Subscribe

Sign up for timely perspectives delivered to your inbox.

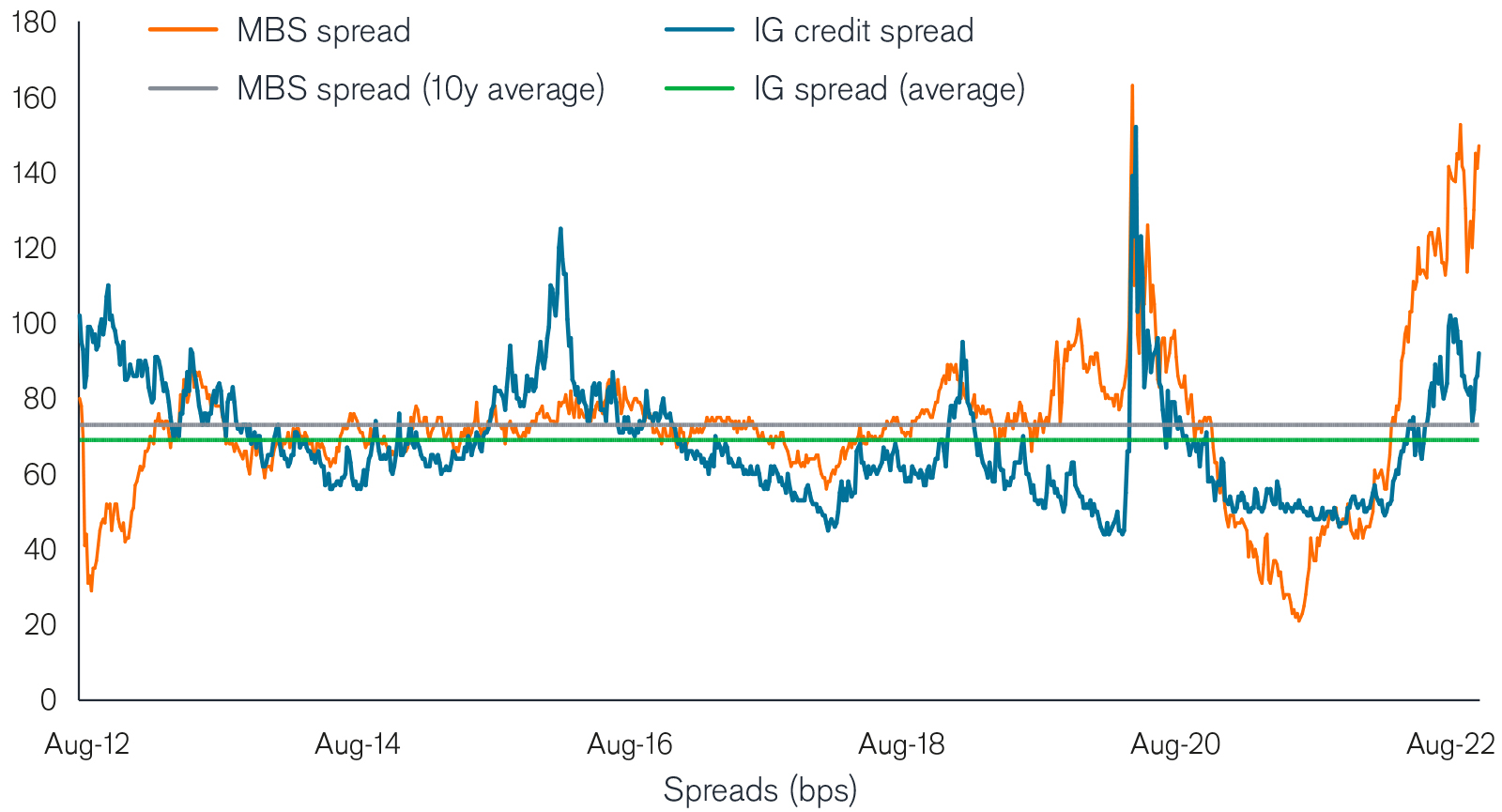

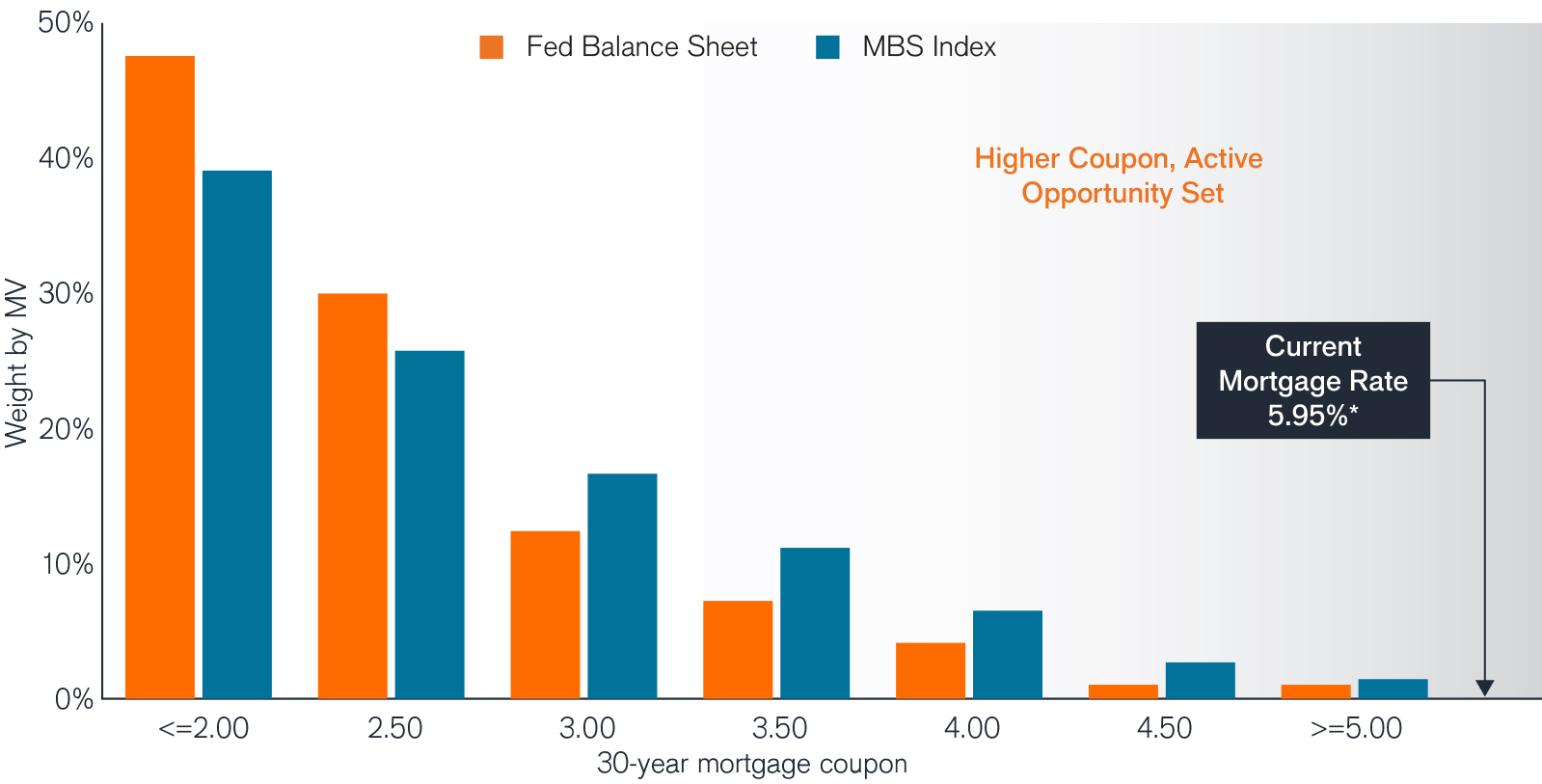

The Portfolio Construction and Strategy Team discusses how this year’s dramatic mortgage rate rise has created opportunities in mortgage-backed securities (MBS) and why active MBS allocations can help increase yield and mitigate risk.

This article is part of the latest Trends and Opportunities report, which seeks to provide therapy for recent market shocks by offering long-term perspective and potential solutions.

This year’s dramatic mortgage rate rise has led to higher-coupon mortgage bond opportunities for investors, with a compelling yield cushion to protect against future volatility.

Source: Bloomberg, Janus Henderson Investors. As of 8/31/22.

Source: Bloomberg as of 8/31/22