Subscribe

Sign up for timely perspectives delivered to your inbox.

This year, investor sentiment has sunk amid a historically challenging economy. Is consensus now the right place to be, or do investors run the risk of missing out on some of the best long-term buying opportunities? The Portfolio Construction and Strategy Team explain why now might be an important time to be brave while others flee.

2022 has been difficult for many reasons. Not just because of challenged market and economic conditions, but also due to the fact that these challenges have come off the back of a torrid two years from the start of the COVID-19 pandemic. This year was heralded as the return to normality, yet at times it feels like there is as much uncertainty today as there was in 2020. Investors are understandably jaded and jumpy.

However, we do believe there does become a stage where sentiment in markets reaches such a low point that the most material surprises are likely to be on the upside.

Given the relentless negative press on global economic conditions and the markets, trying to find any positive views is challenging. This is reflected in sentiment indicators that have now hit record lows.

| University of Michigan Consumer Sentiment Index | OECD Consumer Confidence Index1 | |||

| 1. | Jun 2022 | 55.31 | Sept 2022 | 96.463 |

| 2. | Jul 2022 | 56.97 | Aug 2022 | 96.464 |

| 3. | Nov 2008 | 61.17 | July 2022 | 96.467 |

| 4. | Aug 2011 | 61.73 | June 2022 | 96.669 |

| 5. | Feb 2009 | 62.28 | Jan 2009 | 96.704 |

Source: Bloomberg, OECD, Janus Henderson Investors. Data runs from January 1987 to 30 September 2022.

It takes a level of courage to start considering an opposing market view. Yet we feel that this is an avenue worth exploring for investors who have the risk tolerance to accept volatility in the immediate term.

The best long-term investment entry points rarely occur during times of market exuberance but can be found during periods of deep declines and low market confidence.

It is important to note, however, that we can’t say where the bottom of the market is – no one can. In this current market environment, there are simply too many variables. As such, there remains a strong chance that markets could decline further.

However, what we do know with certainty is that markets go through boom-and-bust cycles.

If we go back to the sentiment indices shown in the previous table and remove 2022 from the equation, it is interesting to see what happened to equity markets in the subsequent one and three years from these low readings, as shown in exhibit 2.

| University of Michigan Consumer Sentiment Index | OECD Consumer Confidence Index |

|||||

| Base month | 1-year return | 3-year return | Base month | 1-year return | 3-year return | |

| 1. | Nov 2008 | +29% | +33% | Jan 2009 | +33% | +48% |

| 2. | Aug 2011 | +6% | +44% | Feb 2009 | +51% | +73% |

| 3. | Feb 2009 | +51% | +73% | Dec 2008 | +27% | +29% |

Source: Global Equities Returns as measured by the MSCI World Index, excluding 2022. Bloomberg. OECD. Janus Henderson Investors, as at 30 September 2022.

While we are looking at very few data points, and therefore must be cautious with drawing conclusions, what we do see is that in all but 2011, global equities recovered materially with 12 months, and all produced strong 3-year returns.

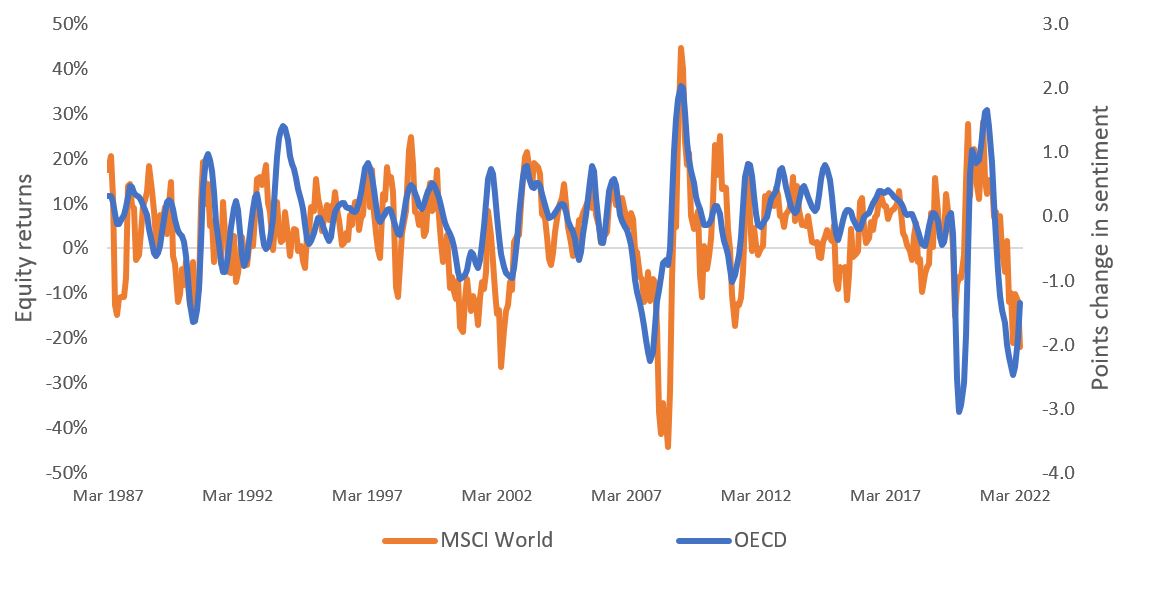

Historically, there has been a clear link between confidence levels and equity returns. At the time of this writing, the Confidence Index is declining at a slowing rate, which has yet to be reflected in equity market returns.

Source: Global Equities Returns as measured by the MSCI World Index. Bloomberg. OECD. Janus Henderson Investors, as at 30 September 2022.

Source: Global Equities Returns as measured by the MSCI World Index. Bloomberg. OECD. Janus Henderson Investors, as at 30 September 2022.

In many of our recent client consultations, the Janus Henderson Portfolio Construction and Strategy (PCS) team has been hearing of a universal fear of markets, a desire to remain “risk off,” and, in some cases, “closing up shop” for the rest of the year.

However, when we look through history, environments such as these have been the critical moments where being brave as others flee have presented the best buying opportunities. That is not to say markets will suddenly recover – markets may well continue to struggle. But at some point, that will change. Time will tell whether we are at, near, or some ways away from the bottom of the market. But what we can say with certainty is that markets always recover, and right now we are an awfully long way from the top.

IMPORTANT INFORMATION

Investing involves risk, including the possible loss of principal and fluctuation of value.

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

1 The Organization for Economic Cooperation and Development (OECD) consumer confidence indicator provides an indication of future developments of households’ consumption and saving, based upon answers regarding their expected financial situation, their sentiment about the general economic situation, unemployment and capability of savings. An indicator above 100 signals a boost in the consumers’ confidence towards the future economic situation, as a consequence of which they are less prone to save, and more inclined to spend money on major purchases in the next 12 months. Values below 100 indicate a pessimistic attitude towards future developments in the economy, possibly resulting in a tendency to save more and consume less.

MSCI World Index℠ reflects the equity market performance of global developed markets.

Index performance does not reflect the expenses of managing a portfolio as an index is unmanaged and not available for direct investment.

Thomson Reuters/University of Michigan Consumer Sentiment Index is a barometer of the U.S. economy based on a monthly survey of consumers’ attitudes about present conditions and expectations of future economic activity.