Subscribe

Sign up for timely perspectives delivered to your inbox.

Guy Barnard, Co-Head of Global Property Equities and Nicolas Scherf, Portfolio Manager, discuss the weakness in listed European property markets this year, and if the worst has already been priced into the market, signalling an upturn ahead.

Investors in European listed real estate have suffered a torrid 2022 to date, with the sector being the weakest part of the equity market. European real estate equities have declined close to 40% year-to-date, comparable to the 49% fall in 2008 during the Global Financial Crisis (GFC).1 An increasingly uncertain environment has seen the sector faced with the double whammy of a sharp deterioration in funding costs, given higher swap rates and wider credit spreads (in some cases significantly), and a potential European recession making rental income streams harder to underwrite. Property shares have perhaps also become a source of liquidity for those investors once again trapped in ‘open-end’ direct property funds.

It’s clear that the direct (private) property market has hit an ‘air pocket’ following a period of generally strong ascent over much of the last decade. Property yields that made sense to investors in a world of low rates and funding costs no longer stack up for leveraged buyers who are reliant on debt to meet their return objectives. In addition, many equity-driven investors will now have a wider range of investment options, including debt and credit, to meet their income requirements.

The result for real estate can only be a correction in values, the only question being how severe. At what level does the investment market stabilise and re-open, and how quickly will this be reflected in markets and valuations?

Over the past decade investors in real estate have benefited from around 300-400bps additional yield on their property assets vs government bonds. This level of risk premium was far higher than historical averages,2 in our view reflecting the fact that investors always assumed some normalisation of monetary policy down the line – although we suspect most have been surprised by the speed of tightening in recent months.

If we look further back, then the longer-term real estate risk premium is closer to 100-200bps,3 supported by the fact that real estate income streams can (and have) grown over time as a beneficiary of underlying economic growth, through rising rents and in many cases via inflation-linked rental contracts.

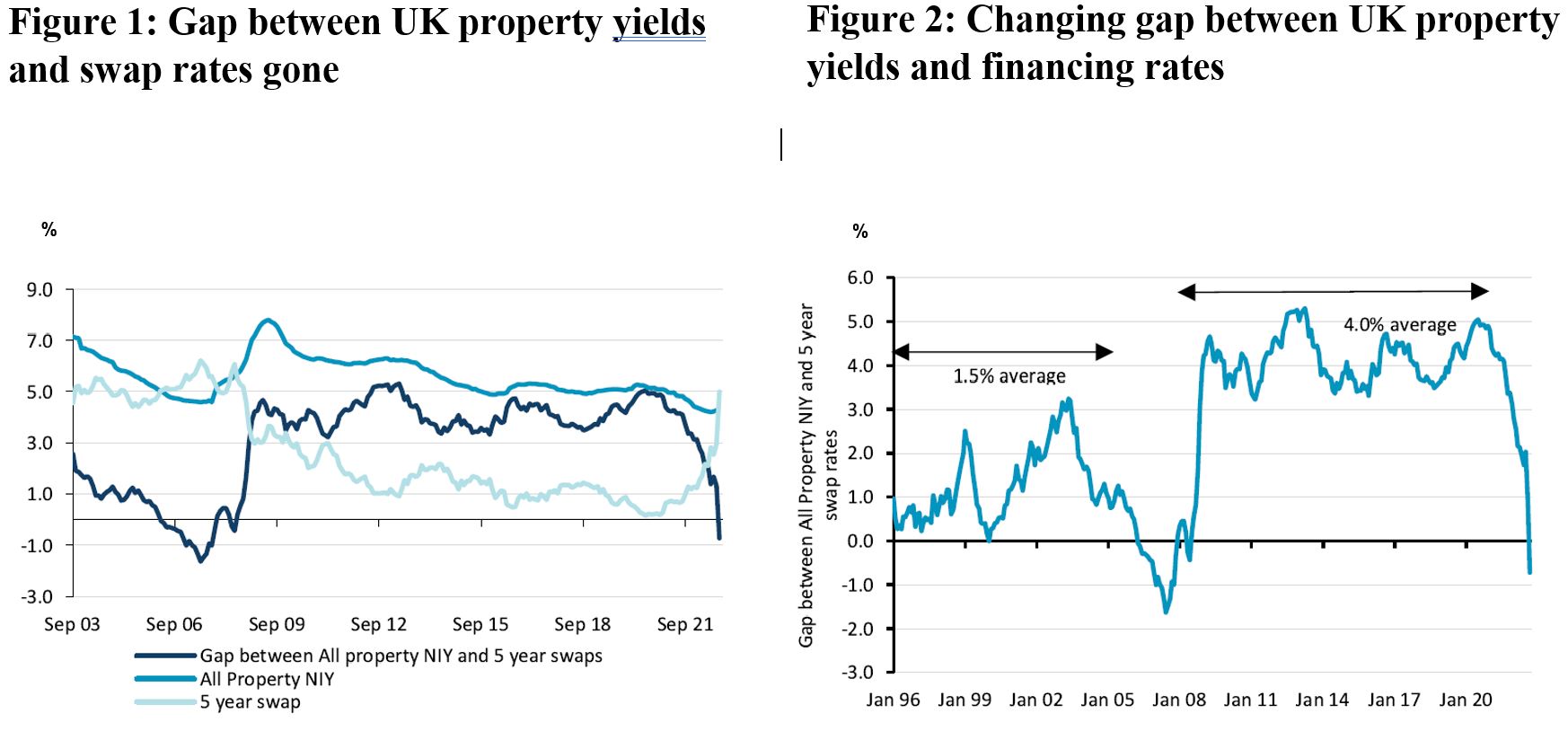

Source: Refinitiv Datastream, MSCI, Panmure Gordon Real Estate Chartbook as at 30 September 2022. NIY= Net Income Yield.

Taking the UK as an example (Figure 1), if we were to assume that the last published 4.5% All Property Income Yield (inclusive of retail, office and industrial sectors) were to establish a similar level of risk premium seen before the GFC then, based on current bond yields, it would imply an increase of around 50-100bps, or a circa 10-20% value decline, assuming stable rents.4

What’s clear from our conversations with real estate companies is that a correction in pricing is possibly underway, with many guiding to a 50bps increase in property yields already seen and more likely to follow, albeit varied by country, sector and asset quality. Valuers in the direct (private) market are beginning to reflect this in valuations, a process which could play out in the year ahead.

While all this sounds rather dramatic, it should not be a surprise to investors in listed real estate. Indeed, when we look at what is implied by the shares of the companies in which we invest, we see more than 150bps of yield expansion already reflected across our European universe.

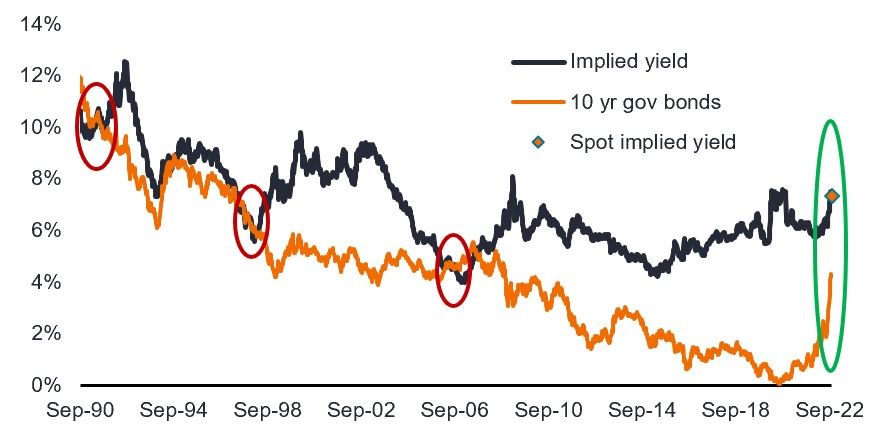

Sticking with the UK, Figure 3 looks at the implied property yield (net rental income/Enterprise Value) for Landsec, one of the larger diversified REITs (real estate investment trusts) active in the UK. Its most recent property valuation (March 2022) reflected a 5.2% yield on its portfolio.5

The stock market today values that same property portfolio at a yield of close to 8%. This is close to the level at the peak of the GFC (when the balance sheet was much weaker than today) and we would need to go back to the late ’90s / early ’00s to see sustained higher implied cap rates. It is also interesting to observe that in the London office market, which forms the largest part of Landsec’s portfolio, prime City office yields have not exceeded 6.75% in the last 30 years, including periods where 10-year gilt yields were over 10%.6

While some may see this as justified given current macro risks, including the recent political chaos in the UK itself, it’s interesting to note that in September Landsec sold one of its largest assets, a soon to be completed office building, which will be the UK headquarters of Deutsche Bank. The Australian buyer paid £809 million, reflecting a yield of 4.7% and a roughly 9% discount to book value (before a tax benefit from selling before completion). While selling below book value may raise questions, we see this as a good deal based on the valuation implied by the stock market, and the fact it crystallised a 25% development gain. It also enabled Landsec to reduce its leverage to around 30% (Loan-to-Value) in a debt book with more than nine years average maturity at a largely fixed/hedged (>70%) interest cost of 2.4%7 – an asset in itself today!

It’s clear that real estate markets have hit a patch of turbulence and will have to find a new cruising altitude in the year ahead that better reflects prevailing funding costs and the challenged economic outlook in Europe and the associated income risk. Further risks remain, most notably around both cost and availability of new debt and this is where stress is likely to be felt for some. However, the listed real estate sector generally appears better placed, with longer term and largely fixed/hedged debt books – this has to be a key focus for investors today. Income quality and dependability will also be more important without cyclical growth to support landlords, and, with refinancing acting as a headwind rather than a tailwind from here. We continue to believe a focus on areas of structural growth and undersupply can help cushion against these negative cyclical forces.

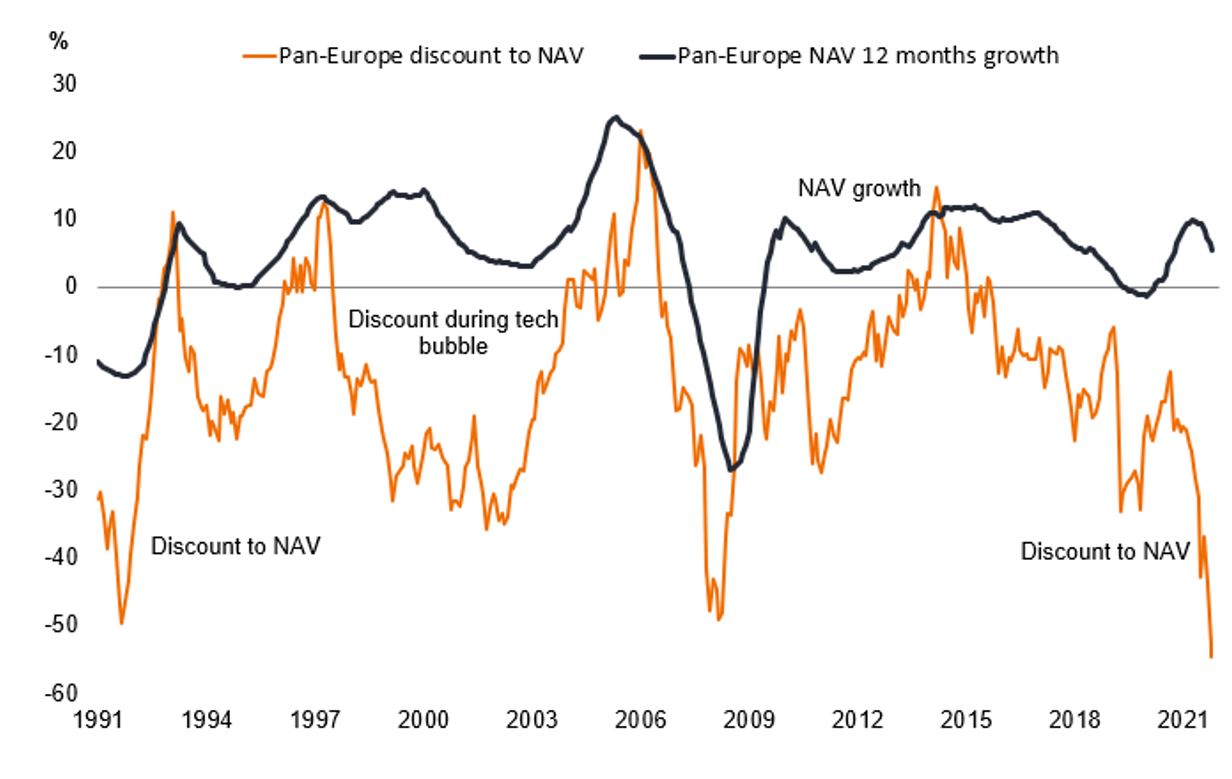

While today valuations may be seen as less relevant than top-down macro considerations, it’s important to understand that with discounts to NAV (net asset value) for the sector now wider than during the GFC and early 1990s, we think a LOT of the risks have already been priced into listed property markets. Undoubtedly there will be more ‘headline risk’ in real estate in the months ahead as valuers and transactions catch up with events and with potential refinancing challenges. But much of this should be expected/known given property shares already imply unlevered valuation declines of 20-30% (Figure 4).

Source: Morgan Stanley Research, Janus Henderson Investors analysis, data from 31 December 1991 to 14 October 2022.

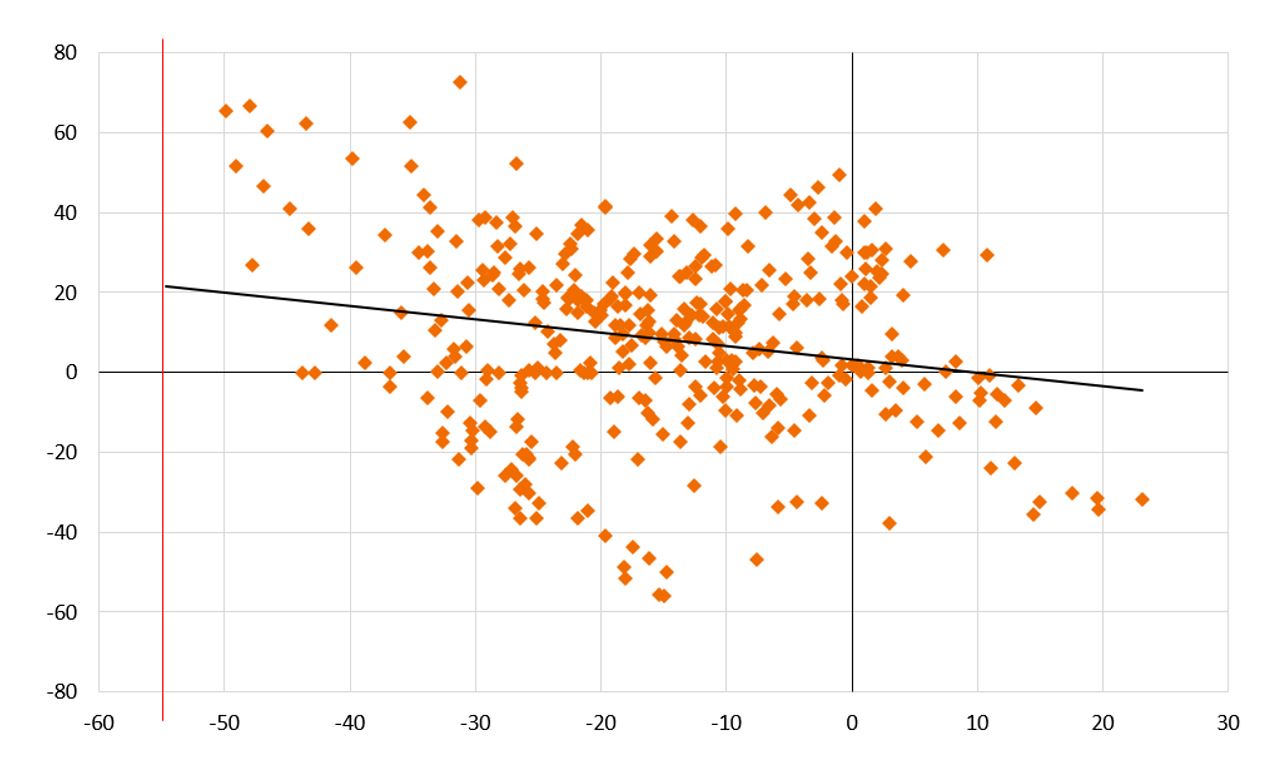

Looking at current valuations, those brave investors prepared to look through short-term noise have historically been handsomely rewarded, looking at the correlation between NAV discount and the following 12-month return (Figure 5). While it may be too early today, or require even greater bravery, the ‘for sale’ signs on European REITs may not persist for ever.

Source: Refinitiv Datastream, company data, Morgan Stanley Research data from 31 December 1989 to 14 October 2022. Past performance does not predict future returns.

Notes:

References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

1 Bloomberg, FTSE EPRA NAREIT Developed Europe Index total returns 31 December 2021 to 26 October 2022, and calendar year 2008. Past performance does not predict future returns.

2 Source: FTSE EPRA NAREIT Developed Europe Index versus FTSE European 10-year government bond yields as at 30 September 2022.

3 CBRE, MSCI, Refinitiv Datastream, Peel Hunt as at 31 December 2022.

4 UBS Global Research, UK Real Estate as at 24 October 2022.

5 Landsec annual report 2022.

6 UBS Global Research, UK Real Estate as at 24 October 2022.

7 Landsec press room; Landsec annual report 2022.

Cap rate: expressed as a percentage, the capitalisation rate estimates the potential return on a real estate investment. It is calculated by dividing the property’s net operating income by the current market value.

REITs or Real Estate Investment Trusts are an investment vehicle that invests in real estate, through direct ownership of property assets, property shares or mortgages. As they are listed on a stock exchange, REITs are usually highly liquid and trade like a normal share.

Real estate securities, including Real Estate Investment Trusts (REITs) may be subject to additional risks, including interest rate, management, tax, economic, environmental and concentration risks.