Subscribe

Sign up for timely perspectives delivered to your inbox.

In his investment outlook, Tom Ross, Corporate Credit Portfolio Manager, believes high yield bond investors may need some inner strength to get past peak fear but 2023 may prove manageable if the economic downturn is shallow.

In 2022, rising interest rates lifted yields on bonds and drove down prices. We think the negative effects of interest rate risk are mostly in the price and signs of easing inflation and central banks stepping off the monetary tightening brakes could turn interest rate risk from a detractor to a potential contributor to bond performance in 2023.

Credit risk remains harder to predict. Yield curves have inverted and lead economic indicators paint universal gloom. Yet corporate earnings and cash flows have held up. There is a wide disparity between dismal forward-looking data and the more resilient realised corporate and employment data. We recognise that the latter lags but it is also one of the reasons why markets were so volatile in the second half of 2022 as investors struggled to ascertain whether economies face a soft or hard landing.

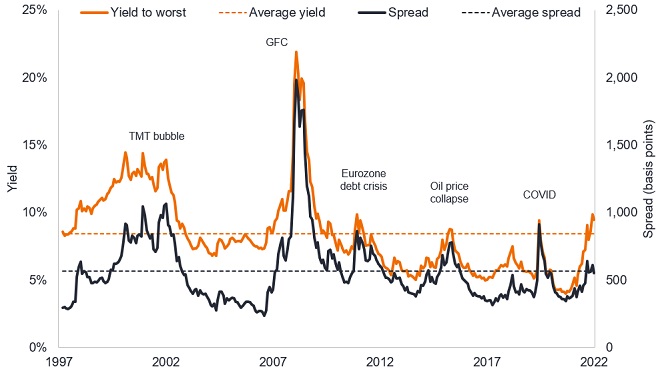

Figure 1 shows there has been a significant repricing of high yield bonds. The yield to worst on global high yield has moved up from lows of 4.6% at the start of 2022 to 9.5% in late 2022, above the 25-year average of 8.4%. Spreads have similarly widened from lows of 373 basis points (bps) at the start of 2022 to 550 bps by late 2022, although this is slightly below the 25-year average of 564 bps.

Source: Bloomberg, ICE BofA Global High Yield Bond Index, yield to worst, Govt OAS (option-adjusted spread), monthly datapoints, 31 December 2017 to 31 October 2022. TMT= Telecom, media, telecoms. GFC = Global Financial Crisis. Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%. Yields may vary over time and are not guaranteed.

Global figures disguise some regional differences. We think European high yield spreads have priced in more of an economic slowdown compared with US high yield, although deservedly so given Europe’s greater vulnerability to energy and supply shocks aggravated by the conflict in Ukraine.

We are not complacent. Financial conditions have tightened. Mortgage rates have doubled in many countries. Floating rate costs have risen on loans. All of this is making life tougher for companies. Inflation provided cover for businesses to raise prices, which kept revenues strong, but as the cost of living bites and central banks’ policy tightening works through the system, the economy should deteriorate further. We expect credit spreads to remain volatile and view the tightening move in autumn 2022 as a temporary and technical correction rather than the beginning of a persistent move.

Markets typically overshoot on fear – weakness in corporate earnings and negative employment prints we think are likely to catalyse a spike in peak spreads, most probably in the first half of 2023. These episodes tend to be short-lived, however, and are historically a great buying opportunity.

During the 2007-9 Global Financial Crisis, spreads widened to almost 2,000 bps but this was extreme. It reflected panic at the time that a systemic collapse may occur as the banking system was the oxygen for the whole economy.

Today, banks are well capitalised. More recent crises, such as the 2011 eurozone debt crisis, the 2015 oil price collapse, and the 2020 COVID pandemic have seen spreads peak well below 1,000 bps. We think the economic downturn in 2023 will have more in common with these episodes and there are five reasons to think spread widening may be less intense.

There is no guarantee that past trends will continue or forecasts will be realised.

With any economic downturn, however, we think it is worth reducing risk and moving up in quality. We have a preference for BB rated bonds and selective B rated bonds over the lower rated CCC cohort. While the spreads on CCC rated bonds (those with a higher risk of default) widened relative to B and BB rated bonds during 2022, we remain cautious towards these weaker issuers that are most vulnerable to default.6 Across high yield, the rapid rise in yields sent bond prices lower, often below par value in many cases. This pull to par should offer some support, but its value lies in inflation and yields in the wider fixed income universe coming down. In terms of sectors, the weakening economy leans us towards more defensive areas with strong cash flows such as European pharmaceuticals and US banks, which we recognise are cyclical but well capitalised and likely to benefit from higher net interest margins.

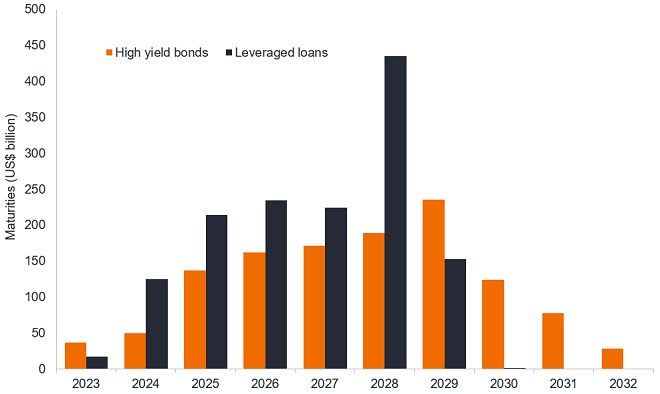

Our outlook is premised on recessions in Europe and the US being shallow. If we are wrong and the downturn is more severe, then defaults will be higher and spreads will widen aggressively. Similarly, if high inflation persists, warranting tighter monetary policy, then the road to lower yields will elongate. This could have implications for refinancing costs. Refinancing becomes an issue about 12-18 months before maturity so by late 2023, the thicker maturity wall in 2024/5 (Figure 2) will come into focus.

Source: BofA Global Research, 30 September 2022.

Ultimately, we believe that 2023 will be an improvement on a difficult 2022 for high yield bond investors but whether that translates into positive or negative returns will depend on whether the economy has a soft or hard landing.

1Source: Moody’s Default Report, Global speculative-grade default rate (global baseline forecast) trailing 12-month rate to 31 October 2023. Forecast as at 22 November 2022.

2Source: Morgan Stanley, US quarterly chartbook, data as at end Q2 2022, November 2022. Gross leverage is debt as a ratio of earnings before interest, tax, depreciation and amortisation.

3Source: Morgan Stanley, US Corporate Credit Chartbook, US high yield new issue volumes year-to-date to 31 October 2022 (-79% year-on-year), and European Credit Strategy, European high yield non-financial volumes to 18 November (-82% YoY), November 2022.

4Source: Bloomberg, ICE BofA Global High Yield Index, weight of BB cohort, full market value in US dollars, 31 December 2000 to 31 October 2022.

5Source: Bloomberg, ICE BofA US High Yield Index constituents at month end for each specified date period TMT (31 March 2001), Energy crisis (31 December 2014) and 31 October 2022.

6Source: Bloomberg, ICE BofA Global High Yield Index, spreads of BB, B and CCC cohorts, 31 December 2021 to 31 October 2022.

Credit ratings: A score given by a credit rating agency such as S&P Global Ratings, Moody’s and Fitch on the creditworthiness of a borrower. For example, S&P ranks high yields bonds from BB through B down to CCC in terms of declining quality and greater risk, i.e. CCC rated borrowers carry a greater risk of default.

Credit risk: The risk that a borrower will default on its contractual obligations, by failing to meet the required debt payments.

Credit spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

Cyclical: Companies that sell discretionary consumer items, such as cars, or industries highly sensitive to changes in the economy, such as miners. The prices of equities and bonds issued by cyclical companies tend to be strongly affected by ups and downs in the overall economy, when compared to non-cyclical companies.

Default: The failure of a debtor (such as a bond issuer) to pay interest or to return an original amount loaned when due. The default rate is typically expressed as a percentage rate reflecting the face value of bonds in an index defaulting over a 12-month period compared with the total face value of bonds in the index at the start of the period.

Financial conditions: The ease with which finance can be accessed by companies and households. When financial conditions are tighter it is harder or more costly for people and businesses to access finance.

Floating rate: A loan that does not have a fixed rate of interest. Typically rates typically change based on a reference rate, such as the London Inter-bank Offered Rate (LIBOR), the rate at which banks lend to each other.

High yield bond: A bond that has a lower credit rating than an investment grade bond. Sometimes known as a sub- or below investment grade bond. These bonds carry a higher risk of the issuer defaulting on their payments, so they are typically issued with a higher coupon (regular interest payment) to compensate for the additional risk.

ICE BofA US High Yield Index is a measure of US dollar denominated below investment grade corporate debt publicly issued in the US domestic market.

ICE BofA Euro High Yield Index is a measure of Euro denominated below investment grade corporate debt publicly issued in the euro domestic or Eurobond markets.

ICE BofA Global High Yield Index is a measure of USD, CAD, GBP and EUR denominated below investment grade corporate debt publicly issued in the major domestic or Eurobond markets.

Inflation: The annual rate of change in prices, typically expressed as a percentage rate. The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

Interest rate risk: The risk to bond prices caused by changes in interest rates. Bond prices move in the opposite direction to their yields, so a rise in rates and yields causes bond prices to fall and vice versa.

Investment grade: A bond typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments. The higher quality of these bonds is reflected in their higher credit ratings.

Leverage: This is a measure of the level of debt in a company. Gross leverage is debt as a ratio of earnings before interest, tax, depreciation and amortisation.

Leveraged loans: Secured loans extended to businesses rated sub-investment grade, typically with coupon payments linked to a floating reference interest rate.

Monetary policy: The policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money. Easing refers to a central bank increasing the supply of money and lowering borrowing costs. Tightening refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money.

Par value: The face value of the security, the amount that will be paid back on maturity.

Recession: A significant decline in economic activity lasting longer than a few months. A soft landing is a slowdown in economic growth that avoids a recession. A hard landing is a deep recession.

Volatility: The rate and extent at which the price of a portfolio, security or index moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. The higher the volatility means the higher the risk of the investment.

Yield to worst (YTW) is the lowest yield a bond can achieve provided the issuer does not default and accounts for any applicable call feature (i.e. the issuer can call the bond back at a date specified in advance). At an index or portfolio level, this statistic represents the weighted average YTW for all the underlying issues.

Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Energy industries can be significantly affected by fluctuations in energy prices and supply and demand of fuels, conservation, the success of exploration projects, and tax and other government regulations.

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

High-yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.