Subscribe

Sign up for timely perspectives delivered to your inbox.

Senior Portfolio Strategists Sabrina Denis and Lara Castleton from the Portfolio Construction and Strategy team consider how balanced funds can be used to help build a portfolio that works effectively for investors – particularly pertinent at a time when both equity and fixed income markets have struggled to find their footing amid inflation and growth fears.

Throughout recent portfolio consultations, we have seen a growing number of investors interested in discussing the role and intended use of balanced funds in investment portfolios. This makes sense, as both equity and fixed income markets have struggled to find their footing amid inflation and growth fears, and balanced funds offer the potential to outsource some of the most difficult decisions regarding equity and bond allocations.

On average, investors who own balanced funds hold at least two different strategies in their portfolios, with an average weight of 18%.

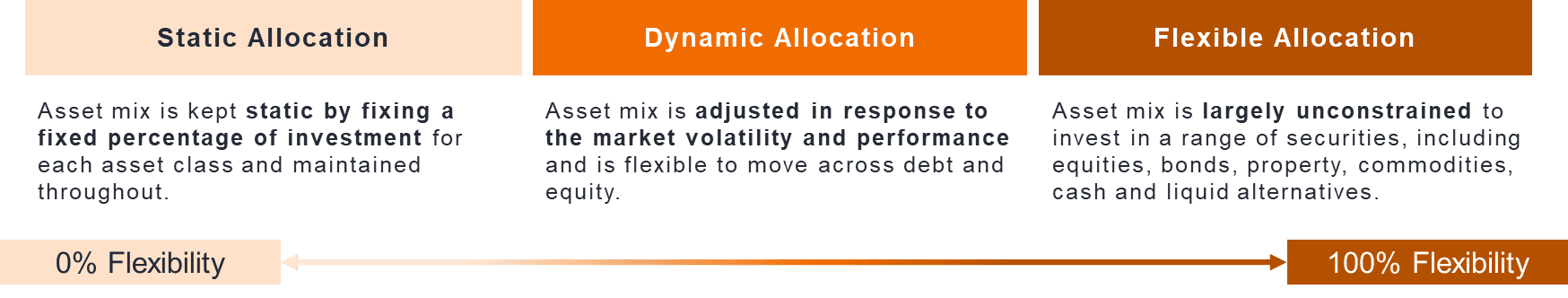

When considering allocations to balanced funds, the most common question is, “How do I use a balanced fund in a portfolio?” Of course, the answer to this will depend upon the investor’s individual circumstances and objectives. But overall, we see balanced funds being used in three different ways:

1) As an entire portfolio

Using one, or several, balanced fund(s) to build a portfolio can work effectively for investors who aim to fully outsource their allocation process. Balanced funds can automatically rebalance and shift their allocation across multiple assets and/or regions to fit a pre-set risk model. Among the financial professionals we work with, we have seen this methodology work well for those who rely upon the resources of outside managers, or those who manage either too many accounts, or too few, where the thresholds required for a bespoke discretionary investment account are too great.

With over 5,160 strategies1 categorized as “balanced,” financial professionals are not without options to create a portfolio to fit their clients’ needs. However, with that variety comes the need to truly understand the risks, exposures and intended goals for each solution.

Given the breadth and depth of the balanced category, financial professionals looking to these funds to fulfil their entire asset allocation may want to consider combining two or more balanced funds for manager diversification. We would also recommend conducting a detailed assessment of each manager’s holdings. This can help maximize manager diversification potential by finding two (or more) funds with investment styles (e.g., domestic vs. global equity, core vs. high-yield fixed income, etc.) that complement each other, and also fill any asset allocation gaps that may exist with a single manager.

2) As a core allocation

Perhaps most commonly, investors utilize one or more balanced funds as the core component of their portfolio and diversify the allocation by adding high-conviction satellite or tactical positions, such as alternatives or specific regional or sector exposures.

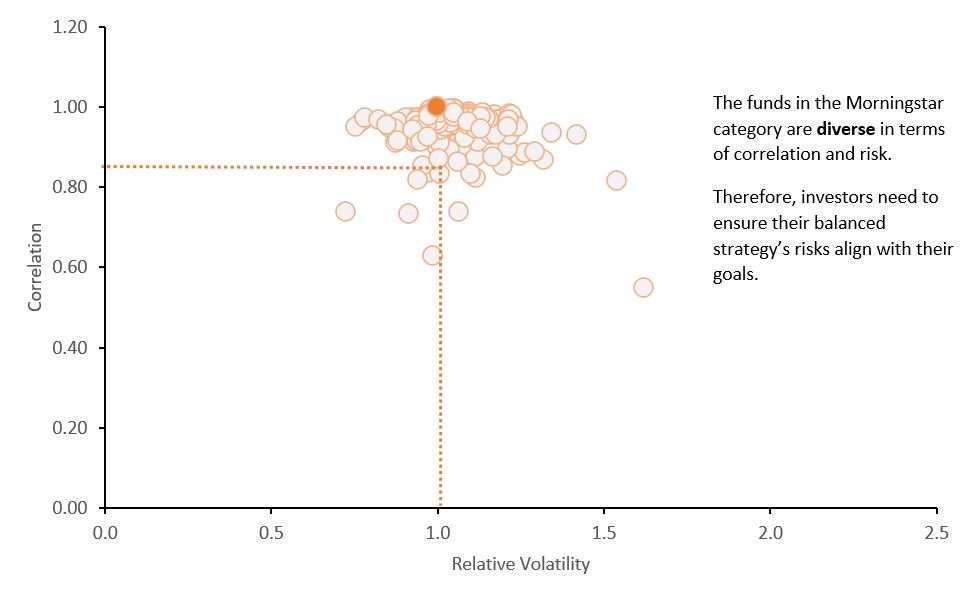

While balanced funds can provide a solid foundation for a core allocation, investors may be surprised to see that the correlations of solutions to a moderate blended 60/40 benchmark range from 0.55 to 0.99. Moreover, the volatility difference can be significant, ranging from three-quarters the average volatility to two times as much, using the Morningstar Allocation 50% to 70% Equity category as an example.

Due diligence is therefore critical, as investors looking to balanced funds as a core replacement might view a high correlation to a traditional 60/40 benchmark as an indicator that the balanced fund can indeed meet their objective of replacing a 60/40 core.

Balanced Funds Show a Wide Range of Correlations and Volatility Source: Morningstar, Portfolio Construction and Strategy Team, as at May 2022. US Allocation 50% to 70% Equity Morningstar category, 5-year correlation and relative volatility (annualized) to blended benchmark of 60% S&P 500 and 40% US Aggregate bond, May 2017 – May 2022. Past performance does not predict future returns.

Source: Morningstar, Portfolio Construction and Strategy Team, as at May 2022. US Allocation 50% to 70% Equity Morningstar category, 5-year correlation and relative volatility (annualized) to blended benchmark of 60% S&P 500 and 40% US Aggregate bond, May 2017 – May 2022. Past performance does not predict future returns.

3) As a tactical overlay

Finally, investors will often introduce balanced funds as satellites to diversify their core equity, bond and alternative allocations. The role of the balanced fund(s) in these circumstances is to serve as an overlay to broader asset allocation decisions – hopefully serving to enhance portfolio returns and/or reduce portfolio risk.

When used in this capacity, it is important to identify options that can be complementary to the existing core portfolio. Active security selection and active asset allocation is key when choosing balanced funds as a tactical overlay in order to benefit from short-term market dislocations and core diversification.

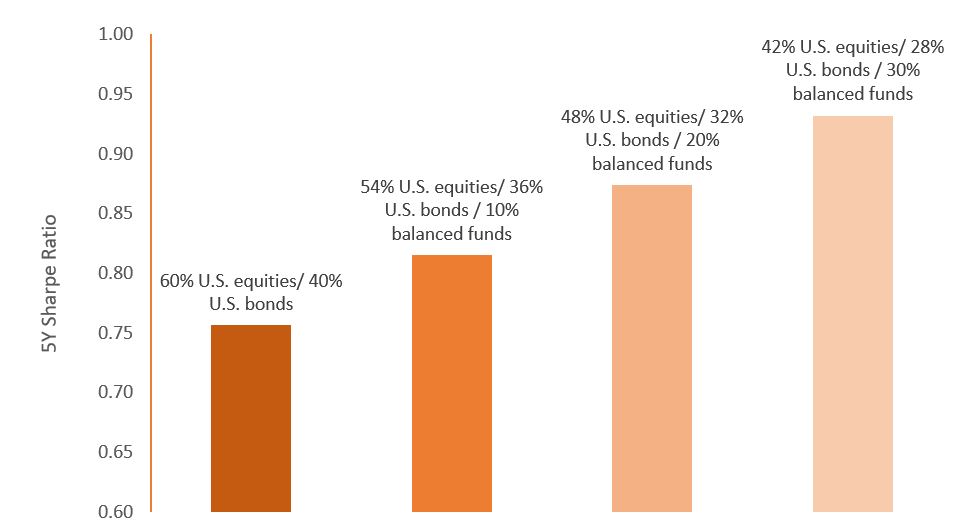

Depending on the investor’s needs and goals, balanced fund(s) can offer several potential benefits:

Source: Morningstar, Portfolio Construction and Strategy Team, as at May 2022. U.S. Allocation 50% to 70% Equity Morningstar category. 5-Year Sharpe ratio, month-end May 2017 – May 2022. S&P 500 TR USD and Bloomberg U.S. Agg TR USD. Balanced funds returns are the average top 50 percentiles of the Morningstar category. Past performance does not predict future returns.

Source: Morningstar, Portfolio Construction and Strategy Team, as at May 2022. U.S. Allocation 50% to 70% Equity Morningstar category. 5-Year Sharpe ratio, month-end May 2017 – May 2022. S&P 500 TR USD and Bloomberg U.S. Agg TR USD. Balanced funds returns are the average top 50 percentiles of the Morningstar category. Past performance does not predict future returns.

It is worth keeping in mind that, while balanced funds offer various potential advantages, their use can make an overall portfolio opaque and less straightforward to assess in terms of exposures and potential risk. This conundrum, coupled with the range of solutions available in the market, highlights the importance of thorough research and due diligence. Please reach out to our team for a dedicated consultation to ensure the use of balanced fund(s) is helping you achieve your intended goals.

1 Morningstar Global Category of allocation funds, oldest share class only, as of May 2022.

The PCS team performs customized analyses on investment portfolios, providing differentiated, data-driven diagnostics. From a diverse universe of thousands of models emerge trends, themes and potential opportunities in portfolio construction that the team believes may be interesting and beneficial to any investor.