Subscribe

Sign up for timely perspectives delivered to your inbox.

Senior Portfolio Strategists Sabrina Denis and Damien Comeaux from the Portfolio Construction and Strategy (PCS) Team share practical insights from recent consultations with global investors on sustainable investing, with a focus on whether unintended risks are introduced into sustainable model portfolios. They also discuss why it is important to follow an active, forward-looking approach when using environmental, social and governance (ESG) factors as criteria.

In the case of sustainable investing, environmental, social and governance (ESG) criteria are often considered in the portfolio construction processes. But what if many of these new sustainable portfolios carry different risks compared to their traditional counterparts when it comes to asset class, style and sector concentrations? In other words, can a shift to “sustainable” investing introduce unintended risks?

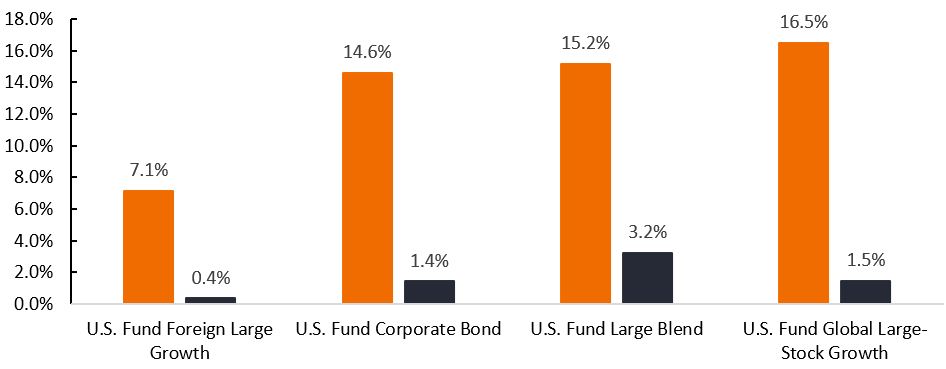

An investor in traditional U.S. Large Blend equity or Foreign Large Growth equity has a plethora of strategies available. As shown in Exhibit 1, that same investor looking to mirror this selection in their sustainable portfolio is limited to a much smaller selection. For example, only 7% of funds in the Morningstar Foreign Large Growth Category – less than 1% of assets under management within the category – explicitly indicate any kind of ESG impact in their strategy.

Exhibit 1: Share of Sustainable Funds and Total Net Assets in the Respective Morningstar Fund Category

Source: Portfolio Construction and Strategy, Morningstar. Number of funds in the respective Morningstar category and percentage of total net assets that explicitly indicate any kind of sustainability, impact or ESG strategy in their prospectus or offering documents, as of June 30, 2022.

One result of this availability challenge is that sustainable portfolios might look and feel different than traditional portfolios and therefore expose investors to a different set of risks.

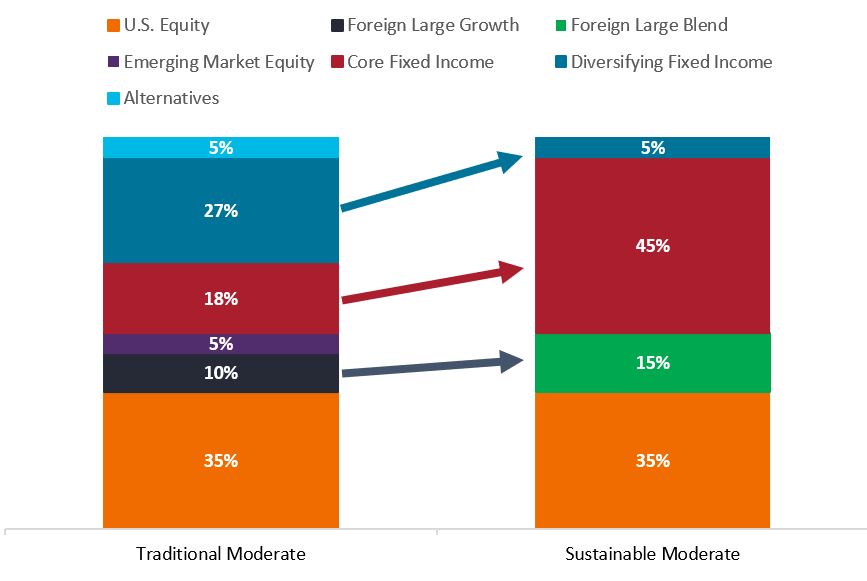

Exhibit 2 represents a recent U.S. client case study based on a PCS Team consultation. When translating their traditional model to a sustainable approach, they made many asset allocation shifts – and therefore risk shifts – which are attributable to the relative paucity of sustainable strategies in certain categories.

Exhibit 2: Traditional vs. Sustainable Portfolio Holdings

Source: Portfolio Construction and Strategy, as of June 30, 2022. The allocations are shown for illustrative purposes to represent a model and are based on sample allocations from our database.

Source: Portfolio Construction and Strategy, as of June 30, 2022. The allocations are shown for illustrative purposes to represent a model and are based on sample allocations from our database.

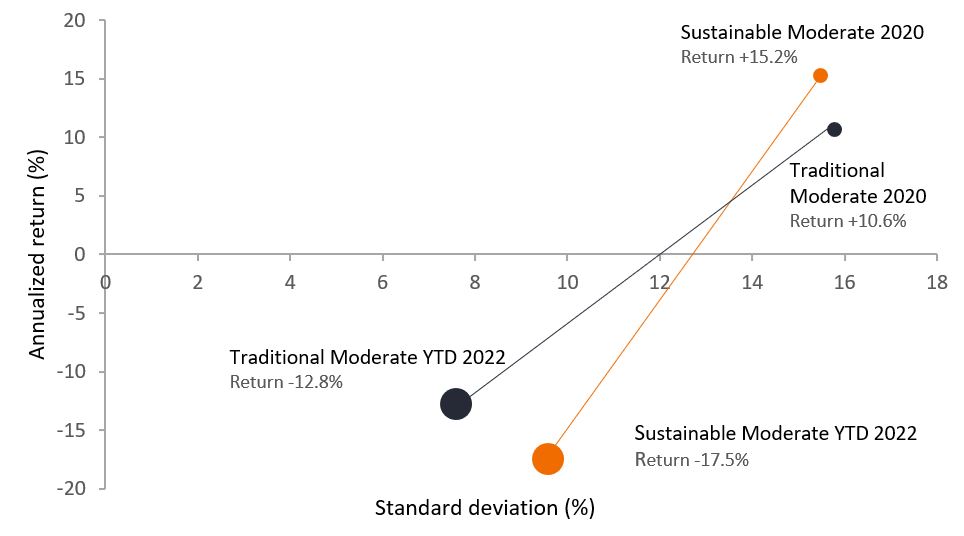

The asset allocation inconsistencies between the two models above should of course be expected to lead to a return divergence, but we found the degree of divergence somewhat surprising. As illustrated in Exhibit 3, the sustainable portfolio significantly outperformed the traditional portfolio in 2020, but the roles have been reversed more recently, with the traditional model outpacing the sustainable model by almost 5% year to date. These return discrepancies can create headaches when managing client expectations across traditional vs. sustainable portfolios.

Exhibit 3: Traditional vs. Sustainable Sample Moderate Portfolio – 2020 and YTD 2022 Risk and Returns

Source: Portfolio Construction and Strategy, Morningstar. Cumulative 2020 calendar year and YTD 2022 returns, net of fees, as of June 30, 2022. Returns assume reinvestment of dividends and capital gains. The allocations are shown for illustrative purposes to represent a model portfolio and are based on sample allocations from our database. Past performance does not predict future returns.

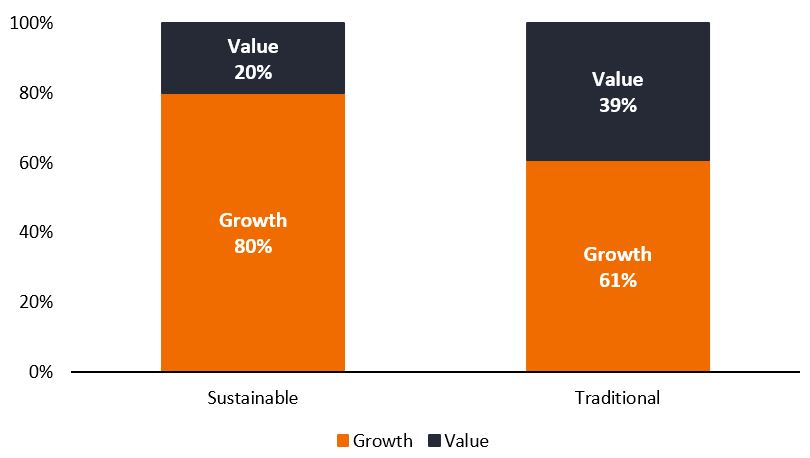

As we dug deeper, we saw that the differences between the traditional and sustainable models are not just attributable to asset allocation effects. Looking at the equity portions of the models, the difference in style between the Traditional and sustainable equity managers also introduces a significant difference in the exposure to the growth factor, as well as sector allocations.

Exhibit 4: Growth vs. Value Equity Style Bias

Source: Portfolio Construction and Strategy, Morningstar. The style breakdowns are shown for illustrative purposes to represent a model and are based on sample allocations from our database. Data as of June 30, 2022.

Source: Portfolio Construction and Strategy, Morningstar. The style breakdowns are shown for illustrative purposes to represent a model and are based on sample allocations from our database. Data as of June 30, 2022.

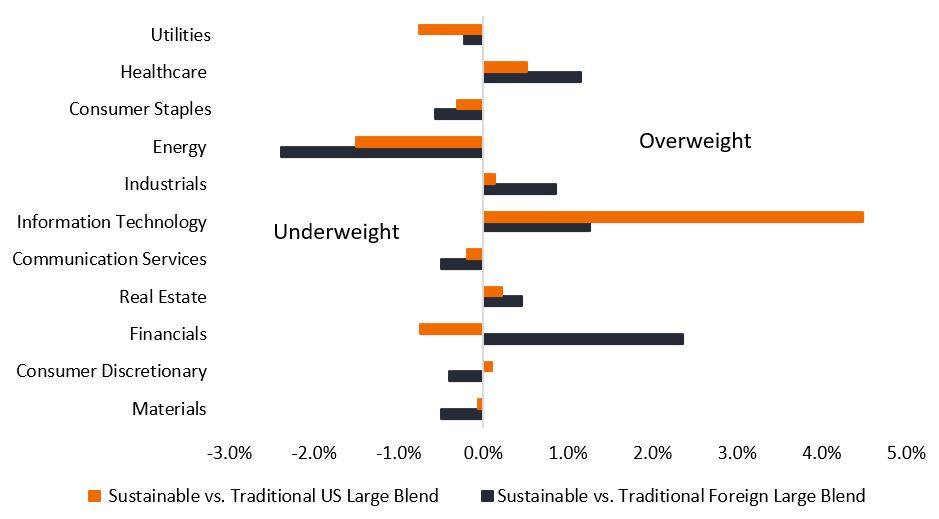

This difference in growth exposure in the models has obvious consequences, especially during periods of market volatility. Consistent with that observation, when we compare the sector exposures of all U.S. large cap and ex-U.S. large cap funds with their sustainable counterparts, we see that sustainable equity funds tend to have a stronger bias toward the technology and health care sectors (Exhibit 5). These sectors generally outperformed in recent years, especially in 2020 as “beneficiaries” of the COVID-19 crisis. Our analysis shows that managers of sustainable funds have typically been less exposed to a few of the better-performing sectors – such as energy, consumer staples and utilities – relative to broader equity funds year to date.

Exhibit 5: Sustainable Sector Exposures Compared with Traditional

Source: Portfolio Construction and Strategy, Morningstar as of June 30, 2022. Sector exposures of funds’ holdings in the Morningstar categories, comparing US Large Blend vs US Large Blend ESG equity and Foreign Large Blend vs. Foreign Large Blend ESG Equity. ESG defined by Morningstar, as prospectus with a clear sustainability objective.

The translation from traditional to sustainable models introduces a variety of changes in risk, whether it be overall asset allocation shifts or the composition of risks within the same asset classes in both models (e.g., style and size) – all of which can have an impact on returns.

Building sustainable model portfolios requires appropriate risk management tools, asset allocation perspective and fund-level due diligence to minimize unintended asset allocation tilts, biases, drifts and other risks. These, in our view, are important considerations in maintaining asset allocation consistency across client portfolios.

Lastly, it is important to remember that there is no one-size-fits-all solution to sustainable investing. That’s why our Portfolio Construction and Strategy Team partners with financial professionals to help them build sustainable portfolios by utilizing a full spectrum of ESG tools and resources.

The PCS Team performs customized analyses on investment portfolios, providing differentiated, data-driven diagnostics. From a diverse universe of thousands of models emerge trends, themes and potential opportunities in portfolio construction that the team believes may be interesting and beneficial to any investor.