Subscribe

Sign up for timely perspectives delivered to your inbox.

Portfolio Manager James de Bunsen argues why holding investments that can show resilience in the face of multiple, meaningful headwinds, from market volatility to potential stagflation, should give investors confidence in 2023.

Challenging at best, brutal at worst… that was 2022 for most investors. Everyone knows it was as bad as it gets for traditional balanced investors, with bonds offering no offset for plummeting equity markets. Moreover, many alternatives also performed poorly, with the notable exception of broad commodity indices, largely driven by Russia’s conflict escalation in Ukraine.

| YTD | 2021 | |

| Private equity | -20.6 | 60.7 |

| Loans | -1.0 | 5.2 |

| Property | -21.1 | 32.6 |

| Infrastructure | -3.6 | 18.8 |

| Renewables | -6.2 | -5.0 |

| Gold | -3.8 | -3.5 |

| Commodities | 19.0 | 27.1 |

| Reinsurance | -4.0 | 4.9 |

| Hedge funds | -3.6 | 2.7 |

| Global equities | -14.1 | 22.4 |

| Global bonds | -11.0 | -1.5 |

Source: Morningstar Direct, Bloomberg, total returns to 30 November 2022. Indices used: LPX Composite TR EUR, Morningstar LSTA US LL TR USD, FTSE EPRA Nareit Global REITs TR USD, FTSE Dvlp Core Infrastructure TR USD, Morningstar Gbl Util – Renewable GR USD, S&P GSCI Gold Spot USD, Bloomberg Commodity TR USD, SwissRe Global Cat Bond TR USD, HFRI-I Liquid Alternative UCITS Index USD, MSCI World GR USD, Bloomberg Global Aggregate TR Hdg GBP. Past performance does not predict future returns.

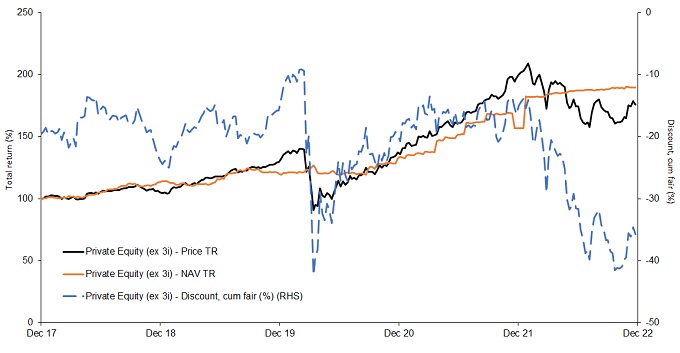

The indices in Exhibit 1 are all liquid, mainly consisting of listed securities, rather than private markets, which – thus far – have seemingly managed to defy these generalised negative moves (according to their own mark-to-model valuations), despite significantly wider NAV discounts (Exhibit 2).

Source: JP Morgan, Refinitiv Datastream, 1 December 2017 to 1 December 2022. TR = total return. Private Equity (ex 3i) – Price TR and Private Equity (ex 3i) – NAV TR (LHS) rebased to 100 at start date. Past performance does not predict future returns. Cum fair discount here includes income and assumes any debt is repaid at current market value.

Historically, we know that while private market valuations are slow to adjust downwards, they get there eventually. This is likely to come through in year-end valuations (published sometime in Q1 2023) and also as companies in the venture capital and growth parts of the market run out of cash and need to carry out further capital raises at lower valuations.

So, what did we learn from 2022? Mainly that all asset classes are impacted by higher interest rates that dictate both the cost of capital and rates at which assets are discounted. The latter is particularly pertinent for long-dated assets, such as those typically found in the infrastructure sector.

On the positive side, specialist areas of credit, such as loans and asset-backed securities tend to have floating rate coupons, which makes them profoundly more attractive than fixed-rate bonds as rates rise. Nevertheless, they are still credit investments and are therefore subject to the same laws around cost of capital.

Reinsurance as an asset class is also generally accessed via debt instruments with floating rate coupons. Until late September, this sector was largely immune to the carnage in mainstream markets. However, this all changed after Hurricane Ian barrelled into Florida, triggering the second-costliest insured loss in history. Being genuinely uncorrelated does not mean that bad things cannot happen!

Finally, hedge funds – as per usual – had a mixed year. Overall, indices were down but there was huge dispersion among and within sub-sectors. The major winners were managed futures and trend-following strategies. Any discretionary macro managers that were ahead of the game in terms of where monetary policy were headed also had an advantage. Bringing the whole sector down, however, were long/short equity funds, which suffered from generally being long biased, and skewed towards growth stocks, which fell most.

While broad renewables indices were negative due to rising bond rates and windfall taxes, there were plenty of winners in the sector. The war in Ukraine caused power prices to spike, turbo-charged the energy transition and hammered home the need for energy security.

By comparing 2022 to 2021, one can easily conclude that active asset allocation can, if done well, really improve returns. Private equity had a stellar year in 2021 but valuation metrics across the markets were flashing red. Investors in 10-year, closed-ended, private funds have no real choice but to sit tight and hope that longer-term numbers recover. By investing in liquid vehicles to access alternative assets, investors can, however, adjust their portfolio’s exposure to interest rates and equity market gyrations. Meanwhile, those with calm heads can take advantage of the inevitable market over-reactions to unexpected events, such as war in Europe or a catastrophically misjudged budget.

The outlook is unclear to say the least. But that does not mean one cannot invest with conviction. Holding investments that can show resilience in the face of multiple, meaningful headwinds, or perform in a backdrop that overwhelmingly looks stagflationary, should give investors confidence.

The battle to tame inflation goes on and thus interest rates have likely not yet peaked, even if longer-term bond yields may have done so. We continue to favour assets with a high degree of inflation linkage such as infrastructure and renewables. Renewable and energy efficiency companies should continue to benefit from the drive to reach net zero. Discount rates have adjusted higher and therefore downside risk on this front looks low.

Elsewhere, listed private equity and property vehicles have already priced in a very severe fall in valuations. This looks particularly overdone in some property sectors where occupational markets look very robust, demand structurally outweighs supply and balance sheets are strong. As mentioned above, private equity valuations must inevitably come down, but discounts of 20-40% in the listed market already discount a prolonged and severe downturn, akin to 2008. There are many aspects of the global economy that are different to the global financial crisis (GFC), most pertinently the strength of the labour market and the fact that corporates have taken advantage of super-low rates to improve their debt profile.

The key risk remains inflation and how much tightening is needed. Investments that can benefit from the volatility associated with monetary policy regime changes, something that favours certain macro hedge fund strategies, are also a key component of a robust alternatives portfolio.

As 2022 demonstrates, genuine diversifiers are rare at certain points in the cycle but, for want of a better phrase, they are worth their weight in gold.

Asset allocation: The allocation of a portfolio according to an asset class, sector, geographical region, or type of security.

Cost of capital: The calculation of the minimum return that would be required to justify an investment for a business, including all debt and equity. As interest rates rise, borrowing naturally becomes more expensive.

Closed-ended funds: A type of investment company with a fixed number of shares that are traded in the open market like a stock.

Floating rate coupons: The interest rate on a bond that varies, depending on changes in an associated benchmark rate, such as the federal funds rate (the base rate of interest set by the US Federal Reserve).

Growth stocks: Growth investors search for companies they believe have strong growth potential. Their earnings are expected to grow at an above-average rate compared to the rest of the market, and therefore there is an expectation that their share prices will increase in value.

Inflation: The rate at which the prices of goods and services are rising in an economy. The CPI and RPI are two common measures.

Liquid investment vehicles: Strategies that invest in assets that can be easily bought or sold in the market without causing a major price move.

Long/short strategies: A portfolio that can invest in both long and short positions. The intention is to profit from price gains in long positions, and price declines in short positions. This type of investment strategy has the potential to generate returns regardless of moves in the wider market, although returns are not guaranteed.

Long position: A security that is bought in the expectation that it will rise in value.

Monetary policy: The policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money. Monetary stimulus refers to a central bank increasing the supply of money and lowering borrowing costs. Monetary tightening refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money.

Short/short position: Fund managers use this technique to borrow then sell what they believe are overvalued assets, with the intention of buying them back for less when the price falls. The position profits if the security falls in value.

Futures/managed futures: A futures contract is an agreement between two parties to buy or sell a tradable asset, such as shares, bonds, commodities or currencies, at a specified future date at a fixed price agreed today. Managed futures are investments where a portfolio of futures contracts is actively managed by professionals.

Private equity: Investment into a company that is not listed on a stock exchange. Like infrastructure investing, it tends to involve investors committing large amounts of money for long periods of time.

Trend-following: A trading strategy where an investor looks to buy an asset when its price trends up, and sell when it trends down, in the expectation that the trended price movement will continue.

Volatility: The rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. Higher volatility means the higher the risk of the investment.

Stagflation: A relatively rare situation where rising inflation coincides with anaemic economic growth.

Net Asset Value (NAV): The total value of a fund’s assets less its liabilities.

Balance sheets: A financial statement that summarises a company’s assets, liabilities and shareholders’ equity at a particular point in time. Each segment gives investors an idea as to what the company owns and owes, as well as the amount invested by shareholders. It is called a balance sheet because of the accounting equation: assets = liabilities + shareholders’ equity.

Asset-backed securities: A financial security which is ‘backed’ with assets such as loans, credit card debts or leases. They give investors the opportunity to invest in a wide variety of income-generating assets.