Subscribe

Sign up for timely perspectives delivered to your inbox.

The second edition of the Janus Henderson Decarbonisation in Emerging Markets Report – Perspectives and Insights from Asia – indicates that decarbonisation efforts across Asia are hampered by a fragmented market, but recent trends are encouraging.

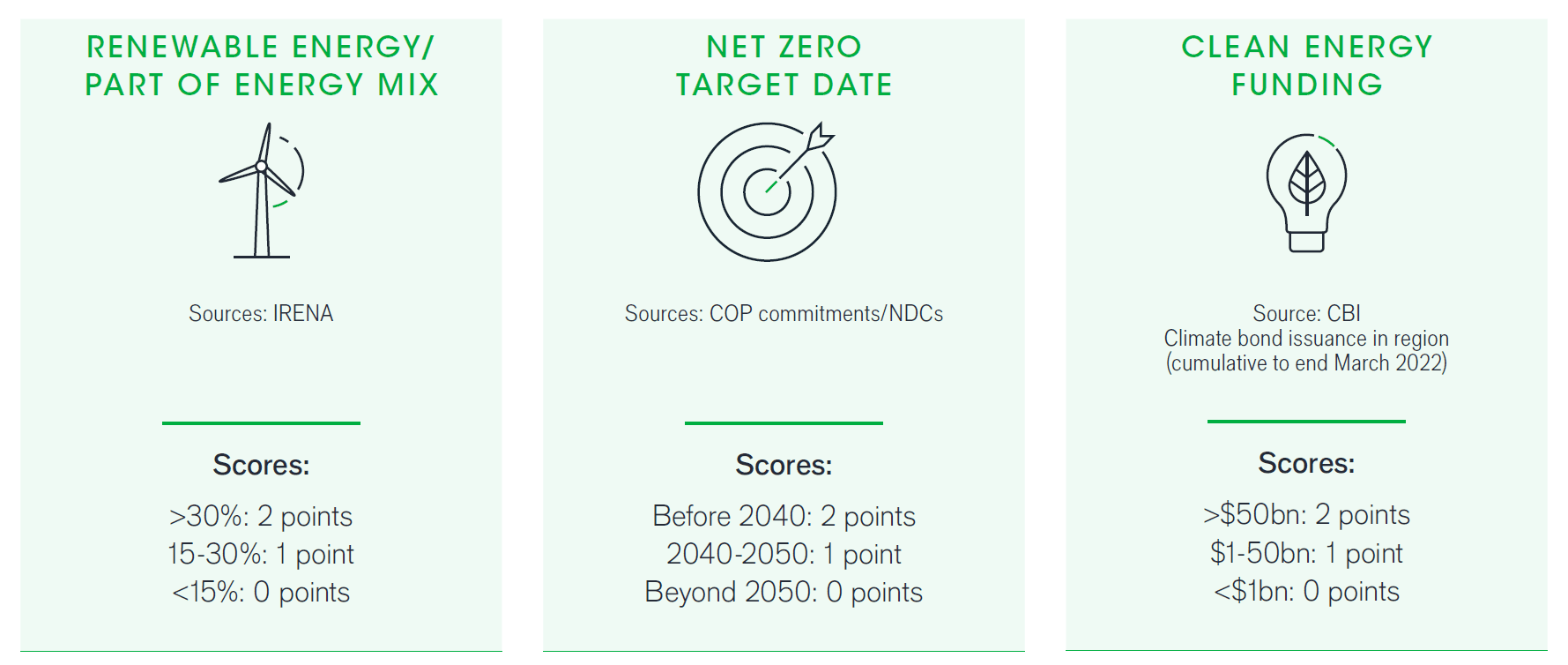

The Janus Henderson Decarbonisation in Emerging Markets Index is constructed as an equally weighted index of scores given to three trends that can be tracked effectively over time. Each trend is tracked via a proxy indicator which we believe can help follow the degree, and speed, of progress on decarbonisation trends now and in the future.

Perspectives and Insights from Asia, the second report based on the Index, measures the decarbonisation efforts facing emerging markets in Asia against three metrics: renewable energy as a percentage of total energy mix, climate bond issuance as a percentage of total bond issuance, and net zero target dates.

As of May 2022, the overall Decarbonisation Emerging Market Index for the region sits at 50.68, based on the following factors:

Total score: Each category weighted 1/3 each to get country composite score. Each country composite score weighted in regional index by % weight of each country in regional real GDP per capita in PPP dollars, as of end 2021 (Source: IMF). Regional sum x100.

Total score: Each category weighted 1/3 each to get country composite score. Each country composite score weighted in regional index by % weight of each country in regional real GDP per capita in PPP dollars, as of end 2021 (Source: IMF). Regional sum x100.

With 30% of the global land mass and 60% of its population, it’s abundantly clear that decarbonisation initiatives in Asia are not only important for the region but for the whole planet. Moreover, as the “factory of the world,” Asia uses a significantly higher amount of energy in its economy than other regions – often coal or diesel. However, climate financing solutions are underutilised by most of the emerging markets in Asia, and those that do issue green bonds are dominant economic powers in the region.

Emerging markets in Asia will need to continue to balance economic growth against renewable energy affordability and availability. There is a clear opportunity for bond investors to play a key role in helping companies upgrade their capital toward complying with long-term emissions targets and international engagements. With hydrogen predicted to be one of the fastest-growing alternative energy sources in the next decade, investing in hydrogen solutions as a low-carbon alternative could accelerate the clean energy transition across the region.

Environmental, Social and Governance (ESG) or sustainable investing considers factors beyond traditional financial analysis. This may limit available investments and cause performance and exposures to differ from, and potentially be more concentrated in certain areas than, the broader market.

Emerging market investments have historically been subject to significant gains and/or losses. As such, returns may be subject to volatility.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.