Subscribe

Sign up for timely perspectives delivered to your inbox.

With a 2023 policy pivot likely not in the cards, Portfolio Managers Jason England and Daniel Siluk argue that investors need to brace themselves for higher-for-longer interest rates and that a conservative approach toward duration is merited.

After a tumultuous 2022, fixed income investors are seeking grains of optimism wherever they can find them, and a modest – but ultimately short-lived – rally off the year’s lows suggested they had unearthed a few. In contrast, we maintain our stance that caution continues to be merited as the calendar turns to 2023.

Over the past two years, both policymakers and investors have gotten plenty wrong. Bonds’ recent rally was premised on inflation having peaked and the expectation that the Federal Reserve (Fed) will pivot toward a dovish stance once the U.S. economy slows. While we acknowledge that the worst of inflation is likely behind us, we cannot ignore that its stickiest components – namely wages – remain elevated. We believe the task of guiding inflation back toward the Fed’s 2.0% objective will take longer than the market expects. Consequently, it’s our view that a 2023 policy pivot is not in the cards.

The path of inflation, interest rates, and the economy will continue to play a significant role in the bond market until greater visibility into these forces emerges. The chances are slim that the inflation and interest rate disruptions of 2022 will be repeated. Yet, 2022’s resetting of rates has left bonds better positioned to withstand additional shocks. After several years, a fixed income allocation once again has the potential to offer diversification against swings in riskier asset classes, as well as levels of income generation that investors feared had been consigned to the annals of history.

Some adjustment has been made in resetting expectations as consensus has coalesced around the global economy slowing in 2023. In the U.S., annualized quarterly economic growth is forecast to range between 0.0% and 1.0% over the year. At these levels, any downside surprise could tilt the economy into recession. This potential outcome is partly responsible for the bond market’s recovery, as bulls expect it would force the Fed to pivot. But we think a pivot is unlikely. Fed Chairman Jerome Powell has been resolute in his messaging that guiding inflation back toward 2.0% is his highest priority. Inflation falling from 9.0% to 5.0% is the easy part, as the baseline effects from strong pandemic-era demand for goods rolls off. The hard part will be getting from 5.0% to 2.0%, especially as the contribution of the wage-heavy services component to overall inflation has increased in recent months.

We don’t see any path toward 2.0% inflation that doesn’t involve quelling the demand for labor, which feeds directly into upward wage pressure. As alluded to in the Fed’s most recent projections, the central bank is willing to pay the price of a slowing economy and higher unemployment to maintain credibility and – importantly – avoid the mistakes of the 1970s when a premature dovish pivot only increased inflation’s volatility.

At its own peril, the market is seemingly ignoring Chairman Powell’s hawkish assertions and is pricing in a recovery to a recession that has yet to occur. This is especially evident in riskier assets. Both 2022’s equity bear market and ensuing rebound were driven by changes to the multiple attached to stocks’ earnings. Yet to be fully priced in, however, are the headwinds to earnings themselves, as slowing demand for labor would dent wage growth, and ultimately consumption.

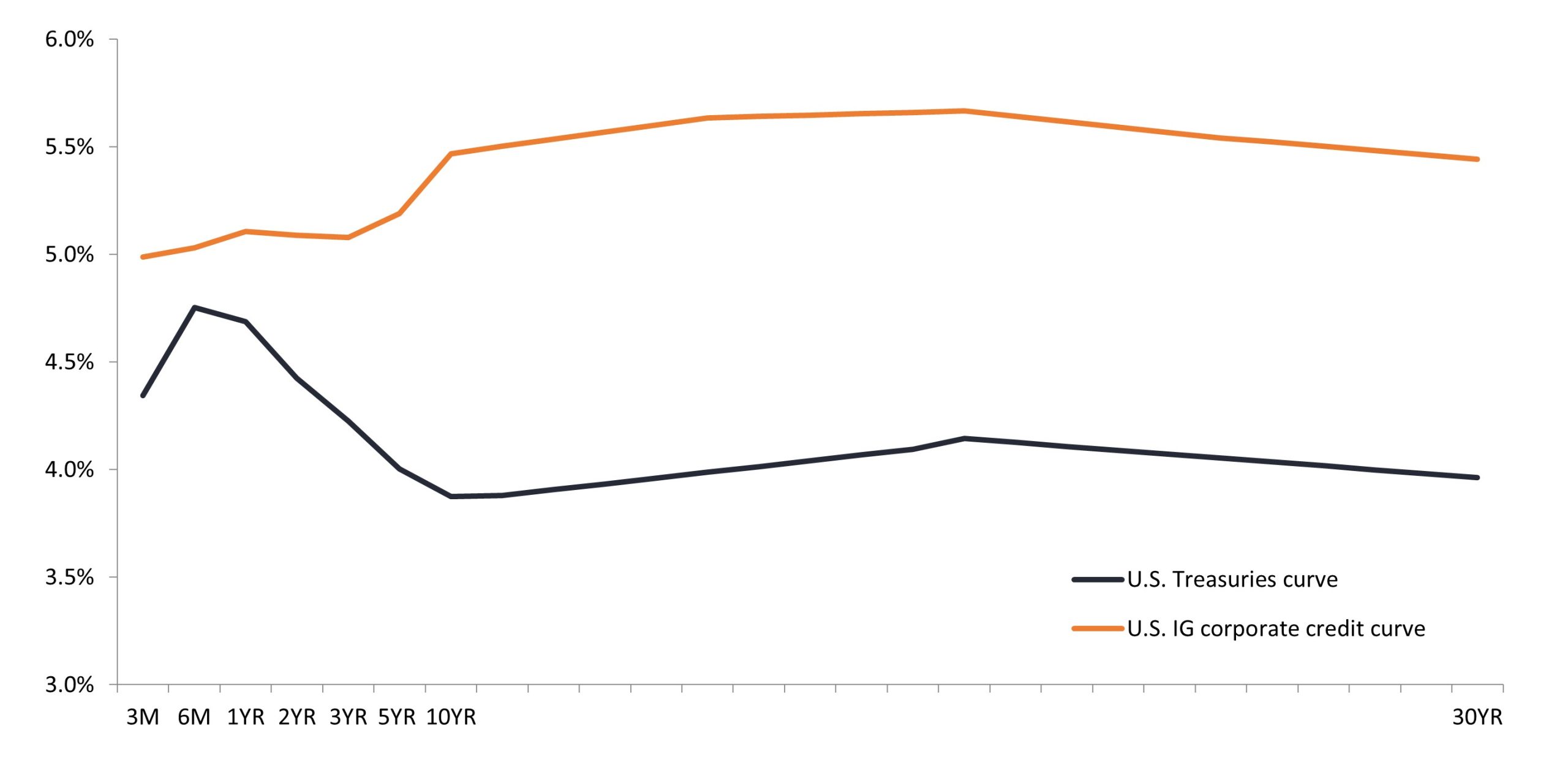

An inverted Treasuries curve hints at a slowing economy; it also displays the attractiveness of shorter-dated securities relative to the longer-dated issuances that tend to be more sensitive to interest rate swings.

Source: Bloomberg, as of 30 December 2022.

Source: Bloomberg, as of 30 December 2022.

Similarly, the difference between the yields of corporate credits and those of their risk-free benchmarks have narrowed. While this may be understandable for the higher-quality issuers that spent the past few years fortifying their balance sheets, for higher-yielding companies – especially those with cyclical exposure – an economic recovery may not occur until after these issuers’ vulnerabilities are exposed. Even shorter-dated U.S. Treasuries have flashed dovish signals, as illustrated by falling yields on the 2-year note.

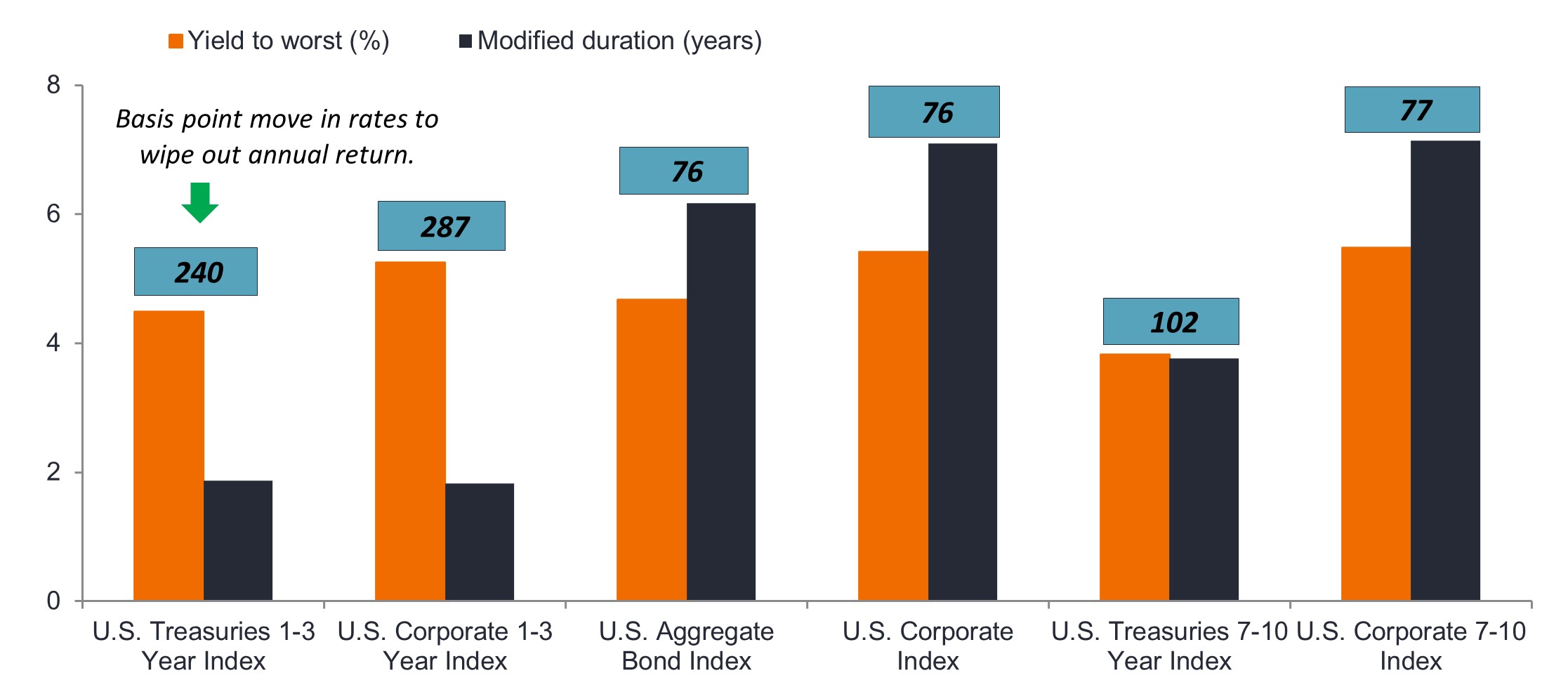

Given what we view as the questionable foundation of the late-year rally, we believe conservative positioning within a bond allocation is in order. Typically, this entails forgoing the higher yields of longer-dated securities with the aim of limiting interest rate risk. However, with shorter-dated securities offering meaningfully higher yields than those with longer maturities, an allocation that’s light on duration also presents the potential for a greater amount of income generation.

It would take a much larger increase in interest rates to erase the potential annual yield of shorter-dated bonds than it would for longer-dated securities.

Source: Bloomberg, as of 30 December 2022.

With the macro outlook far from certain, any assessment of how different segments of the bond market could fare will not get everything right. On a risk-adjusted basis, we believe shorter-duration securities offer investors a combination of features that should help weather whatever 2023 brings.

If the Fed proves to be more hawkish than consensus, the ceiling to front-end yields is likely limited. But if the Fed blinks and higher inflation expectations become imbedded, longer-date bonds could experience a material sell-off. Thus, with the fate of longer-dated bonds resting on a yet-to-be-determined path, we believe the environment merits being late, rather than early, in adding back duration.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

A yield curve plots the yields (interest rate) of bonds with equal credit quality but differing maturity dates. Typically bonds with longer maturities have higher yields.

An inverted yield curve occurs when short-term yields are higher than long-term yields.

Yield to worst (YTW) is the lowest yield a bond can achieve provided the issuer does not default and accounts for any applicable call feature (ie, the issuer can call the bond back at a date specified in advance). At a portfolio level, this statistic represents the weighted average YTW for all the underlying issues.

IMPORTANT INFORMATION

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

U.S. Treasury securities are direct debt obligations issued by the U.S. Government. With government bonds, the investor is a creditor of the government. Treasury Bills and U.S. Government Bonds are guaranteed by the full faith and credit of the United States government, are generally considered to be free of credit risk and typically carry lower yields than other securities.