Subscribe

Sign up for timely perspectives delivered to your inbox.

The key events of 2022, the challenges and surprises faced by the economy and what to expect in the year ahead.

There was no shortage of surprises over 2022 – it has been a year like no other. Even before Russia’s invasion of Ukraine in late February, it was becoming more evident that demand side factors (fuelled by massive Pandemic fiscal and monetary support), as well as supply side factors, were playing a role in driving inflation higher.

“Despite the rapid monetary tightening, periodic flooding in the east coast and COVID-19 breakouts, the economy has been surprisingly resilient.”

The subsequent policy pivot by central banks, including the Reserve Bank of Australia (RBA), was astounding.

After beginning the year signalling patience, the RBA lifted the cash rate from 0.10% to 2.85% between May and November, swiftly taking policy settings from accommodative to the tighter side of neutral. At the time of writing, a further 25 basis points of tightening is expected following the RBA’s December meeting.

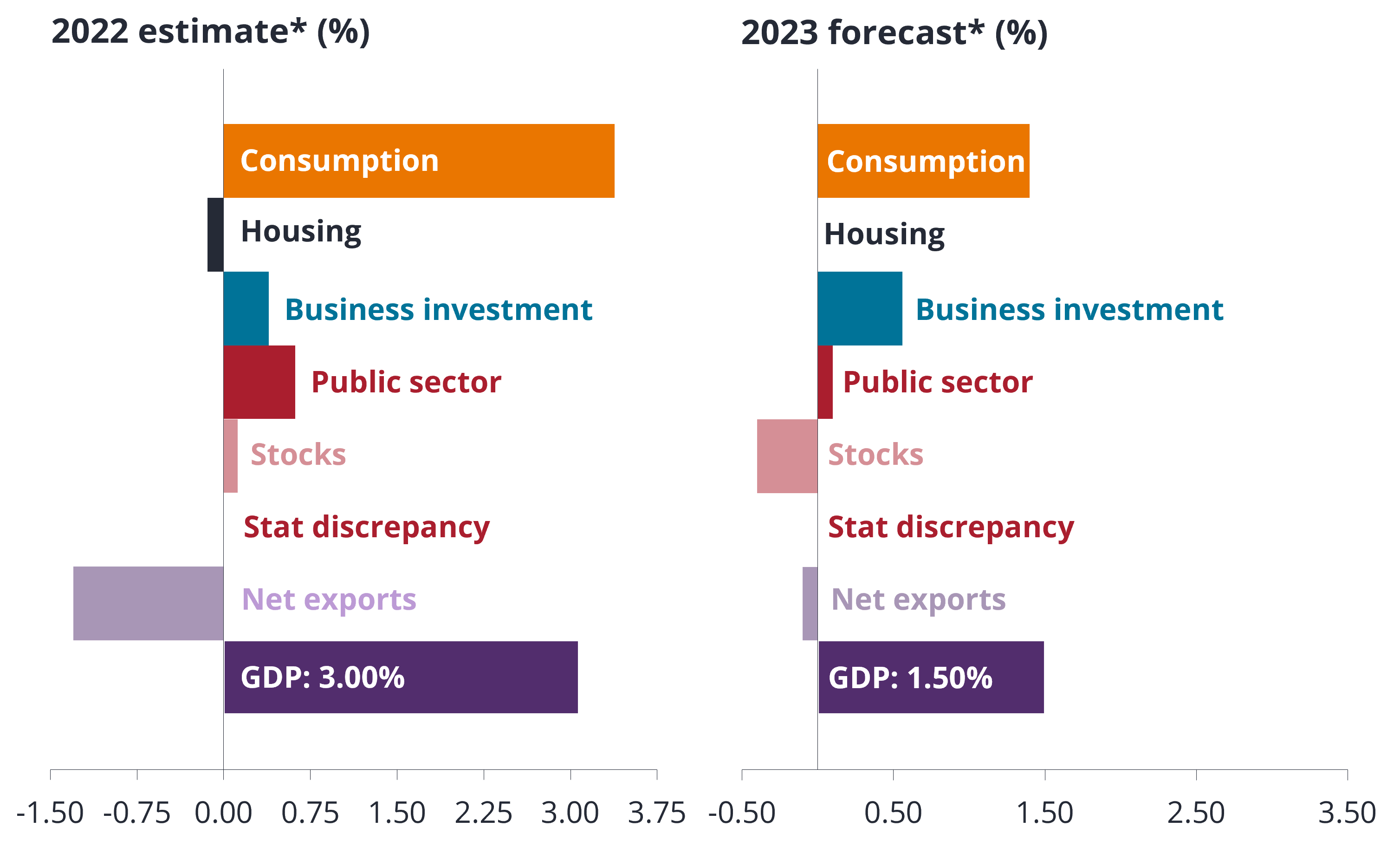

Despite the rapid monetary tightening, periodic flooding in the east coast and COVID-19 outbreaks, the economy has been surprisingly resilient, with business conditions remaining at high levels. The economy is poised to grow by around 3% over the year.

Labour market conditions remained relatively robust, with the unemployment rate falling from 4.2% in January to 3.4% in November. While activity levels have held up so far, consumer confidence plummeted in the face of rising cost of living pressures.

Inflation broadened and rose more than expected, looking set to peak at around 8% by year end. Demand and supply factors both played a role, with the Russia/Ukraine conflict pushing food and energy prices higher.

We expect to see the impacts of rapid monetary tightening progressively show up as we go through 2023. In our view, tightening monetary conditions and slowing consumer spending will see the rate of economic growth halve to 1.5% over 2023. Such a growth rate is below Australia’s trend growth rate, and we should see some slack emerge that helps resolve demand and supply imbalances.

Source: ABS, last actual June quarter 2022, # ppt = percentage point. Note: *Janus Henderson Investors forecasts of y/y GDP growth with percentage point contributions from GDP components. Forecast numbers are estimated projections only based on internally generated research.

While a recession is not our base case, it remains a significant risk given the uncertain paths for the Russia/Ukraine conflict, energy prices and offshore central bank tightening.

Inflation is yet to be vanquished, but is set to slowly ease towards the top end of the RBA’s 2%-3% target band over the next couple of years.

Nearer term, inflation pulses are expected to come from higher fruit and vegetable prices following recent flooding and the re-introduction of fuel excise rates in the December quarter. Higher gas and electricity charges will also be a significant driver of inflation over 2023.

With few signs yet of a significant slowing in activity and risks that the latest round of inflation pulses end up being recycled into a higher core inflation rate via pass-through effects, the RBA has little choice but to tighten monetary conditions further.

Our base case view is that the cash rate peaks at a moderately restrictive 3.6% in mid-2023, making the current tightening cycle the largest and fastest in the monetary policy inflation targeting era.

As we expect to see growth and inflation decelerate over 2023, the door opens for the RBA to take its foot off the monetary breaks in 2024 and begin bringing monetary settings back towards more neutral levels.

We see the balance of risks tilted towards our high case scenario, one where the RBA has to do more to stop higher inflation becoming entrenched. In this scenario, the cash rate is expected to peak at a restrictive 4.35% by the end of 2023 and remain at that level until late 2024.