Subscribe

Sign up for timely perspectives delivered to your inbox.

With elevated inflation, higher rates, and slowing growth likely to stress markets in 2023, Portfolio Manager Jeremiah Buckley shares his outlook, explaining why he believes company-level factors will shape longer-term progress for U.S. equities.

U.S. equity markets have shifted dramatically since the beginning of the year. On the first trading day of 2022, the S&P 500® Index reached its all-time high. Markets promptly reversed course as investors − and the Federal Reserve (Fed) – began to recognize inflation as a more persistent risk than many had anticipated. As we approach 2023, markets remain almost wholly consumed with that risk, as we have seen in the dramatic swings related to key economic data points and the Fed’s policy decisions. Recent numbers suggest some easing in inflation, but a litany of nagging factors − the Russia-Ukraine war, labor shortages, resilient consumer spending, de-globalization, restrictions on cross-border trade, and global currency fluctuations – have conspired to keep upward pressure on prices.

Investors are closely watching economic data in anticipation of the eventual resting point for interest rates, which will be critical in gauging future growth potential and company valuations. Any signal that the Fed could moderate the pace of tightening would settle markets. A cooling of flaring geopolitical tensions would have the same effect. Improved relations between the U.S. and China and/or resolution in the Russia-Ukraine war could eliminate some cross-border trade restrictions and alleviate supply chain disruptions and bottlenecks.

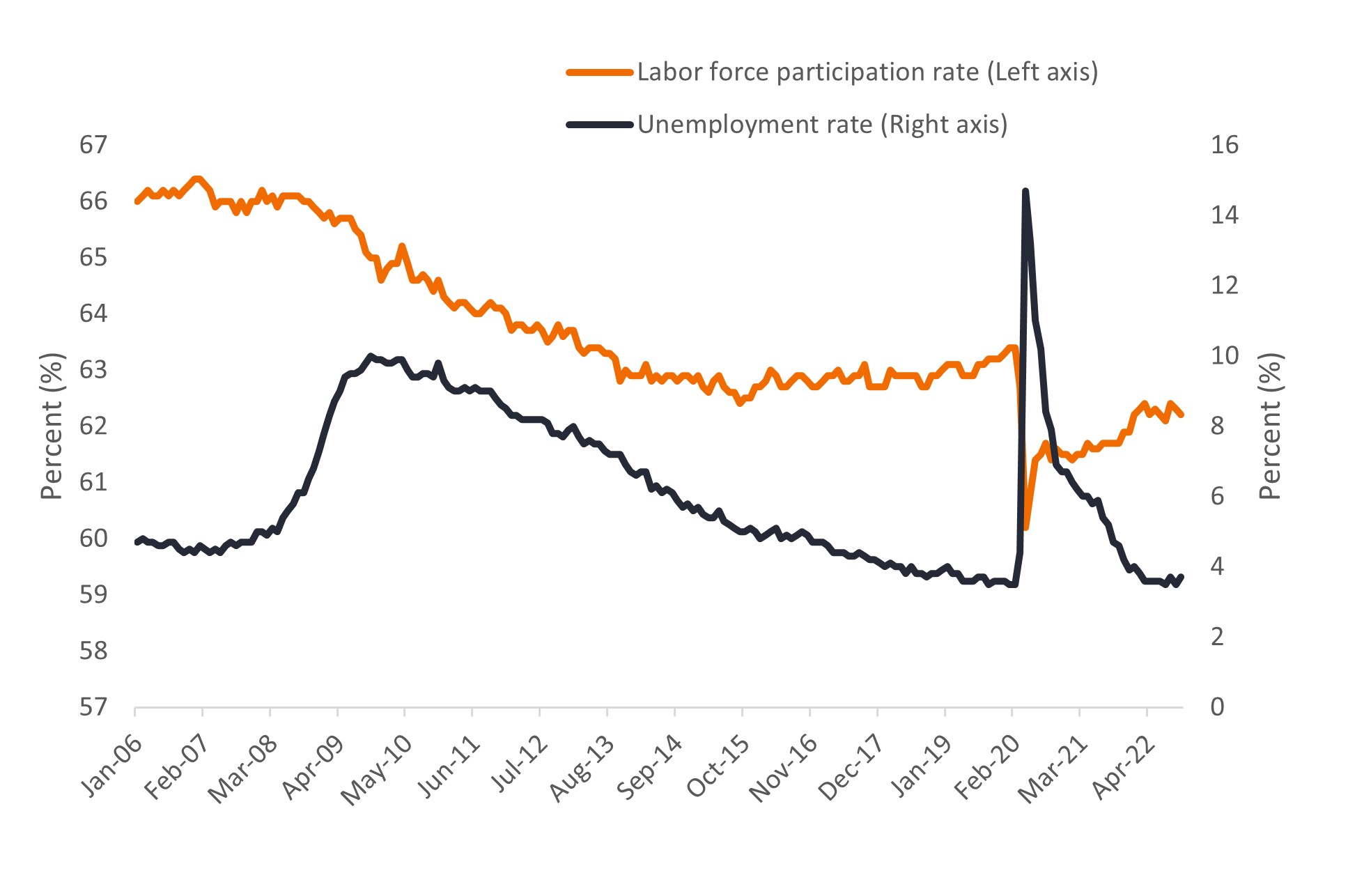

While high-profile supply disruptions – in oil, natural gas, semiconductors, and agricultural products, for instance − have risen to the forefront, we believe that a shortage of labor supply is one risk that may be underappreciated. As the economy settles into the endemic phase of COVID, many believed that more people would rejoin the workforce, thus alleviating labor supply constraints. Although labor force participation has been grinding slowly higher since the peak of the pandemic, it has remained stubbornly low compared to pre-pandemic levels, as seen in Figure 1 below. At the same time, the unemployment rate remains near record lows. The result has been a significant uptick in wages, adding yet another inflationary force to the mix. An increase in labor force participation would help contain this wage inflation, and improving labor productivity, which has also declined in the first three quarters of 20221, would help ease businesses’ need to hire additional workers.

Source: U.S. Bureau of Labor Statistics, retrieved from FRED, Federal Reserve Bank of St. Louis, Labor Force Participation Rate, Unemployment Rate, Seasonally Adjusted, as at 15 November 2022.

Source: U.S. Bureau of Labor Statistics, retrieved from FRED, Federal Reserve Bank of St. Louis, Labor Force Participation Rate, Unemployment Rate, Seasonally Adjusted, as at 15 November 2022.

With the Fed applying pressure in the form of higher rates, slowing economic growth may also begin to ease some wage growth, but for now it continues to increase company costs while simultaneously providing more cash to individuals for spending. Indeed, consumer strength has been consistent since the pandemic, supported not only by higher wages but also government stimulus and, until recently, strong housing and capital markets. Government stimulus has now waned, and personal savings have diminished as a result. Meanwhile, higher rates have begun to make their impact felt on both the housing and investment portions of household balance sheets. These forces could begin to push down inflation as their effects ripple through the economy in the coming year.

For now, we believe consumer spending will prove to be resilient. While spending on goods has begun to shrink post-pandemic, spending on services continues to grow. Given the adjustments to valuations in the consumer discretionary sector – which has been among the hardest hit this year − some opportunities have become attractive for investors with a longer holding period.

Within the information technology sector, we still believe digital transformation and the shift to the cloud are creating economic value for both customers applying these technologies and their providers. Hence, we continue to see opportunities in the software and services industry. Technology hardware is an industry segment that appears less attractive due to weakness in personal computer (PC) sales and maturing smartphone demand.

While the labor market remains tight, as employment improves in the healthcare sector, we should see recovering volumes in medical technology and services.

Energy has been the standout performer this year in the S&P 500. While there are concerns about demand growth and increased regulation as the world transitions to greener energy sources, we have seen improved capital discipline in the sector, making it potentially more attractive.

Equity multiples appear to be in a reasonable range now, and we are likely facing a market in the coming year that is less thematic. Rather than broad groups of stocks leading based on general trends or factors, we believe relative performance will be more dependent on dynamics at the individual company level. In this market, innovation in products and services, effective capital allocation, and management’s ability to contain costs and gain productivity from resources (both physical resources and labor) as well as the skill to utilize capacity at efficient levels will all be integral in determining companies’ growth. While day-to-day market swings and volatility will almost certainly continue, capital appreciation going forward will likely be driven by whether companies can grow earnings along the lines of these factors.

1 U.S. Bureau of Labor Statistics, Nonfarm Business Sector: Labor Productivity (Output per Hour) for All Employed Persons, as at 16 November 2022.

Industrial industries can be significantly affected by general economic trends, changes in consumer sentiment, commodity prices, government regulation, import controls, and worldwide competition, and can be subject to liability for environmental damage and safety.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

IMPORTANT INFORMATION

Consumer discretionary industries can be significantly affected by the performance of the overall economy, interest rates, competition, consumer confidence and spending, and changes in demographics and consumer tastes.

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.