Subscribe

Sign up for timely perspectives delivered to your inbox.

Portfolio Managers John Kerschner, Nick Childs, and Jessica Shill discuss why they believe collateralized loan obligations (CLOs) might be well aligned with a hawkish Fed.

By now we’ve heard it a thousand times: Don’t fight the Fed.1 Historically, the mantra has served investors well, particularly in the post-2008 era of ultra-accommodative monetary policy. We need only look back to March 2020 to see it in action, as the rapid spread of COVID-19 brought the global economy to a grinding halt and more than half of the world’s population was under stay-at-home orders. The S&P 500® Index was down over 30% in a matter of weeks and bond markets were virtually frozen. Amid such dire circumstances, in stepped the Fed with their self-termed “bazooka” – they dropped the federal funds rate to 0% and committed to quantitative easing (QE) to the tune of $120 billion a month.

At the time, opinion was split on whether the Fed’s actions would prove sufficient to keep financial markets from falling further. The bears’ argument? That monetary policy couldn’t fix a virus-induced global shutdown. The bulls, on the other hand, reminded us of the golden rule: Don’t fight the Fed.

Fast forward to the end of 2021 when the S&P 500 was up 89% from its March 2020 low – the bulls had been proven right. But in 2022, the Fed pivoted, changing course to combat rampant inflation by raising interest rates and reversing QE in favor of $95 billion per month in quantitative tightening (QT). The question is, have investors pivoted with the Fed? It seems that many have not, but are rather holding fast to prior Fed policy and hoping to be in position for an imminent return to the days of easy money.

This is understandable. For the average investor, cognitively it seems easier to follow the Fed when it is being accommodative and creating tailwinds for asset prices versus when it is tightening and threatening to tip the economy into a recession. Despite the sober reality it represents, we think it is important to recognize our susceptibility for cognitive bias as we aim to make better investing decisions.

Despite having already hiked rates 3.75%, the Fed continues to communicate that its policy stance going forward is to be tough on inflation. That means more rate hikes (at least another 100 basis points according to most recent fed funds futures), a higher-for-longer terminal rate, a bias toward overtightening, and a willingness to accept job losses in its efforts to curb inflation. While the Fed may well pivot again – especially if markets freeze up or economic fundamentals deteriorate swiftly and significantly – we believe that investors would do better to follow the Fed and position their portfolios for its current policy stance rather than position for the hoped-for future pivot.

In that vein, we believe collateralized loan obligations (CLOs) may be well aligned with current Fed policy. While many investors have limited familiarity with CLOs, it is anything but a niche market: CLOs have grown to $1.2 trillion globally and have been around for over 30 years, having weathered numerous market dislocations during that time.

As financial conditions continue to tighten, we’re likely to see a rise in issuer defaults. To prepare, investors might consider improving the credit quality of their portfolios. In our view, corporate investment-grade bonds in particular are not adequately pricing in the chance of a recession or a significant increase in defaults. And with nearly 50% of the Bloomberg Corporate Investment Grade Bond Index rated BBB, investors are far more exposed to default risk in corporate credit than in CLOs, where 100% of the JP Morgan AAA CLO Index is rated AAA.

Interest rate volatility has been extremely elevated for much of 2022, and prices of longer duration assets have generally been more affected. With CLOs having essentially no duration (due to their floating rate coupons), investors seeking to reduce interest rate risk or dampen portfolio volatility might consider an allocation to CLOs.

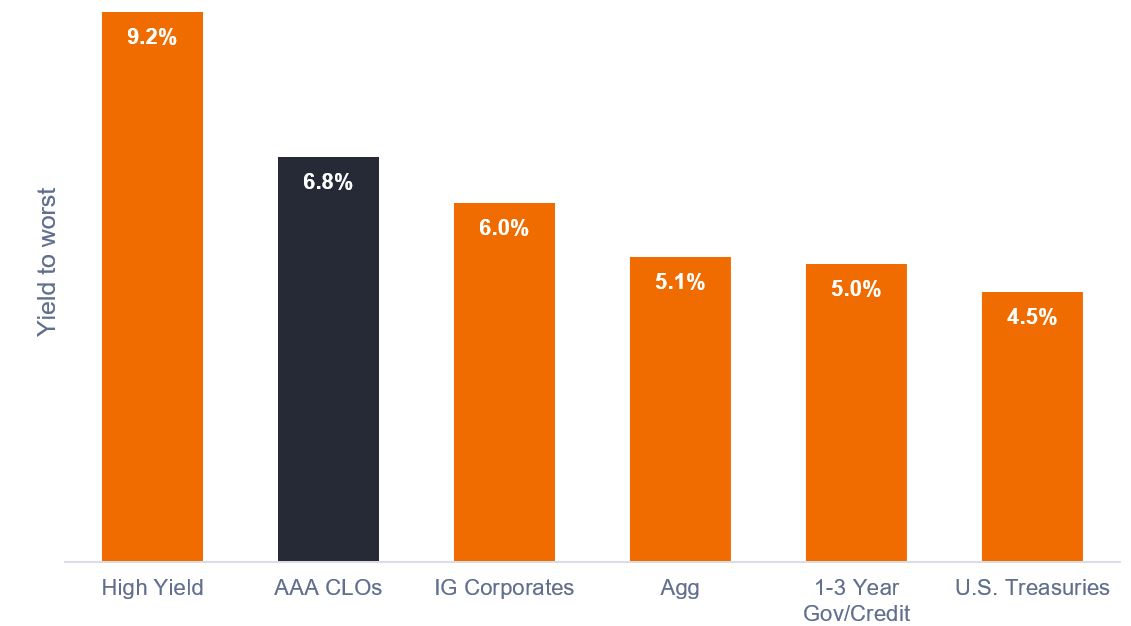

While yields on fixed income assets have risen across the board, AAA CLO yields look attractive relative to alternatives, as shown in Exhibit 1. Considering their strong credit quality and ultra-low duration, in our view, AAA CLOs are offering the highest yield per unit of risk of any fixed income sector. And with the likelihood of another 100 basis points in rate hikes, we expect CLOs’ floating rate coupons to be further underpinned by higher rates.

Source: Bloomberg, JP Morgan, as of 4 November 2022. Indices used to represent asset classes: High Yield (Bloomberg U.S. Corporate High Yield Index), AAA CLOs (JP Morgan AAA CLO Index), IG corporates (Bloomberg U.S. Corporate Investment Grade Index), Agg (Bloomberg U.S. Aggregate Bond Index), 1-3 Yr Gov/Cr. (Bloomberg 1-3 Year U.S. Gov/Credit Index), U.S. Treasuries (Bloomberg U.S. Treasuries Index). Yield to worst (YTW) is the lowest yield a bond can achieve provided the issuer does not default and accounts for any applicable call feature (i.e., the issuer can call the bond back at a date specified in advance). At a portfolio level, this statistic represents the weighted average YTW for all the underlying issues.

Relative to investment-grade (IG) corporates, CLO spreads have widened substantially, as shown in Exhibit 2. While the broad sell-off in fixed income in 2022 can be ascribed to a combination of higher rates and an anticipated deterioration in credit quality, the same cannot be said for CLOs. CLOs have not sold off for any fundamental reason – there has not been a deterioration in their credit metrics, and they stand to benefit from rising rates. Rather, the sell-off in CLOs has been due to liquidity risk. As asset prices have fallen, investors have looked to their most liquid investments – in many cases, CLO holdings – to raise cash. We believe this unsubstantiated selling has created a good opportunity to buy AAA CLOs at historically cheap valuations. Further, we believe if relative spreads tighten from current levels, it could provide a tailwind for the asset class.

Source: Bloomberg, JP Morgan, Janus Henderson Investors, as of 4 November 2022.

We believe CLOs can be used in various roles within portfolios – first, as a cash management tool. With cash rates still well below the rate of inflation, investors may consider using CLOs as a way to park cash in an income-producing asset where the current yield exceeds the core inflation rate. Second, investors who are concerned about a recession can consider using CLOs to improve the overall credit quality of their portfolios. Third, CLOs may be used in a barbell approach, where investors can combine CLOs with a longer-duration asset, such as agency mortgage-backed securities (MBS), in varying percentages according to their portfolio duration target.

In whichever capacity investors choose to use CLOs, we believe the addition of the asset class may help investors to navigate the current environment and better align their portfolios with a hawkish Fed.

IMPORTANT INFORMATION

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Securitized products, such as mortgage- and asset-backed securities, are more sensitive to interest rate changes, have extension and prepayment risk, and are subject to more credit, valuation and liquidity risk than other fixed-income securities.

1 This investing rule suggests investors should align their investment strategies with the Federal Reserve’s (Fed) monetary policies, instead of going against them.

The barbell strategy is a fixed income strategy where the investor only buys short-term and long-term bonds. The strategy helps decrease downside risk while still having exposure to higher-yield, long-term bonds.

Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Bloomberg U.S. Corporate Bond Index measures the investment grade, US dollar-denominated, fixed-rate, taxable corporate bond market.

Bond prices generally move in the opposite direction of interest rates, thus bond prices may decline as interest rates rise, and vice versa.

Collateralized Loan Obligations (CLOs) are debt securities issued in different tranches, with varying degrees of risk, and backed by an underlying portfolio consisting primarily of below investment grade corporate loans. The return of principal is not guaranteed, and prices may decline if payments are not made timely or credit strength weakens. CLOs are subject to liquidity risk, interest rate risk, credit risk, call risk and the risk of default of the underlying assets.

Credit Spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

J.P. Morgan CLO AAA Index is designed to track the AAA-rated components of the USD-denominated, broadly syndicated CLO market.

Quantitative Easing (QE) is a government monetary policy occasionally used to increase the money supply by buying government securities or other securities from the market.

Quantitative Tightening (QT) is a government monetary policy occasionally used to decrease the money supply by either selling government securities or letting them mature and removing them from its cash balances.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

Volatility measures risk using the dispersion of returns for a given investment.

Yield to worst (YTW) is the lowest yield a bond can achieve provided the issuer does not default and accounts for any applicable call feature (i.e., the issuer can call the bond back at a date specified in advance). At a portfolio level, this statistic represents the weighted average YTW for all the underlying issues.