July 2022 Global Equities

Can Biotech Bounce Back? Copy

Andy Acker, CFA

Andy Acker, CFA

Global Life Sciences | Portfolio Manager

![]()

Despite experiencing its deepest and longest drawdown on record, the biotechnology sector looks stronger than ever, says Portfolio Manager Andy Acker, thanks to accelerating innovation and valuations that have reset.

KEY TAKEAWAYS

- Over the past year, biotechnology has been caught up in a historic sell-off, sending the sector’s stocks down by more than 50%, on average.

- But in our view, biotech’s long-term growth drivers have not been impaired. On the contrary, a combination of scientific breakthroughs and robust funding are expected to lift sales by an average of 9% annually through 2026.

- At the same time, the S&P Biotech Sector trades at half its long-term average, which could set up the sector for a strong recovery.

KEY TAKEAWAYS

- Over the past year, biotechnology has been caught up in a historic sell-off, sending the sector’s stocks down by more than 50%, on average.

- But in our view, biotech’s long-term growth drivers have not been impaired. On the contrary, a combination of scientific breakthroughs and robust funding are expected to lift sales by an average of 9% annually through 2026.

- At the same time, the S&P Biotech Sector trades at half its long-term average, which could set up the sector for a strong recovery.

It’s easy to be discouraged by this performance, but we don’t believe the long-term outlook for biotech has become impaired. On the contrary, with valuations compressed and innovation in the sector accelerating, we’d argue the case for biotech has only grown stronger.

Short-Term Setbacks, Long-Term Value

A number of reasons have been cited for biotech’s recent rout. For one, it followed a frothy initial public offering (IPO) market, fueled by monetary stimulus and enthusiasm for the industry’s historic COVID-19 response, lifting valuations of early-stage companies. It was impacted by a renewed push for drug-pricing reform in the U.S. and the absence of a permanent commissioner at the Food and Drug Administration (FDA), which may have contributed to unexpected regulatory decisions. Finally, the prospect of rising interest rates drove a rotation out of longer-duration assets, including biotech.

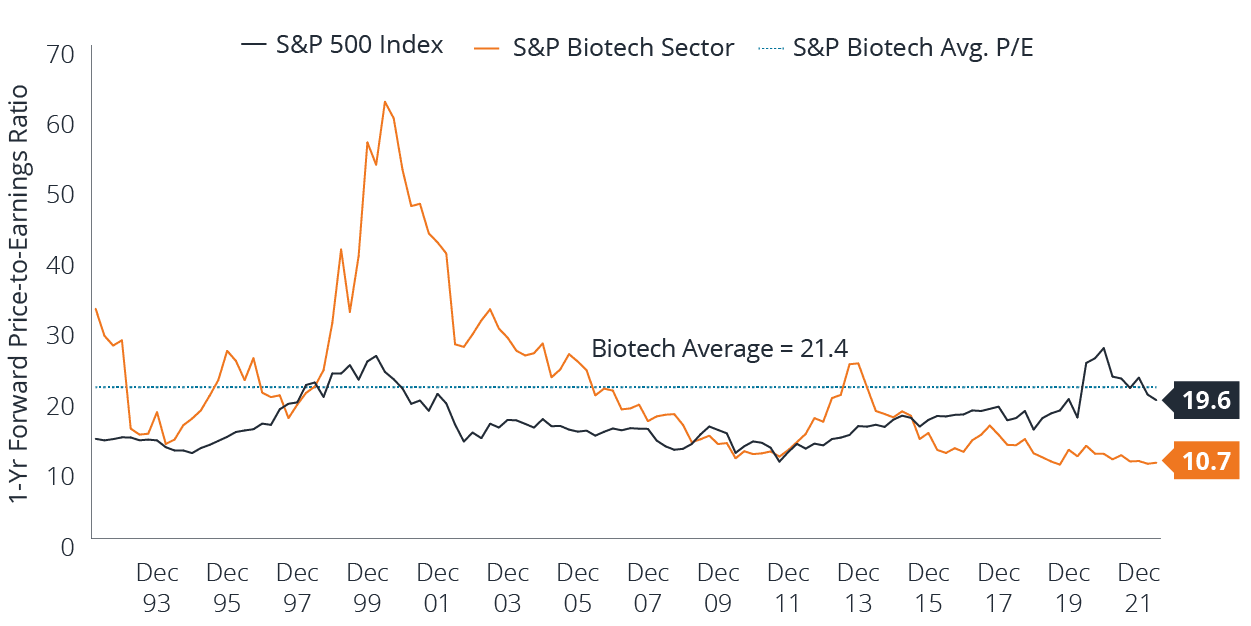

The IPO freeze could thaw when market volatility subsides and the path of rate hikes becomes clearer. In the meantime, there’s reason to believe many areas of the sector have become oversold. As of early 2022, a remarkable 16% of U.S.-listed biotechs traded below the level of cash on their balance sheets, more than during the 2002 and 2008 equity bear markets (8% and 11%, respectively).6 And by the end of February, valuations for large-cap biotechs sat well under their long-term average, as well as the average for the broader equity market (Exhibit 1).

Source: Bloomberg, from 30 September 1992 to 28 February 2022. The S&P Biotech Sector is composed of the large-cap biotechs in the S&P 500 Index. Forward Price-to-Earnings (P/E) Ratio measures share price compared to estimated future earnings per share for a stock or stocks in a portfolio.

Innovation Drives Growth

Positioning for Recovery

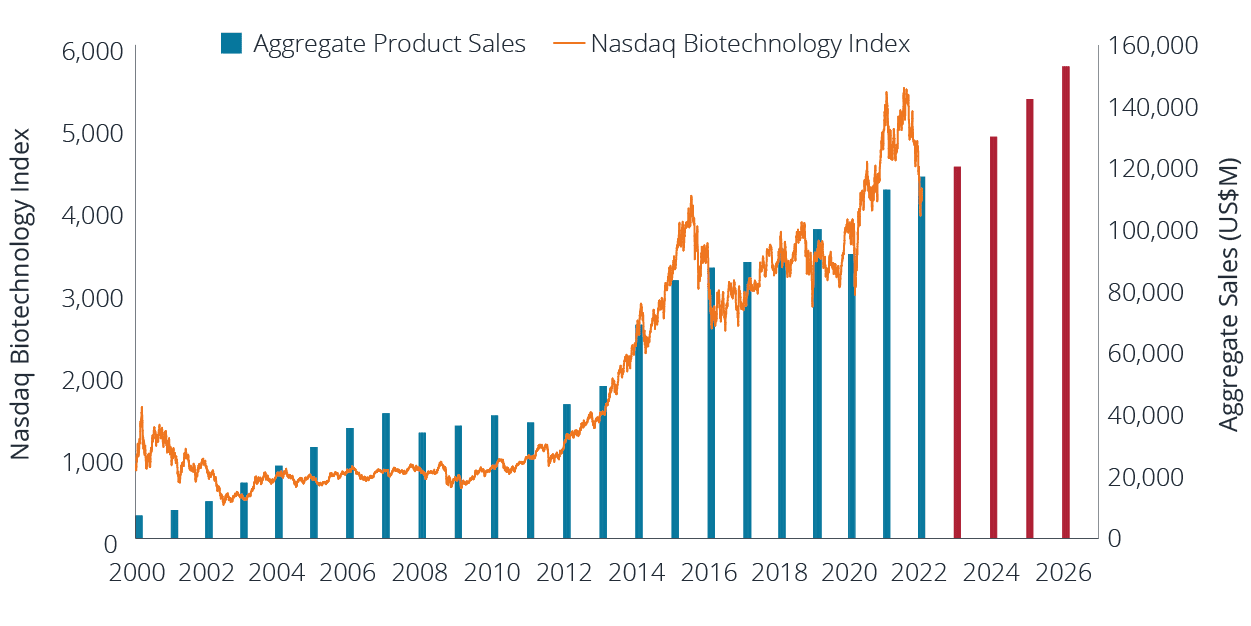

It’s anyone’s guess what will spark a rebound in biotech, whether it’s a pickup in M&A or clarity on drug-pricing reform or something else. But we do know that after the bottom of the last 11 drawdowns of at least 20%, the XBI has delivered a median return of 50% over the following 12 months.12 In addition, over the long term, returns for large-cap biotechs have historically been correlated with drug revenues. With health care demand growing and pharma pricing remaining steady – particularly as more medicines revolutionize the standard of care – revenues are projected to rise by a compound annual growth rate of 9% from 2020 to 2026 (Exhibit 2).

Source: Cowen and Company, as of 25 February 2022. Data from 31 December 1999 through 31 December 2026.

Source: Cowen and Company, as of 25 February 2022. Data from 31 December 1999 through 31 December 2026.

Note: Revenue is an aggregate of actual and estimated figures for 65 companies representative of the biotech sector. The Nasdaq Biotechnology Index is a stock market index made up of securities of Nasdaq-listed companies classified according to the Industry Classification Benchmark as either the biotechnology or the pharmaceutical industry. Red bars = estimated.

As we navigate this challenging period for biotech, we recognize that some companies may have an easier time coming through the current market environment than others. Firms with meaningful revenues/earnings, lower multiples and/or near-term pipeline catalysts could be better positioned than earlier-stage, less-liquid companies. Strong balance sheets can also help support valuations. Still, over the long term, we remain as positive as ever about the sector’s growth potential and believe the current drawdown – like the many that have come before it – will one day give way to a recovery.

Footnotes

1 Bloomberg, Janus Henderson Investors. Current drawdown data from 8 February 2021 to 14 March 2022. Data for other periods are from 27 February 2006 to 16 March 2020 and reflect declines of 20% or more in the SPDR S&P Biotech ETF (XBI). XBI is designed to correspond to the performance of a modified equal weighting of the S&P Biotechnology Select IndustryTM Index, with an inception date of 31 January 2006.

2 Kaiser Family Foundation, Simulating the Impact of the Drug Price Negotiation Proposal in the Build Back Better Act, 27 January 2022.

3 Food and Drug Administration, as of 31 December 2021.

4 Cowen and Company, This Biotech Bear Market Too Shall Pass, 25 February 2022.

5 Janus Henderson Investors, as of 31 December 2021.

6 BioCentury, Weathering one of biotech’s worst bear markets, 4 February 2022.

7 Food and Drug Administration, Advancing Health Through Innovation: New Drug Therapy Approvals 2021, January 2022.

8 IQVIA, Global Trends in R&D: Overview through 2021, February 2022.

9 Q4 2021 PitchBook-NVCA Venture Monitor, as of 31 December 2021.

10 IQVIA, Global Trends in R&D: Overview through 2021, February 2022. Data based on 15 largest pharmaceutical companies.

11 SVB Leerink, Big Biopharma Will Have $500Bn in Gross Cash to Deploy YE22 – Get Set for M&A, December 2021.

12 Bloomberg, Janus Henderson Investors. Data from 27 February 2006 to 16 March 2020 and reflect periods where the SPDR S&P Biotech ETF (XBI) experienced a price decline of 20% or more.

Featured Funds

JFNIX

Global Life Sciences Fund