Subscribe

Sign up for timely perspectives delivered to your inbox.

Small-cap performance during recessions has often been resilient, with the potential for significant growth as the economy recovers.

We wrote earlier this year about navigating the risks that had been building in small-cap stocks, and those risks have come to a head in the volatility we have seen since November of last year. Although they have recovered somewhat, in 2022 small caps suffered their worst first-half drawdown since the inception of the Russell 2000® Index in 1978, falling 23.4%. While market declines were widespread, the period was especially painful for higher-multiple, longer-duration growth stocks, many of which had outperformed during the pandemic.

During the run-up and subsequent sell-off in some of these high-flying names, we noticed unnerving similarities to the tech bubble of the late 1990s and early 2000s. In fact, the investment philosophy we have applied for over 20 years developed out of that environment, and we believe the lessons learned remain relevant today.

Much like many of the “Internet 1.0” stocks, recent market excitement centered around the promise of transformational technology such as cloud-based platforms and software. While we firmly believe in the power of these business models and technologies, we also believe in investing in them at a reasonable price for the growth they offer. In contrast, opportunists following price momentum and looking for quick gains bid these companies up to higher and higher valuations. As those valuations pushed to extreme levels, investors resorted to non-traditional metrics to justify the expense, another hallmark of the dot-com bubble. As veteran investors, we took these developments as a sure sign to be wary.

We had been concerned for some time that the Federal Reserve (Fed) was behind the curve on addressing inflation, so we have been encouraged more recently to see policymakers finally take aggressive action to rein in price pressures, which may help to temper inflation expectations and reassure capital markets. At the same time, we recognize that the Fed’s actions have increased economic risks. Historically, the Fed’s efforts to engineer a soft landing through interest rate hikes have frequently ended in a recession. While we have already seen two consecutive quarters of economic contraction, economic data remains mixed, making the Fed’s job even more difficult.

As we have seen since late last year, small-cap stocks, which tend to be more volatile and economically sensitive than large caps, typically sell off more in anticipation of an economic downturn. What may come as a surprise is that they also tend to recover before recessions end and lead the market coming out of a recession.

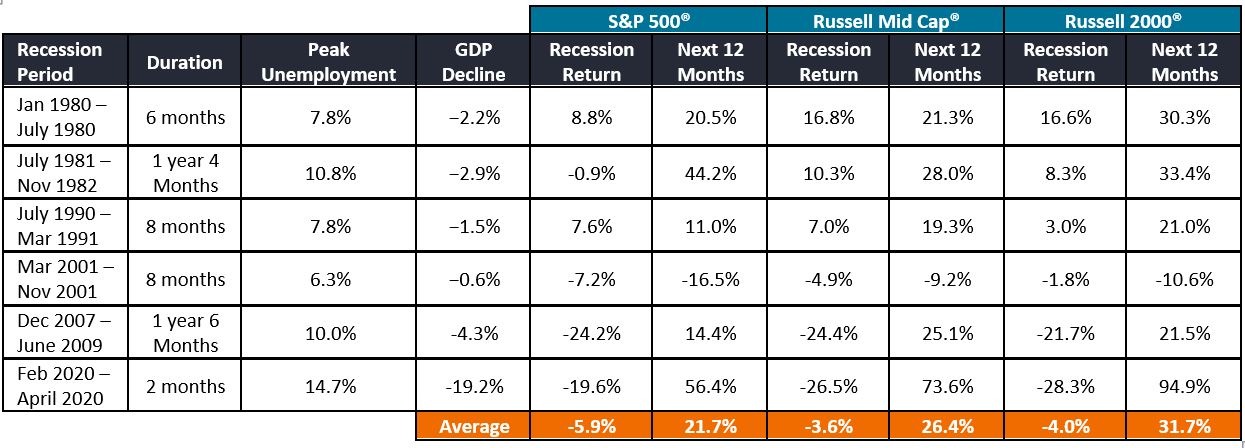

As the data in the chart below show, small caps (as represented by the Russell 2000® Index) led both large caps (S&P 500®) and mid caps (Russell Mid Cap®) following the last six recessions, returning over 31% on average the following year. At the same time, small-cap returns during those recessions averaged a relatively resilient return of roughly -4%.

While this has been the case for the asset class overall, we believe that it is also important for investors to actively identify small-cap companies with specific traits. We believe these companies may be better positioned to weather periods of economic downturn and higher interest rates to emerge in a position of strength.

Recessions and Index Returns by Market Cap (1980 – 2020) Source: Morningstar Direct, National Bureau of Economic Research, U.S. Bureau of Labor Statistics, Bureau of Economic Analysis.

Source: Morningstar Direct, National Bureau of Economic Research, U.S. Bureau of Labor Statistics, Bureau of Economic Analysis.

Given the uncertainties that have developed in the market, investors have shown little patience for unprofitable companies or those with higher debt levels. It will become much more difficult for these companies – which we have always viewed with skepticism – to fund their operations and growth as rates rise and the financing market becomes tighter.

In contrast, we think businesses with high margins, strong free cash flow and quality business models may be better positioned to weather an economic downturn and a higher rate environment. Companies with high profitability and strong cash flows can maintain ample liquidity during recessionary periods, allowing them to continue to invest and grow, and providing a cushion to support debt payments. Those with quality, consistent business models and defensible moats are more insulated from changes that can occur in competitive landscapes during recession. These companies tend to be more resilient and less susceptible to dramatic drawdowns, which are damaging and difficult to recover from, and can position themselves for future growth while others are on the defensive.

We caution that the equity market may remain volatile, but would also note that markets often anticipate in advance what will happen economically. We think it is a fool’s errand to attempt to predict short-term market movements. Rather, we believe investors should respect that the market has cycles and apply a consistent investment process throughout those cycles.

That said, valuations appear much more reasonable now than we have seen for a long time, and in many cases already reflect a dire economic outlook. For high-quality small-cap companies, that may not be something to fear.

Smaller capitalization securities may be less stable and more susceptible to adverse developments, and may be more volatile and less liquid than larger capitalization securities.

Index performance does not reflect the expenses of managing a portfolio as an index is unmanaged and not available for direct investment.

Russell 2000® Index reflects the performance of U.S. small-cap equities.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

Russell Midcap® Index reflects the performance of U.S. mid-cap equities.