Subscribe

Sign up for timely perspectives delivered to your inbox.

Director of Research Matt Peron and Global Head of Fixed Income Jim Cielinski explain why generationally high inflation and an aggressive Federal Reserve (Fed) mean that this year’s U.S. midterms could matter less than usual for financial markets.

While votes are still being tallied in this year’s U.S. midterm elections – which determine the balance of power in Congress – it’s clear that the Republican “wave” forecast in the days leading up to the election has turned out to be more of a splash. Republicans look poised to gain control of the House by a smaller margin than expected, while early signs indicate Democrats could hold its majority in the Senate.

Equity markets in the U.S. were selling off the morning after Election Day, due in part to some races still being undecided. In general, though, stocks favor a divided government in the U.S. – with power split between the White House and Congress – as this setup often limits the scope of policy change markets face in the following years. Similarly, U.S. Treasuries can benefit when division reduces the chance of a surge in fiscal stimulus, which can place upward pressure on yields and push down bond prices.

To be sure, the fiscal side of things will not be completely benign. Congress will need to raise the federal debt limit sometime in 2023, and Republicans could force spending cuts or refuse bipartisan action, creating volatility for markets. (In 2011, under a Republican House and Democratic Senate, a debt ceiling debate led to the most volatile week of trading for financial markets since the 2008 Global Financial Crisis.1) But the gridlock that is likely to settle over Washington for the next two years means that the variables buffeting investors lately – from generationally high inflation and rapidly rising rates to shrinking corporate earnings and geopolitical tensions – will likely continue to dominate the near-term direction of markets.

In other words, even if the midterms change the balance of power in Washington, the biggest issue for investors remains inflation and how the Fed’s response will impact economic growth and corporate earnings. The Fed’s target rate now stands at 4%, up from essentially zero at the beginning of 2022. With inflation remaining stubbornly high, we think the rate will continue to rise through at least mid-2023. Such a rapid pace of monetary tightening has already caused the S&P 500® Index to contract by roughly 20% this year and led to the worst year-to-date sell-off in the Bloomberg U.S. Aggregate Bond Index’s history.2 Corporate earnings have also slowed, with a growing chorus of firms lowering their earnings outlook or pulling guidance altogether. We doubt markets will reverse course until peak inflation rolls over and the endpoint for rate hikes comes into focus – both of which the newly elected Congress will be unable to control.

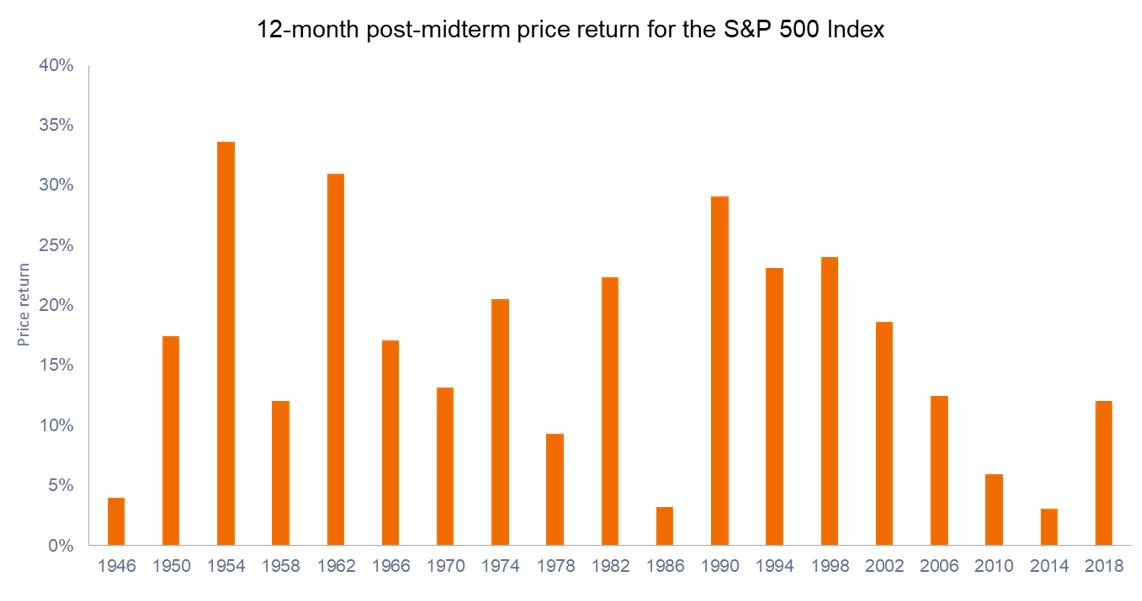

As such, the biggest takeaway from this year’s midterm election may be that U.S. equities could break from their historical pattern of delivering gains in the 12 months following a midterm and that monetary policy – not fiscal policy – will have the upper hand when it comes to influencing financial markets’ performance.

Past performance cannot guarantee future results.

Source: Bloomberg, data from 31 October 1947 through 31 October 2019. Returns are for the 12 months from the market close at the end of the October preceding a midterm election.

Bonds will continue to take their cues from monetary policy. However, on the off chance that Democrats maintain control of the House and Senate, the possibility exists that additional spending would occur, putting upward pressure – in the near term, at least – on short- to mid-dated bonds.

IMPORTANT INFORMATION

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

1 “The cost of crisis: why stock fees rise when markets slip,” Beyond the Numbers. U.S. Bureau of Labor Statistics, February 2017. Vol 6, No. 3.

2 Bloomberg, data as of 8 November 2022.

Bloomberg U.S. Aggregate Bond Index is a broad-based measure of the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.