Subscribe

Sign up for timely perspectives delivered to your inbox.

To provide forward-looking perspective on inflation, Director of Equity Research, Matt Peron and analysts from our Equity and Fixed Income Research Teams assessed comments made by listed corporations addressing the topic. In a series of articles – also available as a whitepaper – they discuss how select sectors are being impacted by rising prices and what it means for both company profitability and the health of the economy.

The past several months have provided a real-time case study on why central bankers and government officials obsess over price stability in the broader economy. Once the genie of accelerating inflation is out of the bottle, it can prove difficult to contain. Now that multi-decade-high inflation is here, participants across the U.S. economy can better appreciate policy makers’ preoccupation with price stability and understand why it commands a central role in monetary policy.

Investors and participants in the “real economy” have both been acutely impacted by higher prices. Everyone is looking for answers and many have seemingly become experts – nearly overnight – in parsing inflation signals ranging from Treasuries’ “breakevens” and consumer sentiment surveys to prices at the pump and a surge in starting wages as businesses scramble for labor. While many of these indicators provide useful insight, we believe they don’t tell the full story. By their lagging nature, much inflation data is already priced into financial markets and consumers need no reminder of the pain they’ve been feeling for months.

To develop a stronger understanding of how the inflationary backdrop may evolve, more forward-looking signals are needed. We believe that an especially powerful tool is the public comments made by listed corporations addressing the subject. These are entities that must make investment, purchasing and pricing decisions based on their expectations of the trajectory of prices. Much depends upon their assumptions being as accurate as possible.

As fundamental investors, our Equities and Fixed Income Research Teams constantly monitor corporate statements and are in frequent contact with executives across a range of industries to discuss their views on inflation and other subjects related to the pricing environment. With an eye toward gaining a fuller understanding of how select sectors are being impacted by rising prices and what it means for both company profitability and the health of the economy, we have surveyed our analysts to distill some key takeaways that we believe add a unique perspective to the wider inflation conversation.

Some of our teams’ findings unsurprisingly align with what is already known about this spate of inflation. Foremost, it is broad-based, emanating from both supply and demand factors. The former owes greatly to the supply dislocations that occurred during the onset of the COVID-19 pandemic and have yet to be fully resolved – think such as semiconductors. The war in Ukraine has added additional pressure, especially with respect to energy, certain crops and fertilizer. On the demand side, recovery – especially in the U.S. – was earlier and stronger than expected. The appetite for consumption has been further amplified by multiple waves of monetary and fiscal stimulus that left household balance sheets awash with excess savings.

Labor market tightness has increasingly become a factor as businesses compete for workers to meet surging demand. This dynamic presents the risk of igniting a wage-price spiral as companies are compelled to raise prices to account for higher labor costs. Those prices, in turn, can cause workers to demand even higher wages to absorb the rising costs of household expenditures.

Over the past two years, the U.S. economy has made up nearly all the jobs lost during the pandemic, now falling just 822,000 – or less than 1.0% – below the pre-pandemic peak. And while the unemployment rate has fallen to 3.6%, suggesting a tight labor market, hidden slack may be found in the labor force participation rate registering a suppressed 62.3% in May, 1.1 percentage points beneath its pre-pandemic level and well beneath its 20-year average of 65%. The unanswered question is whether many workers who have exited the labor force have retired early or can be lured – or compelled – to again seek employment.

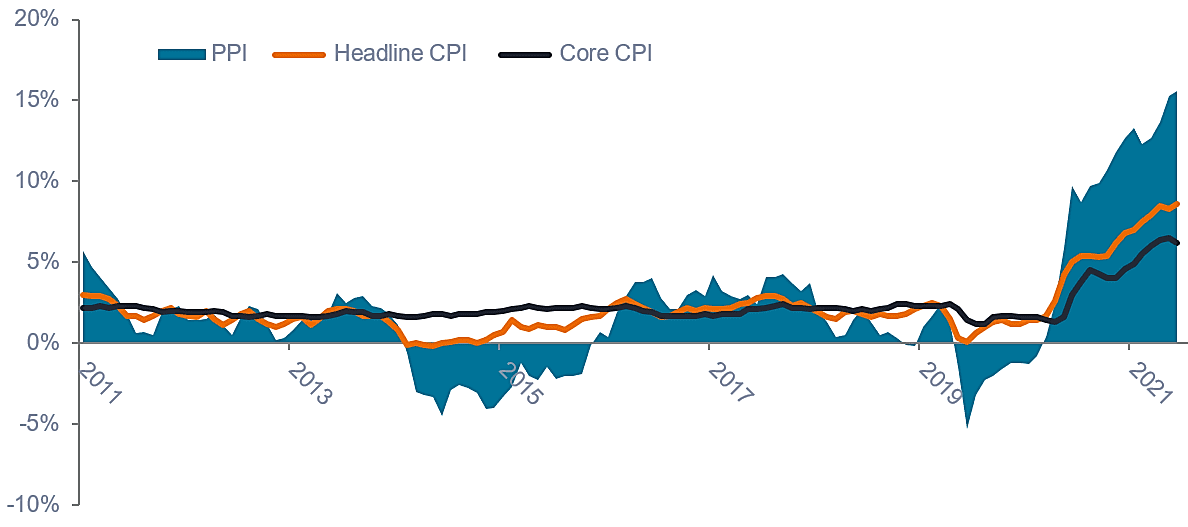

U.S. Consumer and Producer Price Inflation

Labor plays a significant role in the trajectory of prices in service-based economies like that of the U.S. Wages comprise a considerable portion of business expenses and companies face the choice of raising prices or sacrificing margins to compensate for increased labor costs. Perhaps overlooked is that in a tight labor market, the marginal new hire is likely less productive than those with already established skills. This – in itself – is inflationary as it increases the unit labor costs of goods produced. The alternative, however, is to lack the production capacity to meet strong demand.

Thus far, companies across several sectors have had little problem passing along higher input costs to customers. This is a surprise in some respects as once inflation reaches a certain level, demand destruction could bite as customers balk at higher prices. The reasons for resilient demand likely vary across sectors, but one common thread, especially with respect to consumers, is the large amount of savings households built up during the pandemic. To be determined is how consumers react once these reserves have been spent.

Download WhitepaperMonetary Policy comprises a set of initiatives undertaken by a central bank to achieve a range of objectives within a country’s or region’s economy.

Consumer Price Index (CPI) is an unmanaged index representing the rate of inflation of the U.S. consumer prices as determined by the U.S. Department of Labor Statistics.

Headline CPI differs from Core CPI in that the former includes all CPI categories whereas the latter excludes the typically more volatile food and energy categories.

Producer Price Index (output) is a measure of the change in the price of goods as they leave their place of production (i.e. prices received by domestic producers for their outputs either on the domestic or foreign market).