Subscribe

Sign up for timely perspectives delivered to your inbox.

The US Inflation Reduction Act (IRA) represents major progress towards the move to net zero, and supports the long-term case for resource equities according to portfolio manager Tal Lomnitzer.

US President Joe Biden recently signed the Inflation Reduction Act (IRA) into law, which includes a US$369 billion investment in climate and energy policies. This landmark piece of legislation has significant implications for the path towards clean energy in the US and the transition to net zero globally.

The Act is far reaching in nature, with potentially very effective provisions including:

The provisions strongly support existing efforts in the US to transition to a net zero economy. The IRA complements the Bipartisan Infrastructure Deal (Infrastructure Investment and Jobs Act) enacted in November 2021, which provides substantial funding to develop EV charging infrastructure as well as funding for green hydrogen.

In our view, the Bill is an acknowledgement that the US needs cheap, renewable forms of energy to both lower inflation and move towards security of energy supply, by reducing reliance on major suppliers like China and Russia, and instead looking to renewable energy grids and other domestic energy sources.

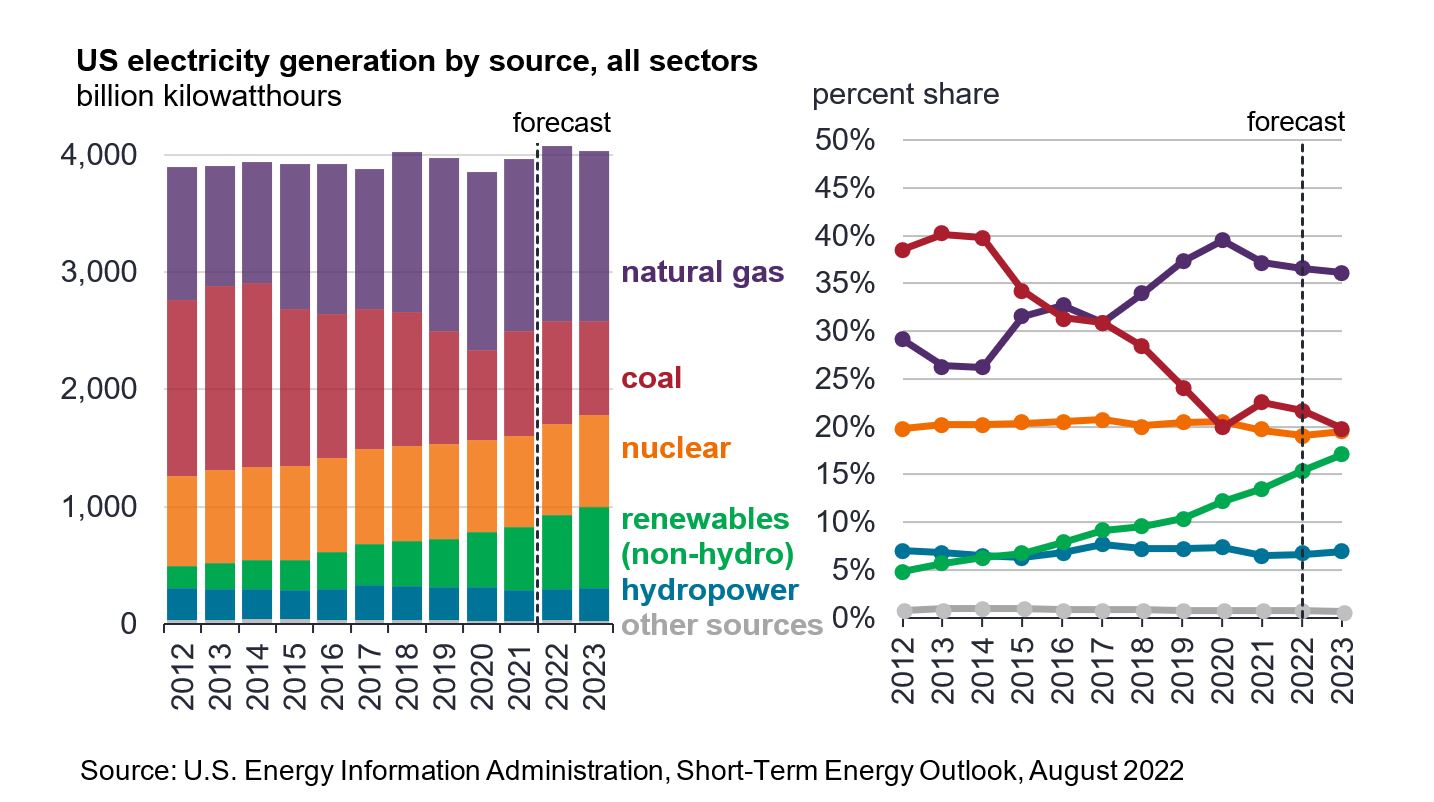

The US is the third-largest solar market and the second-largest wind market in the world. Carbon emissions are down by almost 20% from their 2007 peak1, not quite on track for net zero by 2050 but certainly heading in the right direction. This year the percentage of coal-fired power in the US electricity mix is expected to be around 22%, down from circa 40% in 20142 as shown in the chart below.

These reductions were achieved despite a pro-coal administration, because the economics and long-term interests of all stakeholders favour low carbon power.

The IRA is expected to increase the demand for a broad range of natural resources, along with the products and services from companies across the production and supply chain. Chief among them are metals such as copper, lithium, cobalt and nickel used to manufacture EV batteries. Coupled with Biden’s goal for EVs to make up half of all vehicle sales in the US by 2030, this is likely to support the rising global demand for these metals for the foreseeable future.

Apart from EV motors, batteries, inverters, wiring and charging stations, copper also plays a key role in the switch from gas to electricity, given it has the highest electrical conductivity of any engineering metal and is used among others, in field power cables, grounding networks, main generators and high voltage transformers. Meanwhile, the Bill also provides a boost for the use of solar panels, recycled steel and other building materials, plus green insulation such as wool and cellulose fibre used in energy efficient upgrades for homes and buildings.

A noteworthy factor is that the new IRA bill introduces certainty on tax credits for renewables over an unprecedentedly long period of time. Previously, tax credits would expire and were typically renewed for short periods eg. a few additional years. This stop-start nature resulted in a continued uncertain investment landscape for both investors and companies alike. Now the increased visibility is set to stimulate and accelerate investment into the renewables sector.

New production tax credits for other renewable energy sources including green hydrogen production and solar are also being introduced within the IRA. Under the terms of the green hydrogen PTC, green hydrogen looks to become the cheapest form of hydrogen in the US.

While in our view the IRA certainly provides a constructive backdrop there are some areas that are still lacking. The conditions to qualify for the full US$7,500 tax credit are rather stringent, and EV batteries must be assembled in North America or a country with which the US has a free trade agreement. While the Biden administration is providing funding to bolster battery production and related supply chains, at present China has a stranglehold on the global lithium-ion battery supply chain hence it could take some time for the full tax credits to be claimable.

Also, the Bill does not address local issues concerning the deployment of renewables such as building regulations, planning, and economic and environmental factors. A permitting reform bill could address the key challenges of scaling up renewables. This is an initiative that could accelerate timelines for US energy projects by reducing review periods, and is scheduled to go to vote in the House and Senate by the end of September.

Furthermore, there has been no mention of land access, which is critical to renewables. Princeton University’s Net-Zero America Study identified and quantified five different technological pathways that the US can pursue to decarbonise its economy by 2050. One such pathway, E+ RE+ (100% Renewable) would require approximately the combined land areas of Arkansas, Iowa, Kansas, Missouri, Nebraska, Oklahoma, and West Virginia to accommodate just wind and solar power generation.

The Inflation Reduction Act is set to ensure the US makes concrete and swifter progress towards decarbonisation. It follows in the footsteps of other regions; the REPowerEU roadmap was unveiled by the European Commission in March 2022. It sets out a series of measures to rapidly reduce dependence on fossil fuels, fast forward the green transition to lower energy prices, increase energy security as well as improving industrial competitiveness and supporting technology leadership in the industries of tomorrow. China too has green technology leadership ambitions; it’s anticipated that almost half of the world’s solar installations will be in China through to 2031 according to Fitch Solutions, while the International Energy Agency (IEA) reported that half of global EV sales in 2021 were in China.

For these reasons, the long-term investment case for an allocation to resource equities has never been stronger. We continue to see a diverse range of attractive opportunities within a sector that is providing the inputs and technological advancement needed for a more sustainable world.

Source data:

1Statista, carbon dioxide emissions from energy consumption in the US, comparison between 2007 and 2021 annual data.

2 US Energy Information Administration, Short-Term Energy Outlook, August 2022

Net zero means to emit no more greenhouse gases into the atmosphere than are permanently removed and stored each year. Achieving net zero is essential to halt the buildup of climate-warming gases in the atmosphere and avert costly damages from climate change.

The Net-Zero America study aims to provide granular guidance on what getting the US to net-zero emissions of greenhouse gases by 2050 really requires and the actions needed to translate pledges into tangible progress.

Commodities (such as oil, metals and agricultural products) and commodity-linked securities are subject to greater volatility and risk and may not be appropriate for all investors. Commodities are speculative and may be affected by factors including market movements, economic and political developments, supply and demand disruptions, weather, disease and embargoes.

Natural resources industries can be significantly affected by changes in natural resource supply and demand, energy and commodity prices, political and economic developments, environmental incidents, energy conservation and exploration projects.

Sustainable or Environmental, Social and Governance (ESG) investing considers factors beyond traditional financial analysis. This may limit available investments and cause performance and exposures to differ from, and potentially be more concentrated in certain areas than the broader market.