Subscribe

Sign up for timely perspectives delivered to your inbox.

The hoped-for policy pivot has driven fixed income rallies, but investors may do better to take heed of the current hawkish US policy in our view. Head of US Securitised Products John Kerschner explains why collateralised loan obligations (CLOs) are worth considering.

Historically, the mantra “Don’t fight the Fed”1 has served investors well, particularly in the post-GFC era of easy monetary policy. Amid a widespread sell-off in risk assets, the US Federal Reserve (Fed) rode to the rescue with its coined “bazooka” during the outbreak of the pandemic – it dropped the Federal Funds rate to zero and committed to substantial quantitative easing (QE). At the time, opinion was split on whether the Fed’s actions would suffice. The bears argued that monetary policy couldn’t fix a virus-induced global shutdown, while the bulls reminded us of the golden rule: “Don’t fight the Fed”.

Fast forward to the end of 2021, when the S&P 500 strongly rebounded from the lows – the bulls had been proven right. But in 2022, the Fed pivoted, changing course to combat rampant inflation by raising interest rates and reversing QE in favour of quantitative tightening (QT).

Despite already aggressively hiking rates, the Fed continues to reiterate its tough stance on inflation. That means higher-for-longer rates, a bias towards overtightening, and a willingness to risk tipping the US economy into recession to curb inflation. While the Fed may well pivot again, we believe that investors may do better to follow the Fed and to consider its current policy stance rather than the hoped-for future pivot when making investment decisions. Such pivot optimism has seen bouts of spread tightening in fixed income markets.

In that vein, we believe collateralised loan obligations (CLOs) are a worthy consideration given current hawkish Fed policy. CLOs have grown to US$1.2 trillion globally and have been around for over 30 years2, having weathered numerous market dislocations during that time. Reflecting investor appetite, CLO primary issuance has held up reasonably well in 2022 despite high volatility with US$126 billion of annualised issuance, the second-highest level in recent history, after 20213.

As financial conditions tighten and issuer defaults rise, investors will seek to improve the credit quality of their portfolios. In our view, corporate investment-grade (IG) bonds, in particular, are not adequately pricing in the chance of a recession or default risk. And with nearly 50% of the Bloomberg US Corporate Investment Grade Bond Index rated BBB, investors are far more exposed to default risk in corporate credit than in CLOs, where 100% of the JP Morgan AAA CLO Index is rated AAA4. Another reason for reassurance is a typical ‘AAA’-rated CLO tranche generally has par subordination of 35% (how much capital that must be lost before that tranche incurs losses)5.

Interest rate volatility has been extremely elevated for much of 2022, and prices of longer duration assets have generally been more affected. With CLOs having essentially no duration (given their floating rate coupons), investors seeking to reduce interest rate risk or dampen portfolio volatility might consider allocating to CLOs. They also tend to have amortising structures (principal is paid at intervals through time), resulting in a much shorter weighted average life (WAL) and duration. About a third of AAA CLOs have WALs of more than four years. However, a quarter have WALs of less than two years, mainly amortising CLOs or those that will be out of their reinvestment periods in next six months6. This less rate sensitive cohort may be attractive for investors looking to reduce a portfolio’s interest rate risk.

While fixed income yields have risen across the board, AAA CLO yields look attractive relative to other fixed income asset classes, as shown in Exhibit 1. Considering their strong credit quality and ultra-low duration, in our view, AAA CLOs offer the highest yield per unit of risk of any fixed income sector. And with the likelihood of more rate hikes, we expect CLOs’ floating rate coupons to be boosted further.

Source: Bloomberg, JP Morgan, as of 4 November 2022. Indices used to represent asset classes: High Yield (Bloomberg US Corporate High Yield Index), AAA CLOs (JP Morgan AAA CLO Index), IG corporates (Bloomberg US Corporate Investment Grade Index), Agg (Bloomberg US Aggregate Bond Index), 1-3 Yr Gov/Cr. (Bloomberg 1-3 Year US Gov/Credit Index), US Treasuries (Bloomberg US Treasuries Index).

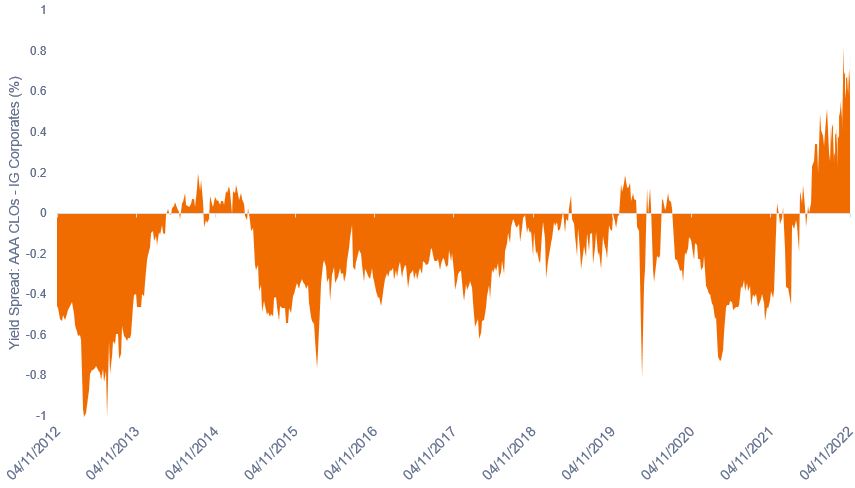

Relative to IG corporates, CLO spreads have widened substantially, as shown in Exhibit 2. While the broad sell-off in fixed income in 2022 can be ascribed to a combination of higher rates and an anticipated deterioration in credit quality, the same cannot be said for CLOs. CLOs have not sold off for any fundamental reason – there hasn’t been a deterioration in their credit metrics, while they stand to benefit from rising rates. The sell-off in CLOs has instead been due to liquidity risk. As asset prices have fallen, investors have looked to their most liquid investments – in many cases, CLO holdings – to raise cash. We believe this unsubstantiated selling has created a good opportunity to buy AAA CLOs at historically cheap valuations. In addition, we believe that if relative spreads tighten from current levels, it could provide a tailwind for the asset class.

Source: Bloomberg, JP Morgan, Janus Henderson Investors, as of 4 November 2022. Indices used: High Yield (Bloomberg US Corporate High Yield Index) and AAA CLOs (JP Morgan AAA CLO Index).

High quality AAA assets offering competitive yields and attractive relative value are an alternative to liquid cash allocations. With cash rates still well below the rate of inflation, investors may consider using CLOs as a way to park cash in a liquid income-producing asset and improve the credit quality of their portfolios. Given attractive carry amid rising rates, strong par subordination and resilient performance across market cycles, this could pave the way for increased demand for AAA CLOs. In whichever capacity investors choose to use CLOs, we believe the addition of the asset class may help investors to navigate the current environment and better align their portfolios with a hawkish Fed.

1 This investing rule suggests investors should align their investment strategies with the Federal Reserve’s (Fed) monetary policies, instead of going against them.

2 Source: Intex, Morgan Stanley Research, 2022.

3 Source: Barclays, LCD, 4 November 2022.

4 Source: Bloomberg, JP Morgan, 17 October 2022.

5 Source: S&P Global, 15 July 2020.

6 Source: Kanerai, Intex, Barclays Research, 7 October 2022. Tranche universe include all active BSL CLOs.

Yield to worst (YTW) is the lowest yield a bond can achieve provided the issuer does not default and accounts for any applicable call feature (ie, the issuer can call the bond back at a date specified in advance). At a portfolio level, this statistic represents the weighted average YTW for all the underlying issues.

Credit rating is score usually given by a credit rating agency such as Standard & Poors, Moody’s and Fitch on their creditworthiness of a borrower. Standardised scores such as ‘AAA’ (a high credit rating) or ‘B’ (a low credit rating) are used however can vary depending on the credit rating agency. Moody’s, another well-known credit rating agency, uses a slightly different format with Aaa (a high credit rating) and B3 (a low credit rating).

Credit spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

Duration is a measure of how far a fixed income security or portfolio is sensitive to a change in interest rates, measured in terms of the weighted average of all the security/portfolio’s remaining cash flows (both coupons and principal). It is expressed as a number of years. The larger the figure, the more sensitive it is to a movement in interest rates. ‘Going short duration’ refers to reducing the average duration of a portfolio. Alternatively, ‘going long duration’ refers to extending a portfolio’s average duration.

Collateralised Loan Obligations (CLOs) are debt securities issued in different tranches, with varying degrees of risk, and backed by an underlying portfolio consisting primarily of below investment grade corporate loans. The return of principal is not guaranteed, and prices may decline if payments are not made timely or credit strength weakens. CLOs are subject to liquidity risk, interest rate risk, credit risk, call risk and the risk of default of the underlying assets.

Tranches are segments of a pool of securities that are divided up by credit rating, maturity, or other characteristics.

A floating interest rate refers to a variable interest rate that changes over the duration of the debt obligation

Weighted average life is the average length of time that each dollar of unpaid principal on a loan, a mortgage, or an amortising bond remains outstanding.

Carry can be defined as the benefit or cost of holding an asset. For a bond investor this includes the interest paid on the bond together with the cost of financing the investment and potential gains or losses from currency changes. Note that the meaning of ‘carry’ is dependent on the context used.