Subscribe

Sign up for timely perspectives delivered to your inbox.

Portfolio Managers Seth Meyer, John Kerschner, and John Lloyd discuss how securitized sectors might play a key role for bond investors amid a challenging interest rate environment.

According to the Federal Reserve (Fed), it’s now official: interest rates will need to move up from here – and remain higher for longer – to stifle unacceptably high inflation. Following a summer of, at times, wild speculation around the Fed’s thoughts and intentions regarding the path of rate hikes, Fed Chair Jerome Powell delivered a crystal-clear statement from Jackson Hole in late August. In it, he dispelled any ambiguity and left little room for conjecture. What he communicated – in no uncertain terms – is that the Fed it is committed to its 2% inflation target, that it will need to move to a restrictive policy stance by raising rates further, and that it must keep at it until the job is done.

Most notable from Powell’s speech was the phrase, “restrictive stance for some time,” because futures markets have been pricing in rate cuts as soon as next year. The Fed poured cold water on this idea, indicating that inflation has become too persistent and broad-based for them not take drastic and sustained action. An imminent return to the post-Global Financial Crisis (GFC) zero-rate regime seems increasingly unlikely.

Of course, a Fed pivot is always a possibility. But this seems an unlikely scenario at present, and a risky one to bet on. We think investors would do well to take the Fed at its word and position their portfolios for a higher-for-longer rate environment. What does that look like for fixed income portfolios? In our opinion, investors should aim to bolster both the offensive and defensive characteristics of their bond allocations. A portfolio’s offense can be reinforced by taking advantage of higher yields and relative valuations, while strengthening defense might entail efficiently managing duration and diversifying one’s risk factor exposure. An allocation to securitized assets may help on both counts.

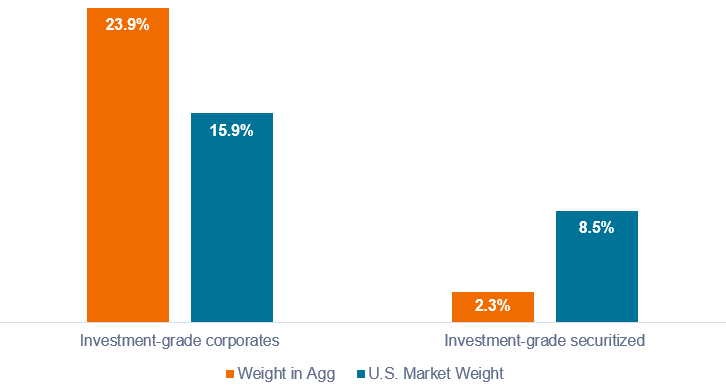

While the Bloomberg U.S. Aggregate Bond Index (Agg) serves, for many, as a proxy for exposure to the investable fixed income universe, composition of the index differs materially from the universe itself. As shown in Exhibit 1, investment-grade (IG) corporate bonds make up less than 16% of the U.S. investable universe but command an almost 24% weighting in the Agg. Conversely, securitized sectors1 have a smaller than proportional weight of 2.3% in the Agg, relative to their market weight of 8.5%. In our view, investors may need to actively manage the weight discrepancies between the Agg and the investable universe to ensure they are gaining adequate exposure to necessary sectors.

Source: Bloomberg, SIFMA, as of 31 December 2021.

Note: Investment-grade securitized category includes ABS, CMBS, CLOs, and CMOs, and excludes agency MBS.

In a more challenging environment, we encourage investors to think less in terms of asset class diversification and more in terms of risk-factor diversification. How much exposure does a bond portfolio have to changes in interest rates? To the corporate credit cycle? To the consumer’s creditworthiness?

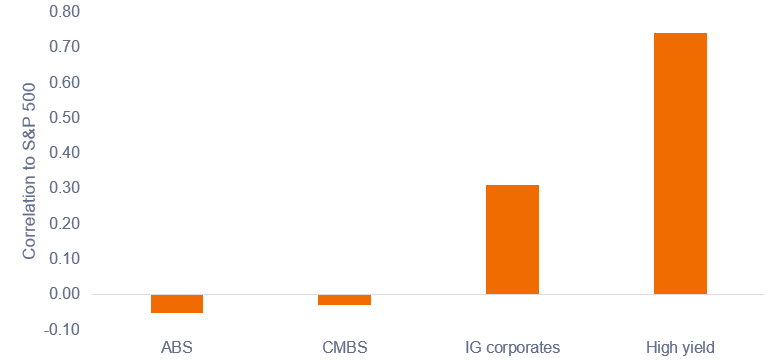

To the extent that many securitized markets are backed by loans made to consumers – not corporations – they should offer some diversity from the risks that drive equities and corporate bonds, and this should be reflected in their correlations. Indeed, as shown in Exhibit 2, for the decade ended 31 July 2022, high-yield and IG corporate bonds have been positively correlated to equities, while CMBS and ABS have exhibited negative correlations. All else equal, adding negatively correlated assets to a portfolio should provide diversification, and may lead to better risk-adjusted returns in the long run.

Source: Bloomberg, as of 31 July 2022.

Note: Weekly correlations for the 10-year period ended 31 July 2022. Indices used to represent asset classes: ABS (Bloomberg U.S. Agg ABS Index), CMBS (Bloomberg U.S. CMBS Investment Grade Index), IG corporates (Bloomberg U.S. Corporate Investment Grade Index), High yield (Bloomberg U.S. Corporate High Yield Index).

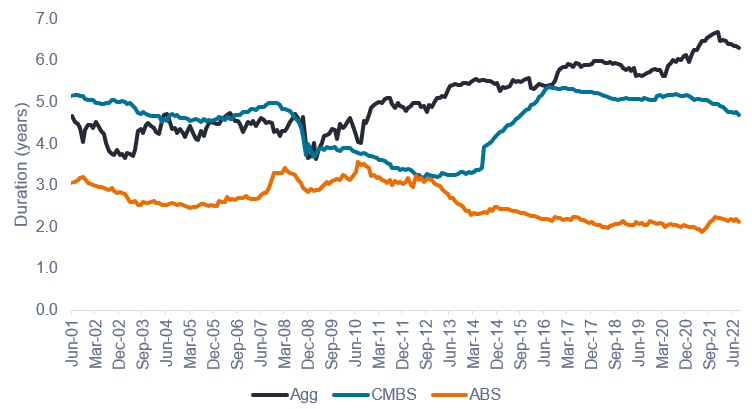

Over the past decade, the Agg’s duration has steadily crept above six years, as issuers have moved to take advantage of low interest rates by issuing longer-dated debt. Effectively, investors holding the Agg have been taking ever-increasing interest rate risk as the duration of the index has ticked up. This duration extension proved to be a tailwind for returns while rates were falling, but would be a headwind for bonds if rates continue to move higher. In our view, investors should consider managing interest rate risk by “rebalancing” their portfolio duration by incorporating lower-duration assets into their core bond holdings. Due to the nature of their underlying assets, securitized sectors exhibit inherently lower duration than the Agg, and can help with duration management, as shown in Exhibit 3.

The addition of securitized assets provides opportunity to dampen overall portfolio duration

Source: Bloomberg, as of 30 August 2022.

While a forthcoming recession in the U.S. is not necessarily a foregone conclusion, a slowdown in growth seems undeniable. As investors prepare for a slowdown – and the uptick in corporate defaults that tends to follow – we think there is value in bolstering the credit quality of portfolios through the addition of securitized assets. The average credit quality of both the ABS and CMBS indices is AAA/AA+, higher than the Agg’s average rating of AA+/AA. Additionally, most securitized bonds amortize as time goes on, as each monthly payment includes both an interest and a principal component. This monthly pay down of principal tends to de-risk most ABS and CMBS bonds as time passes.

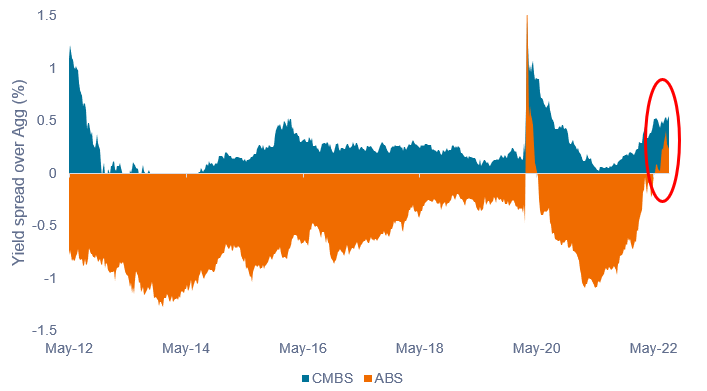

While the yields on the Agg, CMBS, and ABS indices are all relatively comparable at 4.0%, 4.5%, and 4.1%, respectively2, on an historical basis, the yield spread of CMBS over the Agg is at its widest point since 2012, excluding COVID. The yield spread on ABS stands out to an even greater extent – it has historically traded at a discount to the Agg but is now trading at a premium for the first time since the GFC, excluding COVID, as shown in Exhibit 4.

Source: Bloomberg, Janus Henderson Investors, as of 30 August 2022.

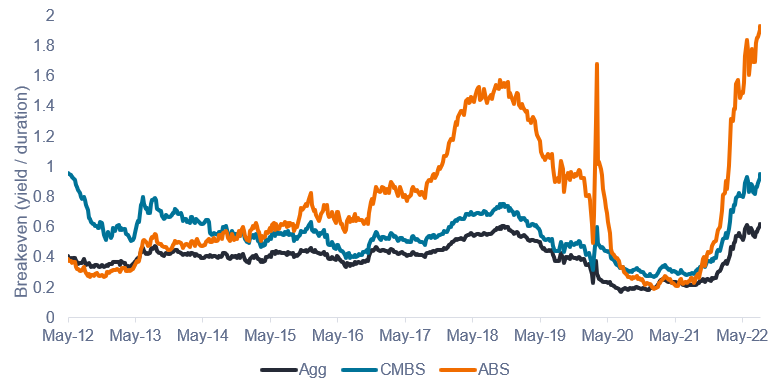

With the threat of rising interest rates, a key metric to follow is the breakeven (yield/duration), which shows the amount of yield a bond delivers per year of duration. The higher the breakeven, the more interest rates would have to rise for price decreases to exceed the yield on the bond. ABS and CMBS are delivering not only higher breakevens than the Agg, but they are at their highest levels in the last 10 years, as shown in Exhibit 5. We believe this presents an opportunity to add CMBS and ABS to portfolios at favorable valuations.

Due to lower duration, ABS and CMBS historically offer better protection against rising rates than Agg

Source: Bloomberg, Janus Henderson Investors, as of 30 August 2022.

While the tailwinds from falling interest rates after the GFC were a boon to fixed income returns, a potential reversal of that trend is likely to put pressure on fixed income returns. We believe investors may need to be more intentional in constructing portfolios, paying particular attention to actively managing duration and finding pockets of value and yield where they’re available. And as the more challenging landscape begins to take shape, the addition of securitized assets with their strong credit quality, low duration, and competitive yields may provide investors with the opportunity for improved risk-adjusted returns.

1Securitized sectors include asset-backed securities (ABS), commercial mortgage-backed securities (CMBS), collateralized loan obligations (CLO), collateralized mortgage obligations (CMO), and excludes agency mortgage-backed securities (MBS).

2Bloomberg, as of 8 September 2022.

Bloomberg U.S. Aggregate Bond Index is a broad-based measure of the investment grade, US dollar-denominated, fixed-rate taxable bond market.

Correlation measures the degree to which two variables move in relation to each other. A value of 1.0 implies movement in parallel, -1.0 implies movement in opposite directions, and 0.0 implies no relationship.

Duration can also measure the sensitivity of a bond’s or fixed income portfolio’s price to changes in interest rates.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

The Fed, or Federal Reserve is the central banking system on the United States.

Collateralized Loan Obligations (CLOs) are debt securities issued in different tranches, with varying degrees of risk, and backed by an underlying portfolio consisting primarily of below investment grade corporate loans. The return of principal is not guaranteed, and prices may decline if payments are not made timely or credit strength weakens. CLOs are subject to liquidity risk, interest rate risk, credit risk, call risk and the risk of default of the underlying assets.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

High-yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.

Mortgage-backed securities (MBS) may be more sensitive to interest rate changes. They are subject to extension risk, where borrowers extend the duration of their mortgages as interest rates rise, and prepayment risk, where borrowers pay off their mortgages earlier as interest rates fall. These risks may reduce returns.

Securitized products, such as mortgage- and asset-backed securities, are more sensitive to interest rate changes, have extension and prepayment risk, and are subject to more credit, valuation and liquidity risk than other fixed-income securities.