Subscribe

Sign up for timely perspectives delivered to your inbox.

As the US Federal Reserve (Fed) moves into restrictive territory and indicates it will stay there for some time, yield curves flattened to the lowest level since 2000 and recession risk rose. Portfolio Manager Helen Anthony discusses what this means for bonds.

The Fed hiked by 75 bps as expected and struck a hawkish tone. In truth, Jackson Hole stole the limelight from this meeting, with Fed chair Jay Powell very much reiterating the tone of his speech then. The Fed is committed to bringing inflation down at any cost, especially given price pressures overshot consensus expectations – both on a headline and core basis – last week.

However, it was the dot plot – that indicates the central bank’s rate projections – that shows the Fed’s thinking that interest rates need to be higher for longer to tame inflation. Rates are expected to reach the mid 4% level by the end of the year (in line with markets) – though markets pushed out the peak in the Fed funds rate from March to May.1 The central bank projects rates to stay at a similar level throughout 2023 to end the year at 4.6% (up from 3.8% in June). Rates are then expected to decline towards a (surprisingly) unchanged long-term dot of ~ 2.5% (indicative of the long-run neutral rate of interest).

The Fed’s forecasts for both growth and unemployment were also revised down:

The Fed’s projections for unemployment and growth seem optimistic, in our view, given the degree of monetary tightening, but only time will reveal to what degree this is wishful thinking.

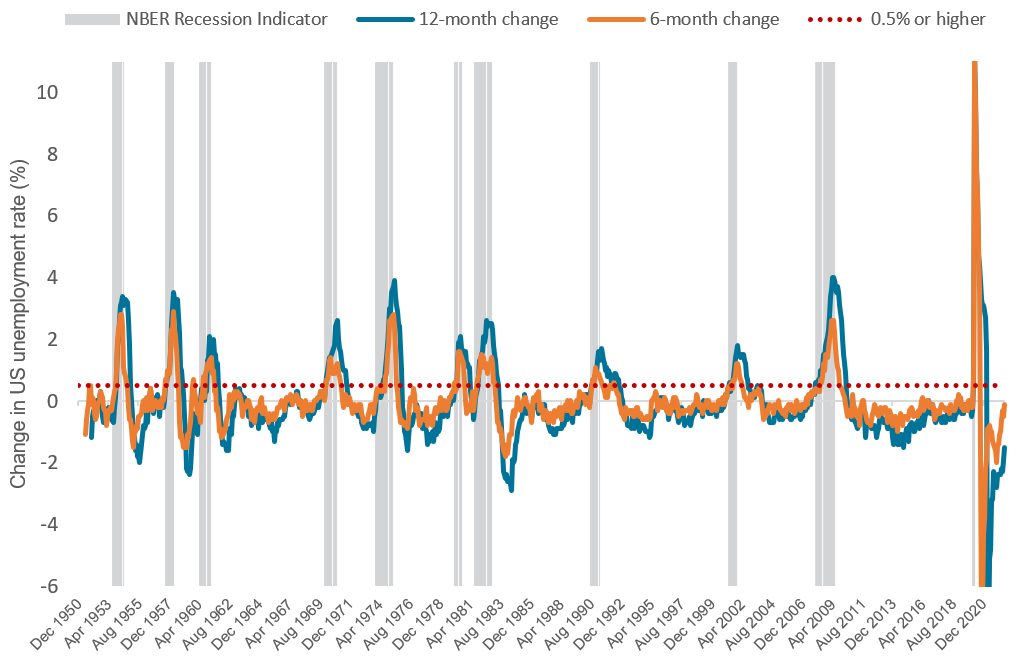

Powell’s desire for a period of “below-trend growth” to tame inflation is more likely to materialise in recession. While we acknowledge that the strong labour market can cool off as hiring plans are scrapped, history shows that the rise in the unemployment rate projected by the Fed is consistent with recession.

Source: Bloomberg, 22 September 2022.

With central bankers in a “shoot first, ask questions later” mood, this may set up the global economy for a fall, especially as monetary policy works with a lag. While we can see the more rate-sensitive parts of the economy experiencing weakness (i.e., housing), this is seemingly ignored by central bankers and now to some extent by markets, given the former are tending to focus on current inflation.

Other central banks like Sweden’s Riksbank (by a hawkish 100 bps) this week have hiked rates and forecasted two consecutive quarters of -0.5% growth this year (following the Bank of England’s lead on forecasting a recession). The Swiss National Bank hiked by 75 bps, bringing its interest rate into positive territory. Central banks know that to bring inflation down through monetary policy, they need to weaken demand (reflected in growth and unemployment) but the issue is, when it occurs, how do you achieve this without causing significant economic stress. Even in the US, the chances of a soft landing are slim.

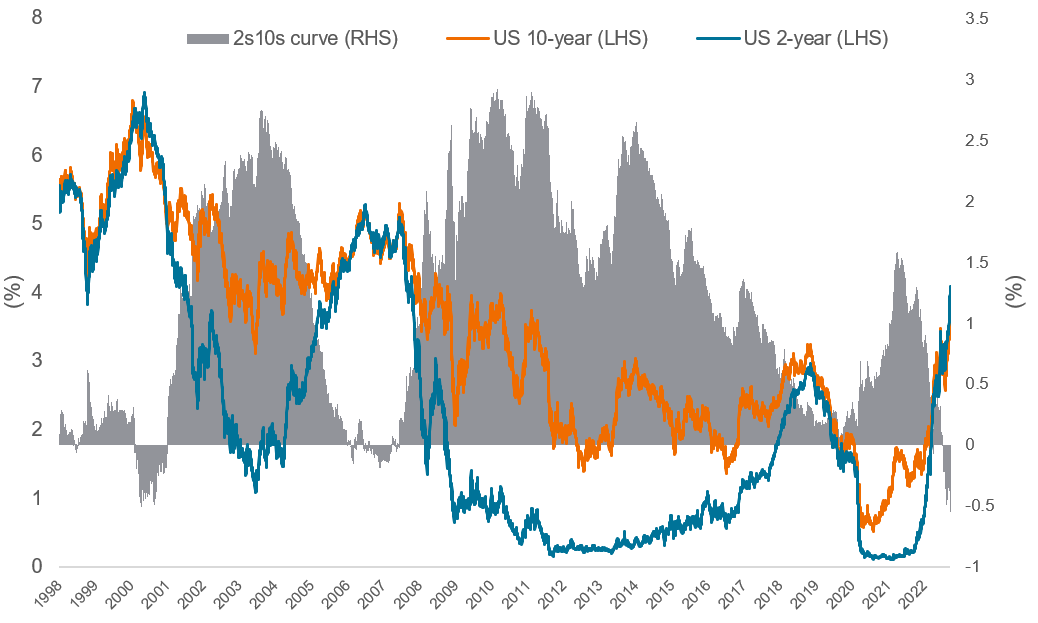

What was notable about the bond market reaction is two-year yields continued to make new highs for this cycle, while the yield curve was sharply flatter, as the Fed re-emphasised its commitment to seeing inflation lower. With elevated recession risks and central banks in a whatever-it-takes mode to lower inflation, we expect government bond yields to recouple to the weak economic outlook over the longer run; however, in our view, the peak in bond yields is unlikely to be seen just yet, given a more decisive turn in inflation is needed first.

Source: Bloomberg, 22 September 2022. The 2s10s curve represents the difference between the 2-year and 10-year yield.

1 As represented by Fed funds futures.

Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Consumer price inflation: A measure that examines the price change of a basket of consumer goods and services over time. It is used to estimate ‘inflation’. Headline CPI or inflation is a calculation of total inflation in an economy, and includes items such as food and energy, in which prices tend to be more prone to change (volatile). Core CPI or inflation is a measure of long-run inflation and excludes transitory/volatile items such as food and energy.

Future: A contract between two parties to buy or sell a tradable asset, such as shares, bonds, commodities or currencies, at a specified future date at a price agreed today. A future is a form of derivative.

Gross domestic product (GDP): The value of all finished goods and services produced by a country, within a specific time period (usually quarterly or annually). It is usually expressed as a percentage comparison to a previous time period, and is a broad measure of a country’s overall economic activity. Real GDP is a measure of a country’s GDP that has been adjusted for inflation.

Hawkish: Hawkish: Indication that central bankers are looking to restrict money supply to achieve their policy objective. The opposite of dovish.

Monetary policy: The policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money. Monetary tightening refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money.

Neutral rate of interest: the real interest rate that supports the economy at full employment/maximum output while keeping inflation constant.

Yield: The level of income on a security, typically expressed as a percentage rate. For equities, a common measure is the dividend yield, which divides recent dividend payments for each share by the share price. For a bond, this is calculated as the coupon payment divided by the current bond price.

Yield curve: A graph that plots the yields of similar quality bonds against their maturities. In a normal/upward sloping yield curve, longer maturity bond yields are higher than short-term bond yields. A yield curve can signal market expectations about a country’s economic direction.