Subscribe

Sign up for timely perspectives delivered to your inbox.

Portfolio Manager Jeremiah Buckley considers the appeal of US equities in an environment of economic and geopolitical volatility, characterised by sustained inflationary pressures.

US equities can play an important role in investor portfolios for several reasons ‒ particularly now, with inflation lingering and the economic outlook so clouded.

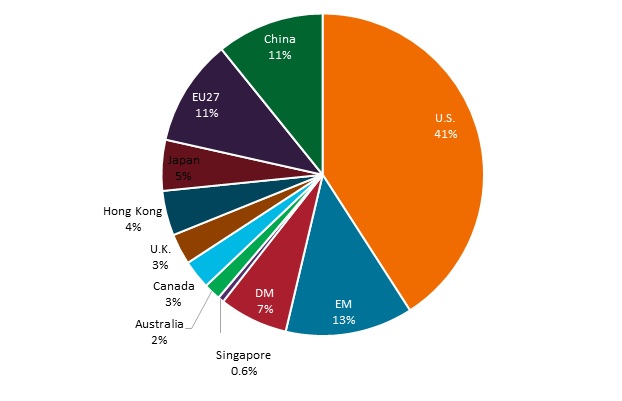

The US equity market is one of the largest in the world, with its companies accounting for over 40% of global market capitalisation (Figure 1). The US is among the most accessible, transparent and liquid markets, and its economic environment has fostered a culture of growth and innovation. Thus, many of the world’s most successful companies are based in the US. Given these supportive dynamics, many investors tend to allocate a portion of their equity exposure to the US market.

Figure 1. Global equities market capitalisation (% of total)

Source: World Federation of Exchanges, Securities Industry and Financial Markets Association (SIFMA) estimates. EU27 = 27 countries of the European Union, EM = Emerging Markets, DM = Developed Markets, at 30 June 2022.

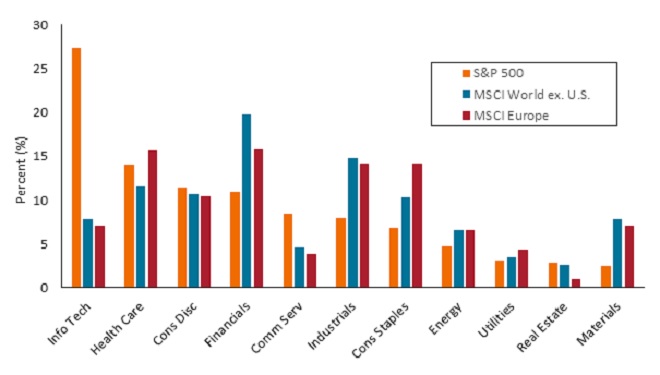

The US differs significantly from other markets in terms of the types of companies that make up its economy. For example, the US market is heavily tilted to growth-oriented, technology-centric sectors such as information technology and communication services. The S&P 500 Index has more than triple the MSCI World ex. US Index’s exposure to information technology companies (27.3% versus 7.8%). At the same time, the S&P 500 Index has about half the MSCI World ex. US Index’s allocation to sectors that comprise a significant portion of other countries’ economies, such as financials and industrials (Figure 2). These differences in economic composition and industry exposure may offer diversification for portfolios that invest in both the US and other markets.

Figure 2. US and global index sector weightings

Source: S&P Dow Jones Indices, MSCI, Inc., at 31 August 2022.

In addition to these broad-level considerations, US equities may also offer advantages specific to the current environment of lingering/high inflation and economic uncertainty. Equities ‒ and growth equities in particular ‒ may generally provide a hedge during inflationary periods, as they have the potential to grow at a rate faster than inflation. As labour costs continue to rise, companies less dependent on labour ‒ like some in the information technology sector ‒ may also be less exposed to wage pressures. At the same time, one of the main drivers of disinflation over the past decade has been the proliferation of technology. Recent wage inflation may incentivise further investment in productivity, efficiency, and substitution solutions to moderate labour costs, to the benefit of select companies.

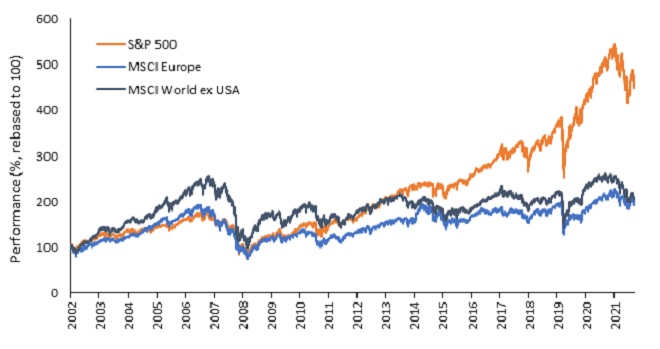

To that point, we believe that a powerful secular shift in how the world utilises technology is underway, and that several US companies leading this transformation are poised to benefit from it. The previously mentioned bias towards growth and technology companies has proven to be a long-term boon for US markets relative to other areas of the global market (Figure 3). As we enter a period where it appears growth may become scarcer and capital is more expensive, an allocation to US equities may prove beneficial.

Figure 3. US and global index performance

Source: Bloomberg, 31 December 2002 to 31 August 2022, rebased to 100 at start date. Past performance does not predict future returns.

Emerging from the COVID-induced downturn, the US market proved resilient, and we believe it can remain buoyant in the face of this year’s increased economic uncertainty. US economic output has recovered fastest among the other group of seven (G7) and euro zone economies, with real gross domestic product (GDP) now just 1.8% below trend (2015–2019), compared to the G7 average of 3.9% below trend.1

The Russia-Ukraine war has added another level of disruption and uncertainty to global markets and sent commodity prices ‒ particularly energy ‒ soaring. As a major producer of oil and natural gas, the US may be more insulated from energy price shocks than other countries in Europe, as well as Japan and China, which are heavily reliant on imported oil and gas. This can be seen in the strong performance of companies in the energy sector, which has to some extent offset the decline of the S&P 500 Index this year.

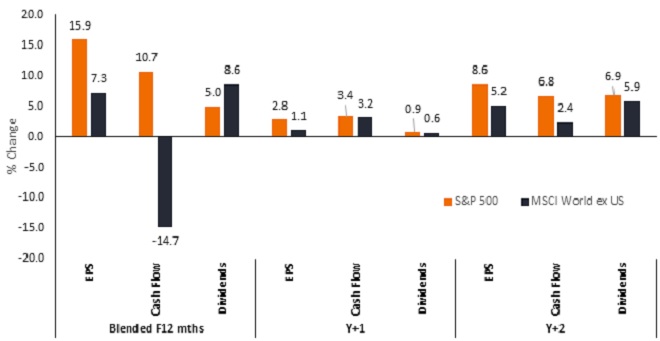

Earnings estimates have moderated in the face of rapidly rising interest rates, higher commodity prices and a significantly stronger dollar, which has been a headwind specifically for multinational corporations, manufacturers and exports. However, consensus S&P 500 earnings forecasts still assume strong growth for 2022, following a double-digit year-on-year increase for the first half of the year. Further, the S&P 500 is expected to grow earnings per share (EPS), cash flow and dividends at a higher rate than the MSCI World ex. US Index in coming years (Figure 4).

Figure 4. US and global index earnings per share, cash flow, and dividend growth estimates

Source: Bloomberg, at 15 September 2022. F12 = Forward 12-month (current and next year) estimates, Y+1 = next year Estimates, Y+2 = 2-year forward estimates. Index-weighted average. There is no guarantee that past trends will continue, or forecasts will be realised. Past performance does not predict future returns.

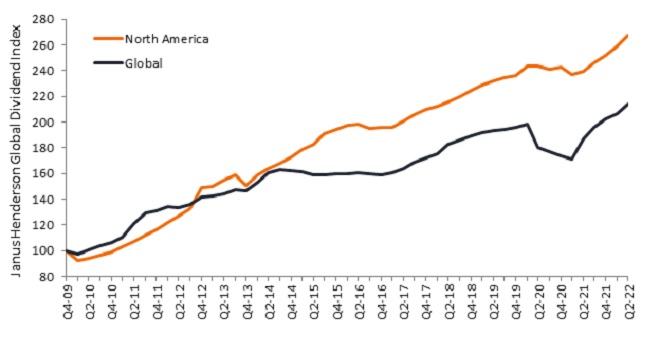

US dividend growth showed exceptional resilience during the pandemic (Figure 5), and while it is lagging behind the rest of the world year-to-date (at 15 September 2022), this by no means implies weakness. 97% of US companies increased their dividends or held them steady in the second quarter of 2022.2 Many US companies have increased share buybacks to funnel surging cash flow back to shareholders, this was after they continued to pay out dividends but cut buybacks in 2020.

Figure 5. Janus Henderson Global Dividend Index – North America

Source: Janus Henderson. The Janus Henderson Global Dividend Index (JHGDI) is a long-term study into global dividend trends. It measures the progress global firms are making in paying their investors an income on their capital. Past performance does not predict future returns.

Given these factors, we believe that US equities can play a multi-faceted role in investor portfolios, especially now, as the global economy faces inflation at multi-decade highs, and an uncertain growth outlook. We think that markets are ultimately driven by long-term sustainable earnings growth, and that companies able to increase earnings over time will possibly benefit. Despite this year’s volatility, we see many of these opportunities today in the US market.

1 The U.S. Economic Recovery in International Context, U.S. Treasury, Benjamin Harris and Neil Mehrotra. Source: Haver Analytics, authors’ calculations.

2Janus Henderson Investors, at 30 June 2022: https://cdn.janushenderson.com/webdocs/H050642_0822_Issue+35_ENGLISH.pdf

Glossary:

Inflation/disinflation: The rate at which the prices of goods and services are rising in an economy. Disinflation is a fall in the rate of inflation.

Growth stocks/growth investing: Growth investors search for companies they believe have strong growth potential. Their earnings are expected to grow at an above-average rate compared to the rest of the market, and therefore there is an expectation that their share prices will increase in value. See also value investing.

Hedge/hedging: Consists of taking an offsetting position in a related security, allowing risk to be managed. These positions are used to limit or offset the probability of overall loss in a portfolio. Various techniques may be used, including derivatives. An ‘inflation hedge’ would be an asset or investment that is expected to maintain or increase in value relative to the level of inflation over time.

Gross domestic product (GDP): The value of all finished goods and services produced by a country, within a specific time period (usually quarterly or annually). It is usually expressed as a percentage comparison to a previous time period, and is a broad measure of a country’s overall economic activity.

Share buybacks: The repurchase of shares by a company, thereby reducing the number of shares outstanding. This gives existing shareholders a larger percentage ownership of the company. It typically signals the company’s optimism about the future and a possible undervaluation of the company’s equity.

Volatility: The rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. Higher volatility means the higher the risk of the investment.

Earnings per share (EPS): The portion of a company’s profit attributable to each share in the company. It is one of the most popular ways for investors to assess a company’s profitability. It is calculated by dividing profits (after tax) by the number of shares.

MSCI World ex US Index: An index designed to measure the combined equity market performance of large- and mid-cap securities in developed and emerging market countries excluding the United States.

—–

Important information

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

Growth stocks are subject to increased risk of loss and price volatility and may not realize their perceived growth potential.

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market as a whole.

Energy industries can be significantly affected by fluctuations in energy prices and supply and demand of fuels, conservation, the success of exploration projects, and tax and other government regulations.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

MSCI Europe Index℠ reflects the equity market performance of developed markets in Europe.