it can keep a relatively leveraged profit machine humming along.

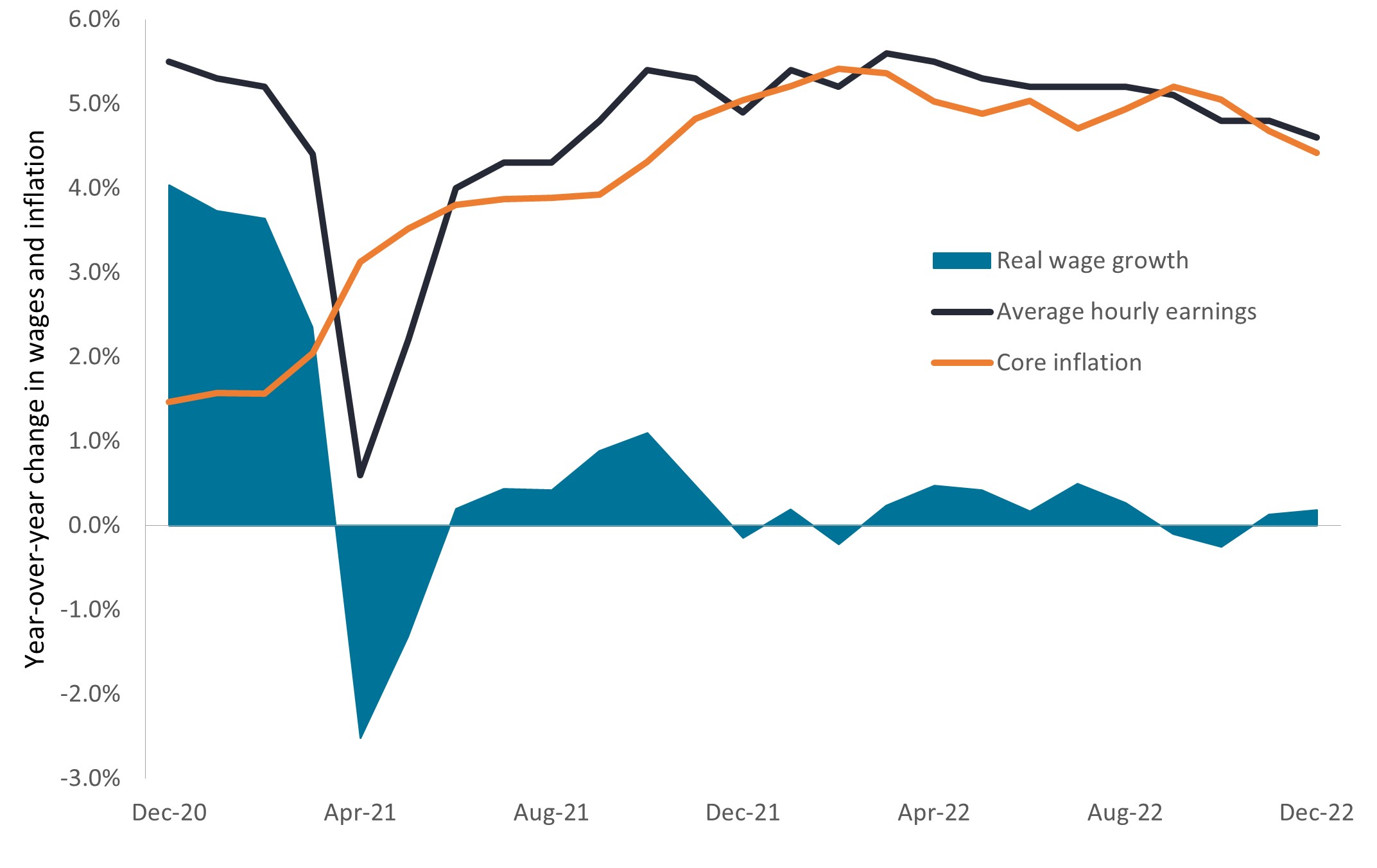

The macro is notoriously difficult to predict, but that’s the task charged to central bank officials and forward-looking markets. Divining the economy’s trajectory in the current market is particularly challenging as the world grapples with inflation, supply disruptions, geopolitical conflict, and the exit from pandemic-era accommodative policies. Still, some factors that will certainly influence the U.S. economy going forward are evident: The labor market remains tight, and for inflation to fall farther, upward wage pressure will have to lose steam. That is a hard ask for workers given that, once adjusted for inflation, year-over-year wage gains are barely in positive territory.

While still pressed by barely positive wage gains in inflation-adjusted terms, U.S. workers will likely seek higher pay as long as the labor market remains tight.

Source: Bloomberg, as of 1 February 2023.

Source: Bloomberg, as of 1 February 2023.

In a services-based economy like that of the U.S., where wages can be a meaningful driver of overall inflation, the mechanics of pushing prices down is fairly straightforward: A higher cost of capital weighs on both business investment and household consumption, lower corporate revenues pressure margins and likely earnings growth, and management teams must then resort to layoffs to defend earnings and “right size” businesses in a slowing economy. It’s clear why many parties don’t find such a scenario palatable, but to maintain credibility and fend off an even worse fate farther down the road, the Fed has left itself little choice.

The conclusion of this story is yet to be written. Implicit in that unknown is a word of caution for investors: As the Fed’s and the market’s expectations diverge further, the risk of someone getting caught offside rises considerably. So, while we expect rates markets – and other asset classes – to trade in a range-bound manner in coming months, as the true path of the economy emerges, we would not be surprised to see a spike in volatility as the market adjusts to a yet-to-be-determined reality.

Our view, given the tightness of the U.S. labor market, is that the Fed will have to do more than the market expects to subdue inflation. As we’ve stated in the past, pause does not equal pivot. And while a second successive 25 bps increase signals that we are nearing an end of this rate-hiking cycle, we are not there yet. That will be determined – as has been the Powell Fed’s practice – by the data.

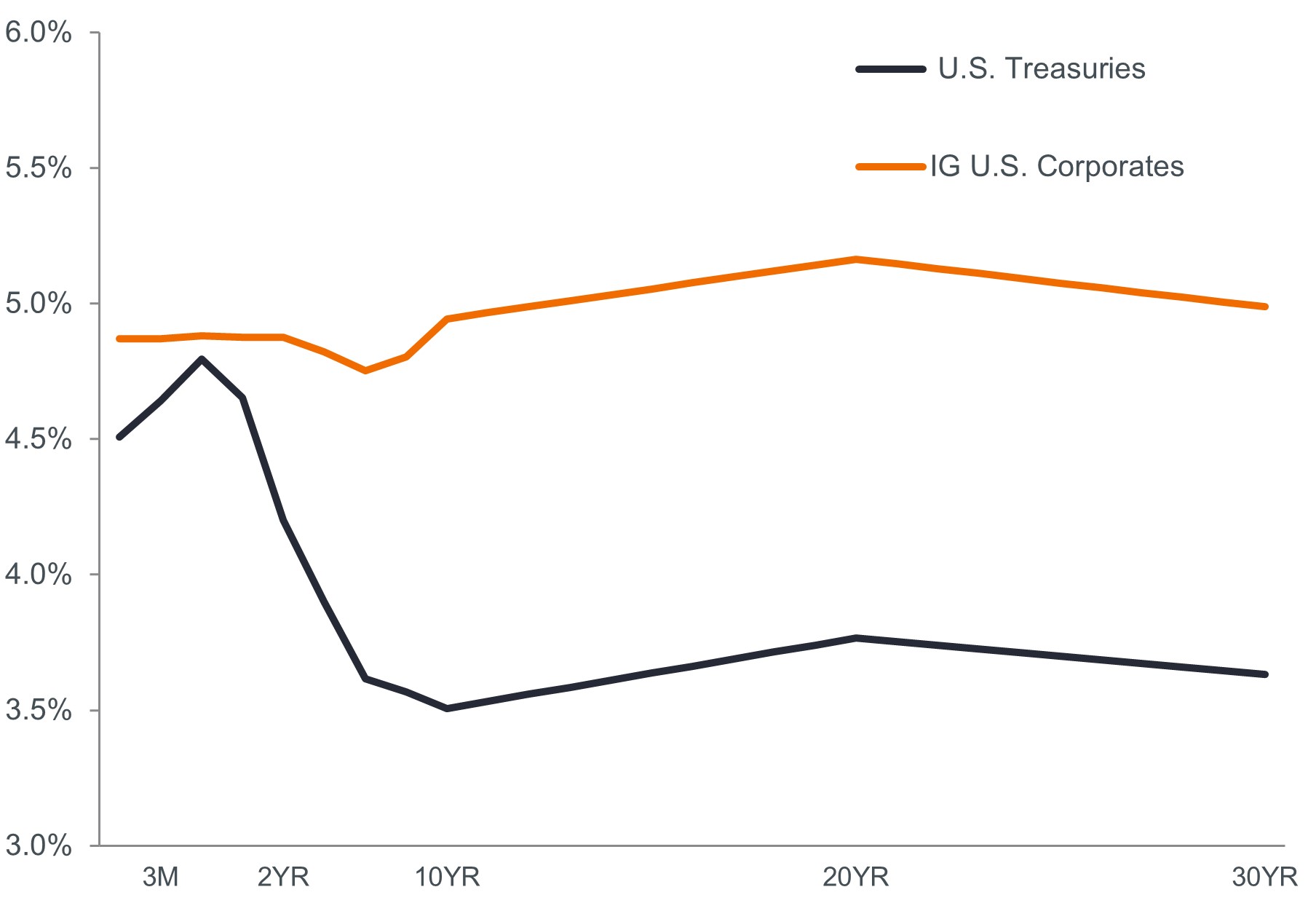

Accordingly, we think the market doves will likely have to adjust their expectations. Should rates stay on the Fed’s more aggressive path, we would expect to see yields on the shortest-dated U.S. Treasuries most influenced by Fed policy creep up to account for a fed funds rate peaking higher than 5.0%. Such an outcome would likely send longer-dated yields lower as investors price in an even more material economic slowdown. Should this scenario unfold, we believe that bond investors could eventually increase portfolio duration with the aim of capturing capital appreciation.

Again, we are not there yet. But with yields having reset at materially higher levels, we believe investors can afford to be patient and earn income streams that had been unimaginable on shorter-duration securities only a year ago. The pronounced inversion of the yield curve – with the yield on 2-year U.S. Treasuries roughly 70 bps higher than that of the 10-year – further underpins the view that the time to extend duration has yet to arrive.

With shorter-dated securities offering yields much higher than a year ago, investors have the opportunity to earn attractive income streams while awaiting clarity on the trajectory of rates over the longer term.

Source: Bloomberg, as of 1 February 2023.

Source: Bloomberg, as of 1 February 2023.

Should the market be right, however, and the Fed blinks before inflation is tamed, investors could be facing a prolonged environment of elevated prices that would cause mid- to longer-dated yields to break well above their current range. Until this potential outcome has been removed from the table, we would caution investors against getting overly aggressive in moving out along the yield curve.

IMPORTANT INFORMATION

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

U.S. Treasury securities are direct debt obligations issued by the U.S. Government. With government bonds, the investor is a creditor of the government. Treasury Bills and U.S. Government Bonds are guaranteed by the full faith and credit of the United States government, are generally considered to be free of credit risk and typically carry lower yields than other securities.

Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Carry is the excess income earned from holding a higher yielding security relative to another.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

Volatility measures risk using the dispersion of returns for a given investment.

A yield curve plots the yields (interest rate) of bonds with equal credit quality but differing maturity dates. Typically bonds with longer maturities have higher yields.

An inverted yield curve occurs when short-term yields are higher than long-term yields.