Subscribe

Sign up for timely perspectives delivered to your inbox.

Greg Wilensky, Head of U.S. Fixed Income, discusses his 2023 investment outlook, including the opportunities and risks he sees in U.S. core fixed income as we head into the new year.

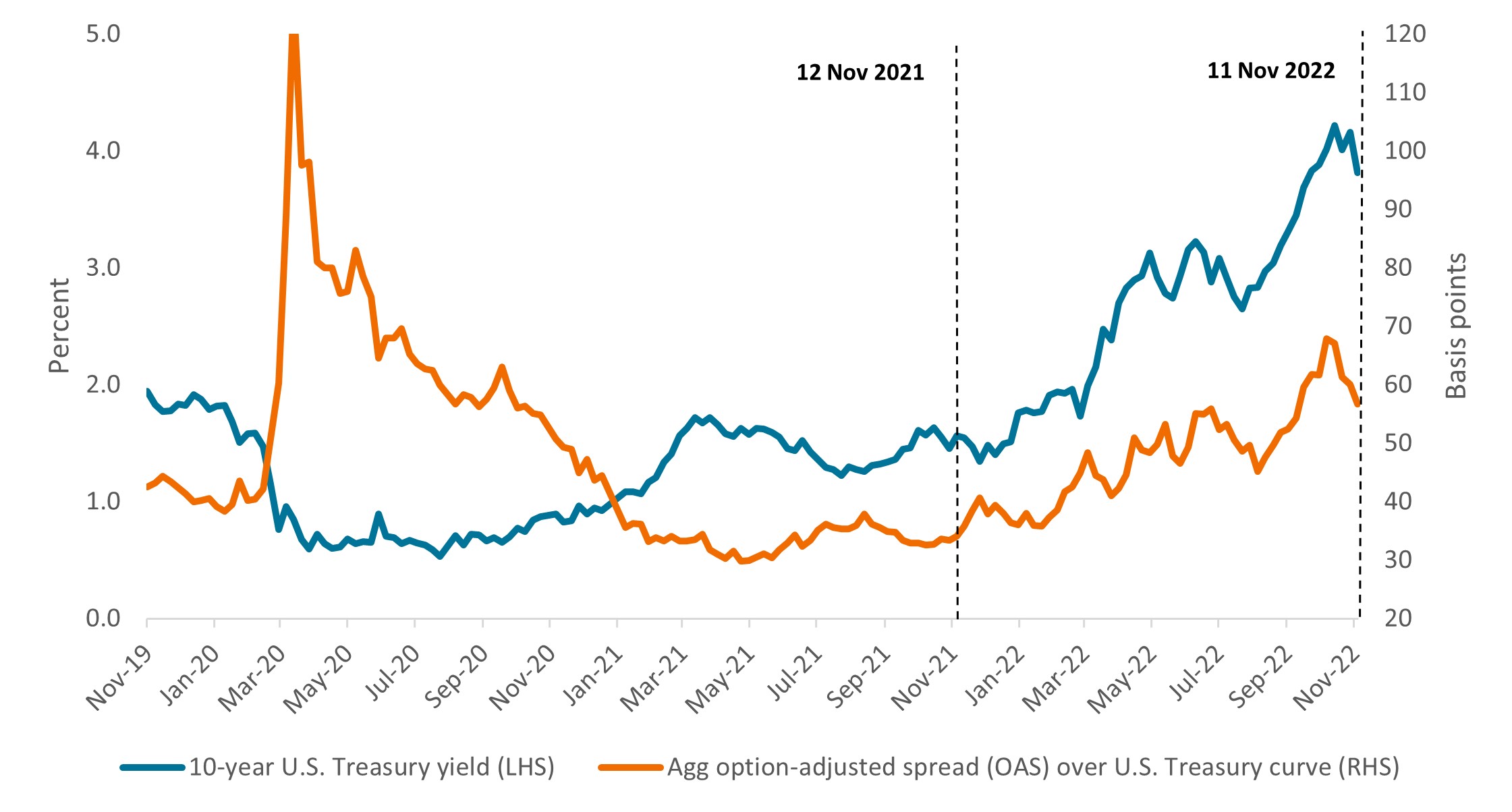

As we look toward 2023 and consider the prospects for U.S. core fixed income in the year ahead, it seems appropriate to first reflect on where we stood just one year ago. The two drivers of fixed income asset prices – interest rates and spreads – were in a very different place heading into 2022, as shown in Exhibit 1. While yields had risen off their COVID-era floor, they were still at historically low levels, supported by the Federal Reserve’s (Fed) prevailing zero interest-rate policy and $120 billion per month in quantitative easing (QE). At the same time, spreads were extremely tight, as record government stimulus had bolstered balance sheets, the economy had recovered from COVID shutdowns, and there was an increased risk appetite among investors.

Today, U.S. core fixed income is in a very different place – perhaps more beaten down after a tough year, but also, in our view, better positioned for positive risk-adjusted returns. While spread widening has taken place, the more significant development has been the sharp rise in yields, driven by the Fed’s aggressive pivot to monetary tightening in its attempt to rein in runaway inflation.

Exhibit 1: What a difference a year makes

Higher yields and spreads imply a better starting point heading into 2023.

Source: Bloomberg, as of 11 November 2022. The Bloomberg U.S. Aggregate Bond Index (Agg) is a broad-based measure of the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. Option-Adjusted Spread (OAS) measures the spread between a fixed-income security rate and the risk-free rate of return, which is adjusted to take into account an embedded option.

Notwithstanding the fact that we are starting from a better place, where we go from here will likely hinge on how rapidly (or slowly) inflation comes down. While goods inflation was largely driving higher prices in 2021, services and wage inflation – which tends to be stickier – has recently taken the lead. In response, the Fed has moved aggressively this year, hiking rates to 4.00% so far to cool the economy and the tight labor market.

The looming question is how much weakness we will need to see in the economy, and specifically in the labor market, to bring down wages and service sector inflation. If wages and services inflation display a high correlation to economic and labor market weakness, this could be positive for bond prices, as the Fed will likely not have to raise rates as far, or for as long, and the economic pain can ostensibly be contained. However, if the correlation is lower and inflation remains sticky despite a cooling economy, the Fed may be forced to go higher and remain there for longer. In that scenario, we would probably see a deeper recession and higher default rates, resulting in more economic pain. In our view, this is the most underappreciated risk in markets today – that inflation could be slow to come down even as the economy weakens.

That said, we did see inflation come down slightly recently, with October’s core inflation reading coming in at 6.3% year over year, down from its 6.7% peak in September. While it is promising to see some peaking in the underlying drivers of higher prices, we will need to see inflation continue to fall for several months before concluding that it’s trending down. We are still a long way from 2%, and seldom does a data series move linearly. Therefore, cautious optimism might be the best way for investors to approach their rate expectations in the coming year.

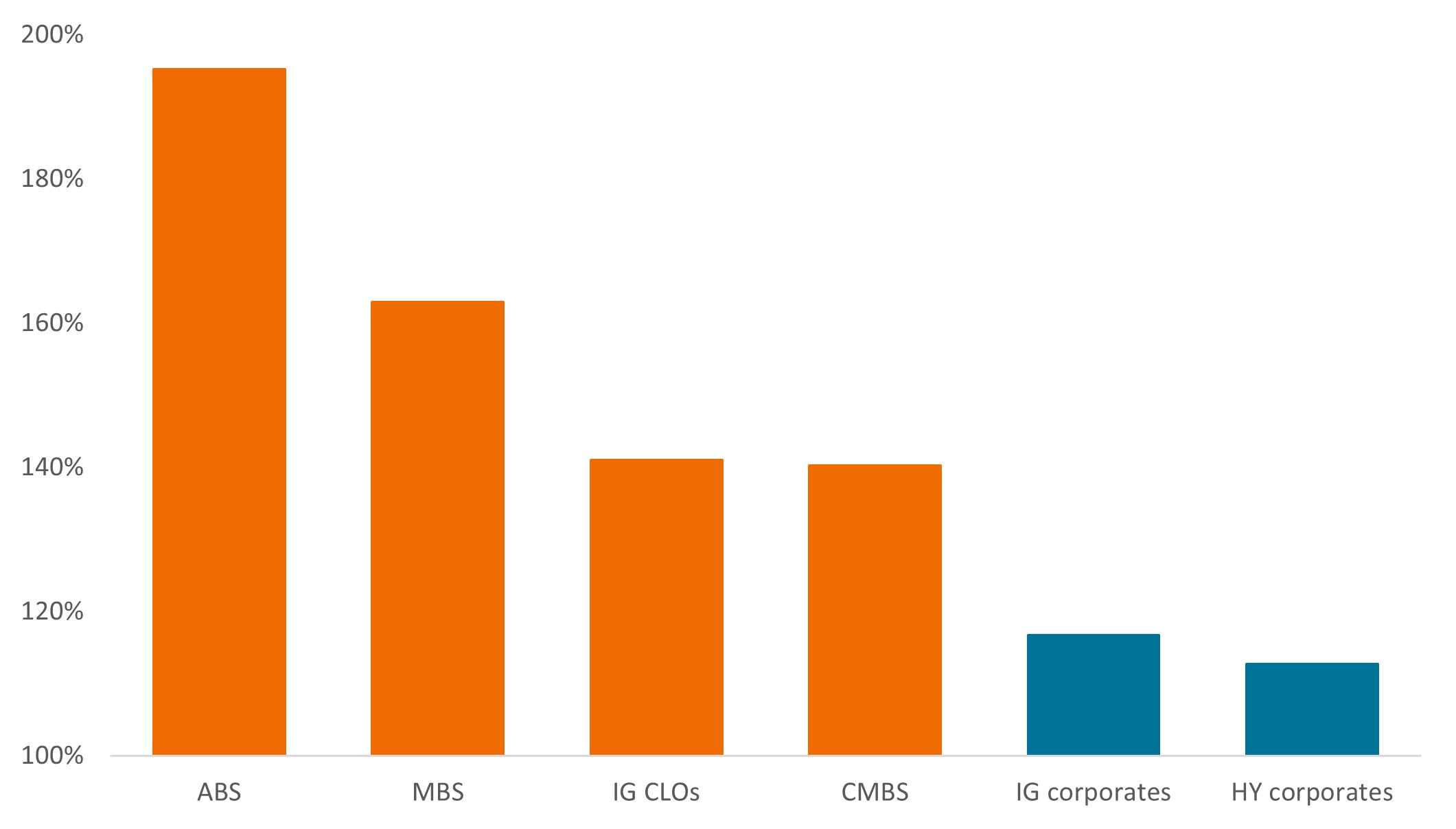

While we’ve witnessed some spread widening across all sectors in 2022, the magnitude thereof has been bifurcated. Notably, spreads on securitized assets have widened substantially more than spreads on corporate bonds, as shown in Exhibit 2. In our view, spreads on securitized sectors imply they are being priced for a recession, whereas corporates are trading only slightly above their 10-year averages. Therefore, we think this is an excellent relative value trade. If we do go into a recession in 2023, corporate spreads are likely to widen to reflect the risks that securitized assets are already pricing in. If a recession does not materialize, then we think securitized spreads should tighten even more, providing a tailwind for returns in those sectors.

Relative to corporates, securitized sectors are trading much wider than their 10-year averages.

Source: Bloomberg, as of 11 November 2022. Indices used to represent asset classes: ABS (Bloomberg U.S. Agg ABS Index), MBS (Bloomberg U.S. MBS Index), IG CLOs (JP Morgan CLOIE Investment-grade Index), CMBS (Bloomberg U.S. CMBS Investment Grade Index), IG corporates (Bloomberg U.S. Corporate Investment Grade Index), HY corporates (Bloomberg U.S. Corporate High Yield Index). Index performance does not reflect the expenses of managing a portfolio as an index is unmanaged and not available for direct investment.

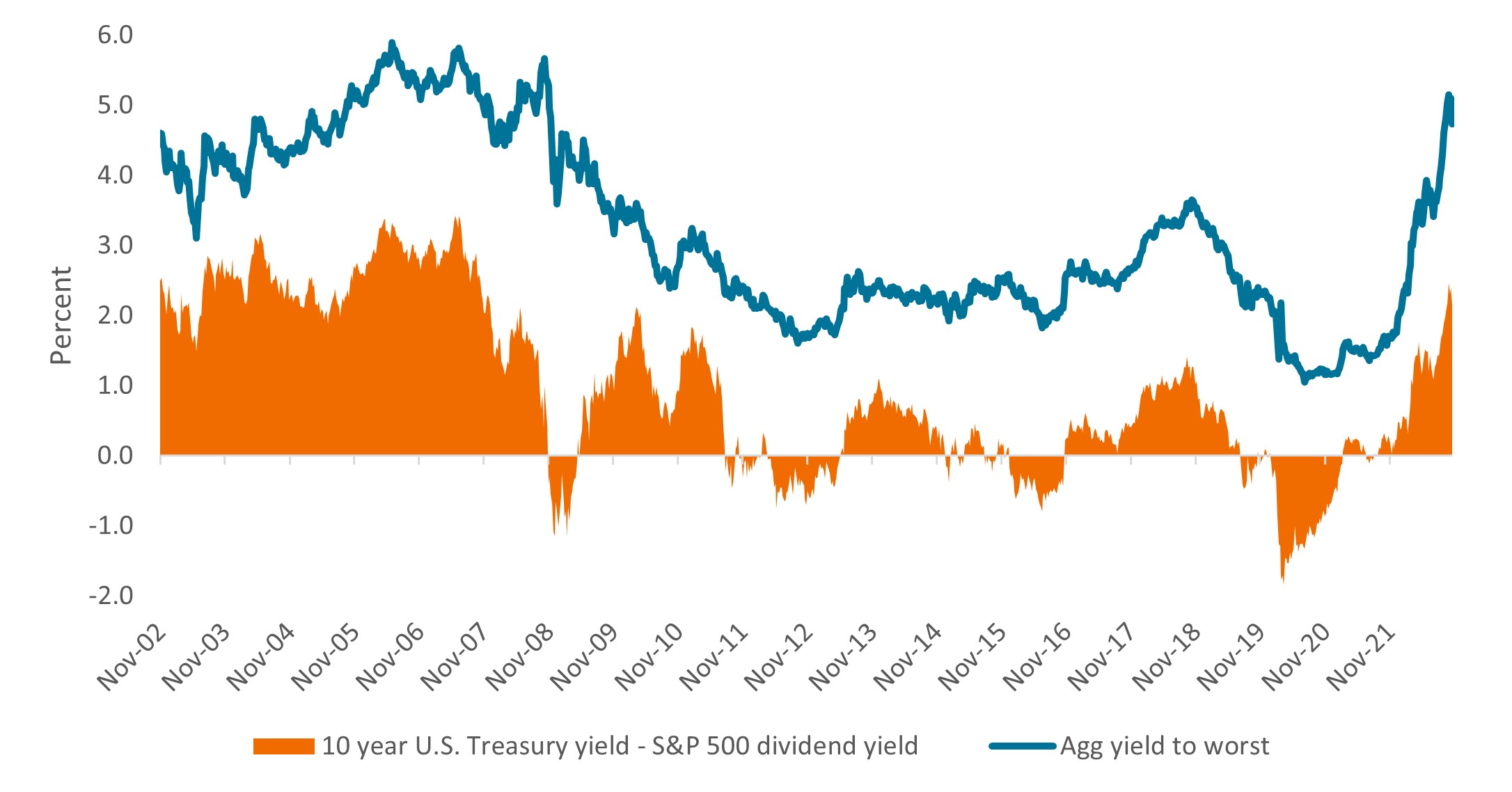

While the short-run view remains cloudy, we believe the long-run view for fixed income looks quite sunny. As previously mentioned, the starting point of higher yields – due to a combination of higher Treasury yields and wider spreads – will have a significant impact on expected intermediate and long-term returns. As shown in Exhibit 3, fixed income looks more attractive in both absolute and relative terms than it has since the Global Financial Crisis. Investors are finally getting the “income” they expect from their fixed income allocations, and TINA (there is no alternative to stocks) can no longer claim to be the prevailing mantra.

Source: Bloomberg, Janus Henderson Investors, as of 11 November 2022.

On a final note, we do expect market volatility to continue in 2023, although we anticipate it will come down as the Fed gets closer to the end of its rate hiking cycle. While higher volatility in the short run can be unnerving for investors, it can be seen as an opportunity for active managers to add assets at favorable prices in pursuit of better risk-adjusted returns. The key here is to maintain a nimble, research-driven approach, and to be disciplined in executing one’s strategy.

Bond prices generally move in the opposite direction of interest rates, thus bond prices may decline as interest rates rise, and vice versa.

Collateralized Loan Obligations (CLOs) are debt securities issued in different tranches, with varying degrees of risk, and backed by an underlying portfolio consisting primarily of below investment grade corporate loans. The return of principal is not guaranteed, and prices may decline if payments are not made timely or credit strength weakens. CLOs are subject to liquidity risk, interest rate risk, credit risk, call risk and the risk of default of the underlying assets.

Credit Spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Quantitative Easing (QE) is a government monetary policy occasionally used to increase the money supply by buying government securities or other securities from the market

Securitized products, such as mortgage- and asset-backed securities, are more sensitive to interest rate changes, have extension and prepayment risk, and are subject to more credit, valuation and liquidity risk than other fixed-income securities.

Volatility measures risk using the dispersion of returns for a given investment.

IMPORTANT INFORMATION

Collateralized Loan Obligations (CLOs) are debt securities issued in different tranches, with varying degrees of risk, and backed by an underlying portfolio consisting primarily of below investment grade corporate loans. The return of principal is not guaranteed, and prices may decline if payments are not made timely or credit strength weakens. CLOs are subject to liquidity risk, interest rate risk, credit risk, call risk and the risk of default of the underlying assets.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Securitized products, such as mortgage- and asset-backed securities, are more sensitive to interest rate changes, have extension and prepayment risk, and are subject to more credit, valuation and liquidity risk than other fixed-income securities.