Subscribe

Sign up for timely perspectives delivered to your inbox.

In his 2023 outlook, Portfolio Manager Brian Demain explains how market changes over the last year are breaking ground for new mid-cap growth leaders to emerge.

Since November 2021, when markets began to process the significance of persistent inflation, mid-cap growth equities have remained volatile. The Russell MidCap® Growth Index is down over 30% during that time and relative valuation measures, such as P/E ratios, have generally come in significantly as the market weighs a new investment paradigm in the space. This shift has reduced many of the excesses we saw in the past several years. We believe that new bull markets are born of new leadership. Thus, as we survey the altered landscape, it will be important to focus on new leaders, not yesterday’s winners. Furthermore, despite last year’s volatility, we think the current market environment can be a fruitful one.

While excess valuations have corrected to a large extent, we still see problematic areas and instances of overvaluation. For the last decade, much of capitalism was built on the sustained availability of inexpensive capital. While the market has punished many challenged business models, companies that supply ecosystems that have relied on abundant capital are likely facing a difficult road ahead.

It will be important to remain focused on sustainable growth – that is, companies that can take market share in growing markets, and that have strong competitive positions and competent management teams. Importantly, as many companies learned in a volatile 2022, we believe valuation will matter.

Finding companies that meet the above criteria and that also trade at reasonable valuations can help reduce volatility in an environment that is likely to remain rough. While we cannot foresee how the macroeconomic picture will evolve in the months ahead, we think investors who are deliberate about addressing these risks may be able to find companies that can weather challenging environments and often emerge stronger on the other side.

We also believe we are exiting a period where growth was concentrated in just a handful of sectors. Going forward, we think the effects of deglobalization, decarbonization, demographic shifts, and other factors will open new areas of growth for market leadership. As a diversified manager, these opportunities for new leadership and a broader opportunity set excite us for the future.

In the mid-cap universe, we are beginning to see the emergence of investment themes that should persist in coming years. COVID and recent geopolitical action have already reinforced these themes, and we’ve seen significant legislation and government investment that should boost them even further.

First, we think we are entering a period of reindustrialization in the U.S. and deglobalization of economic interactions. The U.S. and China, and Europe and Russia, are decoupling due to geopolitics, while supply chains are being broadly reconsidered, spurred in part by the breakdowns experienced during COVID. The Inflation Reduction Act (IRA), which will provide green energy subsidies, and the Creating Helpful Incentives to Produce Semiconductors and Science (CHIPS) Act which will fund semiconductor fabrication, should bolster these specific industries in the U.S.

In the future, we expect to see increased investment in capital-intensive green energy infrastructure. There will also need to be further investment in petrochemicals (liquified natural gas (LNG) export facilities, for instance) and build additional chip manufacturing plants. Railroads, which have seen underinvestment for a long time, will likely need increased attention as well. Thus, we see significant growth opportunities in the areas of transportation, industrials, and materials in the years ahead.

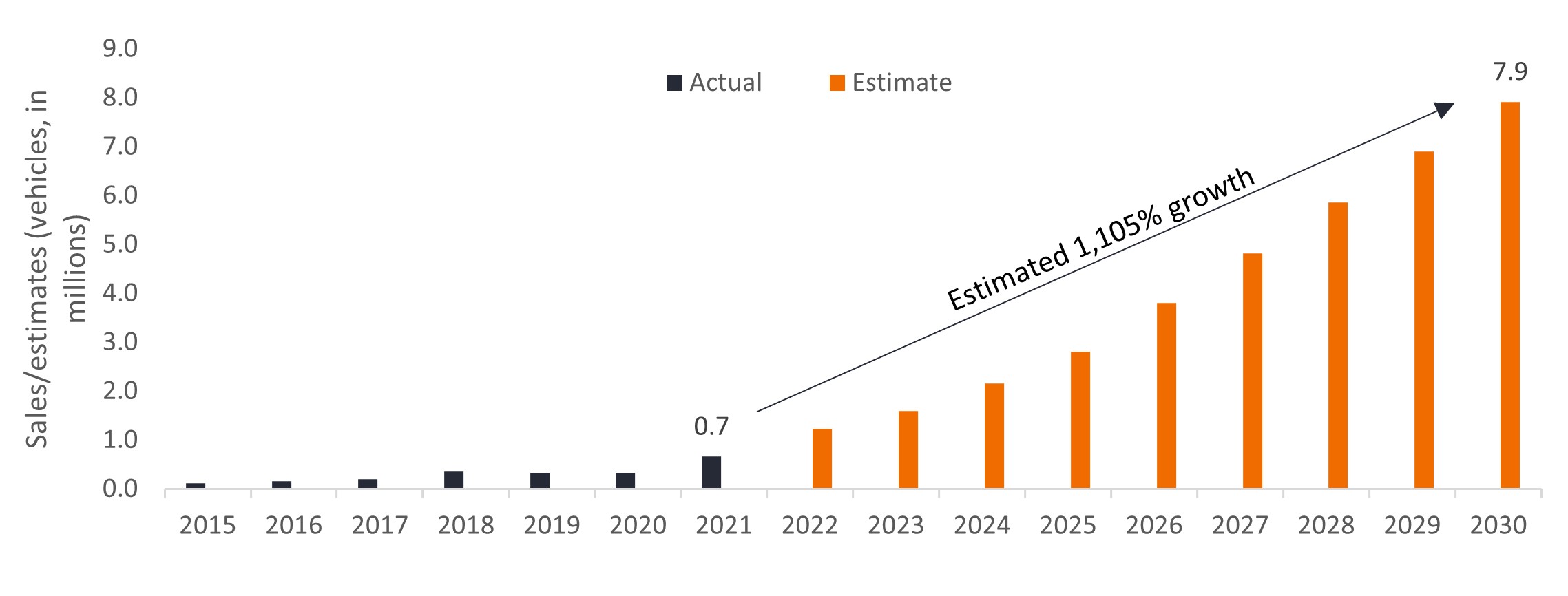

Second, electric vehicle (EV) production is expected to see significant growth. To put context around the size of the change, the U.S. is expected to sell 7.9 million EVs in 2030, up from roughly 700,000 in 2021. This represents a huge shift in one of the largest industries in the world. Investors undoubtedly will want to be on the right side of this massive transformation.

Source: BloombergNEF, Electric Vehicle Outlook dataset, vehicle sales and demand, last update in June 2022, updated annually.

Interestingly, we believe there are opportunities to invest in these powerful secular themes in ways that aren’t necessarily the most obvious. For instance, semiconductor suppliers, connector companies, and others produce componentry for all EV manufacturers. These types of companies can be underappreciated by investors, providing opportunity for greater capital appreciation as their stories become recognized. To use an analogy, in some instances we believe in identifying firms that are “selling pickaxes to the miners” – i.e., providing fundamental building blocks to companies in this transition − rather than seeking to pinpoint individual winners at the end of the supply chain.

In the near term, markets will likely remain focused on the macroeconomic environment that drove the investment narrative in 2022. It appears inflation may have peaked, and the Federal Reserve (Fed) is now in the later innings of its aggressive rate-hiking cycle. The questions will be whether the Fed can execute a relatively soft landing for the economy, what the trajectory of corporate earnings will be, and how each company will handle the challenging economic environment. As earnings growth will likely slow and become more volatile, investors should continue to seek out businesses that can grow sustainably and prudently, and that can finance their own growth so they can prosper in the long term.

IMPORTANT INFORMATION

Smaller capitalization securities may be less stable and more susceptible to adverse developments, and may be more volatile and less liquid than larger capitalization securities.

Price-to-Earnings (P/E) Ratio measures share price compared to earnings per share for a stock or stocks in a portfolio.