Subscribe

Sign up for timely perspectives delivered to your inbox.

Alistair Sayer, Client Portfolio Manager at Janus Henderson, revisits his thoughts on why investors’ need for real diversification could be a long-term driver of demand for liquid alternatives.

For over a decade, equities have been in vogue. The relentless rise of stock markets from the global financial crisis to 2022 ensured that ‘buying the dip’ was a successful investment strategy that, by a process of Darwinian selection, fuelled the rise of many a senior investor. But what underpinned this seemingly one-way bet?

Leading into 2022, equity dividend yields were dwarfing fixed income coupons, suppressed by lower and lower interest rates, which saw the multiples applied to equities skyrocket. It seemed irrelevant that many companies’ supercharged valuations were not underpinned by dividends at all; but were simply growth companies in a new paradigm – a shift in consumer demand for cleaner, more ethical and technologically pioneering investments.

However, with the advent of rampant and persistent inflation, TINA has ‘Turned’. Global equities are down more than 21% year to date, and equities can arguably no longer be ‘simply the best’ investment choice for investors. Concurrently, and at odds with the predominant trend this century, fixed income assets have also cratered in 2022 on the fears of rising interest rates. Hitherto in this century, bonds and equities had mostly delivered positive but uncorrelated returns. This low correlation enabled a diversified portfolio, commonly referred to as 60:40 (60% equities, 40% fixed income) to deliver a reasonably stable growth profile to investors.

The argument extends beyond the orthodox 60:40 multi-asset model, with losses uncannily similar, whatever the shape of the portfolio (Exhibit 1), during each of the different phases of 2022:

| Equity/ bond split |

Supply shock (Q1) | Over-tightening

End Q1-14 June |

Rates-relief rally

14 June-31 July |

Rate-fears return From 1 Aug |

Year to date |

| 20:80 | -6% | -12% | 6% | -9% | -20% |

| 40:60 | -5% | -13% | 7% | -9% | -20% |

| 40:60 | -5% | -14% | 7% | -8% | -20% |

| 60:40 | -5% | -15% | 7% | -8% | -20% |

| 80:20 | -4% | -16% | 8% | -8% | -20% |

Source: Bloomberg, Janus Henderson Investors, 31 December 2021 to 27 October 2022, returns in US dollars. Past performance does not predict future returns.

Note: The Indices used are Bloomberg Global Equity: Fixed Income Indices, BMADM28, BMADM46, BMADM55, BMADM64, BMADM82. Figures rounded to nearest whole percent.

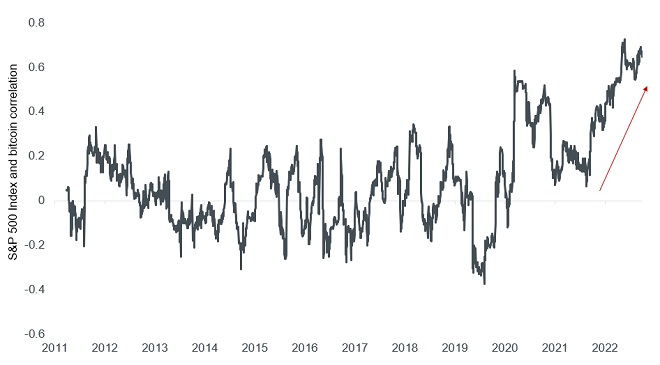

Periods of acute uncertainty can often leave few places to hide, and the risk is that rising risk aversion can fundamentally change how different asset classes interact. We see that in the performance of less regulated alternative (crypto)currencies, such as bitcoin, often touted as a potential diversifier for modern portfolios, yet is increasingly correlating with equities (Exhibit 2) in 2022.

Source: Bloomberg, Janus Henderson Investors, 3 January 2011 to 11 November 2022. A correlation of 1 implies perfect positive correlation, Past performance does not predict future returns.

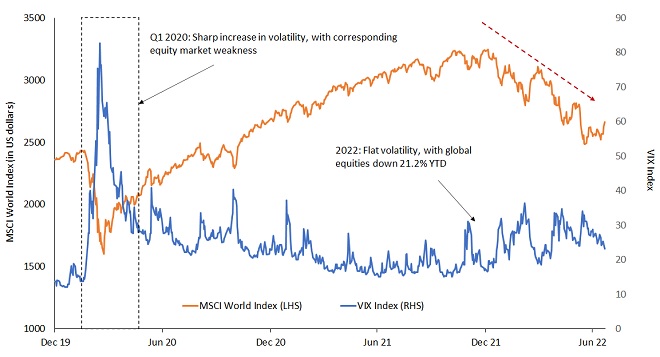

All this carnage to investors’ portfolios seems to be happening like a slow-motion car crash. Volatility, as measured by the VIX ‘fear’ index has risen, but at a gradual pace relative to the sell-off in asset markets (Exhibit 3). One argument for this is that the market became overheated by post-COVID government stimulus. Furloughed employees looking for entertainment, unemployment cheques being spent on the advice of Reddit forums, disruptive technologies driving change, etc. Whatever your choice of market elixir, it might be argued a correction was to be expected and what we are seeing is just the froth that is being blown off the top of the market. After all, based on the last decade of returns, investors are still in the money.

Source: Refinitiv Datastream, Janus Henderson Investors, 31 December 2019 to 31 October 2022. Past performance does not predict future returns.

The fall in markets in 2022 has been remarkably smooth, but if the VIX is to be believed, further volatility should be expected. This means that the asset allocation community faces some dilemmas. Has the correction thus far sufficiently priced in the expected risks? With equities losing a fifth of their value since the start of 2022, are they more or less attractive? Have credit markets priced in a sufficient level of defaults, making this an attractive point to add to positions? Or should investors seek diversification from these asset classes in anticipation of further negative returns to come? In short, should you buy, should you sell, or should you hide?

The quest for real diversification has been a driving force behind investors’ growing interest in alternatives in 2022. Investors who previously relied heavily on traditional equity/bond models have found themselves increasingly looking towards private markets and real assets, which are often quite illiquid, as they seek to manage inflation and rising rates’ consequent impact on traditional asset markets.

There are two problems we see with illiquid alternatives at present, such as private equity, real estate, venture capital, etc:

This is where a portfolio allocating to liquid diversified alternatives can prove to be attractive, offering potentially uncorrelated approaches with structurally different alphas, and if structured correctly, little correlation to stocks and bonds, with liquidity as needed. The liquid alternative end of the diversified alternatives space is really dominated by the multi strategy universe. And as the name implies, it is a combination of different ways of trying to generate returns for investors.

As we move into 2023, economic and market volatility is likely to persist, presenting new challenges and opportunities for investors. Alternatives are a constantly evolving part of the investment industry, and new ideas or opportunities are implicit in the growth of the alternatives universe. It can be well worth the effort to consider the potential role that alternatives can play in a balanced portfolio in such uncertain times.

Alternative allocations are typically regarded as satellite investments within a portfolio predominantly exposed to traditional equity and fixed income volatility. However, by leaving alternatives as a solely peripheral investment, the strong diversification that alternatives can offer can realistically only help to mitigate the risks presented by a core allocation to equities and bonds. It is likely a more significant allocation would be required to achieve stronger diversification benefits.

[1] MSCI World Index, 31 December 2021 to 31 October 2022, in US dollar terms.

—–

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. Any securities, funds, sectors and indices mentioned within this article do not constitute or form part of any other offer or solicitation to buy or sell them.

Past performance is not a guide to future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

This information in this article does not qualify as an investment recommendation.

For professional investors only | Marketing communication | Not for onward distribution