Subscribe

Sign up for timely perspectives delivered to your inbox.

Portfolio Managers Doug Rao, Nick Schommer, and Brian Recht explain how this year’s volatility has affected the landscape for growth equity investing.

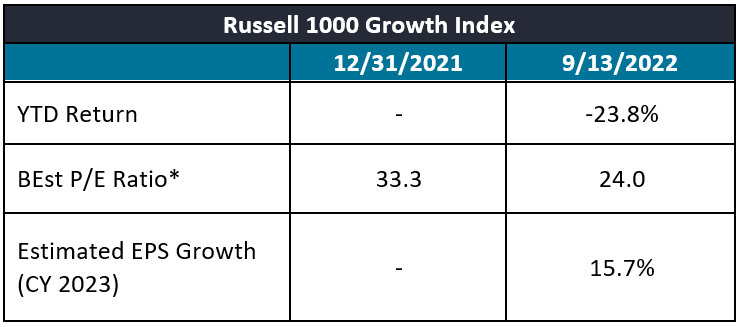

After leading the market higher for many years, US growth stocks have dropped significantly in 2022. Many have come under pressure as interest rates have climbed, eroding the value of expected future earnings and compressing valuation multiples. The Russell 1000® Growth Index, for example, has fallen over 23% year to date. Given the index has seen modest earnings revisions to date, the P/E (price-to-earnings) ratio has fallen even further.

Source: Bloomberg, as of 13 September 2022. *BEst (Bloomberg Estimates), based on blended forward 12-month earnings. Past performance is no guarantee of future results.

There are real risks affecting growth stocks as inflation persists and the US Federal Reserve (Fed) continues its hawkish bent. The investment backdrop has shifted significantly, and some investors may still be anchored to the low-rate, low-inflation expectations that drove the market environment over the last decade. A slowing economy and uncertainty around a potential recession pose challenges, particularly for high-growth technology stocks exposed to businesses adjusting their tech budgets. That said, one of the main drivers of disinflation over the past decade has been the proliferation of technology, and recent wage inflation may incentivise further technology investment in productivity, efficiency, and substitution solutions to moderate labour costs. There have been risks for companies that underestimated demand pull-forward during COVID, and the market has punished unprofitable stocks or those with weak balance sheets as financing conditions have tightened. The market is also facing the potential for waning consumer demand as COVID-related stimulus dwindles and is drawn down from personal savings.

In the face of these risks, however, we still view shorter-term price movements as temporary for quality growth businesses, in contrast to the risk of permanent loss of capital for companies with broken business models. We urge investors to consider the “fundamental” beta of their portfolios – that is, the risk associated with the underlying business strength of the companies they own, as opposed to the backward-looking, quantitative volatility of stocks in their portfolios. For instance, we believe that companies with the most competitively advantaged products in their categories will prove to be less risky in the long term. Furthermore, those that have contracts that are inflation-adjusted, with lower demand elasticity and pricing power, may be less susceptible to inflationary pressures and rising rates. Over the long term, we believe these and other fundamental strengths can lead to lower risk for high-quality, competitively advantaged businesses.

The sell-off this year has been somewhat indiscriminate, with correlations among equities reaching multi-year highs. To that point, as growth stocks have declined, good and bad business models have often been punished similarly ‒ a development we think many investors are missing amid the current turbulence. In this type of factor-driven market, we have seen companies that are growing, highly profitable leaders in their industries, with dominant market share, that have fallen just as much as significantly lower-quality companies.

It appears that we are entering a period where growth may become scarcer and capital is more expensive, which could result in a market that is no longer highly correlated, creating more dispersion of returns. In contrast to the previous regime, where cheap money broadly supported all companies, this new environment could favor individual stock picking. As we have seen this year, passive indices, by definition, have been forced to sell companies on the way down, regardless of their fundamentals. An active manager can do the opposite, recognizing perceived dislocations in value and adding to quality equities that are being sold.

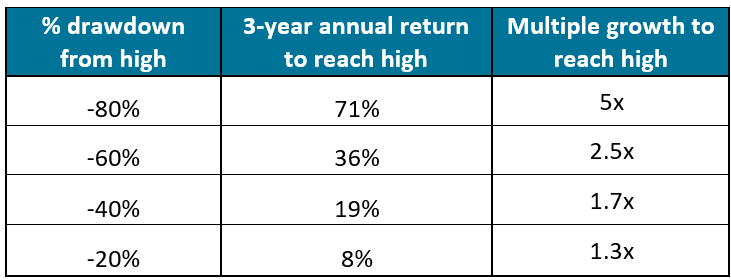

While the technology sector has evolved significantly over the intervening years, we witnessed a similar dynamic in 2000, when much of the sector was sold indiscriminately. Some exceptional businesses that suffered through that turmoil have since emerged in a position of strength. Likewise, we think there are opportunities for quality companies to emerge from the current circumstances and thrive. Given the drawdowns this year, if quality businesses can return to their previous price levels, they will achieve significant returns, as illustrated in Figure 2 below.

The example provided is hypothetical and used for illustrative purposes only. It does not represent the returns of an actual investment.

The question that we are now asking is, what are the next great companies that can emerge from this scenario? While this year’s environment has been volatile, we believe the long-term value proposition for quality growth companies remains intact. If investors can separate short-term moves from long-term fundamental prospects, we believe there is potential to uncover some of the market’s next leaders.

Past performance is no guarantee of future results.

Hawkish: Indication that central bankers are looking to restrict money supply to achieve their policy objective. The opposite of dovish.

Price-to-Earnings (P/E) Ratio measures share price compared to earnings per share for a stock or stocks in a portfolio.

Index performance does not reflect the expenses of managing a portfolio as an index is unmanaged and not available for direct investment.