July 2022 Absolute Return

Absolute Return Fixed Income: The bumpy return of duration risk Copy

Daniel Siluk

Daniel Siluk

Portfolio Manager Jason England

Jason England

Portfolio Manager

![]()

Portfolio Managers Jason England and Dan Siluk explain why shorter-dated bonds offer attractive characteristics in an era of structurally higher interest rates and market volatility.

KEY TAKEAWAYS

- With both the inflation outlook and the trajectory of interest rates uncertain, investors seeking lower volatility and diversification should consider concentrating their focus on the front end of the yield curve.

- With near-term rate hikes likely priced in, the risk/return profiles of shorter-dated bonds appear more favorable than the longer maturities saddled with duration risk.

- The resetting of bond prices has improved the potential for income generation and capital preservation across many market segments, including corporate credits and international issuance.

KEY TAKEAWAYS

- With both the inflation outlook and the trajectory of interest rates uncertain, investors seeking lower volatility and diversification should consider concentrating their focus on the front end of the yield curve.

- With near-term rate hikes likely priced in, the risk/return profiles of shorter-dated bonds appear more favorable than the longer maturities saddled with duration risk.

- The resetting of bond prices has improved the potential for income generation and capital preservation across many market segments, including corporate credits and international issuance.

Views as of early June 2022.

This year’s bond market upheaval has been the antithesis of what investors have come to expect from their fixed income allocation. Volatility has been high and capital losses pervasive. The first quarter’s -6.2% total return on the Bloomberg Global Aggregate Index was a multi-standard deviation event that had been exceeded only once in the past 32 years. In the wake of the sell-off, many investors are questioning the tenets underpinning bond allocations and, subsequently, how fixed income fits within a broader portfolio.

We view the recent volatility as the inevitable consequence of an adjustment from an era in which accommodative policy was a dominant force in the trajectory of bonds to one where prices are increasingly influenced by traditional factors, including interest rate (duration), credit and liquidity risks. Each of these have, to a degree, been distorted by the hyper-accommodative monetary policy that has held sway over the global economy during the post-Global Financial Crisis (GFC) and COVID-19 eras. Of the three, we believe that duration represents the most underappreciated risk to bonds, especially given the unique and potentially difficult-to-manage confluence of forces that have led to inflation reaching generational highs.

What changed

A dozen years of dovish monetary policy is a long time. Throughout that period, central banks sought to ignite growth – and inflation – by purchasing “safer” financial assets, thus compelling investors to venture farther out along the risk spectrum to achieve attractive returns. The objective was to lower the cost of capital for the riskier ventures that should be a source of economic growth. Yet central banks, most notably the Federal Reserve (Fed), became captive to this strategy. Any sell-off in riskier assets ignited fears that accommodation would fail, potentially sending the economy into a deflationary tailspin. Consequently, bouts of volatility were met with greater accommodation either in the form of dovish rhetoric or additional purchases of Treasuries and mortgage securities. With this backstop – the so-called Fed Put – in place, the risks posed by rising rates, corporate defaults and market liquidity all seemed manageable.

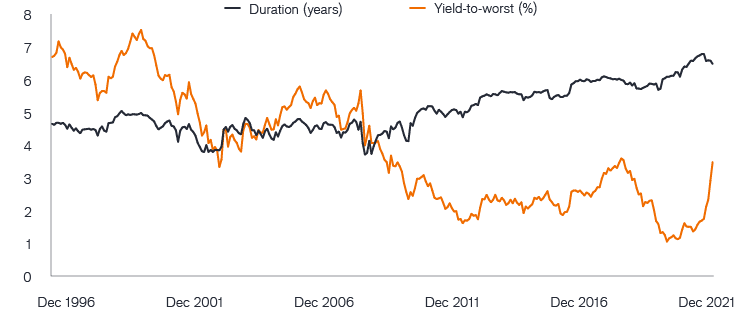

This casual approach to interest rate risk is best illustrated by the post-GFC era mismatch between aggregate bond market duration and yields.

Figure 1: Bloomberg U.S. Aggregate Bond Index duration and yield-to-worst

Source: Bloomberg, as of 27 May 2022. Past performance is no guarantee of future results.

As seen in Figure 1, the historical expectation that a bond’s yield should fairly compensate for its interest rate risk was turned on its head once the Fed became the swing player in the Treasuries and mortgage markets. Investors accepted rising duration risk without being compensated with commensurately higher yields not out of charity, but because many ceased to see higher rates as a bona fide threat.

That changed with the global surge in inflation. The Fed has already raised its benchmark overnight rate by 75 basis points (bps) and futures markets expect the equivalent of seven more 25 bps increases by the end of 2022. Importantly, Fed rhetoric has continuously emphasized controlling prices even as multiple asset classes fell deep into correction territory. Clearly, the Fed Put had expired and with it the notion that bond investors can look past duration exposure as a material risk to one’s capital. Instead, they likely face a future characterized by structurally higher rates and market volatility.

Meet the new bond market

In this era of policy tightening – which may mark the end of the 40-year bond rally – investors must take a more vigilant approach to managing duration. Credit and liquidity risk should also command greater attention, but for now corporate balance sheets appear healthy and markets continue to function. It’s interest rate risk that, in our view, should be prioritized given the unique challenges posed by the current inflationary environment.

Typically, central banks have a well-earned reputation for being behind the curve with respect to combating inflation. While policymakers in the U.S., UK and other jurisdictions have commenced tightening, Europe has been slower to change course, and in most cases central banks seem to be taking an incremental approach, especially within the context of alarmingly high inflation. Clouding the picture even more is that much of the upward lurch in prices originates from supply constraints that are more difficult to manage via monetary policy. On the other hand, shortages act as a brake on economic activity, as do roaming pandemic-related lockdowns in China. In short, an uncertain inflation outlook presents a risk – and risk can manifest itself in volatility.

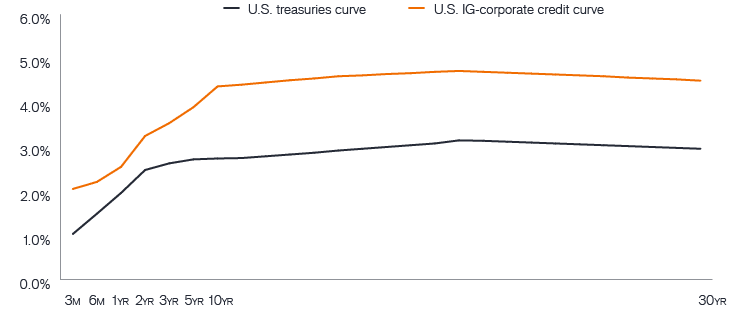

Figure 2: U.S. Treasury and investment-grade corporate yield curves

Source: Bloomberg, as of 27 May 2022. Past performance is no guarantee of future results.

A complex inflation backdrop and the potential for continued volatility takes on added relevance given the recent flattening of U.S. yield curves between mid- and longer-dated tenors. These sections of the curve carry higher duration risk as evidenced by the yield on the 10-year U.S. Treasury cresting 3.0% for the first time in over 40 months as investors grew concerned that the Fed was perhaps too circumspect in acknowledging that its “transitory” inflation call was misplaced.

The market’s inability to gauge the outlook for inflation is illustrated by the yield on the 10-year note reaching its pandemic-era high only one month after the yields on the 10-year and 2-year notes inverted – a development that typically signals rate hikes have a good chance of taming inflation by constricting economic growth.

Volatility data reinforce uncertainty in the path of inflation and longer-dated bond yields. Year-to-date annualized monthly volatility of the excess returns on 7- to 10-year bonds (based on 3-month T-Bills) stands at 6.0%, well above its long-term average of 4.9%. At 4.4% in 2022, this metric for 5- to 7-year maturities is a full 34% above its long-term average. By contrast, monthly excess return volatility on 1- to 3-year notes – at 1.6% through April – is only 20% above its historical range.

A focus on the front end

Although longer-dated maturities have proven more volatile in 2022, curve steepening has actually been concentrated on the front end. The yield on the 2-year Treasury rose 174 bps through May 27 – compared to 123 bps for the 10-year – as investors priced in well-telegraphed near-term moves by the Fed. We believe that shorter-dated Treasuries reflect the likely pace of rate hikes over the next year. With rate hikes “priced in” along the section of the curve most tethered to Fed policy, it is our view that shorter-dated notes should continue to exhibit lower levels of volatility.

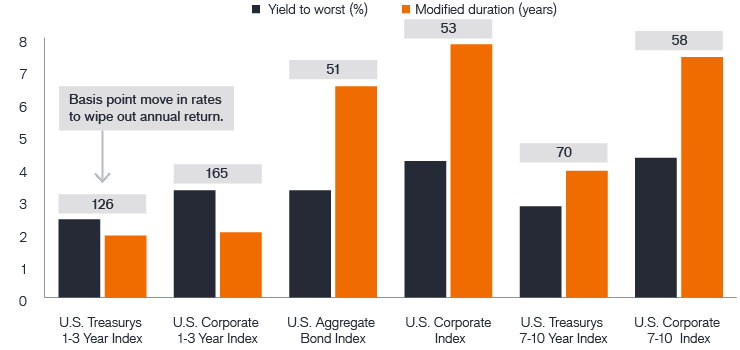

This year’s narrowing of the 10-year/2-year spread – and even that between 5 years and 2 years – has further amplified the variance in the risk/return profiles of different segments of the bond market. As illustrated in Figure 3, the mismatch between duration and yield has resulted in longer-dated bonds being considerably more vulnerable to an additional rise in rates than are nearer-term maturities. It would only take a 70 bps rise in rates to wipe out the annual income expected from Treasuries with 7- to 10-year maturities. For 1- to 3-year notes, it would be a less worrisome 126 bps. Since the rate-hiking cycle commenced, this “breakeven” point favoring shorter-dated bonds has only increased.

Figure 3: Bond market duration, yield and rate hike breakeven

Source: Bloomberg, as of 27 May 2022. Past performance is no guarantee of future results.

Sharpe ratios – another barometer of relative risk and return – tell a similar story. Again referencing annualized, monthly excess returns, the long-term Sharpe ratio of the 1- to 3-year segment of the Bloomberg U.S. Aggregate Bond Index is 0.83. The ratio drops – indicating a less-attractive risk/return profile – for each successive extension of maturity, culminating in just 0.56 for the 7- to 10-year segment. With higher levels of volatility canceling modestly higher yields – especially in a flatter-curve environment – we believe longer-dated bonds could again deliver unwelcome surprises to investors as long as the inflationary outlook remains unsettled.

Putting bonds back to work

We expected that the transition away from extraordinarily loose monetary policy would roil fixed income markets. Aggravating this process were central banks being compelled to aggressively pivot to a hawkish stance in the wake of accelerating inflation. But the resetting of bond yields into a higher range has the potential to enable a fixed income allocation to again deliver its traditional characteristics of capital preservation, diversification, income generation and lower volatility. We believe shorter-dated bonds offer the greatest chance to capture these.

The low yields of the post-GFC era not only hampered bonds’ ability to generate income, but they also limited their price upside. This, in turn, lowered the potential for bonds to deliver returns uncorrelated to those of riskier asset classes. With shorter-dated yields higher, the potential for capital appreciation and diversification has increased. These same higher yields also mean greater income generation as prevailing rates influence the coupons of new issuance and higher yields on existing bonds can capture more “roll down” as they near maturity.

With duration risk elevated, corporate bonds stand a greater chance of delivering traditional bond characteristics. Throughout this year’s sell-off, most of the losses in investment-grade credits were the result of their rate contribution rather than shifting sentiment on credit profiles. And while spreads between corporate-bond yields and those of their risk-free benchmarks have widened, corporate balance sheets among higher-rated issuers appear resilient by most measures.

Wider corporate spreads have the potential to help absorb any future move in rates. As illustrated in Figure 2, at 3.25%, the yield on 2-year corporates is 31% higher than that of 2-year Treasuries. While the credit risk premium may take on elevated importance for longer-dated issuance, for tenors below three years, it’s our view that investors have a higher chance of fairly assessing the default risk of a particular security.

Lastly, the divergence of monetary policies of various jurisdictions also has the potential to inject diversification and income generation into a bond portfolio. As we’ve stated in recent papers, all countries rode the same elevator down during the pandemic. They are taking escalators of different speeds and gradients on the way up. Countries that have already reset rates to a higher level can be sources of incrementally higher yields while those that are facing less inflationary pressure represent the potential for capital preservation. Across jurisdictions, as in the U.S., we believe that shorter-dated bonds are best positioned to allow bond portfolios to exhibit the traditional characteristics that have been notably absent of late.

Featured Funds

VNLA

Short Duration Income ETF

JUCIX

Absolute Return Income Opportunities Fund