Subscribe

Sign up for timely perspectives delivered to your inbox.

Amid tightening financial conditions, companies with strong free cash flows and earnings visibility could be especially attractive in 2023, say Co-Head of Equities – Americas George Maris and Portfolio Manager Julian McManus in their equities outlook.

While much can be said about the drivers of the market rout in 2022 – multidecade-high inflation, rapid rate increases, slowing growth, ongoing COVID-19 lockdowns, and the Russia/Ukraine conflict – remarkably, very little can be said yet about how or when these issues get resolved. Central bank policy hinges on inflation moderating, and it may be another year before we know the impact of rate increases on economic growth. The political backdrop is in flux, with China’s Xi Jinping starting a third term and facing backlash to zero-COVID policies. Meanwhile, the conflict between Ukraine and Russia is approaching its one-year anniversary, with no clear end in sight.

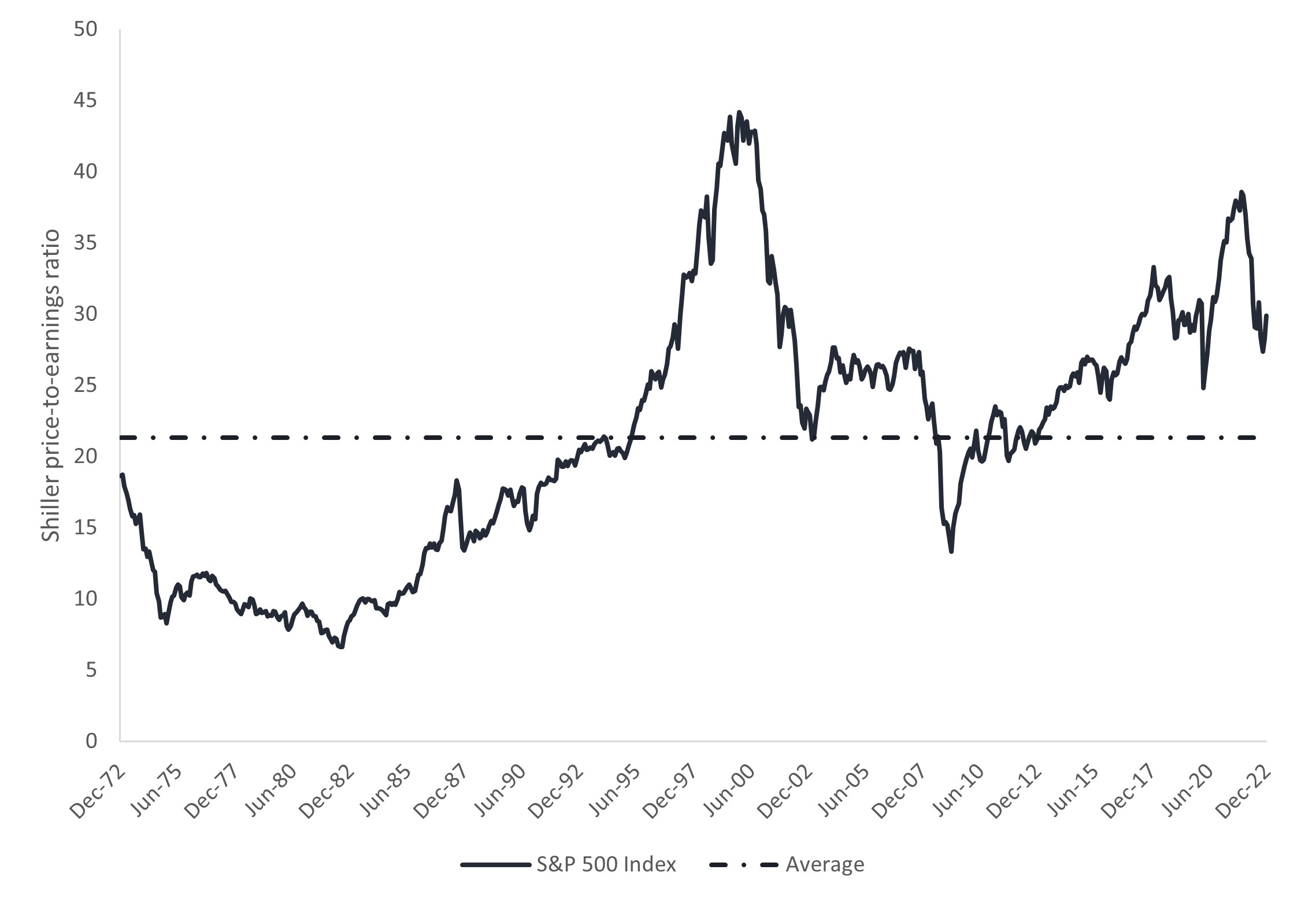

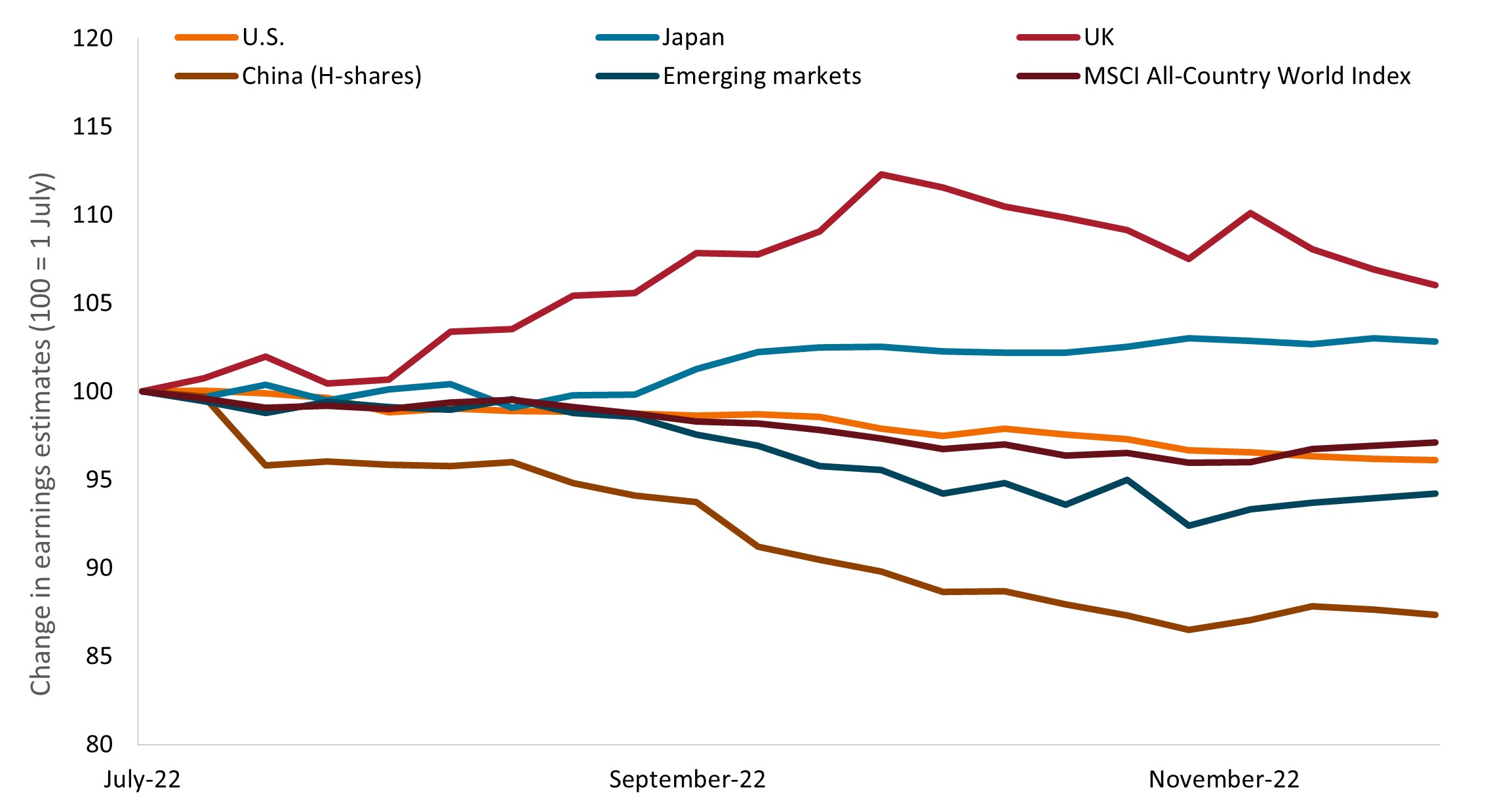

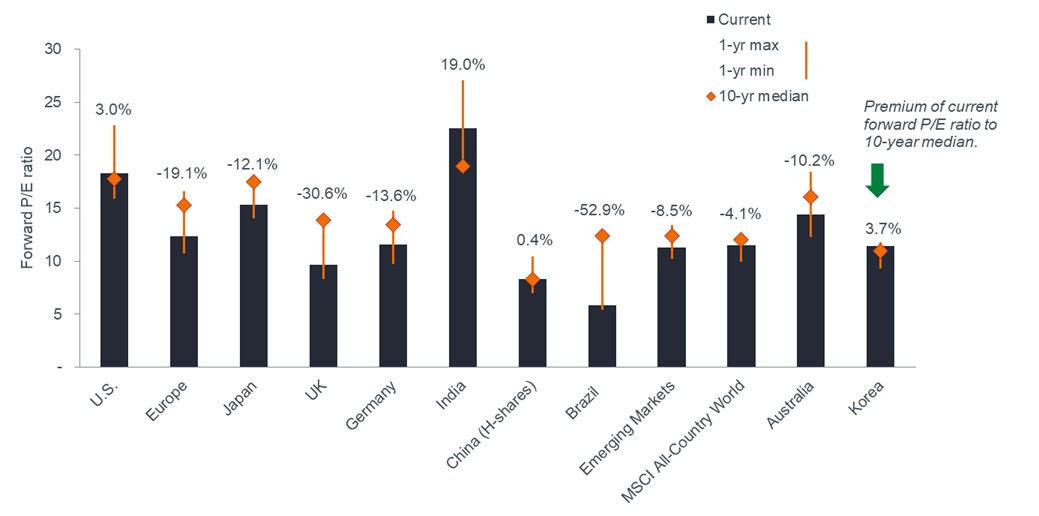

Investors, as a result, may have to brace themselves for more market volatility in 2023. Almost all asset classes declined in 2022, helping improve valuations from a year ago, when multiples sat at abnormally elevated levels. But we hesitate to call the market cheap – at best, large categories such as U.S. equities trade around their historical average. What’s more, companies have started to lower earnings guidance or pull guidance altogether in light of economic headwinds such as a strong U.S. dollar, making U.S. exports competitively disadvantaged. If earnings expectations continue to be adjusted lower, stock prices could have further to fall.

Source: Robert Shiller, as of 1 December 2022. Notes: Price-to-earnings (P/E) ratio is based on average inflation-adjusted earnings from the previous 10 years, known as the Cyclically Adjusted PE Ratio (CAPE Ratio)

Even then, the biggest issue facing markets in 2023 may be parsing whether today’s challenges are transitory or the first tremors of a seismic shift in the investment paradigm. In our view, a number of structural elements appear to be supporting persistent inflationary pressures. These include greater regulatory intervention (especially around environmental issues), the aging of the workforce, geopolitical uncertainties, supply constraints, climate change, and fiscal policies. Even if peak inflation rolls over soon (if it hasn’t already), investors will have to weigh whether higher inflation generally – and reduced productivity, as a result – will remain dominant themes through 2023 and beyond.

In this environment, we think it is risky for investors to continue with the investment playbook of the last decade. In years prior, ultra-loose monetary policy helped to lift all stocks. Now that rates are rapidly rising, we believe investors need to change tack, focusing on companies not dependent on cheap capital to thrive. To find those, we suggest looking for firms that have visible forward earnings and trade at an attractive price relative to the cash they generate. Great companies priced above the market average can continue to work, but they will need to meet already high expectations to perform well – a challenge in a potentially slowing economy. And a lack of forward visibility on cash flows only amplifies uncertainty for investors, which can increase volatility.

Source: Bloomberg, as of 30 November 2022.

Notes: Data reflect changes to full-year 2022 earnings estimates and are rebased to 100 as of 1 July 2022. US = S&P 500 Index; Japan = Nikkei 225 Index, a stock market index for the Tokyo Exchange; UK = FTSE 100 Index, an index of the 100 companies on the London Stock Exchange with the highest market capitalization; China (H-shares) = Hang Seng China Enterprises Index, a stock market index of the Stock Exchange of Hong Kong for H share, red chip, and P chip; Emerging markets = MSCI Emerging Markets Index, which captures large- and mid-cap companies across 24 emerging markets countries; and MSCI All-Country World Index represents the performance of large- and mid-cap stocks across 23 developed and 24 emerging markets.

Companies with earnings visibility, on the other hand, are less likely to deliver unwelcome surprises. While it’s possible to find examples of these firms across all sectors of the economy, we believe areas such as large-cap pharmaceuticals and biotechnology, materials, energy, and financials provide rich hunting ground for investors. These sectors not only tend to have sizable free cash flows, but they are also inflation and/or rate sensitive and could benefit from some of the structural shifts we see taking place in the economy. For example, copper miners could be well positioned for the green energy transition given years of underinvestment in projects to extract the metal, the main conduit for electricity.

These sectors also feature prominently in non-U.S. markets, where valuations look comparatively attractive. To be sure, the lower multiples reflect near-term challenges, including spiraling energy costs and rising rates (Europe) or COVID lockdowns and shifting trade dynamics (China). But these economies tilt more heavily than the U.S. toward the sectors listed above and are home to some multinational firms integral to global supply chains. With low valuations and the benefit of a strong U.S. dollar, we think certain stocks within these regions could be attractive opportunities over a two- to three-year time horizon.

Source: Bloomberg, as of 30 November 2022.

Notes: US = S&P 500 Index; Europe = STOXX 600 Index, which represents 600 large-, mid- and small-cap companies among 17 European countries; Japan = Nikkei 225 Index; UK = FTSE 100 Index; Germany = Dax Index, which consists of the 40 major German blue chip companies trading on the Frankfurt Stock Exchange; India = S&P BSE Sensex Index, a free-float market-weighted stock market index of 30 companies listed on the Bombay Stock Exchange; China (H-shares) = Hang Seng China Enterprises Index; Brazil = Ibovespa Brasil Sao Paulo Stock Exchange Index, the main performance indicator of the stocks traded in B3 and lists major companies in the Brazilian capital market; Emerging markets = MSCI Emerging Markets Index; Australia = S&P/ASX 200 Index, a market-capitalization weighted and float-adjusted stock market index of stocks listed on the Australian Securities Exchange; and Korea = KOSPI Index, an index of all common stocks traded on the Stock Market Division of the Korea Exchange.

It may take courage to hold the shares, especially when behavioral biases such as herd mentality and risk aversion lead markets to buy or sell without regard to fundamental return potential. But in our experience, those periods often provide some of the best opportunities to acquire great assets at great prices, rewarding disciplined investors.

Index performance does not reflect the expenses of managing a portfolio as an index is unmanaged and not available for direct investment.

Price-to-Earnings (P/E) Ratio measures share price compared to earnings per share for a stock or stocks in a portfolio.

IMPORTANT INFORMATION

Energy industries can be significantly affected by fluctuations in energy prices and supply and demand of fuels, conservation, the success of exploration projects, and tax and other government regulations.

Financials industries can be significantly affected by extensive government regulation, subject to relatively rapid change due to increasingly blurred distinctions between service segments, and significantly affected by availability and cost of capital funds, changes in interest rates, the rate of corporate and consumer debt defaults, and price competition.

Foreign securities are subject to additional risks including currency fluctuations, political and economic uncertainty, increased volatility, lower liquidity and differing financial and information reporting standards, all of which are magnified in emerging markets.

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market as a whole.