Subscribe

Sign up for timely perspectives delivered to your inbox.

Health care historically has outperformed during market downturns, and the current period is no exception. But some areas of the sector tend to be more defensive than others, says Portfolio Manager Andy Acker. At the same time, investors should not lose sight of health care’s long-term growth opportunities.

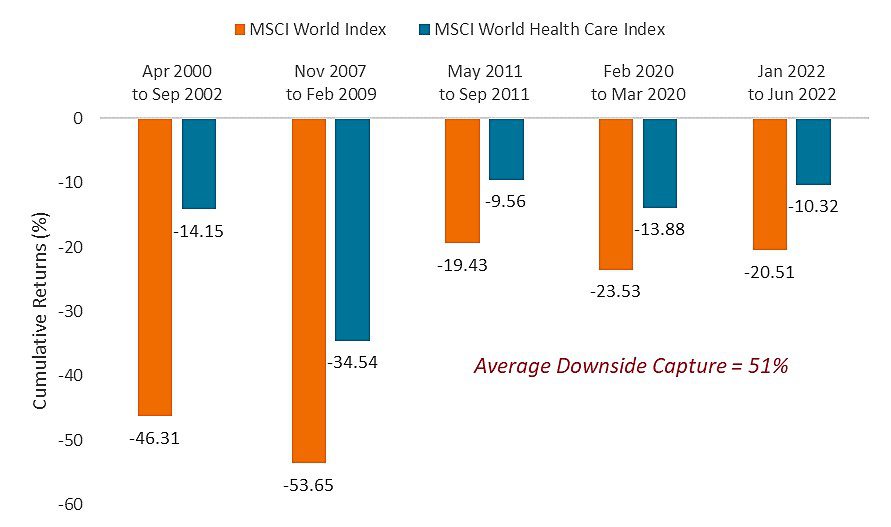

That the health care sector is proving resilient is not surprising. Across five downturns in global equities since 2000, the sector’s downside capture ratio2 has averaged just 51% (see chart). But health care is also made up of multiple industries, which do not move in tandem. Each is impacted differently by rising rates, labor costs and other macroeconomic trends. Investors who keep these dynamics in mind may be able to maximize health care’s defensive nature, while also positioning for growth when the next economic expansion begins.

Health Care’s Defensive Track Record Source: Janus Henderson Investors, FactSet, as of 30 June 2022

Source: Janus Henderson Investors, FactSet, as of 30 June 2022Managed health care: These companies are among the most defensive companies within health care. For one, insurance policies typically are one year in length, with proceeds invested in short-duration securities that get rolled over. As such, rising interest rates are often accretive to these firms’ earnings. At the same time, premiums (and therefore profits) tend to rise in response to inflationary pressures: health insurance companies negotiate rates for commercial plans one to two years out, creating regular opportunities to lift prices or adjust benefits. A deep recession would negatively impact affordability and unit demand by patients. But with labor markets remaining tight, we have yet to see that happen. In addition, losses in commercial insurance membership could be offset by government programs, where growth is not economically sensitive.

Distributors and pharmacy benefit managers: These companies’ business models are tightly correlated with pharmaceutical pricing and volume trends. (The firms form the supply chain of drug distribution in the U.S.) Pharma tends to be a defensive industry during economic downturns, and drug price increases, should they occur, get passed along, leading to higher profits. Retail pharmacy could experience mixed results as affordability decreases, but the impact should be mitigated by the fact that most front-end sales are non-discretionary.

Pharmaceuticals: Pharma represents one of the more defensive subsectors within health care, as demand for medicines tends to be inelastic. With strong balance sheets and high free cash flows, large-cap pharma companies are also less sensitive to rising rates. And with many levers to pull to reduce expenses, these firms are less susceptible to inflationary pressures.

Health care providers: Labor is the largest input cost for providers, such as hospitals. As such, these companies’ profit margins contracted during the first half of 2022, as wages rose before reimbursement rates could be adjusted. Higher supply costs also negatively impacted profitability. In addition, health care utilization has been slow to return to pre-COVID levels as a result of workforce turnover and consumers prioritizing other spending. In our view, these headwinds are largely temporary but will pressure the subsector for as long as they persist.

Medical devices and technology: For many medical procedures, volumes have yet to return to pre-pandemic levels, and with nursing shortages persisting, prospects for an above-trend recovery have diminished. What’s more, medical device companies typically have year-over-year price depreciation. With providers facing high labor inflation, profit margins could be at risk. Against that backdrop, we think it is especially important for investors to focus on finding firms with sustainable competitive advantages – a product, for example, that drastically improves the standard of care or addresses an unmet medical need – and the best pricing power among peers.

Life sciences tools and services: Unlike medical device companies, life sciences tools and services companies – which provide analytical tools, instruments, supplies and clinical trial services – tend to be price makers, and many were recently able to pass on higher-than-normal price increases. That should help preserve profit margins near term. However, these companies are not without risk given their relatively higher valuations for the sector.

Biotechnology: Early development stage biotech companies – those with pipelines in preclinical or early stage clinical trials – are the most vulnerable to slowing economic growth and rising rates. These companies rely on capital markets to sustain future development, and rising rates and risk-off sentiment can put funding at risk. In this environment, investors may want to favor profitable or early commercial biopharma firms, as they have a wider range of financing options and a better chance of being rewarded by investors for positive pipeline developments. The good news: valuations are now unusually cheap. Small- and mid-cap biotech companies entered into a bear market long before the broader equity market did. (A benchmark for small- and mid-cap biotech equities peaked in early 2021, and since then, has retreated more than 50%.3) As such, many small-cap biotechs now trade below the value of cash on their balance sheets, creating what we think is a rare opportunity to invest in these firms’ long-term growth potential at a deep discount.

Contract research organizations (CROs): Rising interest rates have negatively impacted biotech funding and valuations for the sector (as just discussed), which is a key end market for CROs. Emerging biotech companies account for up to 20% of the CRO industry’s backlog of business. To date, CROs have continued to report solid new business metrics, as the record amount of capital raised by the biotech industry in 2020 and 2021 is still being put to work. However, new business metrics could slow if the current risk-off environment persists. In the long run, though, the rate of outsourcing to the CRO industry is expected to grow, and we believe investors will continue to have an appetite for scientific advancements.

1 Janus Henderson Investors, data from 31 December 2021 to 30 June 2022

Capture Ratio measures the percentage of index (market) performance an investment “captured” during periods when the index achieved gains (up capture) or declined (down capture). A capture ratio of 100% means investment performance went up or down exactly the same amount as the index.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

Health care industries are subject to government regulation and reimbursement rates, as well as government approval of products and services, which could have a significant effect on price and availability, and can be significantly affected by rapid obsolescence and patent expirations.

MSCI World Index℠ reflects the equity market performance of global developed markets.

MSCI World Health Care Index℠ reflects the performance of health care stocks from global developed markets.

Premium/Discount indicates whether a security is currently trading above (at a premium to) or below (at a discount to) its net asset value.

Smaller capitalization securities may be less stable and more susceptible to adverse developments, and may be more volatile and less liquid than larger capitalization securities.