Subscribe

Sign up for timely perspectives delivered to your inbox.

The challenge facing investors is deciding which part of the pool to swim in next year, as 2023 could become a tale of two halves, argues Head of Secured Credit Colin Fleury.

Navigating the uncertain waters of 2023 requires some caution given that inflation is still running hot and central banks remain in a battle to tame it. In our view, policy tightening effects are yet to fully filter through to consumers and corporate performance. Excess consumer savings in the US, for example, have dipped to lows post their pandemic boom, but spending is softening rather than rolling over. Third-quarter corporate earnings have held up better than expected. We are seeing only early signs of corporate headcount reductions or pressures being felt by individuals as they tackle higher debt service costs from a rising interest rate environment. We have not yet seen the effects come materially through in the performance of the companies we invest in or the collateral pools of consumer credit or mortgages that back securitised assets. That is still to play out, with other risks to the global outlook such as China property sector and COVID challenges and the Russia-Ukraine conflict bubbling in the background.

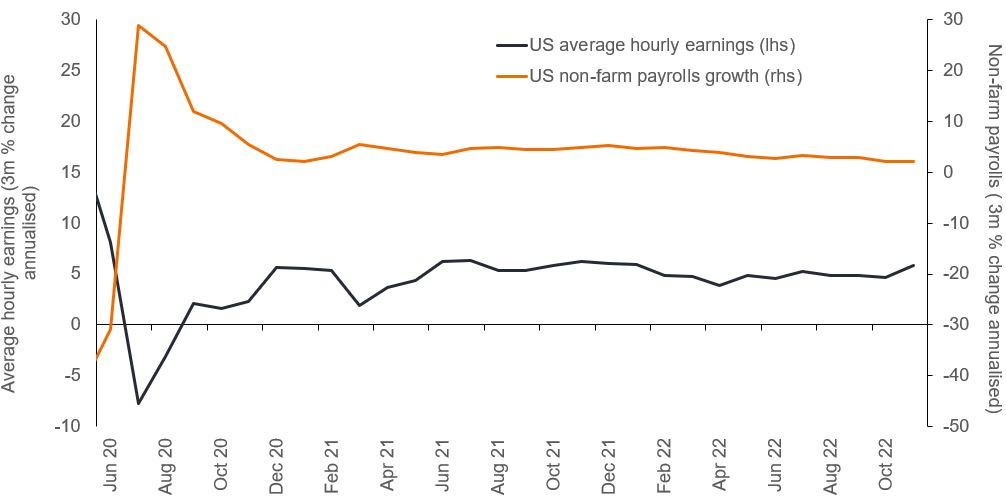

Given such corporate and consumer resilience, we are yet to see a material weakening in credit fundamentals and markets are not fully pricing in the accompanying recession risk. Spreads have also been supported by an unusual supply and demand backdrop, with generally limited debt issuance in 2022. We believe that 2023 could become a tale of two halves, with spreads widening through mid-year as the economic reality of recession seeps through and more appropriately price recession risk. We expect more clarity on the outlook to emerge later in the year. This could include more definitive signs that inflation is getting under control and a pivot from central banks away from policy tightening. Currently the US jobs market, for example, appears to not be cooling enough, given mixed data. Non-farm payrolls growth is starting to moderate, but average hourly earnings ticked up in the November 2022 release.

Source: Refinitiv Datastream, Janus Henderson Investors, 15 November 2022.

A broad repricing of risk-free yields has made credit more attractive. Regardless of which investment pool you swim in, in our view, it feels sensible to start the year on the safer side. This may mean shifting portfolios ‘up in quality’ by, for example, looking at high-grade securitisation, such as AAA- or AA-rated collateralised loan obligations, and other more senior parts of securitisations in Europe and the US. Nevertheless, the risk of further spread widening will have passthrough even to the high-quality end of the market. So, understanding how much recession risk is priced into spreads today is key for investors. In our view, high grade securitisations are pricing in greater recession risk than other credit markets, particularly as recent rallies on optimism about potential policy pivots (a pause or a slowdown in the pace of interest rate hikes) has seen spreads retrace from their recent wides, US high yield bonds being just one example.

Even amid a weakening global economy, we expect to see opportunities to uncover resilient corporates in the sub-investment grade (sub-IG) and high yield (HY) markets. Given the widening seen in 2022 (even though spreads may still move wider in the near term), overall yields still look attractive from a total return perspective on a longer two- to three-year timeframe in our view. The difficult macro backdrop may lead to higher defaults, but the yields on offer should still, in our view, offer decent excess return potential over the long-term, particularly for a carefully constructed credit portfolio. This, to us, highlights the importance of flexibility in portfolios to allow for optionality to find the best areas to swim, and potentially add market risk (beta) as relative value emerges across different areas of global markets.

2022 saw the outperformance of less interest rate sensitive assets, such as loans and asset-backed securities, given their floating rate characteristics. Should rates volatility subside in 2023 as central banks tackle inflation, the duration impact on traditional fixed rate credit, such as IG and HY, should be less of a drag on total returns. The jury is out though on the success of the battle against inflation and whether we have fully dealt with these concerns. While we do not expect to see the same level of divergence between fixed income asset class performance in 2023 as in 2022, we believe that investors would be prudent to maintain diversification.

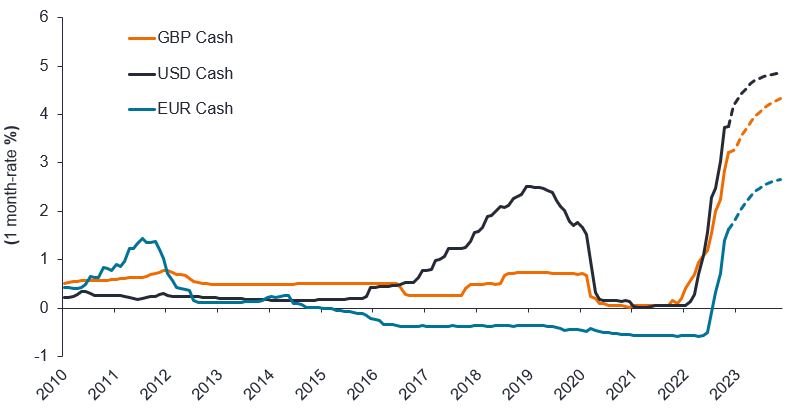

As short-term yields have repriced sharply higher, outpacing the rise in long-term yields, there is also less need to own duration (or interest rate risk) to capture additional yield. Uncertainty persists around the eventual level of peak short-term or cash interest rates, and longer-term inflation and rate expectations. So, while fixed rate bonds could benefit from capital gains if interest rates are cut, causing yields to reprice lower, there remains the risk that interest rates remain elevated in 2023. Cash rates across the euro, sterling and dollar market have repriced significantly higher and are forecasted to climb even more next year. This means that yields on floating rate assets are receiving a boost from higher underlying cash rates, creating attractive carry that should buoy up the return potential of portfolios. That said we do see a benefit in adding some duration to portfolios, which may prove helpful as growth slows and inflation is controlled.

Source: Janus Henderson Investors, Bloomberg, ICE, as at 30 November 2022.

Notes: Data is based on 1-month Libor up to 31 December 2020, then SONIA, ESTR, SOFR 1-month rates. Forward rates based on overnight indexed swap (OIS) curves.

There is no guarantee that past trends will continue, or forecasts will be realised.

Given better forward-looking returns, is it even necessary to be in the risk pool at all? After over a decade at depressed levels, risk-free rates (rfrs) have begun to look attractive. So, it remains to be seen how much investors will feel the need to chase additional duration, liquidity or default risk premia in addition to a rfr – with the uncertain outlook encouraging caution.

The pursuit of higher yields by venturing into private markets seen over the last several years could shift to a different pool – public markets. That desire to chase yield has lessened and investors could feel they can stick to public markets and still capture decent returns. The attractive carry in secured credit, with its floating rate characteristics, could help investors navigate 2023.

Beta: Measure of a portfolio or security, with regards to its relationship with the overall market. The beta of a market is always 1. A portfolio with a beta of 1 means that if the market rises 10%, so should the portfolio. A portfolio with a beta more than 1 means it will likely move more than the market average. A beta less than 1 suggests the portfolio and market will move in opposite directions.

Carry: A typical definition is the benefit or cost of holding an asset. For a bond investor this includes the interest paid on the bond together with the cost of financing the investment and potential gains or losses from currency changes. Note that the meaning of ‘carry’ is dependent on the context used.

Default: The failure of a debtor (such as a bond issuer) to pay interest or to return an original amount loaned when due.

Excess returns: The difference between a security or portfolio’s return and the relevant benchmark’s return. Also often called ‘relative return’.

Duration: How far a fixed income security or portfolio is sensitive to a change in interest rates, measured in terms of the weighted average of all the security/portfolio’s remaining cash flows (both coupons and principal). It is expressed as a number of years. The larger the figure, the more sensitive it is to a movement in interest rates. ‘Going short duration’ refers to reducing the average duration of a portfolio. Alternatively, ‘going long duration’ refers to extending a portfolio’s average duration.

Floating rate: A floating interest rate refers to a variable interest rate that changes over the duration of the debt obligation, usually pinned to a benchmark, such as the US Federal Reserve rate.

Diversification: A way of spreading risk by mixing different types of assets/asset classes in a portfolio. It is based on the assumption that the prices of the different assets will behave differently in a given scenario. Assets with low correlation should provide the most diversification.

Loans: Privately issued debt from non-investment grade companies, generally secured against company assets and that rank first in priority of payment. Interest payments are linked to money market rates.

Asset-backed securities: A financial security which is ‘backed’ with assets such as loans, credit card debts or leases. They give investors the opportunity to invest in a wide variety of income-generating assets.

Premium: When the market price of a security is thought to be more than its underlying value, it is said to be ‘trading at a premium’. Within investment trusts, this is the amount by which the price per share of an investment trust is higher than the value of its underlying net asset value. Premium is the opposite of discount (security price trading lower than the underlying value).

Risk-free rate: The rate of return of an investment with, theoretically, zero risk. Typically defined as the yield on a three-month US Treasury bill (a short-term money market instrument).

Liquidity: The ability to buy or sell a particular security or asset in the market. Assets that can be easily traded in the market (without causing a major price move) are referred to as ‘liquid’.

Credit spread: The difference in the yield of corporate bonds over equivalent government bonds.

High yield bond: A bond which has a lower credit rating below an investment grade bond. It is sometimes known as a sub-investment grade bond. These bonds usually carry a higher risk of the issuer defaulting on their payments, so they are typically issued with a higher coupon to compensate for the additional risk.

Yield: The level of income on a security, typically expressed as a percentage rate. For equities, a common measure is the dividend yield, which divides recent dividend payments for each share by the share price. For a bond, this is calculated as the coupon payment divided by the current bond price.

Inflation: The rate at which the prices of goods and services are rising in an economy. The CPI and RPI are two common measures. The opposite of deflation.

Fundamental analysis: The analysis of information that contributes to the valuation of a security, such as a company’s earnings or the evaluation of its management team, as well as wider economic factors. This contrasts with technical analysis, which is centred on idiosyncrasies within financial markets, such as detecting seasonal patterns.

Monetary policy: The policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money. Monetary stimulus refers to a central bank increasing the supply of money and lowering borrowing costs. Monetary tightening refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money

Credit rating: A score usually given by a credit rating agency such as Standard & Poors, Moody’s and Fitch on the creditworthiness of a borrower. Standardised scores such as ‘AAA’ (a high credit rating) or ‘B’ (a low credit rating) are used however can vary depending on the credit rating agency. Moody’s, another well-known credit rating agency, uses a slightly different format with Aaa (a high credit rating) and B3 (a low credit rating).

Collateralised loan obligations: A collateralised loan obligation (CLO) is a single security backed by a pool of debt. The process of pooling assets into a marketable security is called securitization.

Investment grade: A bond typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments. The higher quality of these bonds is reflected in their higher credit ratings when compared with bonds thought to have a higher risk of default, such as high-yield bonds.

IMPORTANT INFORMATION

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

High-yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.

Foreign securities are subject to additional risks including currency fluctuations, political and economic uncertainty, increased volatility, lower liquidity and differing financial and information reporting standards, all of which are magnified in emerging markets.

Collateralised Loan Obligations (CLOs) are debt securities issued in different tranches, with varying degrees of risk, and backed by an underlying portfolio consisting primarily of below investment grade corporate loans. The return of principal is not guaranteed, and prices may decline if payments are not made timely or credit strength weakens. CLOs are subject to liquidity risk, interest rate risk, credit risk, call risk and the risk of default of the underlying assets.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Volatility measures risk using the dispersion of returns for a given investment.

Credit Spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

Carry is the excess income earned from holding a higher yielding security relative to another.