Subscribe

Sign up for timely perspectives delivered to your inbox.

The Portfolio Construction and Strategy (PCS) Team discuss why an allocation to technology is essential in a diversified portfolio and highlight some key factors for a rewarding investment.

An investment in technology stocks over the past decade has typically delivered very strong returns, regardless of the country where the firm was domiciled, or whether the exposure was through a passive or active vehicle. We believe technology can continue to provide attractive opportunities for investors’ portfolios for several reasons.

Technology by nature is a deflationary force, making things faster, cheaper, and more efficient. This means it can offer a solution to inflation, combatting higher input and labour costs given its capability to create more efficient products and services, and automate production processes. Should inflation levels remain elevated, technology firms could see increased demand. Additionally, the global challenges that we face in terms of energy and food production, while conscious of the impact to the environment, could be resolved by innovative new technology. Although the first half of this year has seen significant falls in the market value of some major technology names, undoubtedly the secular growth themes that are driving technology demand should not be ignored. This article aims to give investors reasons to remain invested in technology stocks, as well as highlight several important factors to consider.

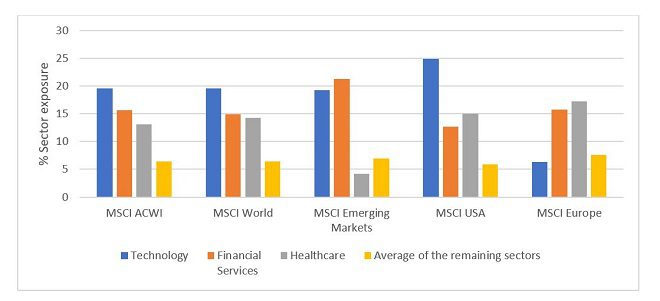

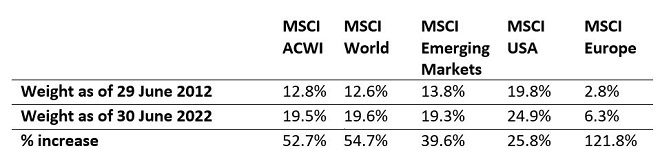

The strong outperformance of the tech sector has led it to become the largest or second largest sector by exposure in most major equity indices (see Figure 1). The exception is Europe where technology ranks as the eighth largest, but it is noteworthy that its sector weight has more than doubled over the past decade (see Figure 2).

As technology has become a larger weight in most portfolios by virtue of its dominant exposure in major equity indices, the sector’s underperformance in the first half of 2022 has investors questioning if it is time to cut their exposure. While every investor has a unique set of goals and the answer to this will depend on their specific requirements, we do not believe that they should cut all exposure to technology, rather, the solution might be a different kind of exposure. There’s been an increase in the number of unprofitable technology firms in the major indices1 that are burning through cash (‘cashburners’). In our opinion, it may be time to shift the focus to more profitable tech companies by investing with active managers that can avoid these loss-making firms. The aggressive selling we have seen year-to-date looks to be a great opportunity that savvy investors can take advantage of to pick up some long-term growth companies that have been oversold unjustly.

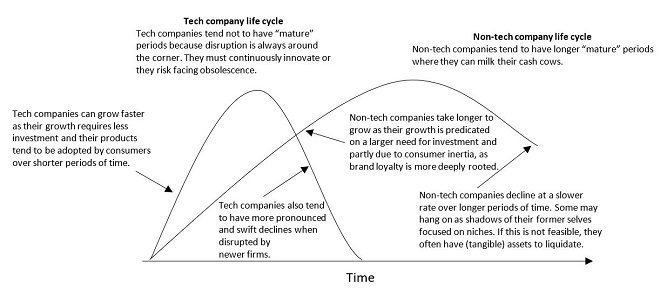

To assess where the best investment opportunities exist it is important to know how a company’s life cycle (Figure 3) works and how it relates to the macroeconomic environment. Tech is a unique sector; the life cycle of technology companies tends to be shorter than that of non-technology firms. Many of us will have witnessed the emergence of a tech company’s new products and the markets created, the company’s evolution and in some cases, its demise.

Modern life would be unthinkable without the internet and most products and services built on it have created completely new industries. Disruptors2 have historically paved the way to new breakthroughs that then become building blocks for newer products or services. However, being a disruptor does not always equate to being a successful firm or having a successful product over the long term. It’s in the early stages of a company’s life cycle when a firm is most vulnerable. We all use internet browsers and some of us might recall Netscape Communications Corp’s browser, Navigator, released in 19943. This was a disruptive company providing a disruptive product built on top of the internet, a technology that was becoming widespread in the mid-1990s. As a young company, it was vulnerable in the early stages, and found itself being disrupted by Microsoft, when it launched Internet Explorer in 1995. Netscape’s fall was as swift as its rise, with the company later being acquired by AOL, and eventually the name Netscape disappeared. Microsoft’s Internet Explorer also looks to be eventually displaced by Google’s Chrome. In fact, the browser market has changed dramatically since the era of the “Browser Wars” in the late 1990s to more recently (see Figure 4).

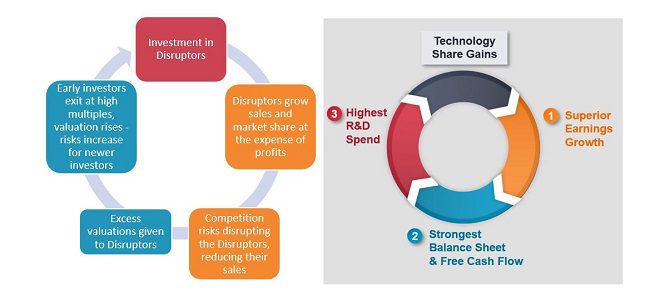

Funding the disruptors can be very lucrative for investors, a process that needs to be monitored closely. The early stages of the disruption cycle, at the company or product level, are where some of the best opportunities can arise, but the investment thesis needs to be tested constantly, as the risks are also highest at this stage. Risks could come in the form of competition, failed business models, or the disruptive technology itself is either not ready for prime time or its promise fails to materialise.

The disruption cycle can be defined as the process of creating and introducing a novel idea, product, or process that challenges the established order. It is termed a cycle because that process is continuous and never-ending. For technology companies, it is the raison d’être, and why they cannot sit still. Innovation must be continuous and so must investment in this process. There are generally two different types of disruption cycles, one funded by external investments (see Figure 5) and the other funded by the company’s own profits (see Figure 6). Companies will find themselves in either, depending on where they are in their own life cycle. Firms in the early stages are most prominent in the externally-funded disruption cycle and those past the early stages are most prominent in the profit-funded cycle.

As markets grapple with higher rates, higher inflation, and tremendous market uncertainty, we believe investors should analyse their technology investments and test the investment hypothesis. Fundamentals matter once again, and the focus should be on earnings – or the lack thereof. Despite heavy losses, investors funding the disruption cycle of technology such as venture capitalists (Figure 5) benefited from strong returns. While high exit prices were available, it meant that investors were willing to absorb losses deemed to be short term, because there was the potential to eventually generate strong returns to cover those losses. But now this disruption cycle is showing signs of stress as external funding has dried up. Given much weaker tech valuations now, the IPO market has seized up and venture capital is under pressure as it becomes difficult to profitably exit investments. In the public markets, loss-making firms requiring constant infusions of cash via debt or dilutive equity issuance are seeing impacts to their bottom line through higher costs and higher interest charges.

Companies without a clear path to profitability risk running out of cash if they keep up their cash burn ratios (negative cash flow) and could face insolvency. The externally-funded disruption cycle appears to be broken, which is why we believe it is time to turn our attention to firms that find themselves in the profit-funded disruption cycle.

While many companies have found themselves on the wrong side of the disruption cycle today and the sector will likely experience more volatility should rates and inflation remain higher than the past decade, we believe a continuous investment in technology is worth it. The best returns are achieved through opportunities that arise at times of uncertainty. Looking beyond the current uncertainty and into areas of the market that will likely drive further adoption and development of new technologies, strong secular growth trends can be found in areas such as financial inclusion, digital democratisation, low-carbon infrastructure, data security, resource optimisation, robotics, smart cities, and clean energy. With many market-leading tech stocks trading well below their recent highs, now could be an opportunity to invest in those companies with strong business models that are well positioned to benefit from these long-term trends.

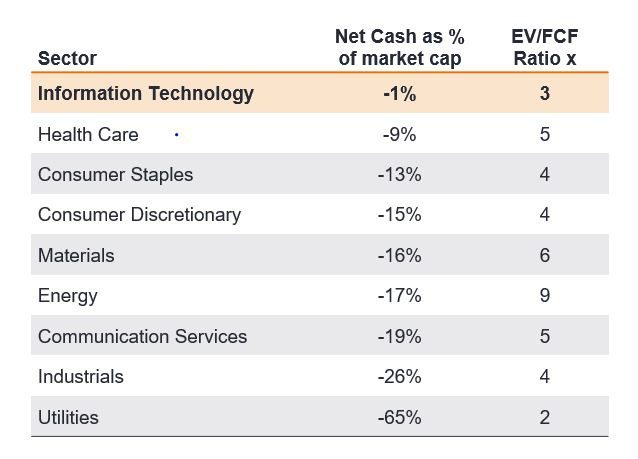

Companies with stronger earnings typically have stronger balance sheets and free cash flow, which holds true for technology as an industry (refer to Figure 7). Net cash as a percentage of market cap shows that companies within the sector are the least indebted among all other sectors. A lower Enterprise Value (EV) versus Free Cash Flow (FCF) ratio is preferred, as this means that a company can generate cash to reinvest in the business at a faster rate and recover its research & development costs (R&D). The metrics shown in Figure 7 indicate that currently, tech stocks generally do not appear to be overvalued, particularly relative to sectors like energy, materials, and consumer discretionary.

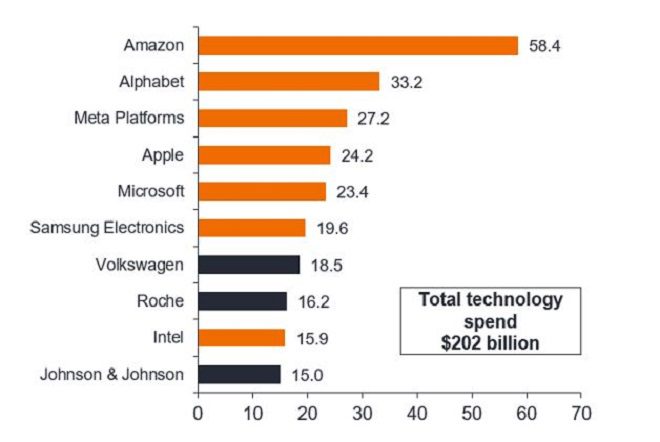

Even tech companies with strong cash flows may find themselves subject to a shorter life cycle. The most successful tend to reinvest their earnings into R&D for further growth. Technology companies with superior earnings and strong balance sheets have an edge, but it is the continuous R&D spend that keeps them ahead. In fact, of the ten global firms with the highest R&D expenditures, currently seven of them are technology firms (see Figure 8). The total R&D spend as of 30 June 2022 for the ten firms was $251.6bn, with $202bn – circa 80% of the total – from technology firms. Loss-making firms have a comparative disadvantage as they will be forced to reduce R&D if they cannot find funding, which would have a direct impact on their future growth prospects.

Cash is king. In environments where external funding is limited, and, if available, expensive – investors need to be mindful of company selection, even more so given the tech sell off this year.

Investors should seek out tech companies that:

In other words, those companies that are in the profit-funded (aka virtuous) cycle of technology investing (Figure 6 introduced earlier) are, on the basis of the reasons given above, more likely to be successful investments.

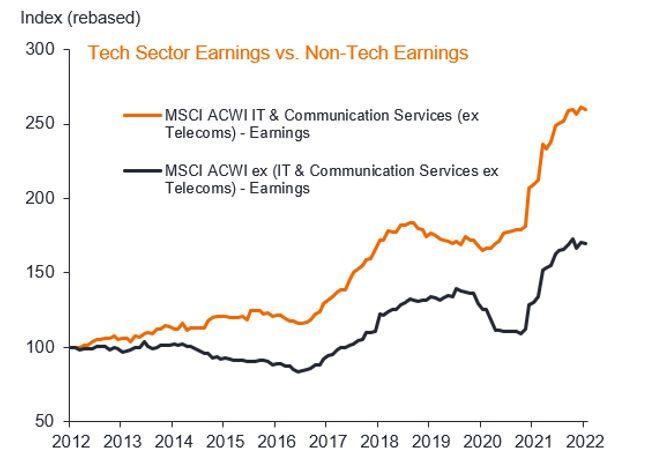

The old maxim of not carrying all your eggs in one basket is worth heeding. An exposure to technology can provide portfolio diversification and could prove to be the satellite allocation a portfolio needs to enhance returns. Over the long term, returns reflect a company’s profitability and the growth in their earnings, thus maintaining exposure to the tech sector would appear compelling, given it is a sector that has been able to grow earnings at a faster pace than other sectors (see Figure 9).

In the current environment, we believe investors should maintain a more selective exposure to technology, consider active managers as they aim to avoid the more problematic areas of the market, and continuously challenge the investment thesis of managers by looking for coherence in their positioning with the growth projections of portfolio companies. Uncertainty will most likely persist during the months ahead, so consider building allocations over time, averaging the entry cost of investments. Hold on for a full cycle and keep in mind what matters to long-term performance is time in the market and not timing the market.

The PCS Team performs customised analyses on investment portfolios, providing differentiated, data-driven diagnostics. From a diverse universe of thousands of models emerge trends, themes, and potential opportunities in portfolio construction that the team believes could be interesting and beneficial to many investors.

1 As of 30 June 2022, 30% of technology companies among the largest 1500 stocks in the US were unprofitable. Source: Bernstein, Janus Henderson Investors.

2 According to Gartner, a digital disruptor is any entity that effects the shift of fundamental expectations and behaviours in a culture, market, industry, technology or process that is caused by, or expressed through, digital capabilities, channels or assets.

3 https://www.popularmechanics.com/culture/web/a27033147/netscape-navigator-history/

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Volatility measures risk using the dispersion of returns for a given investment.

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market as a whole.

Foreign securities are subject to additional risks including currency fluctuations, political and economic uncertainty, increased volatility, lower liquidity and differing financial and information reporting standards, all of which are magnified in emerging markets.

The MSCI ACWI Index is designed to represent performance of the full opportunity set of large- and mid-cap stocks across 23 developed and 24 emerging markets.

The MSCI World Index captures large and mid cap representation across 23 Developed Markets (DM) countries.

The MSCI USA Index is designed to measure the performance of the large and mid cap segments of the US market.

The MSCI Emerging Markets Index captures large and mid cap representation across 24 Emerging Markets (EM) countries.

The MSCI Europe Index captures large and mid cap representation across 15 Developed Markets (DM) countries in Europe.