Subscribe

Sign up for timely perspectives delivered to your inbox.

Following a year that has tested the diversification and resilience of traditional strategies built around the ‘core’ asset classes of equities and bonds, David Elms and Steve Cain consider the opportunity for a multi-strategy approach to using alternatives.

Looking back, 2022 has been a fascinating, albeit troubling, year for those of us who spend our time thinking about big macro themes and fundamentally game-changing shifts in politics and economics. A prominent theme from an economic perspective has been the sell-off in bonds and the consequent rise in interest rates around the globe. A major question for us to consider, in terms of determining where we are in the expansion of risk premia, is whether inflation has peaked, potentially ushering in disinflation again, or if we think inflation will end up being more persistent?

The market is currently pricing in recessions across a range of global economies, particularly in Europe, with the energy crisis coming through this winter, and even the US. If inflation does remain entrenched, we may have further to go in this bearish environment. Longer term, we see a range of macro factors with strong inflationary implications, which, when combined with monetary and fiscal policies designed to reduce high debt levels, suggests an environment where higher inflation becomes the dominant state – or at least one where it struggles to find equilibrium.

Within a global context, Japan is a particularly interesting story. The Bank of Japan has been an outlier in the developed world, placing a ceiling on 10-year government bonds that limits the yield investors can earn to 25 basis points (0.25%). The argument given is that increasing borrowing costs right now would only result in weaker demand, setting back an economy already struggling to recover from the pandemic.

The consequence, however, has been a rapidly devaluing currency, with huge amounts of capital being exported into foreign bond and equity markets as Japanese investors seek solace elsewhere. Should the Bank of Japan decide that it is time to lift that peg – even if it is a relatively minor change, such as shifting the limit on yields to 50 or 75 basis points – we think that could have a dramatic impact elsewhere.

The other place we have found particularly interesting is the UK. We saw extraordinary volatility in the UK fixed income market under short-lived Prime Minister Truss, whose plans to cut taxes and increase borrowing led to weeks of chaos in financial markets. As government borrowing costs rose, this fed through to higher costs for UK pension funds which typically hedge against future liabilities by buying long-dated swaps (interest rate swaps). This forced pension funds to sell their more liquid assets, primarily UK government bonds (gilts), which fast became a cascading liquidity spiral before the Bank of England stepped in to stabilize the market. When these catalysts emerge, how does one take a mean reversion view without exposing investors to abnormally large risks?

If the environment has changed, then for investors like us, being able to apply a broad range of investment techniques is crucial. Our role is to look for places where there is a risk premium, and where we understand the underlying economic drivers of returns in a range of market environments and in different situations.

The outbreak of COVID-19, for example, understandably wreaked havoc on global stock markets. Investors took money out of funds and managers were forced to sell assets to cover outflows. We saw the diversification that investors would ordinarily rely on, via bonds and equities, no longer functioning as it had in the past. So what do you do when diversification doesn’t work? Applying approaches designed to hedge risk or reduce the impact of market volatility have been areas of real interest in 2022 given how markets have behaved. We believe those difficult conditions will continue through 2023 and it will be important to seek to stabilise returns where possible. This means being able to adapt to very unusual situations over time, effectively acting as an insurance strategy for investors, should markets move against their broader positioning, while aiming to capture returns based on different forms of stress throughout the market cycle.

With inflation where it is, we believe it is a particularly relevant time for trend-following strategies. With the reemergence of inflation, demand has grown for inflation-sensitive assets like commodities, which have been a significant trend in 2022. We have also seen a downtrend in (and rising correlation between) traditional assets like equities and bonds, which has raised questions about whether a traditional ‘60/40’ asset allocation strategy (which allocates 60% to equites and 40% to bonds) can consistently fulfil the role it has played over the past few decades.

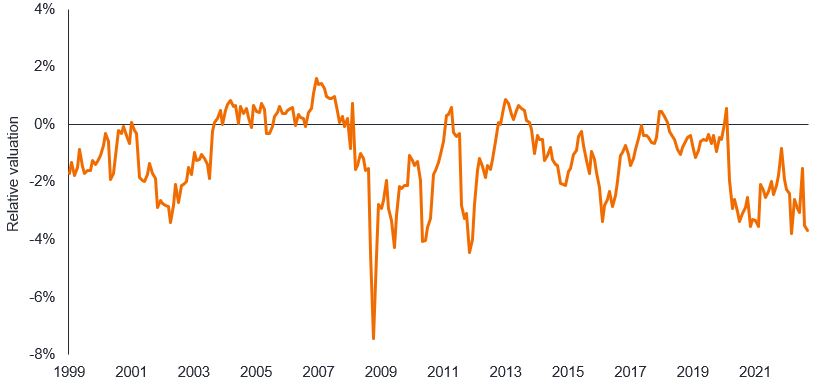

Separately, we think the convertible bond space could present a more attractive prospect in 2023. We saw a wave of convertible issuance in 2020, significantly increasing the size of the global market as companies took advantage of accommodative financing conditions to strengthen their balance sheets in the wake of COVID-era restrictions. However, we saw the primary market effectively shut down in the first half of 2022, with smaller coupons and out-of-the-money options offering little appeal for investors seeking to offset inflation.

Figure 1: Are convertible bonds mispriced?

Source: BofA Merrill Lynch Global Research, Janus Henderson Investors Analysis, as at 30 September 2022.

Note: Fair value relative to market price of BofA Merrill Lynch European Convertible Excluding Mandatory Index. Past performance does not predict future returns.

As we look ahead to 2023, we expect the market for convertibles to pick up. This should be driven by either a stronger pipeline, via refinancing or new issuance, or an uglier, more cathartic sell-off from long-only funds. If the latter materializes, this could set up more attractive risk-reward opportunities, as well as potentially more favourable entry points for ‘buy and hold’ exposures.

More broadly, however, this is a fundamentally different environment to the one we saw in the pre-COVID world, and we believe investors will need to adjust accordingly. It is important to keep in mind that strategies that have worked before might not necessarily work in different environments. It is critical to understand how different strategies and investment tools work together in terms of risk, exposure, and diversification.

We believe that in the coming year a greater focus on catalysts that might drive shocks to the system will be needed. These could be events such as a Brexit vote, an election, policy error, or something significant that we believe could drive a break or a change in the direction of legislation and the monetary and fiscal environment.

However, while a top-down view of the world is critical, we believe bottom-up research should be a primary driver of returns. It will be vital to find structural opportunities in the micro and consider how those opportunities can drive demand for capital. A good example of this bottom-up view is risk transfer. Banks are taking a lot less risk now than they did before the Global Financial Crisis. Whereas banks might previously have had substantial risk appetites, their capacity in this regard is now limited, and this has created an imbalance in supply and demand in those circumstances where liquidity is tight. By providing much needed short-term liquidity to the market, it is possible to earn the return available for providing a capital provision service to the market.

It is also important to watch for those situations that suck liquidity out of the system. Illiquidity can break functioning markets when money is not flowing to the right segments, leading to price gaps and much higher volatility as a consequence. That is a key risk to keep in mind – and one to consider in hedging decisions. The risks illiquidity carries can drive wider risk premia and provide opportunities in the alternatives arena.

Another area that will be of particular interest for us in 2023 is anomalies in commodity markets, where we see a combination of sustainable factors presenting opportunities to seek differentiated risk-adjusted excess returns. Relative value opportunities in fixed income and currency volatility are also strategies that, after more than a decade of being out of favour, now appear target rich.

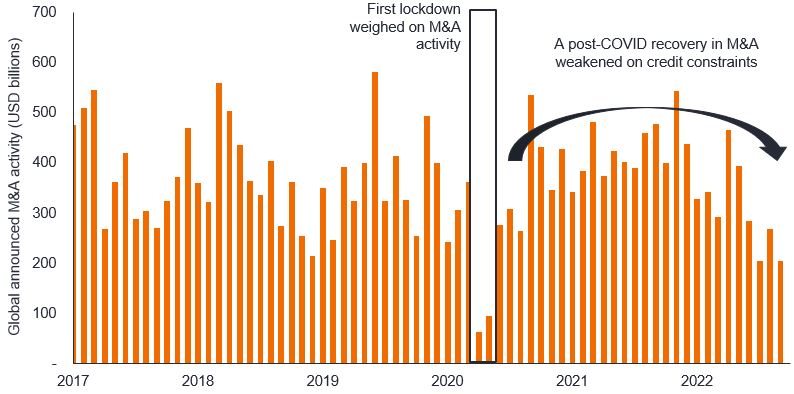

Heightened geopolitical risk and less certain financial conditions have been headwinds for more traditional opportunities in the merger and acquisition (M&A) space in 2022. We continue to see a healthy pipeline of deals in Europe and the US, which could provide some opportunity to harvest M&A risk premium with reduced idiosyncratic risk. However, a competition-focused regulator in the US and a more protectionist approach elsewhere could continue to weigh on activity (Figure 2).

Figure 2: Where next for M&A activity?

Source: Bloomberg Global announced deals, Janus Henderson Investors Analysis, as at 30 September 2022. Past performance does not predict future returns.

We are often asked what role alternatives should play in a portfolio. The answer for 2023 will be the same as previous years – it depends on your need. Alternatives covers an incredibly broad range of strategies, often highly innovative, offering drivers of performance that are fundamentally different from more traditional assets like equities and bonds. These allow for adaptation for different client requirements. But when pushed, we would say there are two things alternatives should do: They should produce a positive return for investors, and they should produce those returns with low correlations to other assets. If the performance delivered makes it difficult to tell whether it were a bear or bull market, we would consider that a positive outcome.

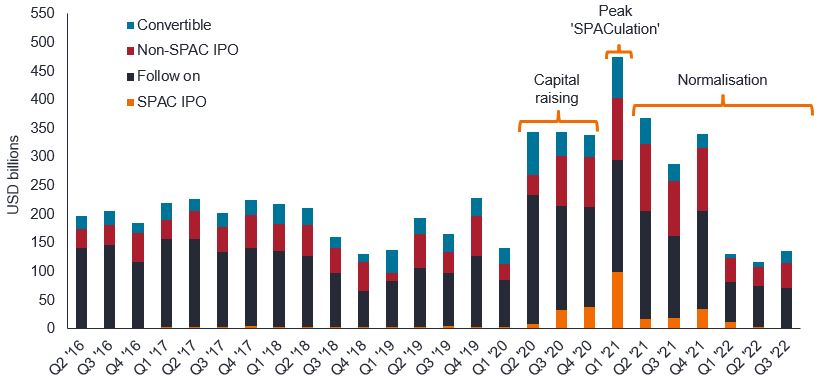

2023 will no doubt present unexpected risks and opportunities. This will require the flexibility to rapidly adapt to a changing opportunity set by moving capital (and focus) between strategies. It will also mean that teams such as ours need to continually add to investment capabilities and potential return streams. One recent example of the evolving nature of the opportunity set was the rise of special purpose acquisition companies (SPACs) demonstrated in Figure 3.

Figure 3: Increased equity capital market activity presented both opportunities and risks

Source: Goldman Sachs, Janus Henderson Investors Analysis, as at 30 September 2022. Past performance does not predict future returns.

The rise and fall of the SPAC markets created a varied set of opportunities. For managers with experience in equity deal flow, the ‘bubble phase’ in the first half of 2021, presented opportunities on the short side. Those positioned for the bursting of the bubble in late 2021 and into 2022, benefited as many SPACs were revealed as overpriced plays on flawed business models. Most recently, in late 2022, we saw a long opportunity hiding in the wreckage: pre-deal SPACs offered at what looked like compelling discounts, as SPAC promoters prepared to hand cash back to investors now unprepared to back their business plans.

This multi-phase approach to SPACs embodies the adaptive and flexible investment style that characterizes a multi-strategy approach to alternatives. To stay ahead in this shifting landscape, we believe alternatives managers will need to continue expanding their capability sets in 2023 and enhancing the adaptability of their processes, enabling them to perform across a broad range of potential market environments.

Basis points: A standard measure for interest rates and other percentages in finance. One basis point (bp) equals 0.01%. 50 bps equals 0.5%.

Coupon: A regular interest payment that is paid on a bond. It is described as a percentage of the face value of an investment. For example, if a bond has a face value of £100 and a 5% annual coupon, the bond will pay £5 a year in interest.

Out-of-the-money options: An option where the underlying price of the stock is below the agreed strike price, meaning the option has no intrinsic value to the owner (only extrinsic value).

Risk premia: The amount by which the return of a risky asset is expected to outperform the known return on a so-called ‘risk-free’ asset, such as a government bond.

SPACS: A special purpose acquisition company (SPAC) is a publicly traded company created for the purpose of acquiring or merging with an existing company.

IMPORTANT INFORMATION

Alternative investments include, but are not limited to, commodities, real estate, currencies, hedging strategies, futures, structured products, and other securities intended to be less correlated to the market. They are typically subject to increased risk and are not suitable for all investors.

Commodities (such as oil, metals and agricultural products) and commodity-linked securities are subject to greater volatility and risk and may not be appropriate for all investors. Commodities are speculative and may be affected by factors including market movements, economic and political developments, supply and demand disruptions, weather, disease and embargoes.