Subscribe

Sign up for timely perspectives delivered to your inbox.

Retirement Director Ben Rizzuto discusses the results of a survey conducted with Janus Henderson interns and explains how the findings can help financial professionals better educate and engage with younger investors.

This summer Janus Henderson had the pleasure of hosting several groups of interns at many of our global offices. Here in Denver, we hosted interns from the Greenwood Project.

The Greenwood Project (GP) provides career opportunities to high-achieving Black and Latinx students through paid internships, educational field trips, a FinTech coding bootcamp, and a summer Financial Institute that provides simulated training for the financial services and technology industries.

I’ve been fortunate to be able to interact with them throughout the summer, and it has afforded me the opportunity to provide guidance and support. (Unfortunately, it’s also forced me to see how “un-cool” I have become over the years.)

More importantly, we conducted a survey that was developed by GP interns Marianna Martinez (Northwestern University, 2025) and Hanna Abera (University of Illinois-Urbana Champagne, 2025) to get their fellow interns’ views on their futures and their finances.

The findings give us valuable insight into what young people are thinking about, worried about, and what their financial goals might be. These ideas should help financial professionals better understand younger people, who very likely will become financial planning clients in the future. I think the survey results – along with open-ended feedback we received from the interns – also provide all of us in the financial industry with clues on how we can better educate and engage with younger investors.

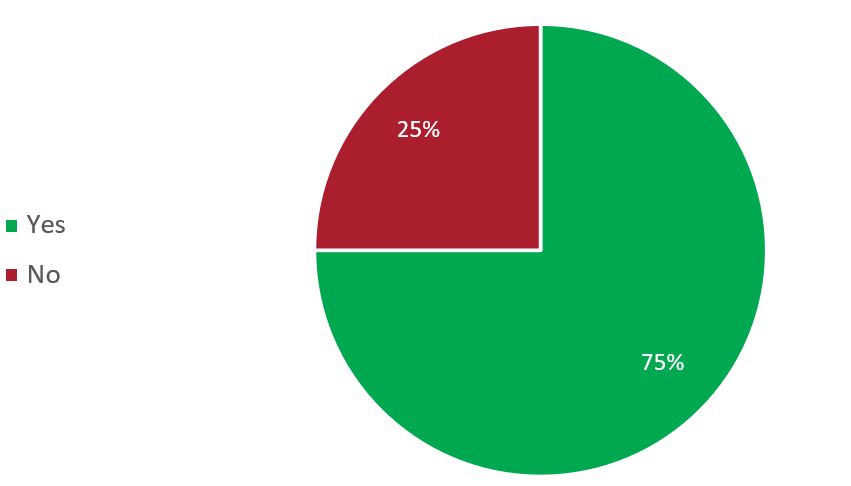

When we think about millennials, Gen Z, or just young people in general, the stereotypical refrain is that they don’t listen and they think they’ve got it all figured out. But in reality, as this survey and others have shown, this group is generally willing and excited to learn. In our survey, 100% of respondents noted that they knew something about finances but wanted to learn more. Topics that were of most interest included real estate and cryptocurrencies, but also foundational ideas like retirement accounts and long-term financial planning.

For example, when I asked Marianna for more of her thoughts on these subjects, she noted that long-term financial planning was important and would help her achieve long-term financial freedom. Hanna noted that she would like to know more about budgeting but also expressed an interest in learning more about affordable investing options like exchange-traded funds.

With these responses, both Marianna and Hanna demonstrate that young people do understand that they need to think about their futures but still need our help to get there.

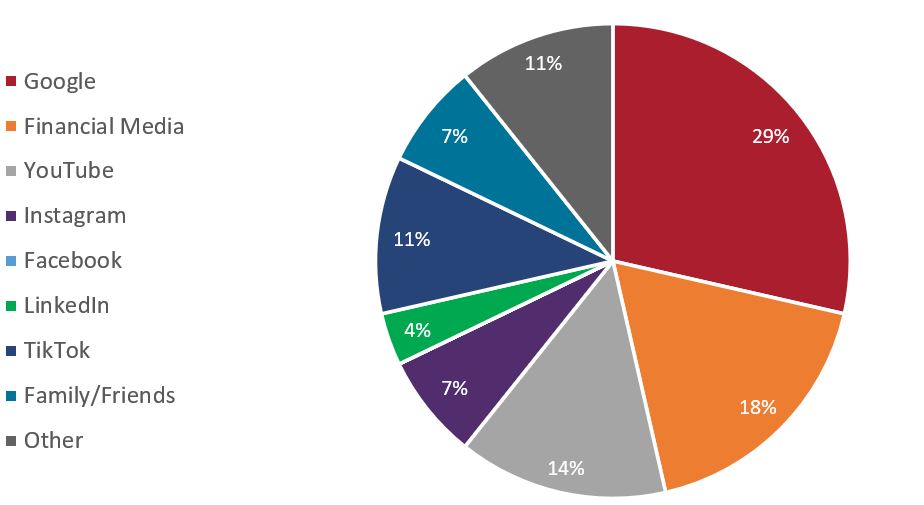

One of the main questions I get from advisors is how to connect with younger people. We’ve encouraged families to conduct family money meetings, but it’s also important to be able to engage with young investors directly. When we asked our group how they got financial information, all of them said they utilized the internet or apps like TikTok or Instagram. (Surprisingly, only 20% cited family/friends as a resource.)

I think this speaks to the fact that financial professionals clearly need to have a presence online and create content that’s viewable on their websites. But they should also be thinking about posting content on sites like YouTube or even TikTok, because that’s where many younger investors turn for financial information. More importantly, they need to make sure this content is relatable to younger people.

One key aspect of that is to create content that is “visual and easily understandable,” as Hanna put it. The use of pictures, simple drawings and analogies are so important here, and they push us to explain financial concepts in simple terms. If you’re able to do this, you’ll be able to connect and build a relationship with your viewers.

It may seem unthinkable, but I’d encourage all advisors to look at the top personal finance YouTube channels. In particular, read the comments on these videos; you will see that viewers feel connected to the creators, many times acting as if they are on a first-name basis with them.

Engaging with people through mediums like YouTube also helps increase accessibility, which is an important thing to remember with this group. Many of the young people I’ve spoken with find financial advisors inaccessible. In fact, Marianna and Hanna both commented that financial professionals are “unaffordable” or “only for rich people.” I’ve heard these same sentiments from other young people, and that reputational issue is a key obstacle that financial professionals of today and tomorrow will need to overcome. Part of the solution lies in being accessible online.

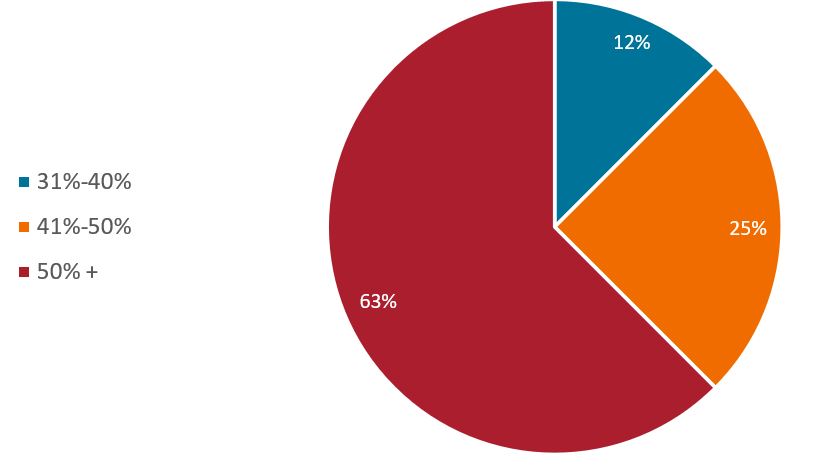

While GP interns have yet to graduate from college, it’s interesting to see when young people plan on retiring. You can see the breakdown in the chart below, but in looking at the results and speaking with respondents, there are a couple key ideas that emerge.

At what age do you want to retire?

First, the “retirement age” may be getting younger. With some respondents saying they’d like to retire at age 40, it’s clear they are going to need help from financial professionals to accomplish these goals or educate them as to what may be possible.

Second, the idea of “retirement” seems to be shifting as well. The idea of working until age 65, getting a gold watch from the company and then playing golf every day is largely a thing of the past. Retirement for Gen Z may look more like a book with many chapters. Young people may close one chapter, or career, to then start something else, with all of these chapters focusing on passions, interests and learning something new. This again highlights the value financial professionals can provide in helping investors generate or manage the income they will need over the years to realize these goals.

The young investors of today and tomorrow will be the people that financial professionals will be working with more and more over the next few decades. While they may seem like an enigmatic group, I continue to see a generation of individuals who are serious about their futures and excited to learn.

Not only that, but this is a group that wants to be role models. Both Marianna and Hanna mentioned helping those around them through increased financial acumen and success. Marianna summed it nicely by saying that she “wants to be able to help my family members and the community around me.”

And isn’t that the type of client we want to meet with? Someone who is engaged and who is going to push us to find solutions for their own financial goals, but also someone who takes those lessons and shares that success with their friends, family and community.

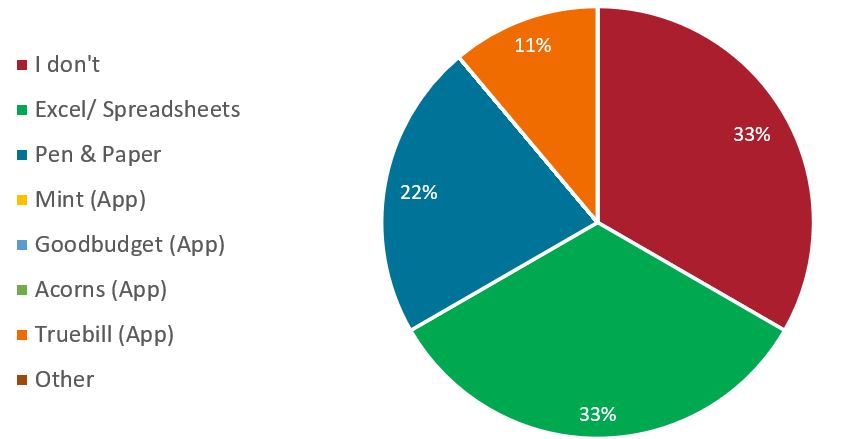

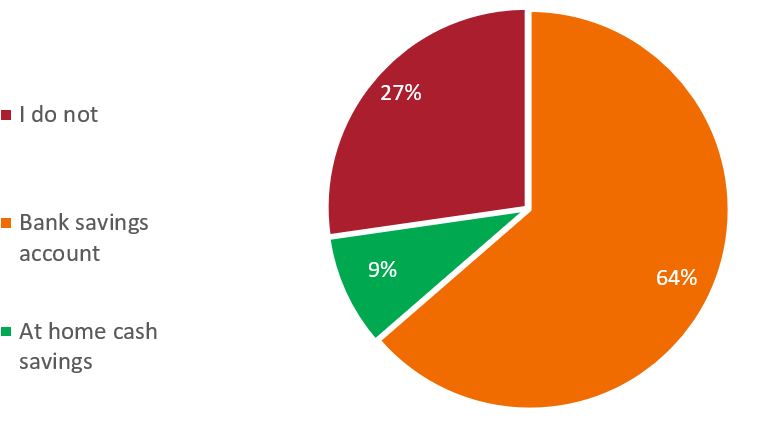

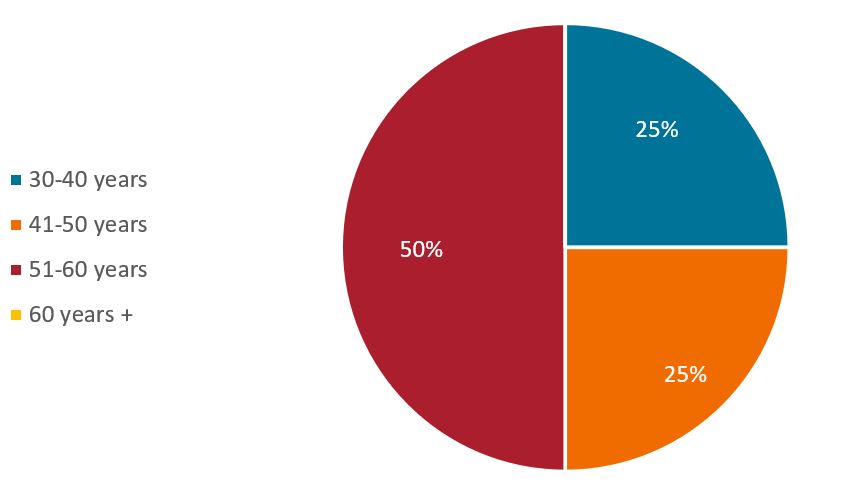

Below are some additional findings from our survey: